The Goods and Services Tax Network has helped in downloading Input Tax Credit (ITC) – invoice wise information of Table 8A of Form GSTR-9 (AnnualReturn).

Details of Table 8A of Form GSTR-9

A facility/feature is available to the taxpayer so that they can download the details and documents of Table 8A of Form GSTR-9 in Form of excel sheet from the portal. This can be availed by using a new choice available in the dashboard of GSTR-9 termed as ‘Document wise Details of Table 8A’ from 2018-19 FY. This will aid the taxpayer in reconciliation the values mentioned in Table 8A of Form GSTR 9, hence enable the filling of Form GSTR 9.

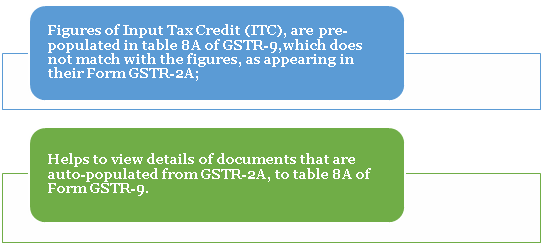

Table 8A of Form GSTR 9 works on the basis of documents essential in filing of Form GSTR-1 along with Form GSTR-5 of the supplier of goods and services. Hence, all documents which are available in GSTR-2A (Table 3 & 5), will not be accessible here, as documents which are under process stage in Form GSTR 1 or 5, are not considered for credit in table 8A of Form GSTR 9.

Read our article:Latest: Government unable to pay state’s GST compensation share

Issues address by Downloaded Excell Sheet

What are the Steps to Download?

- To download or access it, navigate to Services – Returns – Annual Return- Form GSTR-9 (PREPARED ONLINE) and then select DOWNLOAD TABLE 8A DOCUMENT DETAILS option.

- Downloaded excel file will contain following heads: GSTIN[1] or Legal Name or Trade Name of the supplier

- The month in which the document highlighted in GSTR-2A of the receiver.

- Document wise specifics of B2B (invoices), B2BA (amended invoices), CDNR (credit and debit notes) and CDNRA (credit and debit notes amended), filed by the supplier in their Form GSTR-1/GSTR-5, in separate Excel sheets.

- Details from Form GSTR-1/GSTR-5 accurately, which are filed till October 31st of the subsequent year.

- In the case of modifications, only the latest value will be accounted.

- Field showing “ITC available for Table 8A” – Yes or No ;

- ITC is not available, a separate column named ‘Reason for Non-accounting’ with reasons for non-accounting in Table 8A will be mentioned.

Some Other Important Points

- Once GSTR-9 tab for filling in enabled then option for excel file will be available.

- Generated excel sheet will be downloaded as a zip file if the number of documents is less

- If number of documents are large in such a case excel file can be downloaded in multiple parts,

- Data saved/submitted in Form GSTR-1/5 will be shown in Form GSTR-2A, but will not be shown in downloaded excel file of Table 8A of Form GSTR-9 .

Conclusion

Form GSTR-9 is annual return to be filed by all registered taxpayers regardless of the turnover of their entity for GST Registration. A taxpayer shall report all outward supplies,taxes paid, inward supplies, demands raised, refund claimed, and ITC availed and utilized in Form GSTR-9. GSTR-1 and GSTR-3B should be filed before filing the annual return for the financial year.

Read our article:GST Portal Rolled out New Offline Tool for filing GSTR 4 Annual Return Form