India’s economy is based on the public and private limited company’s income, which both the companies invest for the growth of national GDP. The Companies Act, 2013, plays an important role in providing certain rules & regulations related to public and private company registration in India as per the related norms to register. The most commonly practiced corporate firm is a limited company; the unlimited company is relatively uncommon.

Any company gets established by entering in a list of records with the aid of the Memorandum of Association (MOA) and Article of Association (AOA) with the registrar of the companies of the state in which the company registration office is placed. The native companies and foreign companies involved in India’s business activities are allowed to access branches in India closely to carry out the below-listed functions. Those functions are given below:-

- To perform on behalf of the parent company in various activities related to their business in India like buying or selling of the products by agents in India as per the related norms to register.

- To organize various research works on behalf of the parent company, consequences will be made available to Indian companies.

- To commence export/import trading activities in favor of the parent company.

- To publicize several technical & financial association with the Indian companies.

Read our article:Exciting Benefits of Private Company Registration That You Can’t Ignore!

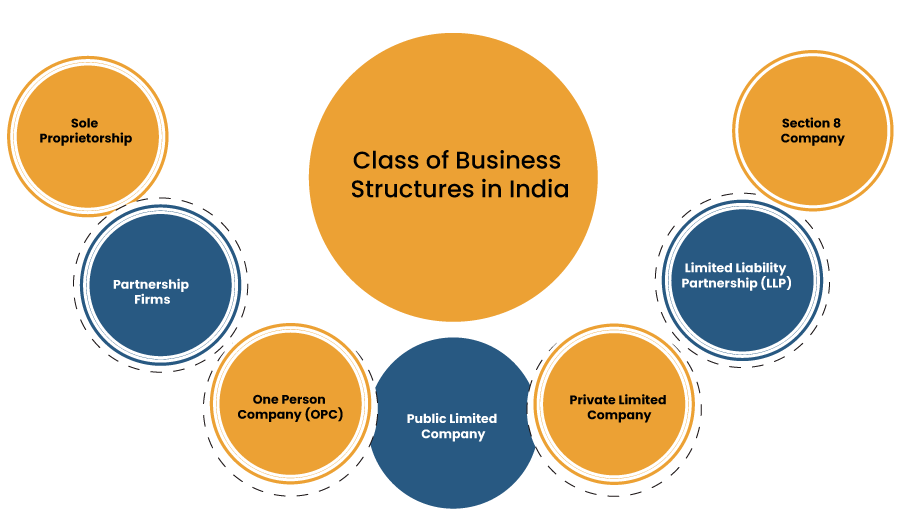

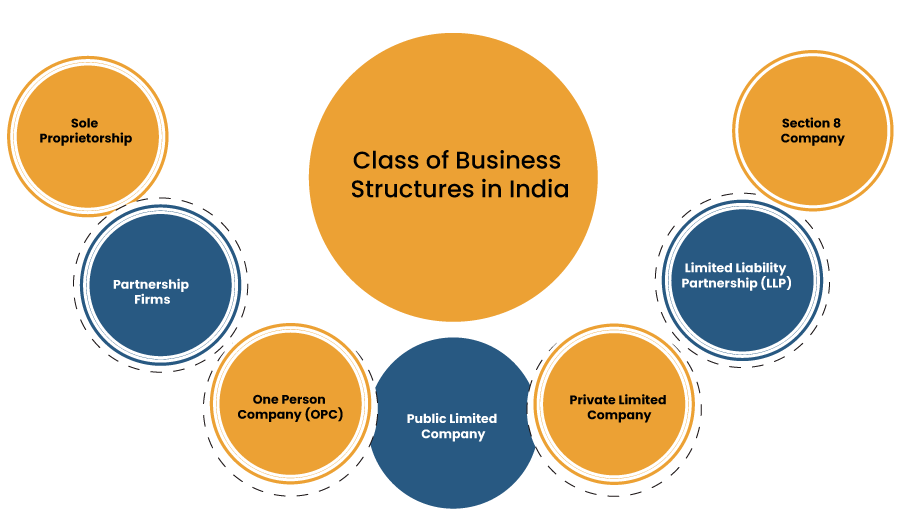

Class of Business Structures in India

There are four main class of companies in which the entrepreneur can incorporate in India as per the related norms to register a company in India.

Sole Proprietorship

The sole proprietor company is the uncomplicated structure of company incorporation in India. One person administers sole ownership, i.e., a sole proprietor.

Benefits of the Sole Proprietorship

- In this structure, there is no need for government registration.

- There is no consent needed for any other individual in this structure.

- The profits & loss all belong to the sole proprietor as per the related norms to register.

- The Sole proprietor does not require paying a double tax. Give income tax returns only on their business income.

Norms to Register the Sole Proprietor Company

Before incorporating the sole proprietor company, the entrepreneur needs to have the below-listed records:

- Aadhaar card

- PAN card

- Bank account

- Registered office proof (rental agreement or utility bills will do)

Once the sole proprietor has these, he/she can approach any chartered accountant for a registration certificate, or he/she can do it by himself/herself.

