The advent of the online portal has made the GST filing procedure easier and seamless. Those looking to migrate to this tax reform should mandatorily opt for GST registration in the first place.

To serve this purpose, the taxpayer needs to fill up the online application on the GST portal. The submission of such an application seeks some mandatory documents for verification purposes. Once the taxpayer completes the registration process, a time span of 15 days will be given by the portal for approving the application. In the meantime, the concerned applicant can take advantage of the Application Reference Number (ARN) to check their status regarding registration.

What is ARN Number?

ARN stands for Acquirer reference number. This unique number’s primary function is to detect the payment flow, whether in transit or not, for the credit card. Generally, the ARN is used by the bank to monitors transaction details of the cardholders. In addition to that, it also renders info about refunds awaited by the customers of the issuing bank. Hence, ARN can also be used to check GST registration status.

Format of ARN

The typical format of the ARN is: AA-07-07-16-000000-1

Let decrypts this code from left to right and see what details it render to the applicant.

- AA – Alphabets

- 07- State code

- 07- Month

- 16- Year

- 000000- It is a system-generated code

- 1- Check Sum digit

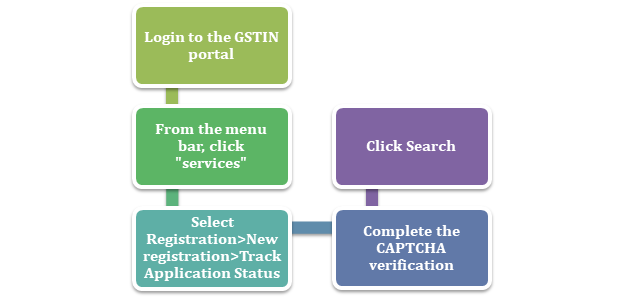

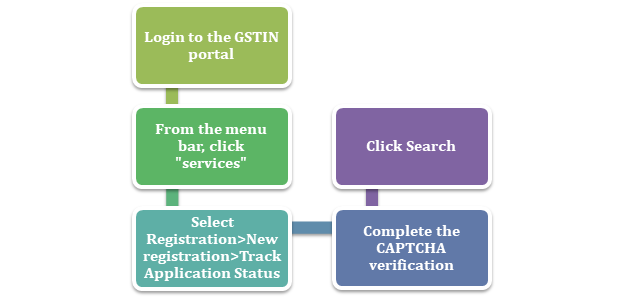

Steps to check GST registration status

- First, head over the GST portal via https://www.gst.gov.in/ .

- On the home page, go to the menu bar and select “Services.”

- Next, opt for the option called ‘registration.’

- Registration tab contains options such as ‘New Registration,’ ‘Track Application Status,’ and ‘Application for Filing Clarifications.’

- Go ahead and select ‘Track Application Status’ and provides the ARN in the given field.

- Complete the CAPTCHA verification process and click ‘search.’

Now within a matter of seconds, the portal will render the info that you are looking for. The GST registration status might contain different terminology that you are not aware of. Having said that, it means that you need to get a better understanding of each terminology, representing different information. The next section will illustrate the same in detail.

Read our article:Know how Taxpayers can cancel GST Registration!

Terminologies in GST registration status

At the GST portal, the applicants are free to check their registration application status at any stage. As we mentioned, that application status might contain some confusing terminologies; you should know how to decode it to track the real-time progress. Below is the list of terms you might encounter while checking up your status.

Provisional status

Provisional status informed the applicant about the application seeking some mandatory fulfillment. The incomplete application generally comes under the canopy of provisional status.

Pending for verification status

It indicates that the application has been filed and seeking verification from concerned officers.

Validation against error status

This status provides clarification regarding the mismatching of PAN details provided by the applicant. Whenever the IT department fails to authenticate the PAN details for a specific applicant, the feedback is delivered under this status. The applicant must rectify such flaws as quickly as possible to avoid unnecessary delays.

Migrated status

Migrated status indicates that the tax liabilities of the specific taxpayer have been migrated to GST successfully.

Canceled status

As the term suggests, the canceled status means the cancellation of the application. Whenever the authority comes across such a situation, they rolled out the quick feedback for the applicant to ensure 100% transparency. Once the application is canceled, the applicant would no longer avail of the GST registration unless they opt for the resubmission.

Mandatory documentation for the GST Registration

If you a good reason to believe that the authority is delaying the registration process due to documentation issues, here is the checklist of document for your cross-reference.

- PAN card issued to your business

- Incorporation certificate of the business, or registration certificate.

- Identity of the core members of the company, such as Directors or promoters.

- Address proof of the core members of the company, such as Directors or promoters.

- Document acting as a proof for business’ address.

- Bank account details such as transaction statements or canceled cheque.

- Aadhaar card if required

- Digital Signature of the concerned company’s members.

- Letter of Authorization.

Key points to remember for GST Registration Process

- ARN is a unique encoded 15 digit code.

- This is a system-generated code obtain automatically whenever the applicant applies for GST registration.

- ARN subsumes information such as year, date, state code, etc., and it helps the applicant to track the progress of the GST registration process.

Conclusion

Overlooking the registration status could incur unnecessary delays, and you won’t be able to proceed accordingly. The GST portal has got everything at its disposal for the well-being of the taxpayers. Whether you want to file the GST return, reap some crucial information or submit an application for GST, this portal will get the job done in no time.

Our CorpBiz group is a one-stop destination for the taxpayer seeking help regarding compliance and registration. Our in-house experts have vast experience in the taxation field and committed to delivering a spot-on solution to various problems related to GST registration. We strive to ensure 100% transparency while handling problems, thus allowing customers to understand to core of the problem. Nonetheless, if you seek additional detail or other clarification, then we are here to help. Please drop your invaluable insight into the comment box in just case if you want to share something crucial related to this topic. We will ensure a swift response to your queries.

Read our article: Guide on Revocation of Cancellation of GST Registration