GST Registration has now become a compulsory requirement for all taxpayers having turnover exceeding the threshold limit. It is also necessary for specific other individuals, including e-commerce operators, UIN holders, persons deducting TCS/TDS, etc. All these entities have to comply with GST’s rules & regulations and should file the tax on the regular interval. Apart from this standard provision, the Act also provides support for the cancellation of the GST registration. In this article, you will be going to learn about how to surrender GST number in a simplistic way.

Reasons for GST Registration Cancellation

Voluntary Cancellation

The cancellation of GST registration becomes inherent in circumstances when-:

- The taxpayer wants to shut down their ongoing business permanently.

- The taxpayer doesn’t wish to pay tax.

- Taxpayers shift their company on account of merger, de-merger, lease, sale, or otherwise.

- Taxpayers opt to make some changes to the company’s policies.

- Taxpayers no longer required to work as a registered entity.

Non-Voluntary Cancellation

As per the GST provisions, any taxpayers can issue an SUO MOTO or Non-Voluntary Cancellation for GST registration for the following reasons:

- When the business conduct from a location other than a registered place of business.

- On the demise of the proprietor of the company.

- If the taxpayer conducts its business against the provisions of the act mention in GST.

- When the taxpayer fails to do its business after GST registration for a specific period.

- If the taxpayer fails to comply with the GST provisions for invoicing of goods and services.

How to Surrender GST Registration? – Process

There is no denying that GST has simplified the way corporates handled the tax compliance previously. A taxpayer who seeks prompt cancellation of GST registration can follow the online process on the specific portal without confronting the hassles of judicial offices.

If appealed for cancellation by the taxpayer

The Surrender GST number can execute in two different ways, which are mention below.

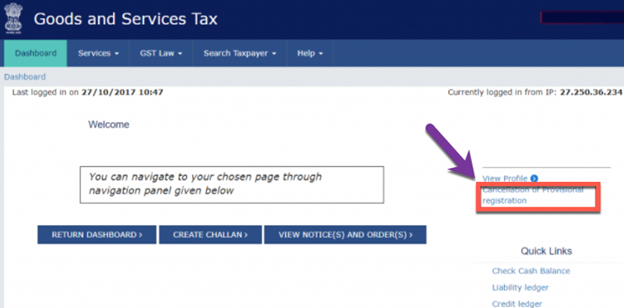

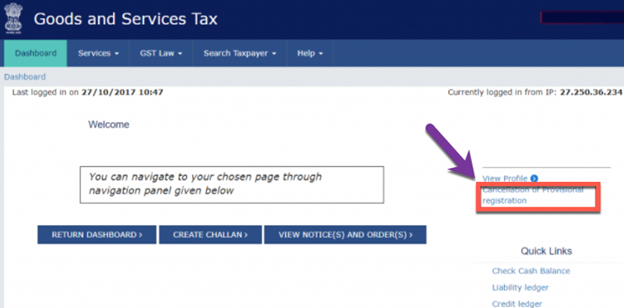

- Method 1: Online mode

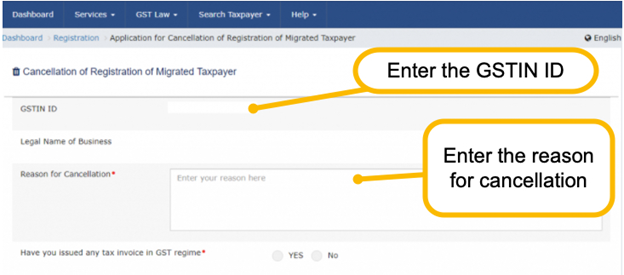

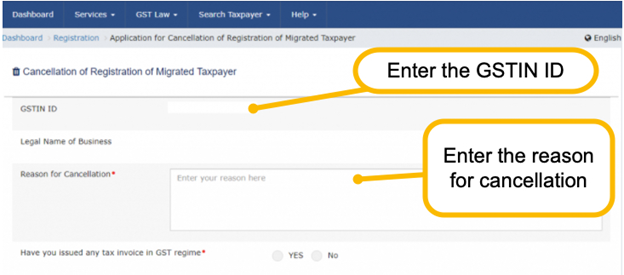

The first option is to head over to the common portal and select ”Cancellation of Provisional Registration.” located on the left pane.

On the next page, you need to enter GSTIN Number and provides a legit statement in the reason for cancellation field.

