Over the years, we have seen that the only way to create financial assets in our country was to put your money in the traditional or conventional investments categories such as stocks, bonds, cash, real estate property etc. But in recent years we have come up with non-conventional investment avenues such as Alternative Investment Funds popularly known as AIF, which is increasingly becoming popular day by day in India and across the Globe.

Investments in real estate, private equity, land, venture capital, intellectual

property, and equity long-short strategies are all alternative investments.

Here we will see an overview of the Alternative Investment Funds.

What are Alternative Investment Funds?

In our country, AIFs have defined in regulation 2(1) (b) of the SEBI[1] (Securities and Exchange Board of India) Regulations, 2012. These funds do not come under the jurisdiction of any regulatory agency in India. The funds are considered as Alternative Investment Funds because the funding comes from the privately pooled investment funds either from India or any other foreign sources in the form of a trust or company or an LLP.

In a recent report published in March 2019, the capital pumped in by the alternative investment funds rose to nearly INR 1.10 lakh Crore in the Jan-March quarter, which is 79% higher than the previous year.

What are the funds covered under the AIF?

The funds which are covered under AIF:

- Venture Capital Funds

- PIPE (Private Investment in Public Equity ) Funds

- Private Equity Fund

- Debt Funds

- Infrastructure Equity Fund

- Real Estate Fund

- SME

- Social Venture Funds

- Strategy Fund (Residual Category, including all varieties of funds such as hedge funds, if any).

What are the categories of Alternative Investment Funds?

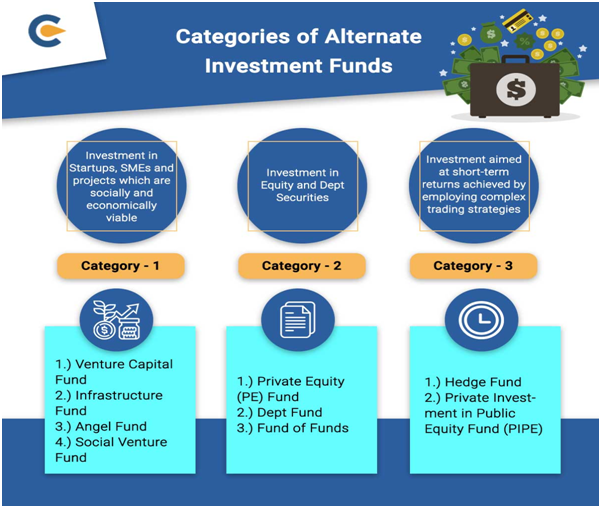

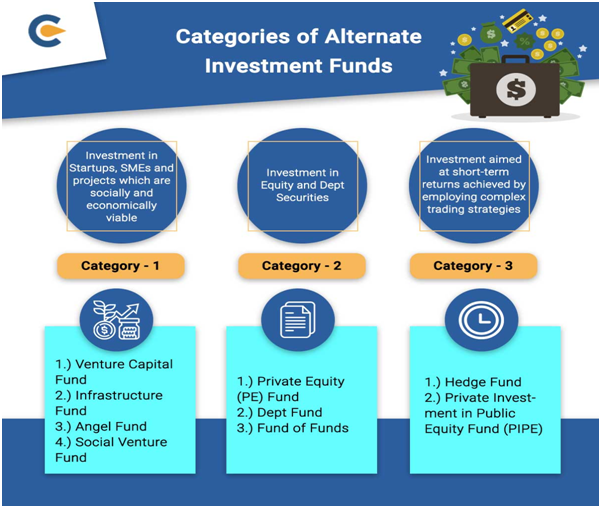

According to the Securities and Exchange Board of India, the AIFs will have to seek registration from one of the following three categories –

Category 1

The entrepreneurs who thrive on starting a Startup can opt for the Category 1. It includes the funds which invest in Startups, SMEs and new businesses which have high growth potential and are considered socially and economically viable. The Indian Government emphasizes and promotes this category of investment as they have an accumulating effect on the economic growth and employment opportunities for youths.

