Nidhi Company rules and regulations oversee the Nidhi Companies post-amendment in Companies Act 2013. A Nidhi Company is a form of NBFC incorporated with intent to implant the habit of thrift and saving among the members for their mutual benefits. The incorporation of Nidhi Company takes place under Section 406 of the Companies Act, 2013.

The Ministry of Corporate Affairs (Commonly addressed as MCA) is the body behind the governance of Nidhi Company Rules and Regulations. Reserve Bank of India holds power to issue commands to Nidhi Companies in matters concerning their acceptance and deposit exercises. However, as the dealings of Nidhi Companies are associated with the money of the shareholders, Reserve Bank of India has specifically exempted this form of company to conform to its core provisions like Going for RBI registration and others. Nidhi Companies generate funds through borrowing and lending activities.

In order to incorporate a Nidhi Company, Nidhi Company rules and regulations are quite stringent. All the Nidhi Companies should work in accordance with the Nidhi Rules, 2014 created by the Central Government of India.

The formation of Nidhi Company requires less capital as compared to other forms of finance companies. Also, the incorporation process is simple, as well as easy. The popularity of Nidhi Company has soared high in recent years. In this article, we are endeavoring to let you know about the Nidhi Company Rules and Regulations.

Nidhi Company Rules and Regulations Concerning Incorporation of Nidhi Company

The Nidhi Company rules and regulations with respect to Nidhi Company Incorporation are-

- Nidhi Company must get registered as a public company as per the Nidhi Rules, 2014.

- The minimum paid-up equity share capital must be at least five lakh INR.

- The name of the Nidhi Company must end with the words ‘Nidhi Limited.‘

- Preference shares can’t get issued by Nidhi Companies according to the Companies Act of 2013.

- The Memorandum of Nidhi Companies must specify that their objects must revolve around the cultivation of saving habits amongst its members, deposits acceptance from as well as lending to its members for the sake of mutual benefit.

- A Nidhi Company needs to have a minimum of three directors along with seven shareholders for getting registered as a Nidhi Company.

- From incorporation within a one-year time limit, Nidhi Company must accumulate 200 members.

- The Net Owned Funds should be at least 10 lakh or more. Net Owned Fund is a blend of paid-up equity share capital and free reserves.

- Deposits must not be more than 20 times of Net Owned Funds.

- Nidhi Rules, 2014 specifies that unencumbered term deposits need to be equal to or more than 10% of the outstanding deposits.

Nidhi Company Rules and Regulations- Adhering to the Annual Compliances

Companies registered under Section 406- Companies Act, 2013 should follow the mandatory annual compliances mentioned below-

Form NDH-1– This Form encompasses the Return of Statutory Compliances. A Nidhi Company must file NDH-1 coupled with prescribed fees in the time limit of 90 days from the first financial year-end. The duly certification of this form must get completed through a Company’s Secretary or a Chartered Accountant in practice.

Form NDH-2- This Form is concerned with the extension of time. Form NDH-2 should get submitted to the Regional Director in the time limit of 30 days from the first financial year-end. Furthermore, you need to file NDH-2 with the prescribed fees under Nidhi Rules, 2014. After the submission, the regional director will check and analyze the application and pass orders in not more than 30 days. Filing this form becomes a requirement if your company fails to maintain compliances such as the inability to keep the NOF to deposit ratio of 1:20 and maintaining at least 200 members till the end of one year of Nidhi Company Registration in India.

Form NDH-3– It is the application for a half-yearly return. In the time limit of 30 days from the half-year closure, you should file NDH-3 as well as prescribed fees with the Registrar of Companies. Furthermore, the form must get submitted by a CA in practice or Cost Accountant or Company Secretary.

Form NDH-4– The Indian government has introduced a new compliance form under Nidhi Amendment Rules, 2019[1]. After filing NDH-4, companies can claim for the Nidhi status. If a company fails to obey the Nidhi Rules, it would eventually let the Nidhi status slip away from its zone. The due date for filing Form Nidhi-4 is in the time limit of sixty days after the year-end from the incorporation date for all the new Nidhi Companies. On the other hand, the due date for filing Form Nidhi-4 for existing Nidhi Companies in a time limit of one year from the incorporation date or in a time limit of six months from the initiation date of Nidhi Rules, 2019, whichever is succeeding.

