Before moving to the Nidhi Company registration procedure in India, let’s have a glimpse on the basics of Nidhi Company.

A Nidhi Company is a type of the non-banking finance company. The governance of laws and procedures of Nidhi Company is as per the Nidhi Companies Rules, 2014, along with Section 406 of the Companies Act of 2013[1]. Nidhi Companies are permitted to accept deposits from members and confer money to its members only.

The contribution of funds with regard to a Nidhi Company gets raised only from shareholders or members of the Nidhi Company, and its usage is only restricted among the Nidhi Company shareholders. All the matters concerning their activities of lending and accepting needs to follow the directions issued by the authorized body, Reserve Bank of India. On the other side, Reserve Bank of India provides exemptions to notified Nidhi Companies from the core provisions in accordance with the RBI Act and several directions applicable to Non-banking Financial Companies considering the point that the conduct of the business of Nidhi Companies is limited to their members/shareholders only.

Also known as Nidhi Bank, Nidhi Companies aims to foster the habit of savings among the members associated with the Nidhi Companies. By following the Nidhi Company registration procedure in India, you can fulfill your desire for commencing a loan or finance business in India.

Prerequisites for Nidhi Company Registration Procedure in India

The prerequisites for Nidhi Company Registration Procedure in India are as follows-

- There must be at least seven members, along with three directors.

- Not authorized and permitted to issue preference shares

- The minimum capital requirement for springing up the Nidhi Company is Rs 5 lakh.

- DIN for directors

- The mission behind the initiation of Nidhi Company should be the development of saving habits among the consumers by receiving deposits from the members and extending support by providing money to members only for mutual benefits of them.

Post-Registration Essentials for Nidhi Company Incorporation in India

The post-registration conditions for Nidhi Company are-

- Net Owned Funds needs to be beyond the figure of Rs 10 lakhs. Net Owned Funds comprise two factors- Free Reserves and Paid-up Share Capital.

- By the first year-end, minimum members or shareholders of Nidhi Company should be 200. In order to adhere to the legal requirements, a Nidhi Company should bring at least 200 members on board. If the total number of members falls below 200 anytime after this point, it will leave the company or an entity at default. There is a provision for applying for the time in the time limit of 30 days of financial year closure with Regional Director actively working with the Ministry of Corporate Affairs in Form NDH-02 in case you are unable to reach 200 members limit.

- Also, there is a condition that a Nidhi Company must not admit a minor, trust, or a body corporate as a member.

- The ratio of Net Owned Funds or NOF to Deposits must be 1:20 or even more.

- Unencumbered term deposits need to more than 10% of outstanding deposits.

Read our article:Nidhi Company Registration: Amendment Rules 2020

Documents Required for Nidhi Company Registration Procedure in India

There is a requirement of following documents for Nidhi Company Registration in India–

- Aadhaar Card copy

- Copy of PAN Card

- Passport-sized photos of every associated director

- Telephone Bill/Electricity Bill/Bank Statement Bill

- Address proof of members along with directors (Voter ID, Ration Card, along with Utility Bill (Water Bill and Mobile Bill)

- A requirement is also for the address proof of the company. You must ensure that proof of address is not older than two months.

- Rent Agreement Copy of premises of the office executed on the company name (if the property is a rented one)

- No-objection Certificate (NOC) from the owner/landlord that he is free from all types of grouses for utilizing his premises as the company registered office