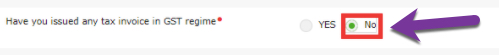

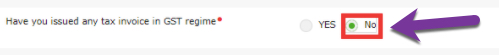

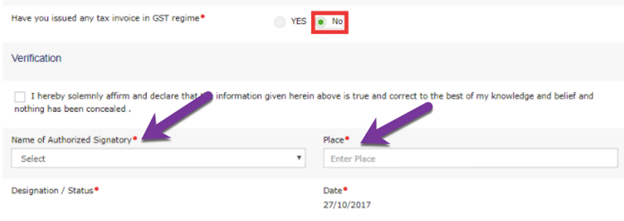

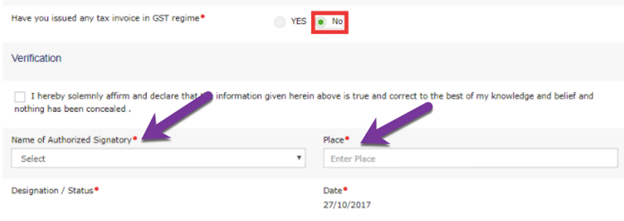

On the same page, you will be asked if you have issued any tax invoices in GST regime.

Fill up the detail regarding authorized signatories, place.

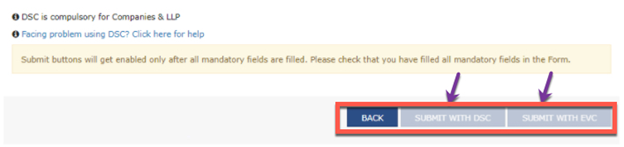

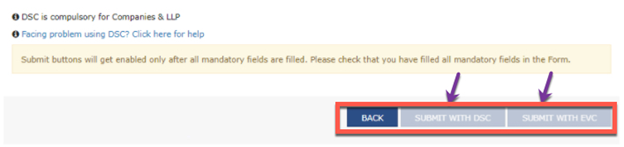

Finally, select either EVC or DSC based on the type of business you are dealing with.

- Method 2: Fill FORM GST REG-16

The second option is a bit tedious in which you have to file GSTR 16, providing reasons and details of GST cancellation.

On receipt of the application, an officer will be appointed for the verification purpose. The office will be responsible for scrutinizing the company’s stock and invoices. After that, the office will issue a cancellation order by issuing a Form GST REG -19.

On confirmation, the registration will be deemed cancelled from the date of the issue of cancellation approved by the officer.

If cancelled by the officer

The officer at any-time, as per GST provisions, can issue the cancellation order of registration via ”Show Cause Notice” highlighting the reason for such decision. In response, the taxpayer has to file GSTR Form 18 within seven days of receipt.

On receipt of a response, the officer can issue an order for the revocation of the cancellation.

Read our article:How To Obtain GST Registration in India?

Within one month of the issue of the

order, the application of GST registration cancellation can be revocated, even

if the taxpayer himself requests the cancellation or if initiated by the

officer. Within 30 days, the taxpayer can drop

a request on the GST portal to recall his application for cancellation. Based

on the reasoning of the taxpayer, the officer can either accept or reject the

cancellation application through a Show Cause Notice. Let’s wrap up this blog with a brief

overview of GST. GST is a massive reformation for

indirect taxation in India that took place post Independence. GST simplify

indirect taxation and reduce the complexities along with the cascading effect.

GST has a significant impact on businesses in India, as it offers a high degree

of transparency as compared to previous taxation models. To understand GST, we must understand

the current indirect taxation system. Unlike Direct taxes, the liability of

indirect taxes can be shifted to another entity. So, the individual who is

responsible for paying the tax can collect the tax from other entities and then

later pay it to the government. This is recognized as the ” Shifting of the tax

burden.” Need not to mention that GST falls in this very category. Hopefully, this article has briefed you everything about how to surrender the GST number. If you still have some questions in your mind, kindly head over to our official website for clarification. Read our article:GST: Penalty, Offences and Appeals Under GST Act 2017

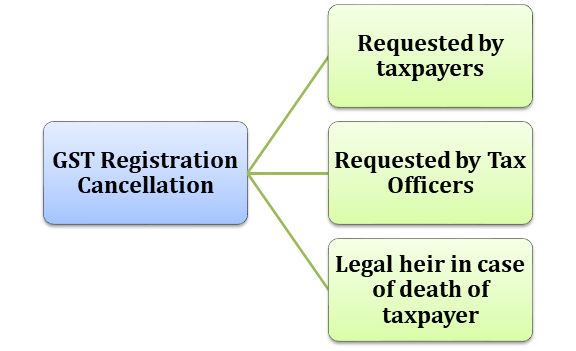

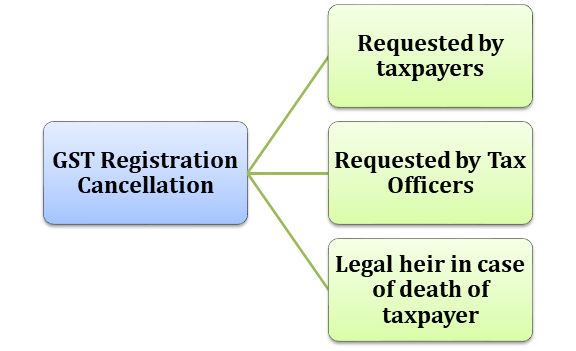

Who is entitled to Cancel the GST Registration?

Revocation of GST Registration Cancellation

Conclusion