Filing the Income-tax return is one of the essential responsibilities of an individual or entity. Where everything is going online, the taxpayer is advised to file Income tax return online. While filing the ITR, there are various mistakes made by the payer.

As we all know, there is always a chance to rectify your error. Similarly, in the case of Income-tax return rectification, it is essential to comply with deadlines and procedures. In this blog, we will see in detail how to rectify the Income Tax return filing Online.

What is Rectification of ITR Filing?

A Rectification of Income tax return filing can be filed either by a taxpayer or by an Income Tax Authority can own its own rectify the evident mistake. Once a taxpayer has filed an income tax return, the Department of Income Tax processes the ITR and sends intimation to the assessee.

The intimation contains details of the return submitted by an assessee and the number that the Income Tax department has. If there is a difference in what a taxpayer had claimed (demand or higher refund) in the ITR, what an assessee can do is –

- File a rectification or

- Agree with the authority and pay the tax.

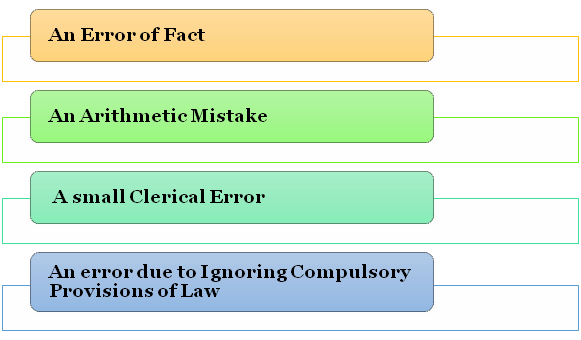

What Mistakes can be corrected by Filing a Rectification under section 154(1)?

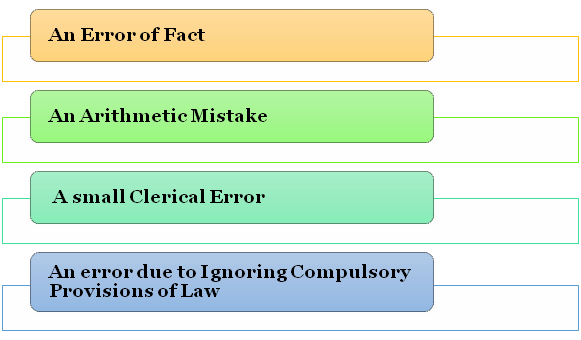

A request for rectification under section 154(1) is allowed by the Department of Income-tax for rectifying the mistakes (Apparent mistakes) in the Income Tax return. The Below mentioned mistakes can be looked after by filing a rectification –

What are the Pre-Requisites to file online Rectification Request u/s 154?

The pre-requisites for filing the Rectification under section 154 are-

- The ITR accompanying to the relevant Assessment Year should have been processed.

- An intimation u/s 143(1)/154 must-have issued by the Income Tax Department.

- If intimation u/s 143(1)/154 is not available, then an assessee applies for a new service request for intimation on the e-filing website.

- In case, an assessee has mistakenly uploaded wrong documents, the assessee can withdraw the rectification request within the end of the day of request.

- Rectification can also be done in cases where rectification rights are transferred to Assessing Officer.

- Only online rectification can be filed.

- An assessee can file a rectification request only if the previous rectification request is processed by CPC.

- In case you are correcting Tax Credits, you need not upload the XML file.

- An assessee should be a registered user on an e-filing portal.

There is another option to rectify the mistake in ITR filing under Section 139(5) of the Income-Tax Act which allows the taxpayers to correct their mistake in ITR filing through filing a Revised Income Tax Return. The provision of this section states that if the taxpayer discovers any mistake after filing their return, or any wrong statement or omission then he is permitted to file a revised return but it should be filed at any time before the end of the relevant assessment year or prior to the conclusion of that year, whichever is earlier.

What are the grounds for Requesting Rectification to the Income Tax Department?

There are certain grounds where rectification is requested. These grounds are termed as “Mistake apparent from records”. These records are supporting based on which we filed our ITR. These grounds are mentioned below-

- Mathematical and clerical mistakes

- The Decision of the jurisdictional high court not complied with while considering the specific case.

