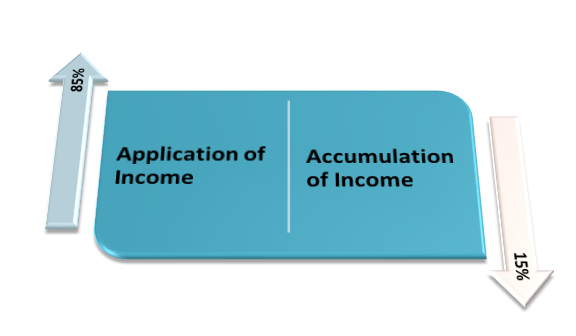

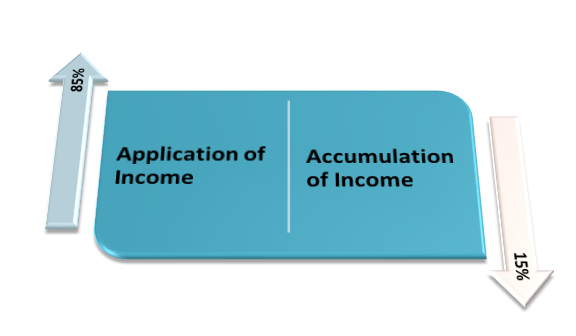

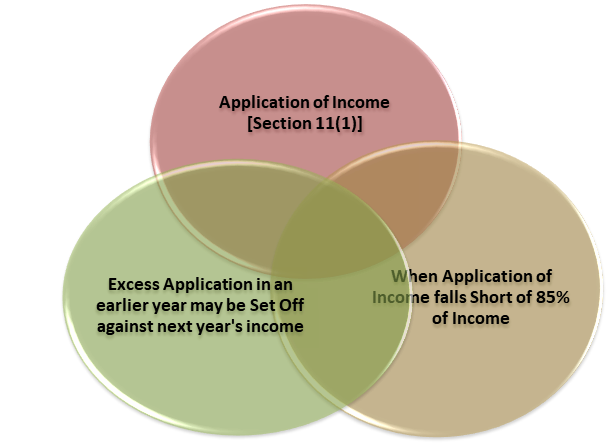

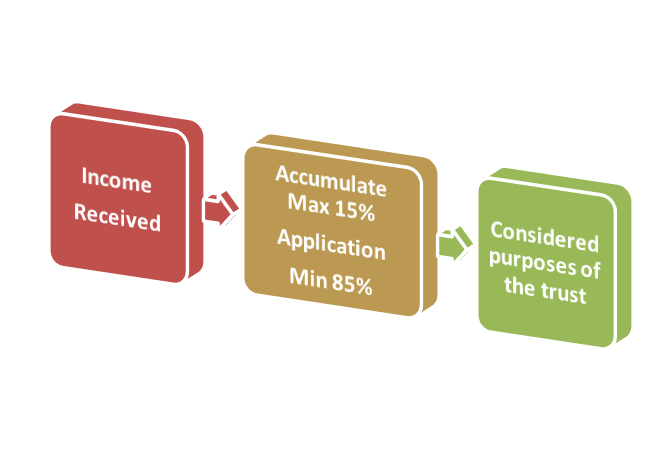

According to the applicability of Income Tax Act regimes, assessee is allowed to accumulate up to 15% of the income received during the year for application of trust purposes in India. If in cases where the assessee tries to accumulate/set apart the income in extension to 15% of the revenue, he can do so if certain conditions get fulfilled. Considering the above said, the amount accumulated more than 15% shall get deemed to have applied for charitable or religious purposes in India throughout the previous year itself.

Furthermore, Section 11(2) liberalizes and enlarges the exemption provided under section 11(1)(a). A mixed and combined reading of both the provisions would undoubtedly show that section 11(2), while expanding the scope of exemption, eliminates the restriction imposed by section 11(1)(a). Still, it does not take away any the exception allotted by section 11(1) (a).

What are the Significances of Accumulation of Income as per Section 11 of the Income Tax Act?

1. Significance of Accumulation of income above 15% of the income earned as per Section 11(2) and Rule 17:-

Conditions to be satisfied for exemption under section 11(2) shall be permitted subject to the following terms being satisfied:

- Such a person provides a statement in Form No. 10 electronically, either supporting digital signature or electronic verification code to the Assessing Officer. It should state the purpose for which the income is holding accumulated or set apart and the period for which the income is to be managed or set apart. In which shall no case surpass more than five years;

- The money therefore accumulated or set apart is invested or placed in the forms or modes as defined in section 11(5);

- The statement attributed to in clause (a) provided on or before the due date specified under section 139(1). It is for furnishing the return of income for the prior year.

2. The Exemption under section 11(2) not be permitted unless the statement specified in section 11(2)(a) and the ‘return of income’ of the trust provided before the due date of filing the return defined under section 139(1) and Section 13(9)

Further, nothing included in section 11(2) shall serve to exclude any income from the total income of the prior year of a person in receipt of any:-

- Statement reflected too in clause (a) of section 11(2) not provided on or before the due date defined under section 139(1) for providing the return of income for the prior year; or

- Such a person does not furnish the return of income in the prior year on or before the due date specified under section 139(1) for providing the return of income for the said previous year.

