The NBFC-Peer to Peer lending platform is an NBFC which engaged in the business of loan facilitation through an online platform. Both borrowers and lenders can approach to their portal and avail the services. This type of NBFC is not permitted to deposit, accept, or lend on its own. It moderates the connection between borrowers and lenders.

Technically, NBFC-P2P renders services of connecting the right borrower to the right lender via due diligence on an online portal. Apart from the aforesaid service, it also renders other ancillary services such as credit assessment services, loan recovery services, profile verification, and other associated services.

Read our article:NBFC Registration: Step by Step Procedure

Prominent Roles of Financial Services in the Indian Economy

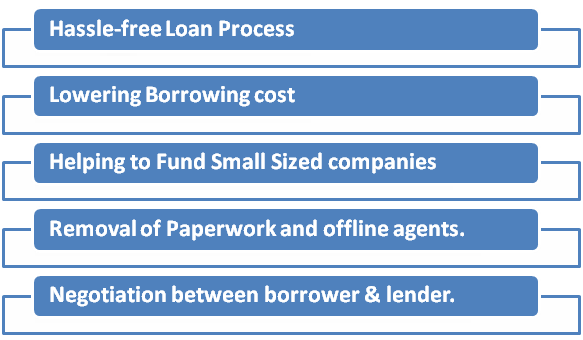

With the latest technology at the disposal, financial services are going to play a prominent role in the Indian economy due to disintermediation and low overhead cost. Credit facilitation services and lending processes of the commercial banks are over the counter. Often times it consumes a lot of time and cost to avail credit from commercial banks.

Prominent reasons for the growing opportunity of Peer to Peer NBFC in the ever-evolving Indian market:-

Registration Prerequisites for NBFC-Peer to Peer Lending Platform

- Company should be working under the Companies Act, 2013.

- Company must have two crore rupees as a minimum net worth at their disposal.

- Company must have scalable and versatile IT infrastructure to ensure the growth in business.

- Company must have a certificate of Registration (CoR) from RBI to perform the activities regarding the Peer to Peer Lending

Apart from the aforesaid prerequisites, reserve banks also look into other conditions of registration i.e. managerial, technological, entrepreneurial capabilities of the applicant to conduct such a business.

After an in-depth evaluation of the given prerequisites, RBI shall grant the approval to the applicant for setting up the Peer to Peer lending licence for the said Platform within the time-frame of the 12 months.

Role of NBFC-Peer to Peer Lending Platform

- Facilitating e-platform to the individuals engaged with peer to peer lending.

- Conducting audit of the individuals engaged with peer to peer lending.

- Undertaking risk profiling and credit assessment of the borrowers and presenting the same to the relevant lenders.

- Obtaining permission from the participants to avail of their credit information.

- Documents of the credit agreement and other relevant documentation.

- Assisting individuals during the repayment or disbursement of credit amount.

- Credit retrieval services for loans exist on the platform.

- Loan Recovery services for Loans originated on the Platform.

- Sparing and compiling all data regarding its activities and participants on hardware present in India.

Activities that are Prohibited for NBFC-Peer to Peer Lending Platform

- It is not eligible to accept a deposit in any situation whatsoever as per the guideline of the RBI Act or Companies Act.

- It cannot pursue the lending business on its own.

- It is not eligible to perform tasks like credit enhancement or provide guarantee services.

- Its balance sheet should not enclose the amount related to repayment done by the borrower and loan disbursed from the lenders.

- Cash transaction doesn’t come in the portfolio of P2P lender. The entire transactions should be conducted through the bank accounts only.

- Its services like secured lending are prohibited on its platform.

- Cross sale of products not permitted except for insurance products.

- International transaction is not allowed.

Constraints Imposed on Transaction via NBFC-P2P platform

Following are the norms that must be followed by NBFC-P2P as per the RBI’ issued directives

- Leverage ratio should be maintained within the threshold range i.e. 2.

- The lending limit should remain under the 50 lakh for all the borrowers.

- A certificate of net worth becomes compulsory in case if the lender invests more than INR 10 lacs across all platforms.

- A borrowing limit has been capped at INR 10 lakhs.

- Rs 50,000 are the limit set up by the authority for the single lender to single borrower in case of lending money across all platforms.

- The maturity period of the loan is limited to 36 months.

Operational Compliances for NBFC P2P

The given section will explain the operational compliances for the NBFC-P2P. Those are as follows:-

Operational Framework and Policy

An NBFC-P2P need to draft a board policy for the following criteria:-

- Forming criteria of eligibility for the borrowers and lenders,

- Figuring out the pricing of the available services.

- Laying down the regulations for matching lenders and borrowers is an unbiased manner,

- Securing the data from unauthorized access,

- Continuity plan for the business in case of closure of the lending platform.

- Addressing complaints thereof,

- Laying down Fit and Proper Criteria for the directors.

Information System and Maintenance

An NBFC-P2P requires the setup of a sound infrastructure backed by the latest information technology. The system must be able to provide information and documents on demand to the lenders and borrowers. The setup must safeguard the rights and information of the participants.

- The framework of the Information Technology must adhere to conditions given by the Reserve Bank for NBFC Sector.

- An NBFC-P2P must secure the Board-approved policy related to the maintenance and security of the IT system[1].

- A business continuity plan should be in place to serve the credits for fill tenures in case if the platform gets closed for any reason.

Sharing Information with Credit Information Companies (CICs)

An NBFC-P2P shall join the Credit Information Companies and share the info of the borrowers on its platform periodically, depending on the terms with CICs.

Disbursal of Loan through the Platforms

All credit must process only when the lender renders its approval and the concerned parties signed the credit agreement.

Setting up an Independent Account for Collection and Loan Disbursements

All transactions initiated from the P2P platforms need to be done via a separate bank account handled by a Bank promoted trustee. The funds accumulated from the lender and borrowers should be transferred via escrow account only.

Conclusion

P2P lending business also recognized as Marketplace lending or crowdfunding, regulated or regulated, is present in numerous countries across the globe. In our country, P2P lending is in its initial phase and it is evolving at a steady pace due to the presence of technology. Feel free to connect with CorpBiz to grab more detail on the same.

Read our article:Synopsis on Exemptions from Registration as NBFC by Reserve Bank of India