Online business accounting is the systematic process of recording, analyzing, and interpreting financial transactions. It is the responsibility of every small scale and large scale business to furnish their accounting records to the Income Tax Department.

Usually, start-ups ignore the accounting at their initial days, and after a few years, they have to face problems. To avoid problems like raids and fines, it is always good to maintain your financial records and furnish details to the government agencies. The entrepreneurs adopt the online business accounting process to maintain the books of the accounts.

Types of Accounting

There are three types of accounting that can help any entity to track income records in the most efficient way.

Cost Accounting

Cost accounting is a form of managerial accounting that assures the entity to have a track record of the actual costs associated with manufacturing of a product or providing a service within the supply chain of business activities.

Managerial Accounting

Managerial accounting is the practice of recognizing, measuring, interpreting, analyzing and interpreting financial information to entrepreneurs in pursuit of an entity goal. The main objective of managerial accounting is to help the company internally in making well-informed business decisions to users.

Finance Accounting

Financial accounting is the process of maintaining a business record through its financial statements such as income statement, balance sheet, cash flow statement and statement of retained earnings.

Why is Online Business Accounting Important for a Private Limited Company?

Online business accounting plays a vital role in small business entrepreneurs. As it helps the proprietors, managers, investors, and other stakeholders in the business evaluate the financial performance of the business. Online business accounting gives essential information regarding cost and earnings, profit and loss, liabilities, and assets for decision making, planning, and controlling business processes.

How to Maintain Books of Online Business Accounting for a Private Limited Company?

To make account books easy, accurate, and secure, entrepreneurs can maintain their financial record through electronic mode. Even the Companies Act 2013[1], under section 128, permits maintenance of electronic books of account.

There are many software’s available to maintain books of account through online business accounting at an affordable price. Each transaction must be recorded under applicable accounting standards and principles while maintaining accounting books through online business accounting. These principles/standards ensure accuracy and meet all requirements of industries and legislation.

Types of Online Business Accounting

The types of online business accounting are as follows;

Double Entry Accounting System (DEAS)

DEAS acts as an error detection system. According to the double-entry accounting system, each transaction has two parts, so it affects two ledger accounts while recording transactions. It includes a debit entry in one account and a credit entry in another account. If the sum of debits does not equal the corresponding sum of credits, it means an error has occurred. It also makes sure the accuracy of the recording of transactions.

Accrual Basis Accounting

The accrual basis of accounting is considered as standard accounting practice globally. It gives a more accurate measure of a company’s profitability, as it covers all revenues and expenses irrespective of cash collections and expenditures. For instance, an expense that has been done in a period for which no invoice has been generated at the end of that period is considered an accrued expense and is still recognized.

