The export and import activities in India is regulated by the Foreign Trade Policy (FTP) under section 5 of the foreign trade (Development and Regulation) Act 1992. The Foreign Trade Policy 2015-20 is in effect since 1st April 2015. As per FT D&R act, the term “export” is referred to as an act of taking goods outside India via land, sea, or air with an authentic transaction of money.

In this write-up, you will learn about how to export goods from India to an overseas destination in a legal way. But before we get started with our topic i.e. how to export goods from India, let’s cover up some basic things first.

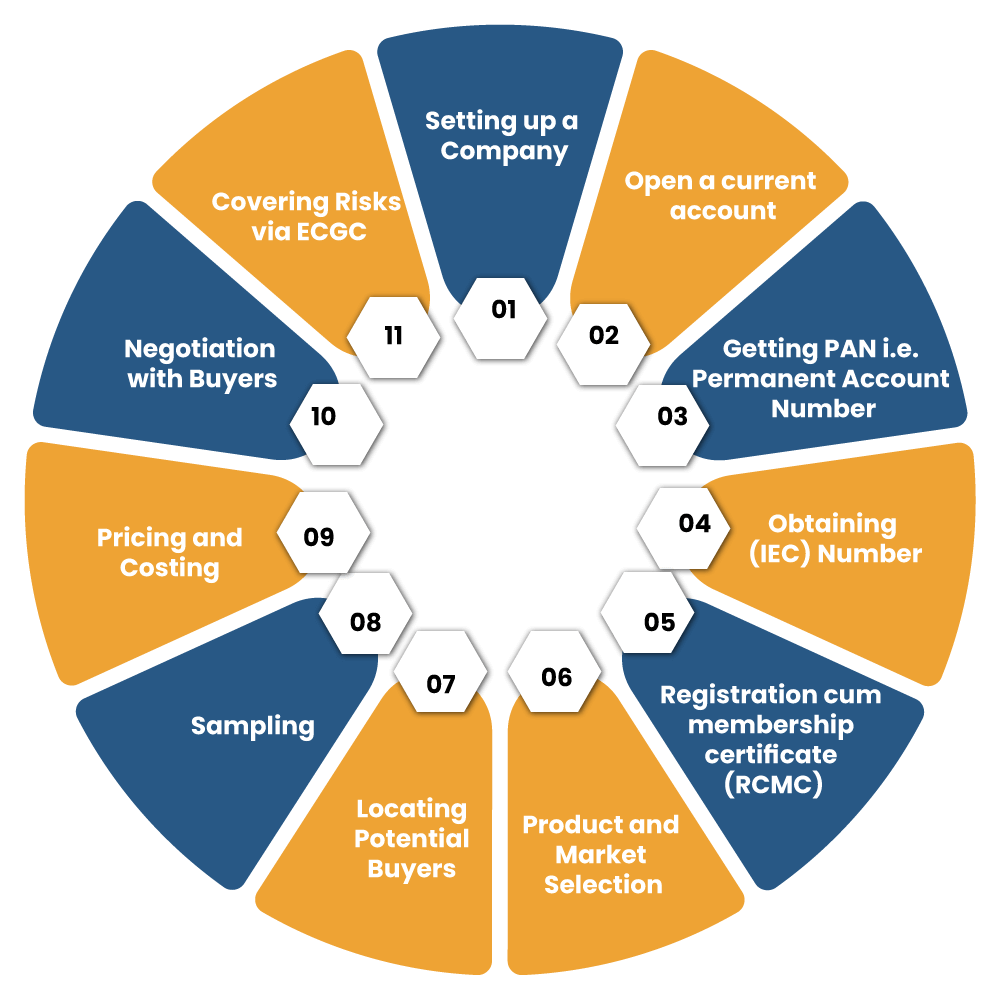

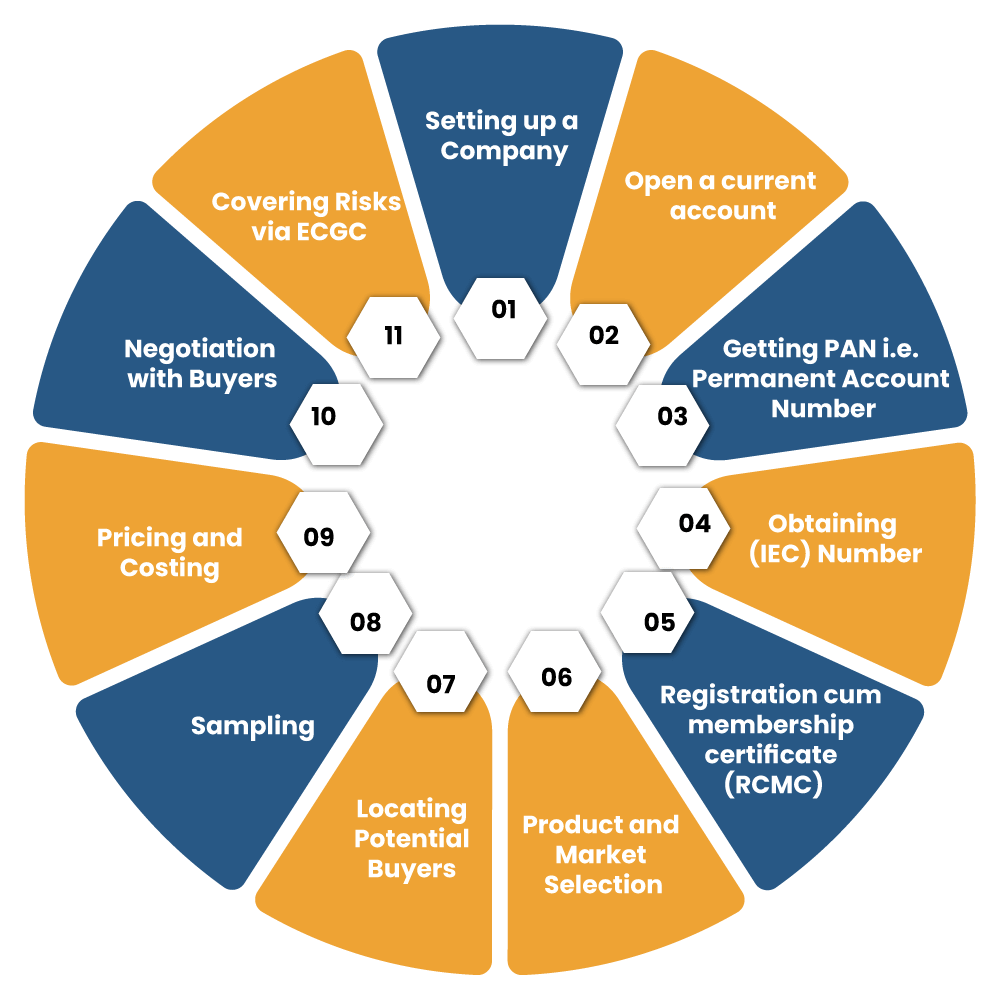

How to Start an Exporting Business?

Export has various dimensions from a legal viewpoint. This is why exporters have to comply with plenty of regulations before getting into international market. The following steps would ease out complications related to the commencement of the exporting business.

Setting up A Company

To commence the exporting business, the individual has to set up a legal entity such as a Proprietorship or partnership firm as per predetermined procedure with a unique name and logo.

Open a Current Account

A current bank account is mandatory for dealing with foreign exchange transactions. To open such an account, you will be required to approach your bank and drop the request for the same.

Getting PAN (Permanent Account Number)

Every exporter needs to avail a PAN from the IT department.A PAN card impart the legal status to the individuals.

Obtaining (IEC) Number i.e. Importer-Exporter Code

Under the Foreign Trade Policy, it is compulsory to get an IEC number for cross-border trading from India. Para 2.05 of the Foreign trade policy, 2015-20 has underpinned the guidelines for obtaining an IEC number, which is PAN based.The application for obtaining the IEC registration is filed at DGFT’s official portal as per ANF 2A. An application seeks the inclusion of some important documents along with a fee of Rs 500 from the applicant.

Registration cum Membership Certificate (RCMC)

For obtaining authorization to export/import under Foreign Trade Policy 2015-20, the exporters have to get an RCMC issued by the concerned authority.

Products Selection

The Government of India has imposed some limitations on the export of certain goods. So it would be a good idea if you go through the list of prohibited items for export available on the DFGT website.

Markets Selection

The market selection should be done based on competition, market size, payment terms, quality requirements, and benefits available under FTP.