- Any provision of the law becomes functional from the retrospective date

- Erroneous application of any provisions of the Income Tax Act.

- Not permitting the credit of TDS / Taxes as per Form 26AS.

- Selection of incorrect form

- Discrepancy in TDS details

- Mentioning wrong assessment year

- Incorrect Personal Information

- Not disclosing all the sources of Income

- Not e- verifying the ITR filed.

- Failure to Pay Advance Tax/Self Assessment Tax.

- Calculating deductions that can be claimed.

- Interest on National Saving Certificate

- Any factual errors.

Read our article:10 Reasons Why Filing Income Tax Return Is Vital For You

What is the Procedure of Filing a Request for Rectification for ITR filing under section 154(1)?

The below-mentioned procedure is to be followed for Rectification for ITR filing-

Step-1: Login to the Portal

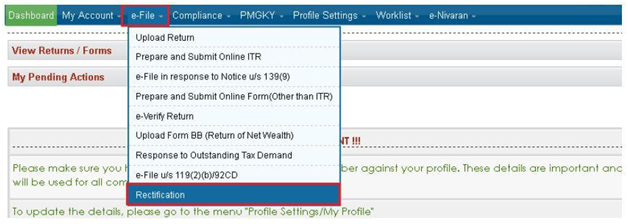

Step-2: Go to the “E-File” menu of the page and click on ‘Rectification’

Step-3: Select the options of Order/Intimation to be rectified and also the Assessment Year for which rectification is to be filed by the taxpayer Click on the “Continue” button once you select the option to be rectified.

Step-4: Based on the reason for filing the rectification, choose any one of the following options of ‘Request Type’ from the list mentioned in the dropdown. After selecting the reason, what you are required to do is-

- Tax Credit Mismatch Correction only – On selecting this option, the below-mentioned checkboxes will be displayed. You can correct TCS, TDS and IT filed in the Income Tax return.

- TDS on Salary Details.

- TDS on Other than Salary Details.

- TDS on transfer of Immovable property/Rent.

- TCS Details.

- IT Details

An assessee may select the check box for which data needs to be corrected. Also, you can add a maximum of 10 entries for each of the selections.

- If the Taxpayer is correcting the data-

If you are correcting the data in rectification, you must select the reason for opting for rectification.

What criteria are to be followed in Return Data Correction (XML)?

For rectification through Return data Correction (XML), Select the following-

- Reason for Rectification (maximum of 4 reasons) by clicking the button made available.

- Schedules being changed

- Donation and Capital gain details (if applicable)

- Upload XML, and

- DSC of the taxpayer (If applicable)

- Reprocess the case if no further data correction is required- In case of Tax Credit mismatch or Tax/ Interest mismatch,an assessee can select this option. Additionally, the assessee may choose the checkbox for which reprocessing is required.

Step-5: Click the Submit button, a pop up will appear to ensure that the details entered by you are as per Form 26 AS.

Step-6 A Reference Number is generated on successful submission of the form. Once the rectification request is processed, the rectification order under section 154 will be issued to the assessee.

Elucidate the Process of Checking the Status of Rectification under Section 154

On E-FILING Portal,the Below-mentioned steps are required for checking the status of Rectification under Section 154-

- Login to E-Filing portal

- Click on My Account and View e-filed Returns/Forms.

- Select the rectification status and click on the Submit button.

Conclusion

To avoid future contingencies, every taxpayer needs to file an error-free ITR. Despite being so careful, the taxpayer commits mistakes like not filing the ITR on time, Mismatch in form and other TDS Certificates, etc. The use of inappropriate ITR may lead to intimation from the Income-tax Authority asking you to rectify your mistakes.

As there is always a second chance to rectify your errors, it is advisable to consult a professional who can advise and assist you throughout the ITR filing and related services. For any queries related to the Income Tax return, feel free to contact our experienced and trained professionals at Corpbiz.

Read our article:ITR return filing: How to e-verify Income Tax Return Filing 2019-20