At the time of the incorporation of a business entity, the applicants are provided with options for selecting their class for Company based on which the Companies Act, 2013 provisions will be applied. To avail the benefits of the other classes, the Companies Act, 2013 allows changing the class post-incorporation from Private Company to Public Company and vice versa. In simple words, Private Company is a closely held Company which put a restriction on transfer of shares through its Articles of Association (AoA). The Companies Act, 2013, prohibits the invitation to the public to subscribe for shares in a Private Company.On the other hand, Public Company does not have any such restrictions regarding an invitation to the public for the subscription of shares or transferability of shares. Both companies have their benefits and limitations. The applicants sometimes desire to change their class of Company. The procedure followed for the Conversion of Private Company to Public Company will be discussed here. The article discusses the relevant provisions of Companies Act, 2013, for Conversion of Private Company to Public Company.

What is a Private Company and Public Company?

The Companies Act, 2013 provides for different types of classes of Companies, of which the most popular in the corporate world are the Private and Public Companies. These are the most preferred and the requisites of the Private and Public Company are as under:

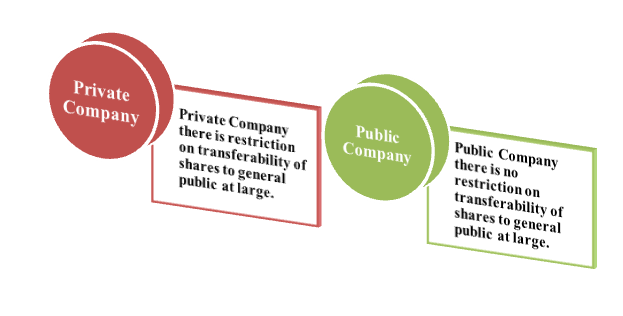

Private Company

The Section 2(68) of Companies Act, 2013, defines Private Company. The Articles of Association (AoA) restricts the transferability of shares in the Company and prevent the public at large to subscribe for the shares of the Private Company. This is the main criteria which differentiate the Private Company from Public Company.

The maximum number of the members for Private Company is 200 (except in case of One Person Company). This maximum number does not include any former employee or present employees. As the Private Company does not transfer the share freely and limited interest of members is involved, the law has granted several privileges and exemptions to Private Company.

Public Company

The Section 2(71) of the Companies Act, 2013[1], defines a Public Company. A Public Limited Company sells all or a portion of itself through an initial public offering. It is not a Private Company where the shares are restricted to be transferred to the public at large. The public Company for expansion can trade-in an open market by selling shares to the public at large to raise capital.

What are the Key considerations for Conversion of Private Company to Public Company?

There are specific rules to be followed when the Conversion of Private Company to Public Company is done. The key points of consideration are as follows:

- The members of the Company should approve for the Conversion of Private Company to Public Company.

- Name clause in the Memorandum of Association (MoA) should be amended to exclude the word Private.

- The number of members of the Company is 7 before the Conversion of the Company as prescribed under Section 3(1) of the Companies Act, 2013.

- The number of the director to be increased to 3 as prescribed under Section 149(1) of Companies Act, 2013.

- The Company should file all the annual returns or financial statements due for filing with the Registrar of Companies (RoC).

- The Company should pay all the matured deposits as prescribed under Rule 29(1) of Companies (Incorporation) Rules, 2014.

- An application should be made to modify Permanent Account Number (PAN) of Company.

- Provide information to the Central government, where the Company is registered.

- Articles of Association (AoA) should be altered so that they no longer include the restrictions and limitations of a Private Limited Company.

- The Central Government should also approve the Conversion.

Read our article:For Less Compliances and Low-Cost Incorporation; Convert your Company into LLP

What is the Procedure for Conversion of Private Company to Public Company?