Locating Potential Buyers

Participating in exhibitions, trade fairs and B2B portals are conducive ways to locate potential buyers. Creating a multilingual website with a goods portfolio, price, payment terms can also help find the right buyers.

Sampling

Providing on-demand samples to the potential buyer is the best way to generate export orders. Under Foreign Trade Policy 2015-20, exports of technical samples and bonafide trade of exempted items would be allowed without any restriction.

Pricing/Costing

Pricing plays an important role in boosting sales as far as international competition is concerned. The price ought to be worked out taking into account all expenses from sampling to export. The goal of obtaining export costing should be to maximize the profit margin by selling large quantities of goods at the best price. It is advisable to prepare an expert costing sheet against every exportable product.

Negotiation with Buyers

After determining the interest of the buyer for the given product, ask for a reasonable allowance in the price might be considered.

Covering Risks via ECGC

International trade is vulnerable to payment risks due to insolvency issues with buyers or countries. These risks can be curbed with an appropriate Policy from Export Credit Guarantee Corporation Ltd (ECGC).

International trading involves the risks of payment due to buyer/ Country insolvency. To cover these risks, one has to take advantage of an appropriate Policy from Export Credit Guarantee Corporation Ltd (ECGC)

Where the buyer is reluctant to make an advance payment on a particular order, it is recommended to procure a credit limit on the importer from ECGC for tackling the non-payment.

Read our article:A Detail Guide to Complete IEC Modification Online

What are the Steps to Export Goods from India?

One must follow the given steps to process the export order. Remember not to skip any of the steps to ensure order processing.

Order Confirmation

The export order received must be examined thoroughly on account of specification, items, payment terms, packaging requirements, and delivery schedules. Now, this would lay down the ground for a formal contract between the exporter and overseas buyer.

Goods Procurement

After securing the export order, it’s time to plan for production to meet the requirement. The good’s quality should not be deviated as of the samples offered to the buyer in the initial stage.

Quality Control

In the current time, it’s imperative to align with the required quality standards while manufacturing the exportable goods. Edible items, agro-based products, and certain chemicals are exposed to mandatory pre-shipment inspection. Overseas buyers may have their standards/specifications in place for quality control[1]. Quality is something that should remain on par when it comes to exportable goods.

Finance

Legal exporters have the privilege to access a wide range of finances for pre and post-shipment offered by commercial banks at lower interest rates. Packing credit advance is available for new exporters in the pre-shipment stage against the lodgment of a confirmed order for one hundred & eight days to meet the work capital requirement for raw material, manpower, packing, and logistic expenses.

In general, financial institutions offer 75% to 90% advances of order value securing the balance as margin. Banks essentially adjust the packing credit advance on account of proceeds of export bills discounted, purchased, or negotiated. Post shipment finance is offered to exporters generally up to 90% of the invoice value for the basic transit period and in the event of usance export bills up to notional due date. To be exact, the maximum timeline for post-shipment advances is one hundred & eight days from the shipment date. Advances granted by financial institutes are adjusted as per the realization of sale proceeds related to export bills.

Labeling, Packaging, and Marking

Accurate labeling helps in recognizing the exportable products. So make sure labeling, packaging & marking should be done as per the convenience of the buyer. Good packing will ease out complications arising during the handling and loading of the shipments. It inherently reduces the shipping cost and boosts the safety of the cargo. Marking includes, buyer’s address, package number, weight, destination, handling instructions, etc. renders identification & details of cargo packed.

Insurance

The marine insurance policy provides comprehensive cover to exportable goods against the risk of loss in transit. In general, exporters use the CIF contract to arrange the insurance, meanwhile, FOB and C&F is used by the buyers to obtain the insurance policy.

Delivery

It is the most imperative feature of export, and the exporter must align with the delivery schedule. There should be precise planning in place to ensure seamless and timely delivery of the cargo.

Customs Procedures

It is mandatory to avail PAN-based BIN ( Business Identification Number) from the customs before the filing of shipping bill related to the clearance of exportable goods and open a current account for crediting of any drawback amount. The current account must be registered on the system. In the case of Non-EDI, the export bill & shipping bills are needed to be filled as per the format given under in the Shipping Bill and Bill of Export (Form) regulations, 1991. An exporter must apply separate forms of export bill & shipping bills of duty-free goods and dutiable goods.