The funds which are covered under the Category 1:

VCF (Venture Capital Fund)

The High Net worth Investors (HNIs) who consider that high risk is directly proportional to the high return considers Venture Capital Funds as the most preferred way to invest in. Depending on the businesses profiles, assets size, and phase of product development, the investors invest in multiple startups to help them get rid of investment crunch in their nascent stage.

Infrastructure Fund (IF)

Investors who invest in infrastructure developments of public assets such as road, railways, airport, communication assets etc. The Indian Government also extends tax benefits on infrastructure investments.

Angel fund

Angel Fund is a kind of Venture Capital in which fund managers pool money from various angel investors. After getting returns from the investments, the investors get the dividends. Since there is an uncertainty in the growth of these startup firms, these investors invest in the angel fund to bring more productivity.

Social Venture Funds

The companies which focus on earning profit as well as solving environmental and social issues simultaneously take their funding from Social venture Funds. They mainly invest in the projects running out in developing countries because they have a high potential for social changes and growth.

Category 2

Category 2 includes fund investing in various equity securities and debt securities. The Government does not offer any incentives or concession on investment in these funds.

Category 2 funds contain the following kinds of Funds:

Private Equity Fund (PE)

The Private equity Funds invests in the unlisted private companies and has a fixed investment horizon from 4 to 7 years. After the completion of 7 years, the company receives a good amount of profit.

Debt Fund

Debt funds invest in the debt instruments of both listed and unlisted companies. Debt fund investors mainly target the companies having a lower credit score. Also, according to the SEBI Regulations, the amount invested in the Debt fund cannot be used to give loans.

Funds of Funds

As per the name Funds of Funds, they do not hit on a specific sector to invest in. Instead, they invest in the portfolios of other AIFs. Also, they cannot issue units of fund publicly, unlike in the case of Mutual funds.

Category 3

Category Funds includes the following funds:

Hedge Funds

In the Hedge funds, the investors’ pools capital from various institutional and accredited investors who invest the funding in domestic and international markets to receive higher returns. Then generally charge 2% for the Asset management fees.

Private Investment in Public Equity Funds (PIPE)

PIPE is a privately managed pool of privately sourced funds which is used for public equity investments. The investor will purchase a stake in the company to grow its business.

What are the top Alternative Investment Funds in which you can invest?

- SBI Small Cap fund

- Mirae Asset Emerging Bluechip Fund

- Canara Robeco Emerging equities fund

- Nippon India small-cap fund

- Kotak emerging equity scheme

- ICICI Prudential All Seasons Bond Fund

- Franklin India Dynamic Accrual Fund

- SBI Magnum Medium Duration Fund

- Axis Strategic Bond fund

- PGIM India Dynamic Bond Fund

- HDFC Hybrid Equity Fund

- Aditya Birla Sun Life Balanced Advantage Fund

The Benefits of the Rise of Alternative Investment

- The Investors must not be under illusion that by investing in the insurance risk they can get exposed to the financial outcome of insurance losses. But as these risks can’t essentially in advance get fully quantified, they can be administered and managed.

- The quid pro quo for the investors is that they are paid premium for the purpose of holding the basic risk and on the assets invested they are given an investment return. The big bonus is true diversification from a portfolio perspective.

- There is also an extensive benefit for the society and economy. The more the pension funds and investments in insurance risk by other large investors it will result in more decline of the cost of insurance and increase in capacity to insure. This shall in turn decrease the volatility of insurance pricing of property, increase stability in the market of insurance, which consecutively increases the access of insurance for those unable to afford it.

- The concluding outcome will be to decrease the negative economic effect of the natural disasters on the economy, as because those that are affected can recover faster without the requirement of government support. While the alternative investments shall create a small percentage of the majority investors’ whole portfolios, with the right kind of investment strategy they can have a noteworthy impact.