Benefits of Accounting Services to a Business

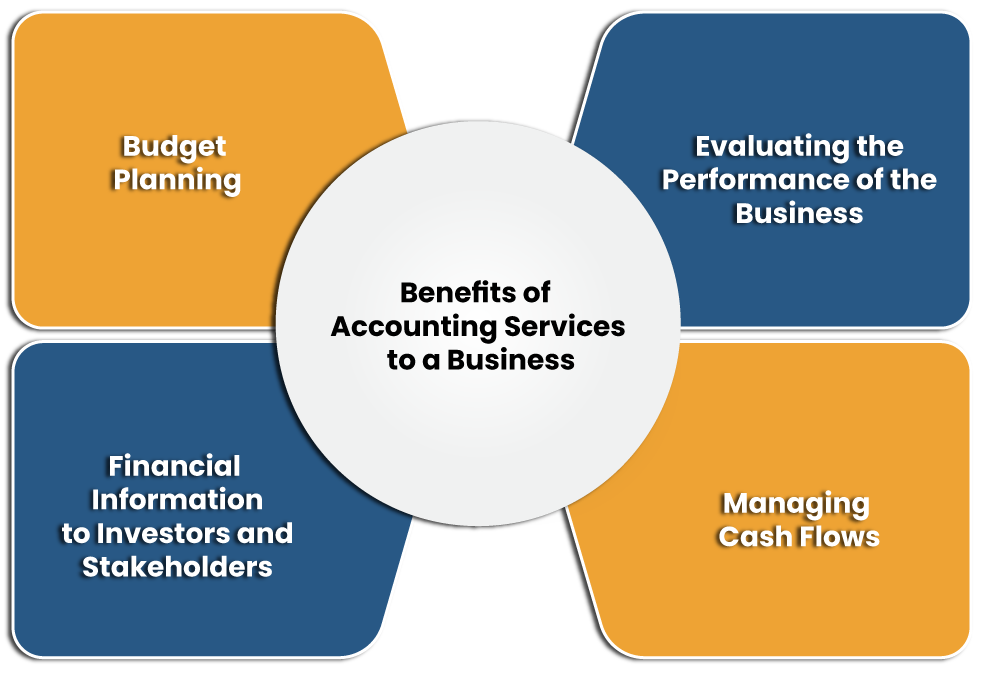

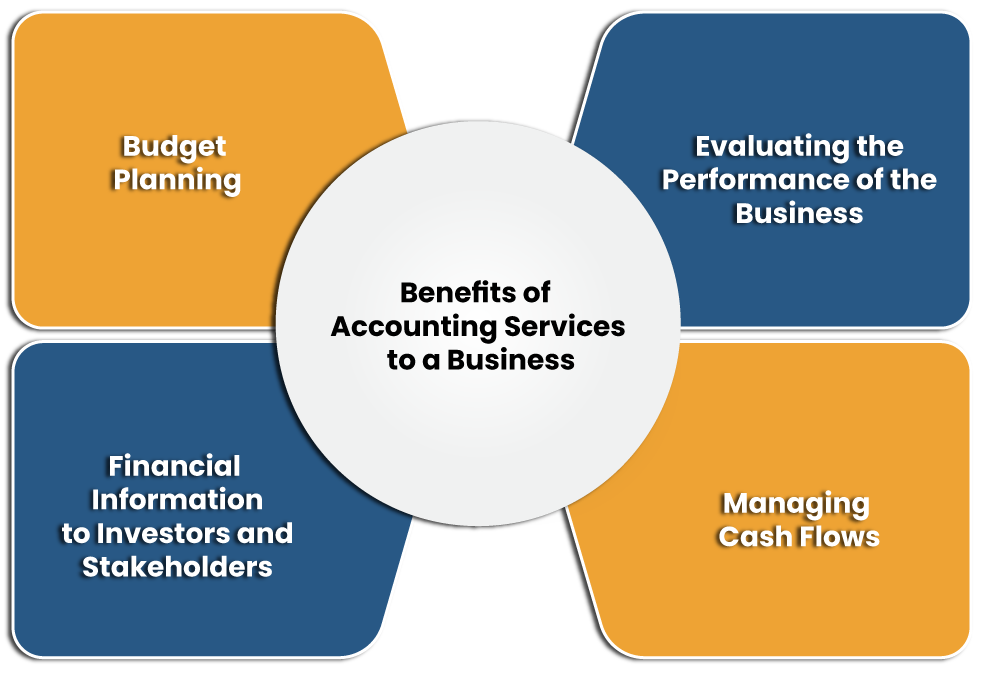

Budget Planning

Budget planning helps the entrepreneurs effectively to control the private limited company’s income and expenditure while monitoring the business’s managerial policies and goals.

Evaluating the Performance of the Business

It helps to measure the business’s performance concerning key metrics like net profit, sales growth, etc.

Managing Cash Flows

Regular tracking of funds coming into the business helps in predicting trends, payments to employees and suppliers, covering loans, etc.

Financial Information to Investors and Stakeholders

The investor will get better business health ideas to understand its solvency, creditworthiness, liquidly, stocks, and bond issuers.

Is it Mandatory By-Law to Maintain Record of all Financial Transactions?

In India, the companies’ Registrar demands a strict record of income tax payments at the end of the financial year, so automatically; it becomes the company’s liability to maintain its book of accounts.

- The Income tax act needs mandatory audit in certain Expertise’s, and that is possible only when books have been maintained as per the law.

- The Companies Act regulates companies, and as per the Act, every company needs to file an annual return with the company registrar. It is compulsory even if there are losses in a business or no income has been earned in a financial year.

- It helps the entrepreneurs to maintain track records of their expenses, monitor their revenues, and make informed financial decisions.

Concluding Remark

Online business accounting may seem a burden at the initial phase of business. Still, it is important to manage the daily functions, which keeps the business running successfully. Without online business accounting, there is the fear of hitting a cash flow crisis, wasting money and other financial information issues, and leading to a business’s closure. In this competitive market, an accurate book of account is necessary for every small business to sustain itself. Kindly associate with the Corpbiz to know more about the Online Business Accounting for your business.

Read our article: An Outline on the Norms to Register Company in India