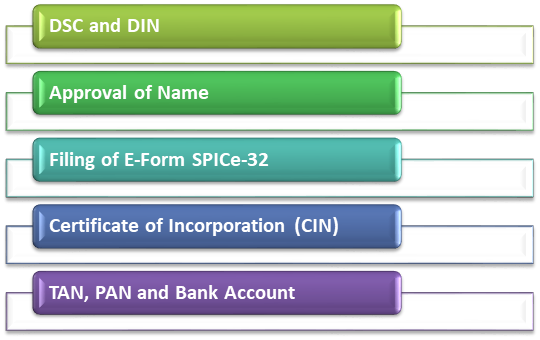

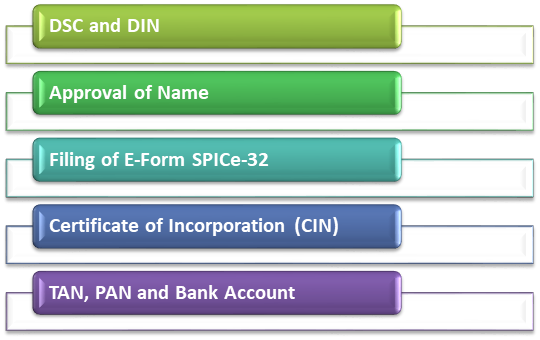

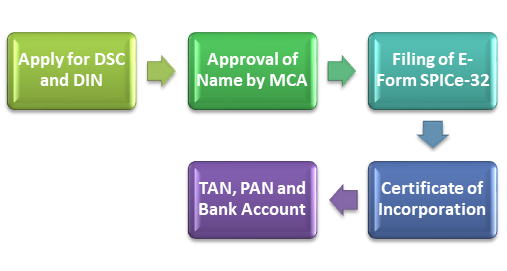

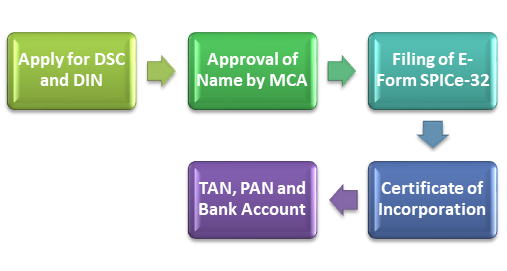

Nidhi Company Registration Procedure in India

DSC and DIN

In the first step, directors of the Nidhi Company needs to apply for DSC (Expanded as Digital Signature Certificate) and DIN (Expanded as Director’s Identification Number). DSC is a digital signature that is useful for processes concerning E-Filing. The Ministry of Corporate Affairs (MCA) is after the issuance of the Director’s Identification Number. Those Directors who are having DSC and DIN can go-ahead for skipping this step.

Approval of Name

In the second step, you have to go for choosing as well as suggesting three distinct names to the MCA (Ministry of Corporate Affairs) for your Nidhi Company registration. MCA is going to give its nod to only one name out of the three available options. Also, there is a condition that the proposed names should not match the previously registered companies’ names, and they need to be unique on their own. The validity period for the approved name is just 20 days.

Filing of E-Form SPICe-32

After the name gets approved, filing e-form SPICe 32 along with the attachments mentioned below to pace up the Nidhi Company registration procedure in India.

- Articles of Association

- Subscribers PAN Card

- Memorandum of Association

- First Directors Address Proof

- Identity Proof of First Directors

- No-Objection Certificate of Registered Office Owner

- Latest Utility Bill of Registered Office (Gas/Electricity/Telephone)

- Registered Office Address Proof (Sales Deed or Rent Agreement)

- Form DIR-2 in which First Director give their Consent and Declaration

- In Form INC-9, Subscribers along with First Directors goes for Self Declaration

Certificate of Incorporation (CIN)

Once filing of documents gets over and stamp duty along with registration fees paid, acquiring the Incorporation Certificate of Nidhi Company will require around 15 to 20 days. The Incorporation Certificate certifies that a company has been formed, and also it states the CIN (Company Identification Number).

TAN, PAN, and Bank Account

At last, you should apply for TAN as well as PAN. In the time limit of 7 working days, the PAN and TAN would get received as usual. After that, you should proceed ahead for submission of the AOA, MOA, Certificate of Incorporation, and PAN to the Bank in order to get a Bank Account opened.

The Final Words

Through this insightful write-up on Nidhi Company registration procedure in India, we have attempted to make you aware of the essentials of the Nidhi Company Registration as well as steps to follow for Nidhi Company incorporation in India. Since Nidhi Companies promote savings, it has become the sector in demand. Even though Nidhi Company registration procedure in India is not as easy as ABC to follow, support from our professionals at Corpbiz, would simplify the things for you.

Read our article: Guide on Benefits of Nidhi Company Registration in India