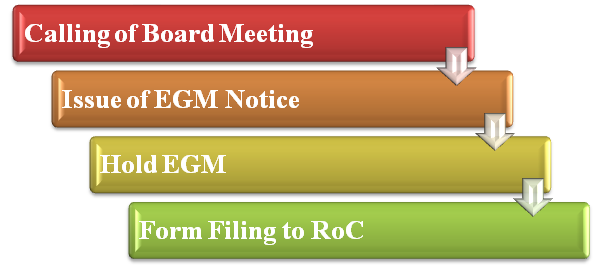

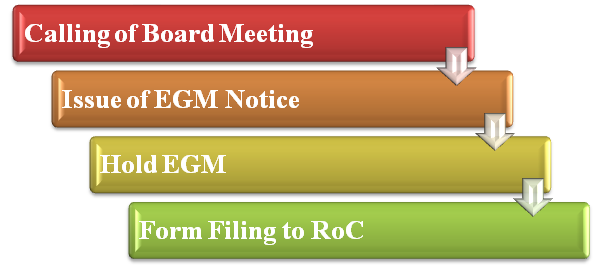

The procedure followed for the Conversion of Private Company to Public Company is as follows:

Issue a notice with the agenda of the Board Meeting. The issue of notice should be given to Directors at least 7 days before the Board meeting. The notice should be sent to the registered address of all the Directors.

Calling of Board Meeting

The Board Meeting should be held to discuss the following agendas:

- To adopt new Memorandum of Articles (MoA) subject to the approval of shareholders.

- To adopt new Articles of Articles (AoA) subject to the approval of shareholders.

- To get the approval of Conversion of Private Company to Public Company from the shareholder.

- Fix date, time and the place for holding EGM in the Company.

- To get approval for EGM and authorize someone to circulate notice of EGM.

Issue of EGM Notice

According to the provisions of Section 101 of Companies Act, 2013, the issue of notice of EGM will be given to all the Directors, Members and Auditors of the Company.

Hold EGM

The shareholder’s approval for the Conversion of Private Company to Public Company will be taken in the resolution passed by all the shareholders in the Extra-ordinary General Meeting (EGM). The notice of EGM should be given not less than 21 days before the date on which the EGM is to be held.

The notice period to shareholders can be shorter if the consent is given in writing or through an electronic medium by not less than 95% of the members entitled to vote at such meetings. Also, follow the procedure for prescribed for issuing and signing of notice of EGM.

The EGM will be held on the fixed date and resolution will be passed. The resolution will be passed for Conversion of Private Company to Public Company and alteration of MoA and AoA.

Form Filing to RoC

After passing of the resolution in EGM, it is mandatory to file Form MGT-14 within 30 days. The attachments with the MGT-14 Form to be attached are:

- Notice of EGM

- Certified Copy of the Resolution passed in the EGM

- Copy of new MoA and AoA

File Form INC-27 within 15 days after passing of the resolution in the EGM. The following attachments should be attached with the INC-27:

- Minutes of the Meeting

- Copy of Altered MoA

- Copy of Altered AoA

- Copy of the Resolution passed

- List of members in the Company with all the essential details

- Optional Attachments if required.

After the approval of the Form MGT-14 and INC-27, the Registrar of Companies (RoC) will issue a new Certificate of Incorporation for the Company with the changed name.

What Documents are Required for Conversion of Private Company to Public Company?

The primary documents required for the Conversion of Private Company to Public Company are as follows:

- Digital Signature Certificate (DSC) of all Directors

- Directors Identification Number of all Directors

- Permanent Account Number (PAN) Card of all Directors

- Passport size Photographs of all Directors

- Adhaar Card Copy

- Rent Agreement Copy (if Rented Property)

- Electricity Bill/ Water Bill (if Business Place)

- Property Papers Copy (if Owned Property)

- No Objection Certificate (NOC) from Land Lord

Conclusion

The Companies Act, 2013, provides for Conversion of Private Company to Public Company. By alteration in the Memorandum of Association (MoA) and Articles of Association (AoA), the Conversion can be done of Private Company to Public Company. The procedure of Conversion is time-consuming. We at Corpbiz have qualified and experienced professionals, to help you with the process of Conversion. Our professionals will plan ideally and will assure the successful completion of your work.

Read our article:Conversion Process of One-person company to Public or Private Company