Restrictions and Prohibitions on Nidhi Company (Nidhi Rules 2014- Rule 6)

- No Nidhi Company should perform business operations other than lending and borrowing business in their own name.

- None of the Nidhi Companies should start a current account with their members.

- No Nidhi Company should conduct the business, such as hire purchase finance, insurance/acquisition of securities issued by any of the body corporates, chit fund, and leasing finance.

- No Nidhi Company shall involve in the issuance of preference shares and debentures along with other debt instruments in any name.

- None of the Nidhi Companies should go ahead for deposits acceptance or lending to any party or individual other than their members/shareholders.

- No Nidhi Company should become a part of the partnership agreement related to borrowing or lending actions.

- No Nidhi Company should pledge any asset lodged by the members of the Nidhi Company as securities.

- No Nidhi Company should issue any advertisement in any other form for tempting deposits.

- No Nidhi Company needs to acquire other companies by buying securities or controlling the Board of Directors of different companies or entering into any arrangement for bringing changes in the management unless a Special Resolution gets passed in general meeting and acquired the approval from the associated Regional Director.

- None of the Nidhi Companies should pay any incentive or brokerage for funds deployment or for rendering loans.

Read our article:Guide on Benefits of Nidhi Company Registration in India

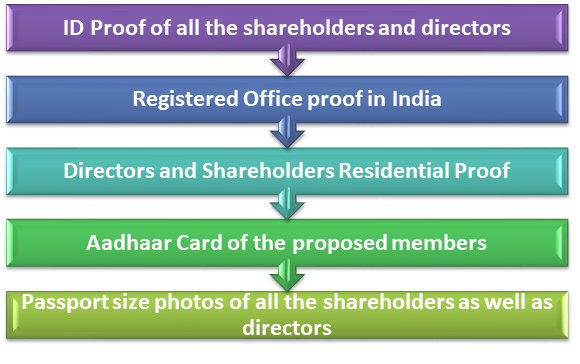

Mandatory Documents for Nidhi Company Registration in India

The mandatory documents as a prerequisite for Nidhi Company Registration in India-

Nidhi Company Membership under Rule 8 of Nidhi Rules 2014

- Trust, and Body Corporate cannot become a part of Nidhi Company.

- Nidhi Company needs to maintain a minimum of 200 members always.

- A minor won’t be able to become a member. However, as per Rule 8, if the natural or legal guardian (Member of the company) make deposits in the name of a minor, then deposits would get accepted.

Rules Regarding the Opening of Branches by Nidhi Company

- As given in Rule 10 of Nidhi Rules 2014, a Nidhi Company can go for opening branches only if it has managed to gain net profits after tax continuously within the last three financial years.

- According to the provisions prescribed in sub-rule 1, a Nidhi Company can open up to three branches in the areas of the district.

- A Nidhi Company should take the Regional Director’s permission to open more than three branches either in the district or outside the district’s boundaries.

- Nidhi Company can’t decide to open the collection centers or branches or deposit centers or offices, and offices by other names outside the boundaries of the state where lies the Registered Office.

How can Nidhi Company close its Branch?

To close any particular branch of the Company, Nidhi Company needs to follow the following points-

- Before thirty days prior to the closure, Nidhi Company must publish a newspaper advertisement in the ingrained language in the place where it performs its business operations. Also, it should inform the public with respect to such closure.

- Nidhi Company needs to fix such an advertisement copy or a notice specifying about the branch closing on the Company’s notice board for a thirty-day time limit from the date on which advertisement got published.

- In the time limit of thirty days of closure, Nidhi Company must inform the Registrar of Companies.