One-person Company

A company made by one person can be considered as One Person Company (OPC). The Indian government introduced it in the year 2013. As of 2013, no person can register a company; as he needed to have a minimum of 2 directors to incorporate a company as per the related norms to register.

Benefits of a OPC

- Insignificant acquiescence in comparison to a private limited.

- Limited liability for directors clearly means the owners’ personal assets will not be at risk at the time of loss.

- Legal acceptance.

- The process will get easier to sanction the loan from the bank.

- The entrepreneur has complete control over the company.

- To manage the structure of OPC will be easier.

Partnership Firm

The entrepreneur needs a partnership deed to register a partnership firm, an agreement signed between the partners. This agreement will include all the duties & obligations of the partners.

Points to Remember in Partnership Deed

- Mandates of all the partners

- Mandates of the partnership firm i.e., initiating date of the firm Capital investment ratio that invests by each partner and Profit share ratio among partners

- Remuneration/fee to be paid out to partners Rights of each partner

- Duties and accountability of each partner

- Additional provisions on which all the partners are jointly acknowledged.

Key Advantages of Partnership Firm

- Easy and convenient to form

- There is no requirement to submit the annual returns to the MCA body.

- Inspection of the financial record is not mandatory.

Limited Liability Partnership (LLP)

LLP endures the benefits of other business structures, corporations, partnerships, and sole proprietorship. Limited Liability Partnership is designated as feasible enterprises, and it segregates the owner’s personal and business liabilities as per the related norms to register the same.

Kindly note: LLP’s are not liable to pay debt on business activities like others.

Benefits to Incorporate LLP

- The paperwork in LLP is much insignificant in comparison to other incorporations. This makes LLP more flexible and accessible to form.

- LLP can keep their members safe from liabilities like personal debts & legal hearings.

- LLP provides to facility their members like tax feasibility, where the income, expenditure & profit become the part of the owner’s tax return.

- In LLP there is no need to follow a business structure to run one’s organization.

- Profit-sharing is also feasible under the characteristics of LLP as per the related norms to register.

Private Limited Company

A private limited company is a body that has a minimum of two and a maximum of 200 members. It cannot lift the public’s reserve; it means that the company cannot issue its shares in public. There is no paid-up capital is needed to set up a private limited company as per the related norms to register the same.

Benefits of having Private Limited Company

- The members of company accountability concerning its debt are only limited to his/her shares.

- The shares of the company are efficiently negotiable to the other person as per the related norms to register.

- The company can issue debentures and can accept funds from public platforms.

- There is more tax assistance in LTDs, and the percentage of applied tax is also lesser than other types of company registrations.

Public Limited Company

A Public limited is a voluntary association of members which is registered under company law. It has a separate legal existence and the liabilities of its members are limited to shares they hold.

Benefits of Being a Public Limited Company

- Raising the capital through issuance of public shares

- Offering shares to the public gives the opportunity to segregate the risk of company ownership among a large number of shareholders.

- The shares holds by the public limited company can easily transferable than those in the private equivalent, meaning shareholders benefit from liquidity.

Section 8 Company

Section 8 company is governed by the Companies Act, 2013. Company incorporation rules, requirements, procedures, and procedures vary more or less exclusively depending on the type of company that is to be incorporated. A Section 8 company is a company licensed under Section 8 of the Companies Act, 2013, formerly known as a Section 25 Company under the Companies Act, 1956, in which the principal item was;

- To promote research,

- Social Welfare,

- Religion,

- Charity,

- Commerce,

- Art,

- Science,

- Sports,

- Education,

- To protect the environment or any such other object

Therefore, the Section 8 Company is a company not registered for charitable or profit purpose. However, it is similar to a company trust or society; the one exception is that the Section 8 Company is incorporated under the MCA of the Government of India, while the Society and Trust are registered under the rules of the State Government. However, it has various advantages when it is compared to a trust or society and also has high credibility among donors, government departments and other stakeholders.

Further, the main feature of Section 8 Company is that the name of the Company can be registered without using the word “Limited” or “Private Limited”

Minimum Requirements for Section 8 Company as Per the related Norms to Register

- Minimum 2 shareholders;

- 2 Directors

- Director shall be the Indian national;(at least one director)

- No requirement of Minimum capital

- The Income-tax PAN is essential requirement in case of the Indian citizen;

- Id Proof of the applicant

- Resident Proof

- If the business place is on rent then the rent agreement along with the copy of the latest electricity/water bill in the name of the landlord and a NOC signed by the owner of that property.

- If the business place is owned by either the Director or the Promoters, any of the documents justifying the ownership such as Sale Deed/House Tax receipt etc along with the no objection certificate as per the related norms to register.

