Every Private Limited Company must file various forms and documents on an annual basis as per the Companies Act, 2013 and Companies Incorporation Rules, 2014. A private Limited Company is a separate legal entity with a benefit of limited liability to its shareholders. A Private Limited Company must stay away from legal disputes that would tarnish its image and name of the company. There will be no legal fines or penalties if the company adheres to the compliance procedures.

What is Annual Compliance of Private Limited Company?

A Private Limited Company enjoys a separate identity which requires maintaining its active status through the regular annual filing with the Ministry of Corporate Affairs. For every private company, it is mandatory to file an annual return and audited financial statements with the Ministry of Corporate Affairs[1] for every financial year. The Registrar of Companies filing is compulsory irrespective of the turnover, regardless of whether it is zero or in crore. Irrespective of the number of transactions done, annual compliance are mandatory for every registered company.

What is the mandatory Annual Compliance for Private Limited Company?

The compliances applicable in a company are divided in two parts:

Mandatory and event-based compliances are elaborated below:

Mandatory Compliances

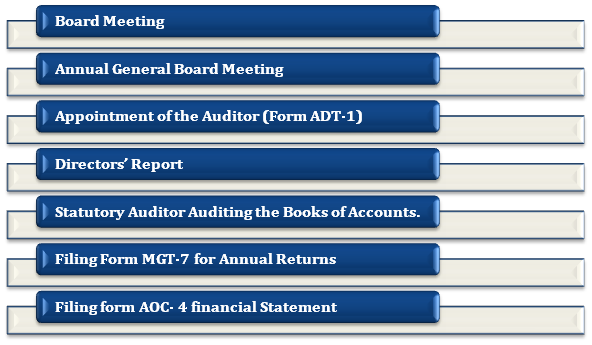

Some of the mandatory compliances which a private Limited Company should ensure are listed below:

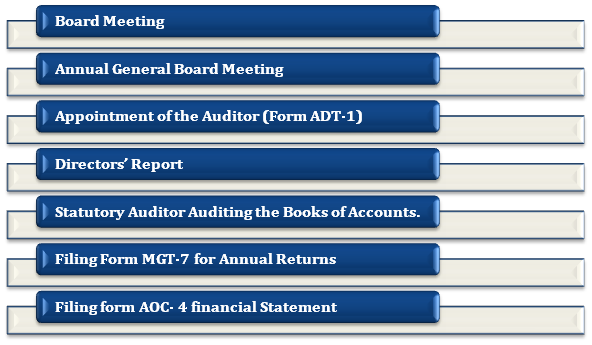

Board Meeting

- The Board of Director’s first meeting is to be conducted within 30 days of the incorporation of the company.

- Furthermore, minimum of four Board Meetings shall be held in a calendar year that is one in every three months.

- In a case where the Private Limited Company is classified as a ‘small Company’, at least two Board Meetings are to be held in a calendar year that is one meeting in every six months. Many Startups fall within the category of ‘small company.’

- Minimum of two directors or one third (1/3rd) of the total number of directors, whichever number is greater, are required to be present in the meeting of the Board of Directors.

- The discussions in relation to the meeting need to be drafted and recorded in the form of “Minutes of the Meeting” and must be maintained at the registered office of the company.

- The Directors should be intimated about the date and purpose of the meeting at least seven days before the date of the meeting.

Annual General Board Meeting

- Every Private Limited Company must hold the meeting of its shareholders once every year in a gap of 6 months from the date of closing of the financial year.

- The primary aim of an Annual General Meeting includes a discussion of Financial statement, appointment and reappointment of auditors, declaration of dividends, remuneration of directors etc.

- The Annual General Meeting shall be conducted during business hours on a working day.

- The meeting shall take place at the registered office or at some other place within the city or locality where the registered office is situated or registered.

Appointment of the Auditor (Form ADT-1)

- Every Private Limited Company must hold the meeting of its shareholders once every year in a gap of 6 months from the date of closing of the financial year that is between 31st March to 1st April.

- The first auditor is to be appointed within 30 days of its incorporation.

- Form ADT-1 must be filed for appointment of auditors.

- The first auditor is appointed for a period of five years.

- Form ADT-1 is to be filed after the appointment of the auditor within 15 days from the Annual general meeting with the Registrar of the Company.

Directors’ Report

- The directors have to give a declaration report every year.

- The declaration is made as per Section 184(1) in Form MBP-1.

- The director in his declaration has to disclose his directorship in other companies.

- The declaration must be in writing in a specified Directors’ format.

Statutory Auditor Auditing the Book of Accounts

- A regular statutory audit is conducted to examine whether the company’s financial position is accurately represented.

- It is also conducted to check Book of Accounts, bank balances etc.

- The audited financial accounts are filed before the Registrar of Companies.

Filing Form MGT-7 for Annual Returns

- The Annual Return is calculated for one financial year that is 1st April to 31st March.

