Before starting a Nidhi company, one must get accustomed to its basics and the relevant attributes. An individual or the corporate entities can start a Nidhi company depending on the advantages that you can reap. There are plenty of restrictions and deposit stipulates that one has to encounter while establishing such a business model. But among all prerequisites, the registration of the Nidhi Company is the most vital requirement. If you are new to this business, getting familiar with its concept should be the first thing on your list.

What do you mean by Nidhi Company?

Nidhi Company is a business model registered under Section 20A of the Companies Act, 1956[1], and is regulated by MCA. There are certain provisions that one must follow to incorporate such a business model in India. Primarily, Nidhi Company follows the concept of mutuality which empowers its core members to deposit or accept funds internally. This company comes under the category of the non-banking finance sector. The primary aim of this company to encourages the sense of savings among its member and cultivates the habit of thrift for their mutual interest.

It gets its funding from its members itself. To render membership benefit, the credits are conferred at relatively nominal rates. The disbursement of such credits is done for house construction or maintenance. Since the notion of this business model is unique as compared to other organizations several imperative factors should be considered before becoming its member.

Read our article:All you need to Know about Nidhi Company Registration Procedure in India

Incorporation of Nidhi Company

- It is incorporated under as a Public Limited Company.

- The primary goal of Nidhi Company is to cultivate the habit of saving amongst its members for their mutual interest. The transaction and movement of funds in such a business model is limited within the scope of the organization. It means that the company can obtain a deposit and lends to its member without an issue.

- It requires a minimum of 200 members to ensure its existence within one year of the incorporation.

- Moreover, the company must secure a minimum threshold of Net Owned Fund i.e. Rs 10 lakhs within one year of its incorporation. The ratio of deposit to Net Owned Fund must not deviate from the prescribed limit i.e. 20:1

Constraints for Nidhi Company

A Nidhi Company is not allowed to perform any of the tasks mentioned below:

- To engage with the business of hire purchase, insurance, leasing finance, acquisition of security, and chit fund.

- To issues shares & debentures.

- To open the current account in the bank for the company’s members.

- To accept, lend, or deposit money from an outsider.

- To adopt any promotion techniques.

- To enter into any sort of contract or pay brokerage to entreat any kind of deposits.

- Promising any of the assets deposited by any member of the company as security.

Conditions related to Deposit

The following are stipulates that every Nidhi company must follow before granting credit to its members:

- The threshold of the accepted deposit must not exceed 20% of its Net owned Fund.

- The period for accepting the fixed amount in the Nidhi Company is limited to the bandwidth of 6 to 60 months. Meanwhile, in the case of periodic, this limit has been capped at 12-60 months.

- The interest rate should be capped at 2% as presented by the nationalized bank.

Eligibility for Branches

- The company should be in profit for 3 preceding years to open a new branch.

- Nidhi Company becomes eligible to open the three branches in a specific district as soon as the timeline of three years reached its completion.

- The opening of branches is also dependent on the submission of an annual return and financial statement. Both these deliverables need to be submitted to the registrar on time.

Limitations Set for Loans

The following list illustrates the limits set against the deposit made for granting of credits.

- Loan amount two lakhs – If the deposit is two crores.

- A loan amount of seven and a half lakhs – If the deposit’s threshold lies between two to twenty crore.

- A loan amount of twelve Lakhs – If the deposit’s threshold lies between twenty to fifty crore

- Loan amount fifteen lakhs – If the deposit’s threshold exceeds the limit of fifty crores.

Additional Key Factors related to Nidhi Company

- The Nidhi Companies work for the upliftment of their members.

- The outsider intervention is prohibited in this business model whether it’s a matter of availing loans or depositing money with Nidhi.

- Even the management of the company is isolated from external intervention.

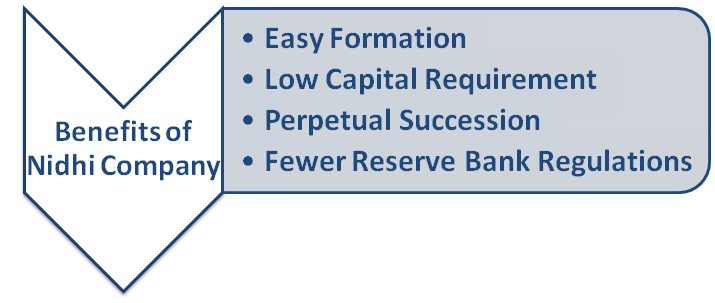

- Though the Nidhi Companies work outside the provision of Reserve Bank, their deposit acceptance operation is regulated by RBI.

- Nidhi companies do not have to access to adequate funding option. Therefore, their scope of credit is not that wide as of the other finance companies.

- The method of Nidhi Company formation is simple. It is not required to obtain any license from the RBI.

- The formation of Nidhi Company seeks minimal documentation.

- Only seven members are required to lay off the foundation of such s business model.

- Ministry of Corporate Affairs, i.e., MCA governs the administration of Nidhi Company. In addition to that, Reserve bank can also issue commands, if required.

- It typically requires a maximum of two weeks to get registered.

Conclusion

The financial markets are evolving promptly in the country as the need for credit escalating every passing day. And here the Nidhi company setting new trends in the financial market. It allows its members to trade freely within the company’s vicinity and without the fear of hostile takeovers. Feel free to connect with CorpBiz’s professionals today for Nidhi company registration. We are open to your feedback and queries.

Read our article:A Comprehensive Guide to Nidhi Company Rules and Regulations