The foundation of the input service distributor under GST has its roots in the earlier tax regime. Applicability of ISD is only for those entities that are having their several branches all over India under the GST regime. GST registration for all the branches is mandatory from where the taxable supply would get executed. Therefore, we must say that the concept of input service distributor under GST is appropriate for those businesses that are performing its functions with more than one branch in India while getting registered under goods and service tax is mandatory.

Meaning of Input Service Distributor under GST

Input Service Distributor under GST is an office of GST-registered persons receiving tax invoices as per section 31 of the CGST Act for input services used by all of its branches. As mentioned in Section 2 (61) of the CGST Act 2017[1], it generates a prescribed document for the distribution of tax credit on input services.

By issuing an input service distributor invoice on a proportional basis, ISD is responsible for distributing the tax paid to such branches. It is necessary for the supplier office that has set its objective to act as an ISD to acquire a separate ISD. GSTIN Number for all the branches will be different from each other. However, all the branches should have a similar PAN number as the PAN number of ISD or head office.

Need for Registering as Input Service Distributor

- All the businesses that use their centralized location for the payment or billing, along with having a significant chunk of common expenditure, get the facility of input service distributor. The mechanism of ISD has emerged as the boon for business entities by simplifying the credit taking process for them. Furthermore, it facilitates the seamless cash flow under goods and service tax.

- There is no threshold prescribed for ISD registration. ISD must get registered in GST law. In order to receive incoming supply invoices whose payment would get completed under RCM, ISD should look for taking a separate registration.

Conditions to be accomplished by an Input Service Distributor under GST

An input service distributor under GST will fulfill the conditions given below in the points-

- The amount of tax paid at the time of business functioning on the services by the registered person business would get distributed by ISD to them.

- An input service distributor is not liable to accept invoices of all types on which the payment of tax would be on the basis of the Reverse Charge Mechanism (RCM). The recipient of taxable service can have the pleasure of taking credit for discharging the tax liability under RCM.

- Thus, if it ponders over taking reverse charge supplies, there is a requirement for making sure that it has registered itself just like another normal taxpayer. However, it can’t take the liberty of distributing the available tax credit.

- Distribution of input tax credit available in a specific month should take place in the same month. Hence, delay in the distribution of credit is not acceptable as well as permissible. ISD should ensure that he won’t engage himself in the distribution of credit more than its availability.

- Distribution of eligible and ineligible credit must take place separately. Furthermore, the requirement is to distribute the credit of SGST or CGST, GST/UT, or IGST in a separate manner.

- Suppose that a unit is making exempted supplies or hasn’t registered yet. In this case, the credit applicable to any such recipient unit would get distributed to it.

- Various branches or offices of a company at all the locations may go for separate registrations as ISD. So, there is nothing wrong with saying that the option of more than one input service distributor registration is on for a company or an entity.

- If the distributed credit has to go through a reduction for any particular reason, the office should issue an ISD credit note.

- Making separate registration as an ISD is compulsory despite receiving the registration in REG-01 like a regular taxpayer by getting itself registered under serial number 14 of the ISD registered form.

- Only those units would receive the ISD invoice from the input service distributor to whom ISD wants to make the distribution of credit of tax paid on services. Moreover, the intent of issuing the ITC invoice must be evident.

Read our article:Inspection under GST: A Concise Study

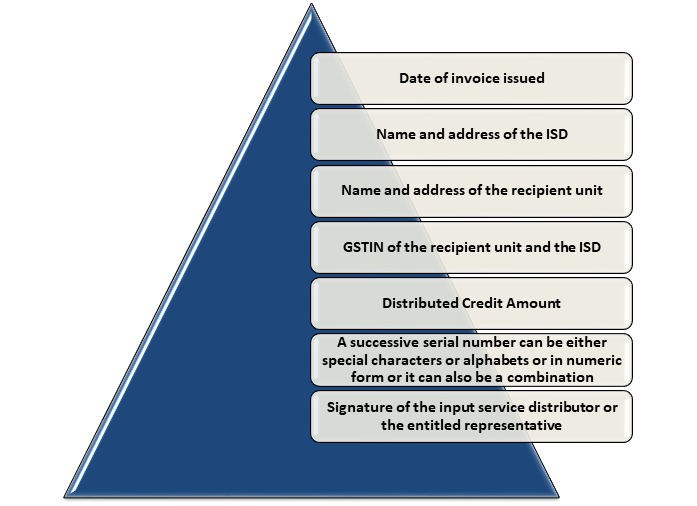

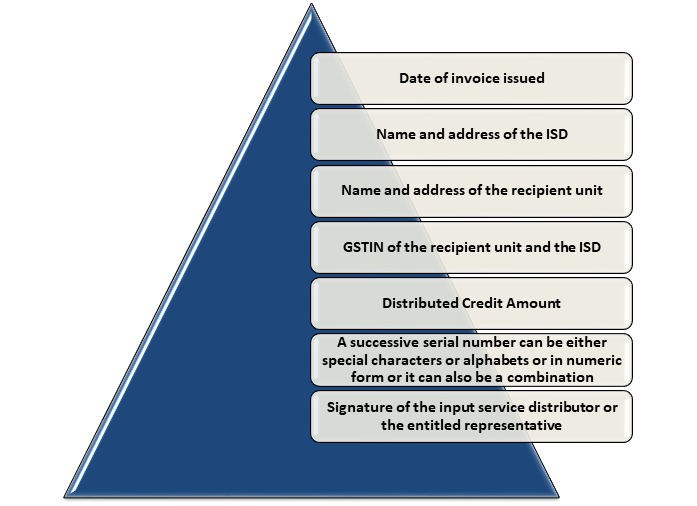

Points that must get covered in the Invoices by Input Service Distributor under GST

The relevant points that must get covered in the invoices by input service distributor under GST are as follows–

There is an exception regarding no need of numbering of documents in a serial order. This exception is applicable if ISD is a financial institution or a banking company (also including NBFC), then there is no need to number the documents serially.

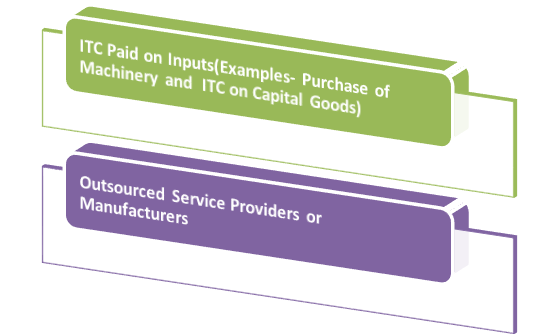

Circumstances in Which Input Service Distributor is not applicable

Input service distributor cannot take a step ahead for the distribution of ITC in two circumstances.

Recovery System for Inappropriate Distribution of Tax Credit by ISD

As per the GST Act, the following would get adjudged to be the wrongful distribution of tax credit by input service distributor-

- Distributed in an inapt ratio to one recipient or all the recipients

- Distributed credit to one recipient or all the recipients in case of the availability of the excess amount for distribution

- Distributed in surplus of what the supplier is authorized and would get recovered from such a recipient as well as interest and the Demand and Recovery provisions need to apply for effecting such recovery.

Closing Remarks

In recent years, the concept of Input Service Distributor under GST has achieved popularity, and by looking at the trend, we must say that it will achieve even more in the future. It got introduced to avoid the accumulation of ITC. At Corpbiz, our experts are working day and night to assist you with the GST registration process and help you understand more about ISD.

Read our article: Know about the Taxation of Educational Institutions under GST