In the purview of the Indian financial landscape, a mutual benefit society is regarded as Nidhi Company by the GOI, which is derived from the term “treasure”. The fundamental objective of these entities is to foster the habit of thrift among its members. The scope of Nidhi Company is limited to its serving members only and hence regarded as the mutual benefit societies. Generally, Nidhi companies facilitated loans to cheaper interest rates as compared to mainstream financial banks. In this write-up, you will come across the legalities to run a Nidhi company in India.

Pre-registration Conditions to Run a Nidhi company in India

Following are the pre-incorporation requirements to run a Nidhi company in India

- Nidhi companies are primarily incorporated as Public Limited Company with a minimum of 3 Directors, seven members, & a mini. capital of INR 10 lacs.;

- Nidhi companies do not have permission to issue preference shares

- Entities seeking Nidhi Company registration must affix “Nidhi Limited” at the end of their name

- Entities intending to serve as a Nidhi company must have a net owned Funds (NOFs) equivalent or more than Rs 10 lacs;

- Entities intending to serve as a Nidhi company must have unencumbered deposits of not lower than 10% of the outstanding deposits;

- The ratio of NOFs to deposit should not surpass the ratio 1:20

Prohibited undertakings for Nidhi Company in India as per Bylaws

Nidhi companies in India are subjected to plenty of legal implications that prevent them from performing the following tasks;

- Running the business of hire purchase, chit fund, leasing, insurance or acquisition of securities issued by any corporate;

- Opening current bank accounts with its serving members;

- Drawing an arrangement for the alteration of its management unless the decision for the same is passed in the general meeting & also availed the prior consent of the Regional Director having jurisdiction over Nidhi;

- Running any business that doesn’t fit the legal definition of the Nidhi company cited under the bylaws;

- Lending credit to the non-members

- Accepting deposits from the non-members

- Pledge any of the members’ assets that are serving as security;

- Drawing any partnership agreement in its lending or borrowing undertakings;

- Issue or cause to be rolled out any advertisement in any form for soliciting deposit;

- Dispense any incentive or brokerage for moving deposit from serving members or for granting loans or for the deployment of funds

Permissible Undertakings to Run a Nidhi company in India

Nidhi companies are not permitted to facilitate or grant unsecured loans to their serving members. It is not permitted to engage in Micro Finance Business and thus is only permitted to grant secured loans to the serving members.

Nidhi companies are legally permitted to advance loans only towards the securities mentioned below:

Gold Loan

Gold Loan is among India’s most popular financing schemes and the primary choice for Nidhi Companies. It is subjected to the following conditions as cited under the Nidhi Rules, 2014.

- The maximum finance limit against the gold shall be up to 80%.

- The max. repayment tenure shall be 12 months.

- The interest rate shall not surpass 7.5% plus the max. Rate of interest on gold loans.

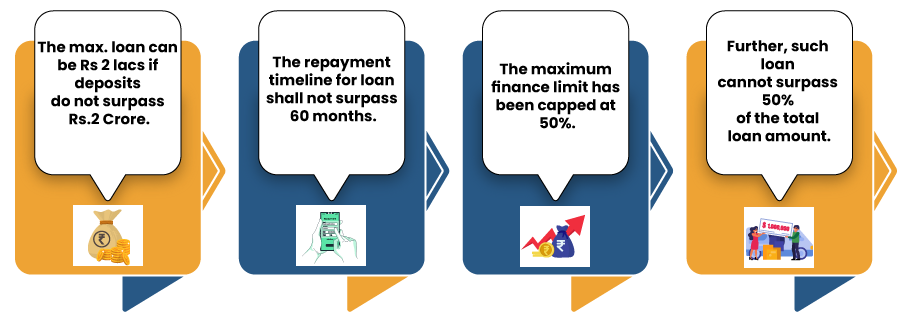

- A maximum sum of a loan of Rs 2 lacs can be advanced by Nidhi Company if deposits do not surpass Rs.2 Crore.

Loan against immovable Property

Unlike a gold loan, Nidhi company usually does not prefer this option. But, an option is facilitated via which these entities can pay their loans to those who do not have the gold.

Loan against FDR and Deposits

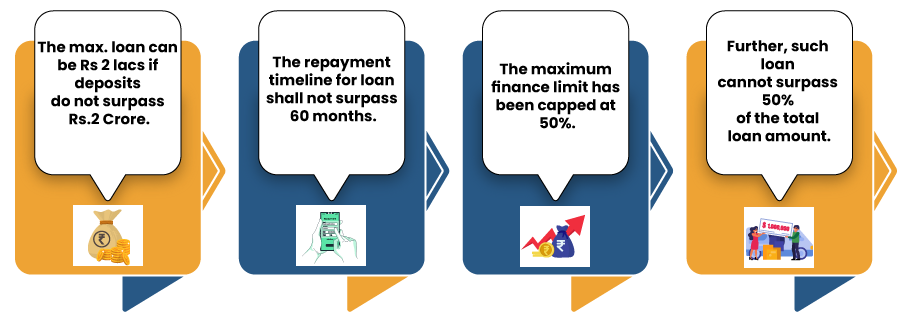

Nidhi Company can advance loans against FDR and also against the deposits kept by it. There are also certain limitations which are as follows:-

- The repayment timeline under such loans shall not surpass the period of fixed deposit.