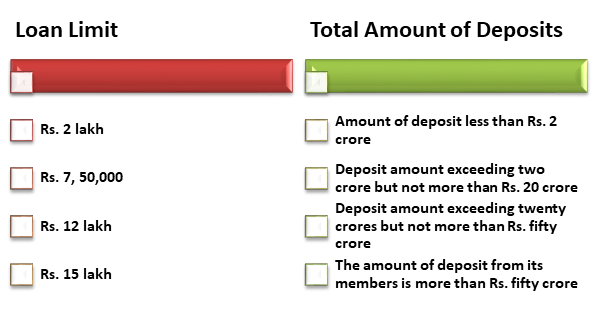

Loans under Nidhi Company Rules and Regulations

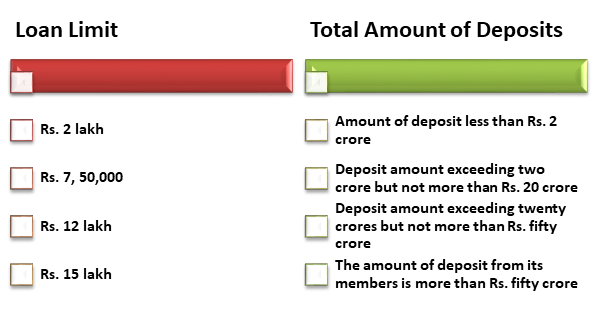

A Nidhi Company is liable to grant loans only to its respective members.Given below are the details concerning the loan limit and deposit amount-

- If Nidhi Company has failed to make profits in the previous three financial years, it won’t be able to make beyond 50% of the maximum loan amounts provided in the table shown above.

- If a member has borrowed a loan from Nidhi Company and has turned out to be a defaulter at the time of repayment, he will not be getting any further loan in the future.

Loans Granted by Nidhi Company against the Securities

A Nidhi Company can grant loans to Nidhi members only against the securities mentioned below-

- A Nidhi Company can provide loan against securities like silver, gold, and jewelry. The repayment duration for loans against these securities must not exceed one year. Loans against these securities are common nowadays. The loan value must not cross the range of 80% of the entire gold or silver value.

- A Nidhi Company can also advance loans against Immovable Property. The repayment period for such a loan must not cross the time limit of seven years. Besides this, the repayment must not exceed 50% of the entire loan.

- A Nidhi Company can also grant loans against securities like National Saving Certificates, Fixed Deposits Receipts, Insurance Policies, as well as other Government Securities. Such securities must get pledged with Nidhi, and they shall not witness lows beyond the loan period or one year; the earlier one would get considered first.

In the matter of loan against fixed deposits (FD), the loan period shall be below the FD unexpired period.

Rate of Interest under Nidhi Company Rules and Regulations

The rate of interest that would get charged on any loan granted by a Nidhi Company must not exceed 7.5% above the rate of interest (The highest one) offered from the Nidhi side on deposits and would get calculated on reducing balancing method. Information concerning the rate of interest is available in Rule 16 of Nidhi Rules 2014.

Nidhi Company Rules and Regulations Concerning Directors

In Rule 17- Nidhi Rules 2014, the Nidhi Company rules and regulations for the directors are-

- The director must be a Nidhi member.

- The director of a Nidhi Company needs to hold office for tenure of ten sequential years on the Nidhi Board.

- The director should meet the eligibility criteria for re-appointment after the two-year expiry of ceasing to become a director.

- If the central government has extended the directors’ tenure in any case, then it would terminate on extended tenure expiry.

- The person to be a director must comply with all the major requirements under the Nidhi Rules, 2014.

Penalties Imposed for Non-Compliance of Nidhi Company Rules and Regulations

If one does not act in accordance with Nidhi Rules, 2014, as well as Companies Act, 2013, then the company and all the officers in default, would get punished with fine which may extend up to Rs. Five thousand. Along with this, if the contravention continues from the side of the company, then it would get marked as punishable. Hence, the defaulter would have to make the payment of Rs. 500 per day till the time contravention proceeds.

Conclusion

It is mandatory for a company to abide by the elongated list of Nidhi Company rules and regulations as prescribed in Nidhi Rules 2013, and Nidhi Amendment Rules, 2019. In addition to this, it must abide by the Companies Act, 2013.

As the Reserve Bank of India is the responsible body behind the monitoring of the Nidhi Companies activities, chances of negligence are very low from the Company’s side. At Corpbiz, we would get the utmost pleasure in assisting you with Nidhi Company Registration and guide you about the compliance requirements.

Read our article:Compliances for a Nidhi Company: A Complete Checklist