Norms to Register a New Company in India

Spice+ is an integrated web form, having two parts; Part A is for Name reservation for new companies and Part B is offering services at the time of incorporation of companies. The below discussed are the norms to register a new company in India.

SPICe+ Web form

- First the applicant have to Login to MCA portal

- After that click on MCA services SPICe+ form

- After that click on new application, if you are going to register a New company

- On click of existing application, the applicant can see the application numbers along with proposed name.

Part A: SPICe+ Web form

Clicking on the new application, SPICe + Part A is enabled which contains fields related to the name reservation. Applicant needs to fill the details of Type, class, category, sub-category and proposed name of the company. After that he has to select auto check button, auto check do the 1st level of automatic scrutiny of the approved/proposed name against the name rules.

- When Part-A has been done , Applicant can click on the submit for name reservation or, he can proceed for incorporation or, cancel

- If he opted for proceed for incorporation, Part-b of the web form gets enabled which will have different proceedings to do.

SPICe+ Part B

- Applicant has to fill the basic details related to the company to be registered i.e. registered or correspondence address of the applicant

- Applicant has to be filled the subscribers and directors details and the details related to capital investment.

- He has to fill the basic details for the issuance of Permanent Account Number (PAN) and Tax Deduction Account (TAN).

- He has to upload mandatory attachments in the web form.

- After performing the above said steps, he has to confirm on the relevant declarations and click on the pre-scrutiny of the attached documents.

- Once pre-scrutiny of attached document is successful, he has to click on submit button.

- Once web form is submitted successfully, applicant will get a confirmation message.

- Applicant can then download Spice+ Part-B pdf file from the dashboard to affix the DSCS.

- In Part-B all relevant linked forms based on the fields filled by the applicant are enabled and available for the applicant to fill and submit as per the related norms to register.

AGILE-PRO Web Form

AGILE means Application for Goods and Services Identification Numbers, Employee State Insurance Corporation Registration plus Employee Provident Fund Organization Registration. The old AGILE form (INC-35) has now been replaced with the AGILE –PRO web form.

AGILE-PRO Web Form requires to be Filed Linked with Spice+ Web Form as per the related norms to register

- Registration with Goods and Services Tax Identification Numbers (GSTIN).

- Registration with Employee State Insurance Corporation(ESIC)

- Registration with Employee Provident Fund Organizations(EPFO)

- Professional Tax Registration.

- Bank account number.

eMoA and eAoA form

The Electronic Memorandum of Association (EOMA) which is the constitution of the company can be filed as a form linked to the Spice + Web form. The Electronic Articles of Association (eAoA) which lays out all the rules related to the internal affairs of the company can be submitted as a form associated with the SPICe + web form.

URC-1 INC-9 PDF Generation

In case of Part-I companies, it is necessary to file URC-1 form including details of existing company. On the basis details of subscribers and directors filled in Part B, INC-9 declaration form shall be auto populated and available in dashboard for the applicant to download and affix DSCs.

To Upload Spice+ Web Form

After the DSC is affixed with Spice + Part B PDF and all other linked forms, the applicant asks to click on the option to upload form. On successful upload of all forms, a Unique Service Request Number (SRN) is generated and displayed to the applicant.

If forms need resubmission due to any errors flagged during the processing, the SPICe+ form has to be resubmitted in the above said manner.

Documents Required concerning the norms to register a New Company

The below discussed are the list of documents required in order to fulfill the norms to register a new company in India.

For SPICe+ Web Form

- MOA

- AOA.

- Declaration of the directors and subscribers (Affidavit is not required)

- Address proof of principle place of business.

- Utility Bills

- Certificate of Registration of foreign body corporate (if any).

- A resolution passed by Promoter Company.

- The interest of first directors in other company.

- Nominee Consent (INC-3).

- Identity Proof of the subscribers along with the residential address.

- Identity Proof of the nominee along with the residential address.

- Identity Proof and address of applicant I, II, III.

- Resolution of unregistered companies in case of Chapter XXI (Part 1) Companies.

- Declaration in Form no. INC-14 and INC-15 as per the related norms to register.

For AGILE –PRO Web Form As Per The Related Norms To Register

- Address Proof of office

- Proof of appointment of Authorized Signatory for GSTIN (either of the documents

- Letter of Authorization

- ID Proof of Authorized Signatory for the opening of a bank account.

- Address proof of place of business of Authorized Signatory for the opening of a bank account.

- Specimen Signature of Authorized Signatory for EPFO.

Conclusion

The embodiment of a company plays an important role in the company’s business and Economic activities latterly. It can be considered the company cannot take benefit in exemptions of transactions unless & until it is registered under the Companies Act’s 2013[1] and do not fulfill are the condition provided under the Act.

Being the reason for this can be considered as even the government can examine the company’s matters only when the company is fulfilling the norms to register the company provided under the Companies Act. The company can enjoy certain benefits and concessions provided by the government. Kindly associate with CorpBiz expert to know more about norms to register the company in India.

Read our article:All you need to Know about Private Limited Company