- The maximum finance limit under such loans shall be up to the Fixed Deposit (FD) amount under Nidhi Company.

Loan against NSC/Government Bonds: It is rarely preferred by the Nidhi company.

Unsecured loan by Nidhi Company: Nidhi Companies are not permitted to grant such type of loans.

Vehicle Finance by Nidhi Company: Nidhi Companies are not permitted to grant such types of loans.

Casting Light on the Limited Reserve Bank Regulations

Though Nidhi Company serves as an NBFC-based entity, it is not mandated to avail RBI’s consent to undertake business activities. RBI has exempted these entities from the several provisions that apply to NBFCs in India. This allows them to rejoice fewer compliances as compared to their counterparts.

Accordingly, Nidhi companies are not mandated to comply with specific provisions of the Companies Act, 2013[1]. A Nidhi company confronts no restrictions while making a private placement to the serving members. Such Act shall not be considered as a public offers.

Acceptance of Deposits

- A Nidhi company has been restrained from accepting deposits more than 20 times of its NOF as per the last audit balance sheet.

- The fixed deposit (FD) shall be accepted for a minimum timeline of 6 months & a max. timeline of 60 months.

- Recurring deposit shall be accepted for a minimum timeline of 12 months & a max. timeline of 60 months.

- In case of recurring deposits pertaining to mortgage loans, the maximum timeline of recurring deposits shall correspond to the repayment timeline of such loans disbursed by Nidhi.

- The maximum balance in the saving deposit account at any instance qualifying for interest shall not surpass Rs 1 lacs, & the interest shall not surpass 2% above the interest rate payable to the saving bank account by the nationalized bank.

- Interest for recurring & fixed deposits shall be at a rate not surpassing the max, interest rate recommended by Reserve Bank, which the NBFC can pay on their public deposits.

- Every Nidhi company shall make a continual investment in unencumbered term deposits with a scheduled commercial bank or post office deposit in its name, an amount which shall not be lower than 10 per cent of the deposits outstanding at the close of the business on the last working day of 2nd preceding month.

- In case of unforeseen commitments, temporary withdrawal might be allowed with the prior consent of the Regional Director for making repayment to depositors, exposed to such norms and time limit which the Regional Director may prescribe to ensure the restoration of the standard limit of 10%.

Loan

A Nidhi company shall facilitate loans only to its serving members; the loan disbursed to a serving member shall be subjected to given limits:

- Rs 2 lacs- where the overall amount of deposit from a member is lower than Rs crores;

- Rs 7.5 lacs- where the overall sum of deposits from its serving members is higher than Rs 2 crore but lower than Rs 20 crores;

- Rs 12 lacs- where the overall amount of deposits from its serving members is higher than Rs. 25 crores but lower than Rs 50 crores;

- Rs 15 lacs,- where the overall sum of deposits from its serving members is higher than Rs 50 crores.

NOTE: A Nidhi company shall disburse loans to its serving members only against the given securities, as mentioned below:

- Loans to the serving member shall be disbursed against the securities of gold, jewellery, & immovable Property.

- The repayment timeline of such loans shall not surpass one year in case securities of gold, silver and jewellery.

- In case of immovable property, the loan amount shall not surpass 50& of the Property’s value offered as security & the repayment timeline of such loan shall not exceed seven years.

- The loan may be disbursed against the FD receipts, National Savings Certificates & other Government-based securities & insurance policies.

- The rate of interest to be imposed on any loan amount shall not surpass 7.5% above the highest interest rate offered on the deposit by Nidhi company and shall be computed on the reducing balance method.

- The deposit amount shall be estimated for the aforesaid purposes by taking the last audited annual financial statements into account.

Returns Filing for Nidhi Company

- Within ninety days from the closure of the 1st financial year post-incorporation and where applicable, the 2nd financial year, Nidhi company shall file the statutory compliances return in form NDH-1 along with such fee amount as prescribed with the Registrar certified by CA or CS in practice.

- If the Nidhi company fails to stay in line with the above, it shall within ninety days from the closure of the 1st financial year, apply to the Regional Director in form, viz NDH -2 accompanied by a fee for the time extension and;

- Every Nidhi company is mandated to file form NDH-3 with the Registrar of Companies within thirty days from the closure of each half-year- April 30th for the half-year ending March 31 & Oct 30th for the half-year ending 30th. Form NDH-3 entails the information about members admitted during the half-year, no. of members ceased, and overall members serving the entity as on the date. Loan disbursed by Nidhi Company against the certain deposit & security accepted by the Nidhi company from its serving members.

- Form NDH-3 must be validated and attested by the functional CA or CMA.

- In the purview of the Rule 3a of Nidhi (Amendments) Rules, 2019, the Nidhi-based entities within a period of one year from the

- As per Rule 3A of Nidhi (Amendments) Rules, 2019, the Nidhi Company within a period of a period of one-year from the date of its incorporation or within six months from the date of commencement of Nidhi (Amendment) Rules, 2019, whichever is later is required to file e-form NDH-4

Conclusion

Nidhi Company is a legal association where the serving members get engaged in lending and borrowing to ensure the financial well-being of each other. It serves as an independent legal entity and come under the ambit of the Company Act, 2013. The rules and provisions mentioned above are mandatory to run a Nidhi company in India.

Read our article:How to get Loans under Nidhi Scheme?