What is the tenure and Listing of Alternative Investment Funds or Schemes?

- Category 1 and Category 2

The Alternative Investment Funds launched under category one and Category 2 is close-ended and the tenure is determined at the time of application. Also, the period is for a minimum of 3 years.

- Category 3

Category 3 AIFs may open or closed-ended.

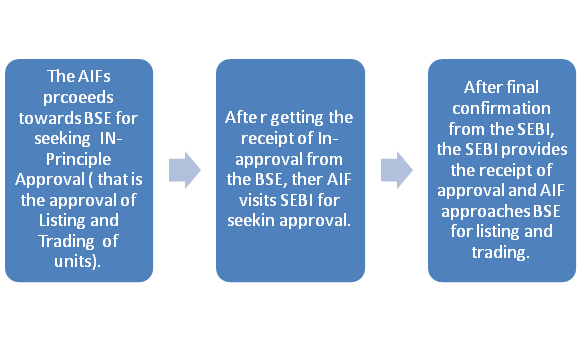

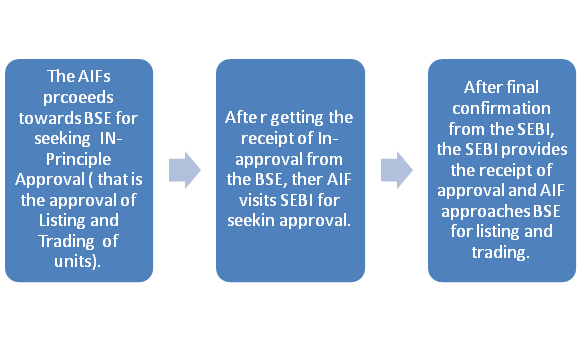

What is the process for Listing and trading alternative Investment Funds on BSE (Bombay Stock Exchange)?

What are the lists of Documents required for seeking IN-principle approval for listing units of AIF scheme?

- A Certified True Copy of Draft Information or Placement memorandum. (Hard or soft copy, any of two).

- A Certified True Copy of Investment Management Agreement. (In case of 1st Listing)

- A Certified True Copy of Certification of registration of Alternative Investment Fund issued by SEBI. (In case of 1st Listing)

- A Certified True copy of Custodian Agreement. (In case of 1st Listing)

- A Certified True copy of R & T Agreement. (In case of 1st Listing)

- A Certified True Copy of Trust Deed (if applicable)

- A Certified True Copy of Memorandum & Articles of Association of the issuer (in case of 1st listing)

- A Certified True Copy of Resolution passed by the trustee in case AIF is established as trust or Board of directors or is established as Company or by partners. in case AIF is established as a Limited Liability partnership at their meeting approving the listing of units of close-ended AIF on the BSE Ltd.

- An undertaking from the CEO/ compliance officer that AIF is in compliance with SEBI (Securities and Exchange Board of India) Regulations, 2012 as amended and all the other applicable laws.

What are the top Alternative Investment Funds in which you can invest?

- SBI Small Cap fund

- Mirae Asset Emerging Bluechip Fund

- Canara Robeco Emerging equities fund

- Nippon India small-cap fund

- Kotak emerging equity scheme

- ICICI Prudential All Seasons Bond Fund

- Franklin India Dynamic Accrual Fund

- SBI Magnum Medium Duration Fund

- Axis Strategic Bond fund

- PGIM India Dynamic Bond Fund

- HDFC Hybrid Equity Fund

- Aditya Birla Sun Life Balanced Advantage Fund

Final thoughts

The final though suggest that the successful investors are those who have a distant horizon in their thoughts in terms of an investment plan. At the same time if you want to look at the volatility of the conventional and non-conventional funds, then it is a wise option to go for the Non-conventional AIFs.

Read our article:Mergers and Acquisitions: SWOT Analysis