In other words, the benefit of accumulation shall not be allowed under section 11(2) unless the said statement in the prescribed form, as well as the return of income, are furnished before the due date of filing the return of income specified under section 139(1).

What are the Modes of Investment specified under Section 11(5)?

The modes of Investment specified under Section 11(5) are as follows:-

- The modes can be as Investment in Government Saving Certificates and any other Securities or Certificates issued by the Government under its Small-Saving-Scheme.

- Invested Deposits with the Post Office Savings Banks in India.

- Invested Deposits with Scheduled Banks or Co-operative Banks.

- Investments deposited in the units of Trust of India.

- Investments deposited in Central as well as State Government Securities

- Investments deposited in debentures issued by any company or corporation in India. Nevertheless, both the principal and interest thereon should have confirmed by the Central or the State Government.

- Investments deposited in any Public Sector Undertakings.

- Investment deposited in bonds of certified financial corporations implementing long term finance for industrial development.

- Investment deposited in bonds of approved public undertakings whose principal object is to provide long-term funding for construction or acquisition of houses in India for residential prospects.

- Investment deposited in fixed property, excluding plant and machinery.

- Investments deposited in any bonds announced by a public company undertakings formed and registered in India. They should have with the main object of carrying on the business of producing long-term finance for urban infrastructure in India.

- Investment Deposited with the Industrial Development Bank of India.

- Investment deposited in any other form or mode of finance or deposit as may be ordered.

What are the consequences if Accumulated Income is more than 15% not applied or Invested as per section 11(3)?

Consequences referring to the income of the trust mentioned in section 11(2)—

- Gets applied other than charitable/religious purposes, or ceases to be accumulated or placed apart for application,

- If it ceases to remain invested or deposited in any mode specified under section 11(5) above, or

- If not employed for the purpose for which it is so accumulated or set apart during the term specified (not exceeding five years) or in the year immediately resulting thereof.

- Gets credited or paid to any trust listed under section 12AA or any institution or trust designated to in section 10(23C)(iv), (v), (vi) or (via), such income shall get considered to be the income,—

- of previous year applied for other purpose or terminated to be accumulated or set apart, or

- of the last year in which it ceases to remain so deposited, or

- of the previous year immediately following the expiry of the period specified therein, or

- Of the last year in which it is paid or charged.

Read our article:Know Everything about President, Secretary and Treasurer of a Trust

What are the Relevant Case laws determining various aspects of Accumulation and Application of Trust Income?

- Negating the assessee’s claim for the accumulation of unused income (Section 11) Case – Bharat Krishak Samaj v. Deputy Director of Income-tax (Exemption) (2008) 306 ITR 153 (Del)

In this case, the High Court held that it is not essential for a charitable trust to specify every object for which accumulation required. It is sufficient if the assessee seeks accumulation only for the considered purposes of the trust.

- The accumulation of income needs to point toward some specific purpose: Case- Director of Income-tax (Exemption) v. Trustee of Singhania Charitable Trust.

In this case, the Lordships of the Calcutta High Court held that where a charitable trust provides notice for accumulation of income under section 11(2) of the Income Tax Act, the trust must point toward some specific purpose or purposes.

- Repayment of borrowed funds applied for construction of commercial complex (section 11) Case: Director of Income-tax (Exemption) v. Govindu Naicker Estate (2009) 315 ITR 237 (Mad.)

In this case, the High Court held that the Tribunal was correct in keeping that the ‘repayment of loan’ reserved from the bank for construction of commercial complex was eligible for exemption under section 11 of the Act via application of income for charitable purposes and the assessee-trust.

If the application of the income brings out the maintenance of the property – believed to be under trust for a charitable purpose, the income will amount to follow the objects of the trust.

- Carried activity for charitable purposes as per 2(15) and aiming the Commissioner of Income-tax to grant registration U/s 12AA. Case – CIT v National Institute of Aeronautical Engineering Educational Society (2009) 315 ITR 428 (Uttarakhand)

In this case, the High Court held that section 12AA of the Act provides the process for registration. It empowers the Commissioner to request for such documents or evidence from the trust or institution as he thinks necessary. It would be to satisfy him about the genuineness of the activities of the trust or institution and also make such inquiries, as he may consider necessary in.

- The assessee is entitled to accumulate 15%Trust Income under section 11(1) (a) – Case: CIT v Programme of Community Organisation (2001) 248 ITR 1 (SC)

In this case, the Supreme Court[1] held on the plain language of section 11(1) (a) that the assessee was permitted to accumulate 15% of its Trust income under Income Tax Act. However, even if 85% of the income applied for charitable or religious purposes throughout the prior year, the assessee can claim 100% exemption of the revenue earned during the previous year.

