Volkswagen Financial Services UK deals with the financing business related to vehicle purchases under the renowned brands Skoda, Bentley, Volkswagen, Porsche, Audi etc. In this article we described about An Analysis on Margin Scheme on the Sale of Repossessed Vehicle: Latest from UK Tribunal.

Area of Contradiction

The contradiction arose when VFS seek a refund against the tax paid on the sale of repossessed vehicles on the basis of the fact that they are resellers and are eligible for the benefit of margin scheme related to aforesaid sale acquired from customers in the event of the cancellation of the hire purchase agreement.

The margin scheme is referred to as a tax arrangement that permits a VAT-registered business to address tax liabilities on the difference between sale and cost of goods. The purpose of the scheme is to avert the double taxation.

Here are the following Consideration Referred by the Upper Tribunal

- As per hire and purchase agreement, the customer is not liable to dispose of the vehicle as owner until and unless the customer purchase the vehicle after discharging the remaining instalments. Thus; whenever the agreement ends up prematurely, the customer cannot dispose of the vehicle as an owner

- No supplies involves when the customer decided to transfer the possession of the vehicle back to the VFS. In such an event, the notion of a margin scheme cannot be applied.

- ‘Repossession of the car” cannot be considered as the actual handing over of the tangible items.

- The concept of supplies in hire purchase would end up on the cancellation of the agreement.

- Irrecoverable VAT[1] Cost won’t exist in regards to repossession, thus; no double taxation and margin scheme.

- The concept of supply cannot be applied to repossessed vehicles.

Read our article:Lok Sabha clears the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020

Notion of VAT Arrangement related to a Stream of Transaction

VFS buys out vehicles from authorized dealers after paying out applicable VAT charges. Consequently, such purchases allow VFS to availed credit of VAT paid. There is no contradiction in such an arrangement.

The vehicles are further sold to the customers via hire purchase agreement. VFS is paying out VAT on the sale value of the vehicles at the point of sale to the customer, though such liabilities are retrieved from the customer overtimes.

VAT is paid on the entire value of the vehicle upfront as the concept of supply encompasses within its scope “transfer of possession under the hire purchase agreement”. There is no issue in this regard as well.

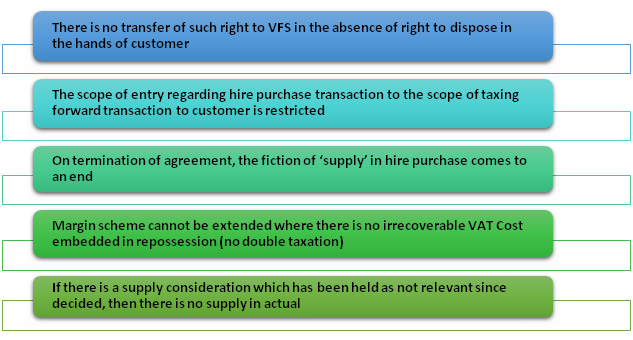

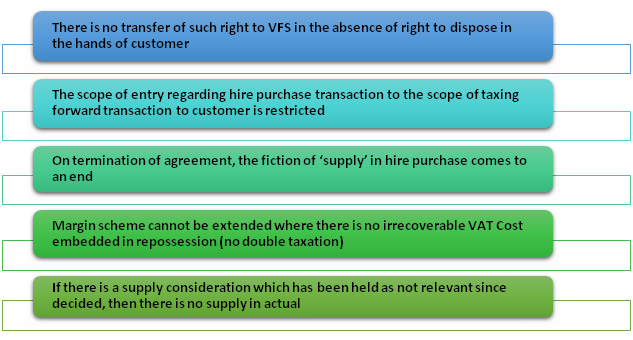

Key Pointers – Summary and Considered Decisions

Conclusions

As soon as customers pay out the entire instalments, he/she becomes the legal owner of the vehicle in absolute terms meaning – VKS would no longer claim the ownership of the vehicle. The customer is also eligible to terminate the contract after making 50% of the instalments. In such an event, the possession of the vehicle routed back to the real owner i.e. VFS. The installment paid by the customers in this regard is treated as the cost of supply by the VFS.

Read our article:An Outlook on Banking Regulation (Amendment) Bill, 2020 Passed by Lok Sabha