- The Annual Return is filed within 60 days of holding of the Annual General Meeting.

- The Annual Return is to be filed in form or e-form MGT-7.

Filing form AOC- 4 Financial Statement

- The Directors’ Report, along with the financial statements, should be filed in form AOC-4.

- Members of the company will get approved financial statement and Directors’ report at least 21 days before the Annual General Meeting.

Event-Based Compliance for Private Limited Company

There are other compliances which need to be done when an event takes place. Some of them are mentioned below:

- Change in Directors or the registered office.

- Increase in paid-up capital or increased share capital.

- Filing of all resolution and agreements.

- The issue of remuneration or loans to the Directors.

Read our article:Procedure of Filing Annual Return: A Complete Guide

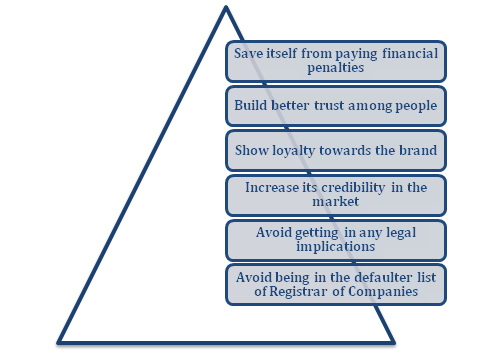

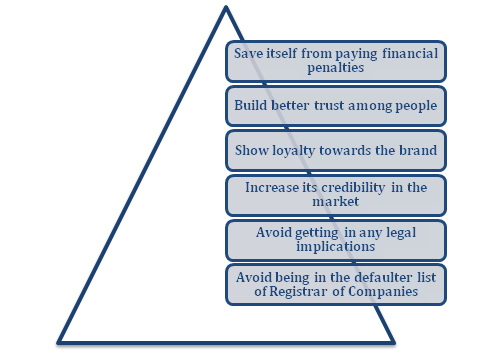

What are the benefits of Annual Compliance?

By maintaining simple procedure private Limited Companies can:

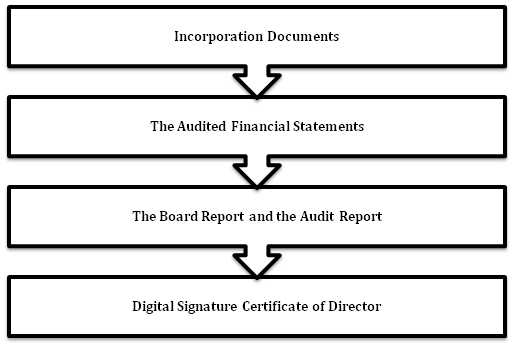

What are the information and documents needed for Annual Filing of Company?

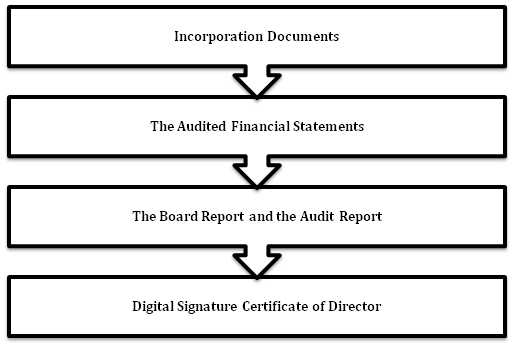

The checklist of Documents needed for Annual Filing of a Private Limited Company is mentioned below:

Incorporation Documents

Incorporation Documents includes documents like:

- PAN Card

- Memorandum of Association of the Private Company

- Articles of Association of the private Company

- Certificate of Incorporation

The Audited Financial Statements

The auditor must audit all the financial statements

The Board Report and the Audit Report

The independent Board Report and auditor’s report must be provided

Digital Signature Certificate of Director

The valid Digital Signature Certificate of one of the Directors must be provided

Know about the Consequences of Non-Compliance

In case a company fails to follow any of the regulatory compliances which are mandatory, then the company and every officer who is in default shall be punishable with a fine for the default period. The penalties will keep on increasing as the time period for non-compliance increases.

Contact Corpbiz for Easy Annual Compliance for Private Limited Company!

Our Corpbiz professionals will provide you with complete guidance on all the compliances applicable to your company. Our experienced team is driven by Chartered Accountants, Company Secretary and IT professionals having vast experience in their respective fields. Our professionals will provide emphasis on end to end compliance procedures.

Conclusion

To maintain shareholder’s trust and to bring the company a competitive advantage, the company should follow their mandatory compliance. The compliance act also attracts regular investment in the company. Failure to comply with annual compliance may lead to the removal of the company’s name from the Register of Companies register. The Ministry of Corporate Affairs is taking extreme steps to deal with any such failures. Take help of professionals as managing timely fulfillment of compliance along with day to day operations of company’s business is very difficult, so it is better to take help of our services.

Read our article:What are The Compliance and Annual Filing Requirements of One Person Company?