- Accumulation of Agricultural Income over 15%: Case – CIT v Nabhinandan Digamber Jain (2002) 257 ITR 91 (MP)

Accumulation of agricultural income will not form part of total income to calculate the income over 15 % of the entire income as laid down as per section 11 of the Income-tax Act, 1961.

- The Capital expenditure or outgoing on maintaining property of trust: Case- CIT v Kannika Parameswari Devasthanam & Charities (1982) 133 ITR 779 (Mad)

In this case, it has propounded that the capital expenditure incurred on improving or maintaining the property of the trust did constitute under the application of income for charitable purposes.

- Application of surplus funds would amount to applying funds for charitable purposes of Trust: Case – St. George Forana Church (1988) 170 ITR 62 (Ker)

In this case, it has propounded that the application of surplus funds in the construction of new buildings to lease them out and apply the rent for the objects of the trust will aggregate the amount for using funds for religious and charitable purposes.

- Salaries and miscellaneous expenses would get considered as an application for charitable purposes: Case- CIT v Birla Janahit Trust (1994) 208 ITR 372 (Cal)

In this case, it has propounded that the expenditure on salaries and miscellaneous payments to transport and carry out the objects and purposes of the trust must get measured as application for charitable purposes.

- Legal expenses incurred are allowable as a permissible deduction: Case- Ananda Marga Pracharaka Sangha v CIT (1994) 76 Taxman 88 (Cal)

In this case, it has propounded that where the assessee is a charitable institution, legal expenses incurred for defending the persons running the association counter to criminal charges are permissible as a deduction while calculating the total income of the assessee Trust.

- Loss on sale of shares to make investments will get treated as application of Income: Case- Chidambaram Chettiar Foundation v ITO (1991) 39 TTJ 82 (AT)(Mad)

In this case, it has propounded that Income for section 11 should assume in its commercial sense. Therefore, loss on the sale of shares to make investments in specific investments should be within the connotation of section 11(5) to get preserved as application of income of the trust.

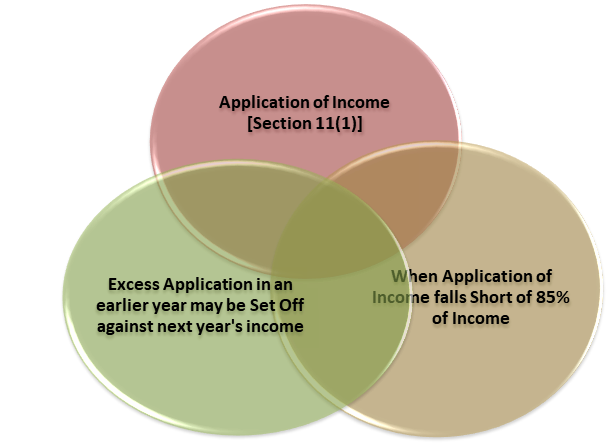

- Excess expenditure in an earlier year may set off against next year’s Income: Case- CIT v Maharana of Mewar Charitable Foundation [(1987) 164 ITR 439 (Raj)

It held in this case that the application of Income for the next year, the carried forward debit, should stand first to be set off against the income of the following year.

- Application of income files after completion of Assessment: Case- Nagpur Hotel Owners Association (2001) 247 ITR 201 (SC)

In this case, it stated that the application in Form No. 10 could get filed even after the assessment is complete. Moreover, the trust is permitted to set-off the amount of excess application of last year Income alongside the insufficiency of the current year.

- Excess of an expense in the earlier years can get balanced up : Case: – CIT vs. Institute of Banking [2003] 264 ITR 110 (Bom): 185 CTR 492 (BOM)

In this case, it says that in case of a charitable trust whose Income left out under section 11, excess of expenditure in the earlier years can get balanced up against Income of the following years.

- Section 11(2) does not prohibit plurality of purposes while application of Income: Case- CIT v. Hotel & Restaurant Association, DIT(E) v. Daulat Ram Education Society, DIT(E) v. Eternal Science of Man’s Society, DIT(E) v. Mamta Health Institute for Mother and Children, Bharat Kalyan Pratishthan v. DIT(E)

The Delhi High Court, in a sequence of decisions, including held that section 11(2) does ‘not prohibit plurality’ of purposes. Consequently, as long as the purposes stated by the assessee find place in its objects, the accumulation will be valid as long as the said purposes are charitable.

- Beyond the time limit, it would not suspend the claim exemption while applying the Income: Case–C.I.T. v. Anjuman Moinia Fakharia.

In this case, it got held that an application for accumulation filed under section 11(2) beyond the time limit would ‘not get suspended’ while claiming exemption for applying the Income for income-tax.

Conclusion

In view of the case laws rendered in this blog, it can get concluded that the trust aspect of enforceability under Section 11 seems to have put significance on taxation platforms. As a result of it, charitable institutions-assessee is allowed to accumulate 15% and apply 85% of income during the year of application in India. We at Corpbiz have expert legal consultants to aid you with the process of accumulation and application of expenses for your charitable reflections, confirming the fruitful and timely fulfilment of your work.

Read our article:Is Micro-Finance Allowed under Trust? Get all the Detailed Updates Here!