The lower house of the parliament i.e. Lok Sabha has passed the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020. The Taxation Bill 2020 was introduced by the honorable finance minister Nirmala Sitharaman. The ordinance renders a handful of relaxations in regards to compliance, such as wavier of penalty and extension of the time limit in the context of certain specified laws such as the Customs Act, 1962, IT Act, 1961, Prohibition of Benami Property Transaction Act, 1988, Central Exercise Act, and some Finance Acts. The Ordinance renders aforesaid relaxations in the purview of the crisis created during the coronavirus pandemic.

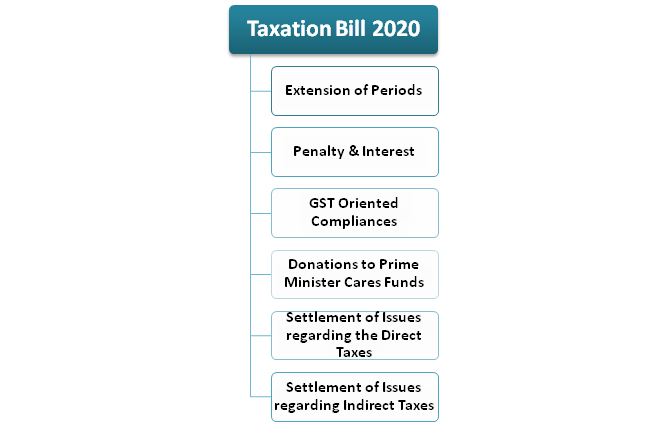

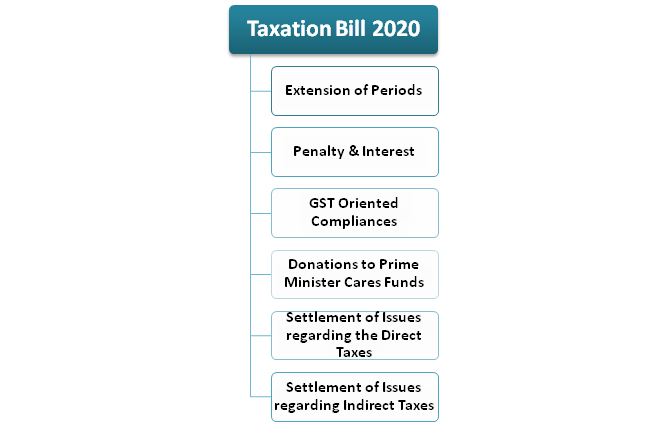

Extension of Periods

The time limits prescribed for the completion of certain tasks or compliance in the purview of specified laws, falling during the time slab 20/3/2020 to 29/6/2020, has been extended. The time for completing such tasks has been extended to 30/6/2020 or any other date recommended by the central government via notification.

The aforesaid relaxation has been given to the certain actions mentioned below:

- Issuance of notification, Addressing legal proceedings, Passing order by Tribunal and Authorities

- Appeal filing, application & replies, and providing documentation, making investment or payment for availing tax benefits under Section 80C and 80 GGC of Income Tax Act.

Read our article:Lok Sabha Passed the Foreign Contribution (Regulation) Amendment Bill, 2020

Penalty & Interest

Any tax-related payment made after the due date (due between 20/03/2020 to 29/03/2020), but after 30/06/2020 or any other date recommended by the government, will not be liable to prosecution or penalty. The interest rate applicable to the delay in payment shall not surpass 0.75%/month.

GST Oriented Compliances

The Taxation Bill 2020 amends the Central Goods & Services Tax Act, 2017 that permits the government to issue notification regarding an extension to the period for several GST-oriented compliances mentioned under the Act. Such extensions would be given based on the instructions of the GST Council. This will be done particularly in the event of actions which cannot be fulfilled or complied with due to force majeure (such as war, pandemic, or a natural catastrophe).

Donations to Prime Minister Cares Funds

The Income Tax Act permits an individual to avail certain deductions specified in the Act to lower down the taxable income. The taxpayers are eligible to avail tax benefits against the contribution made to certain charities or funds. The Taxation Bill 2020 amends the Income Tax Act to provide that contribution made by a taxpayer to Prime Minister Cares fund[1] will be eligible for a 100% deduction. This gives an implication that an amount equivalent to the contributions made by a taxpayer to the fund can be subtracted from this earning while estimating his total income under the Income Tax Act.

Settlement of Issues regarding the Direct Taxes

The Ordinance amends the Direct Tax Vivad Se Vishwas Act which renders a method for resolving the pending tax dispute related to corporation or income tax. In case if the payment is made after 31/03/2020 then the taxpayers are required to pay an additional amount in pursuant to prescribed norms. The Ordinance extends the aforesaid deadline to 30/06/2020.

Settlement of Issues regarding Indirect Taxes

The Taxation bill 2020 amends the Finance (No.2) Act, 2019 in order to extend the time limits prescribed for completing several tasks mentioned under Sabka Vishwas (Legacy Dispute Resolution) Scheme. The scheme facilitates ways to settled pending disputes regarding indirect taxes such as education cess or excise duty. In order to resolve particular disputes, an individual must file a declaration.

Further, the designated authority will look into the matter and figure out the amount payable as per the scheme and then finally issue a declaration. The Ordinance omits the sixty days time limit and clarifies that the committee must issue the statement by 31/05/2020. In the purview of the scheme, the individual is liable to pay the amount (determined by the committee) within thirty days from the issuance date of the statement. The Ordinance omits the aforesaid time limit and clarifies that the payment must be made by 30/06/2020.

Conclusion

Taxation Bill, 2020 has brought plenty of much-needed relaxation for the taxpayers seeking help amid the coronavirus pandemic. Apart from deferring several deadlines related to IT Act and Goods and services tax the bill also focuses on giving relaxations for donations made to PM Cares.

Read our article:An Outlook on Banking Regulation (Amendment) Bill, 2020 Passed by Lok Sabha

THE-TAXATION-AND-OTHER-LAWS-RELAXATION-AND-1