Under the EDI system, a declaration as per the prescribed format must be filed via the Service centers of customs. A checklist is rendered for the data verification by the exporter/CHA. After completion of the verification process, the data is submitted to the system which in turn generates a Shipping Bill Number for the exporter/CHA. In the majority of scenarios, a shipping bill is processed depending on the exporter’s declaration. Where the testing of the sample of exportable goods has to be conducted, the customs officer may pick up two samples from the shipment and enter the details thereof along with particulars related to the testing agency in the ICES/E system. Any changes in the checklist generated post declaration’s filing can be made at the service center if the document yet to be submitted.

Customs House Agents

Exporters may avail services of Customs House Agents licensed by the Commissioner of Customs. They are professionals and facilitate work connected with the clearance of cargo from Customs.

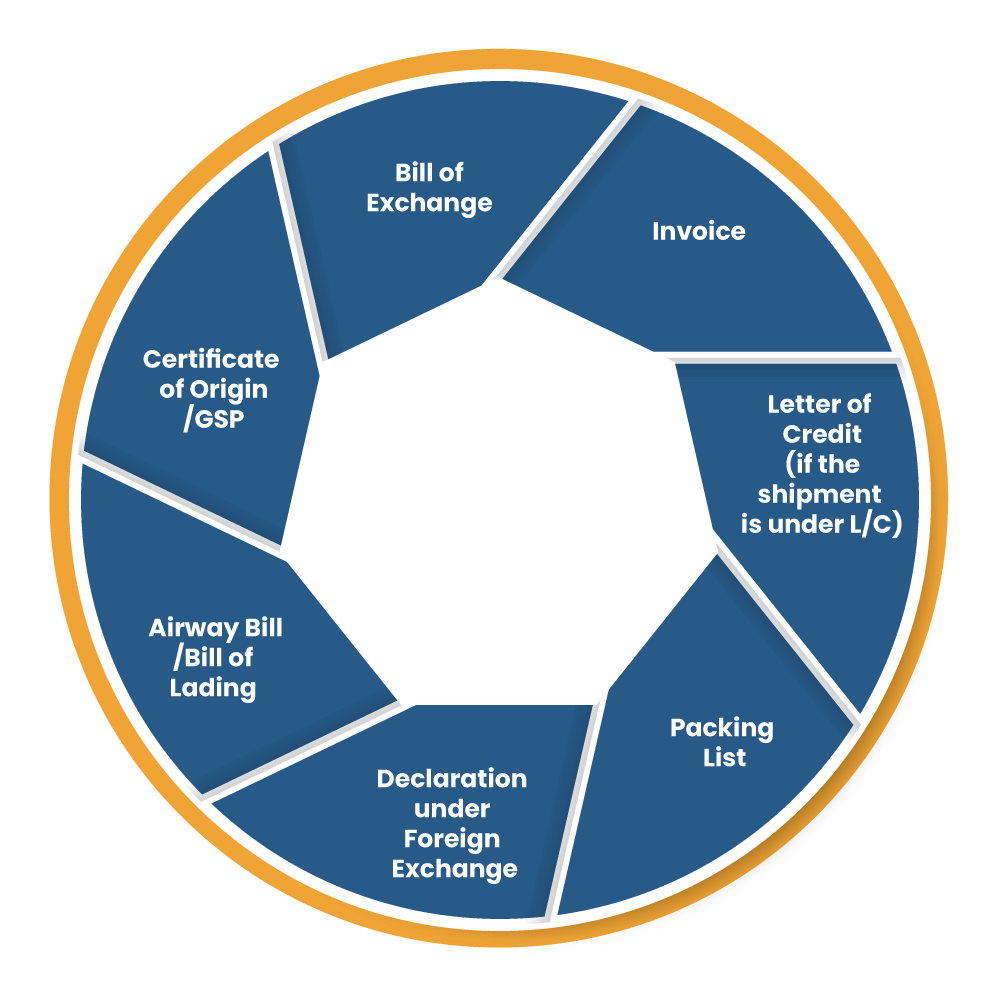

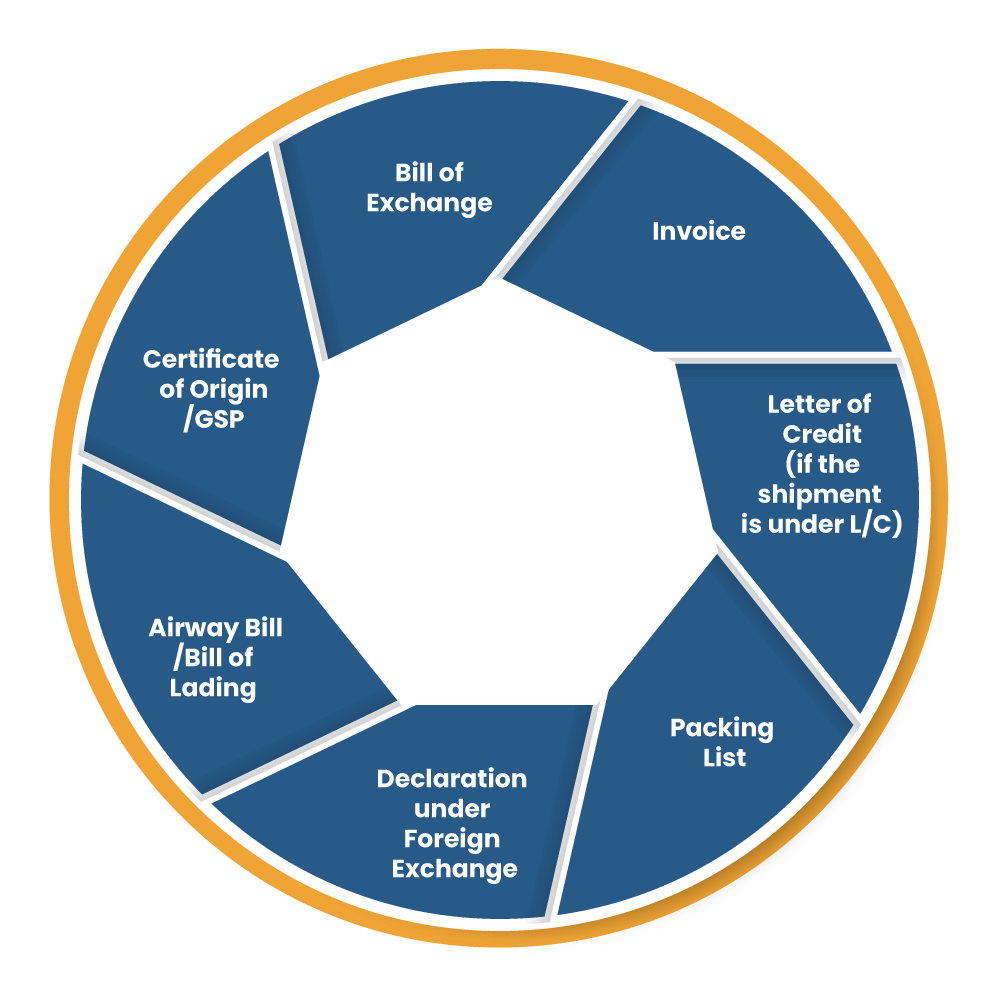

Documentation

As per the FTP 2015-2020, the following documents are mandatory for import and export.

- Bill of Lading/ Airway bill

- Commercial invoice cum packing list

- Shipping bill/ bill of export/ bill of entry (for imports)

- Certificate of Origin, if required.

- Inspection certificate, if required.

Submission of Documents to Bank

After shipment, it is mandatory to furnish the documents to the bank with twenty-one days for onward dispatch to the overseas bank for arranging payment.

The document should be drawn as per the contract along with the following documents:

Realization of Export Proceeds

As per FTP 2015-2020, all contracts regarding export will be denominated in Indian currency. However, the same does not apply to export to Iran.

Conclusion

It all boils down to how you proceed with the exporting procedure while keeping the buyer requirement in mind. Setting up Obtaining an IEC code is mandatory for commencing the exporting business. You can reach out to DGFT’s portal to apply for the same. Make sure to submit documents as prescribed in the application form. In case of any trouble, make sure to visit Corpbiz’s help desk for professional-grade assistance. Apart from that, you can also ping them in case you have concern with the same topic i.e. How to export goods from India.

Read our article:Advantages of Obtaining IEC (Import Export Code) Registration in India