In India, the Make in India initiative introduced by the NDA-led government has witnessed positive changes in exports & imports. In Financial Year 2017-18, the export valuation of India was increased by 9.98%. The overall valuation of commodities exported in FY 2016-17 was $ 275,852 million, while in 2017-18, the export escalated to 303,376 million. In consideration of the prevailing economic state of the nation, establishing an export business can be incredibly profitable.

Detailed Guide on how to start export business in India

Following is the step-by-step guide that will help you start export business from India without minimal of hassles:

Setup Organization

The first and foremost is to set up a company by selecting one of the following legal business structures:

- Partnership Firm

- LLP

- Private Limited Company

- One Person Company

- Public Limited Company

Once you select an apt business structure that offer best fit for your need, make sure to do some research on company name and market.

Open a Current Bank Account

Open a current bank account in a bank that has the required foreign exchange authorization.

Avail Permanent Account Number (PAN)

All entities in an EXIM domain are mandated to obtain a Permanent Account Number (PAN) from the IT department.

Secure Import export code from DGFT

An importer-exporter Code, broadly known as IEC, is a ten-digit code that is granted against the Permanent Account Number from the Directorate General of Foreign Trade (aka DGFT). IEC Registration is an absolute mandate for entities willing to start export business from India.

Secure RCMC from Export Promotion Council

A Registration cum Membership Certificate (aka RCMC) is necessary for accessing benefits cited under the prevailing Foreign Trade Policy (FTP). Additionally, an RCMC also facilitates the Indian exporter access to service & assistance by relevant Community Boards, Export Promotion Councils, and other related agencies.

Choose Eligible Products and Market

Before finalizing products and their market, make sure that don’t exist under the list of prohibited items outlined by DGFT in the purview of Foreign Trade Policy. Also, do take the parameters like prevailing export trends, competition, and market size into account during the product selection process.

Identify Potential Buyers

Identify potential foreign customers via buyer-seller meet, trade fairs, and B2B portals. Seeking assistance from the Indian Chamber of Commerce (ICC) & Indian Mission Abroad are other productive ways of identifying key customers in foreign markets.

Offer Product Samples To Prospective Customers

Provide the customer with product samples in accordance with the requested shipment size. This is the viable approach for securing a purchase order.

Ask for LOC, i.e. Letter of Credit:

Prompt the buyer to facilitate the letter of credit if the buyer fails to send the same along with an order.

Avail ECGC Scheme

After securing the purchase order from the prospective buyer, the exporter must approach Export Guarantee Corporation to get approval on the importer with the amount of limit. After receiving the request, ECGC, with its available network and contacts, determine the creditworthiness of the importer and estimates a figure of creditworthiness and prompt the max limit of the sum that can be dispatched at any instance.

Fix the Exchange Rate with the Importer

Fluctuating exchange rates can be detrimental to EXIM business if not set accordingly before the trade. Make sure to conduct trade at the mutually agreed rate.

Address Foreign Exchange Formalities

In the purview of the Foreign Exchange Regulation Act[1] (aka FERA), all Indian exporters are mandated to submit a declaration in the prescribed form before actual transactions come to life.

Conduct order execution

Prepare the shipment in accordance with the purchase order and norms cited under FTP.

Hire a custom agent for customs clearance

Hire an authorized customs agent to avail shipping bills and required clearance from the customs department. The functions performed by custom agents include:

- Obtainment of Shipping Bill

- Paying dues related to shipment

Provide Bill of Lading to the Shipping Company

A Bill of lading is a mandatory document facilitated by the exporter to the shipping company. It usually encloses the detail of the shipment and quantity requested by the importer. A bill of lading (BOL) also acts as a shipment receipt when the exporter dispatches the shipment at a predetermined destination.

Shipment Advice to the Importer

Shipment Advice is a prior notification released by the exporter for the buyer before the arrival of the shipment at the destination. It typically includes details of shipment. After the completion of the export procedures at the loading port by the exporter, the cargo is handed over to the shipping company.

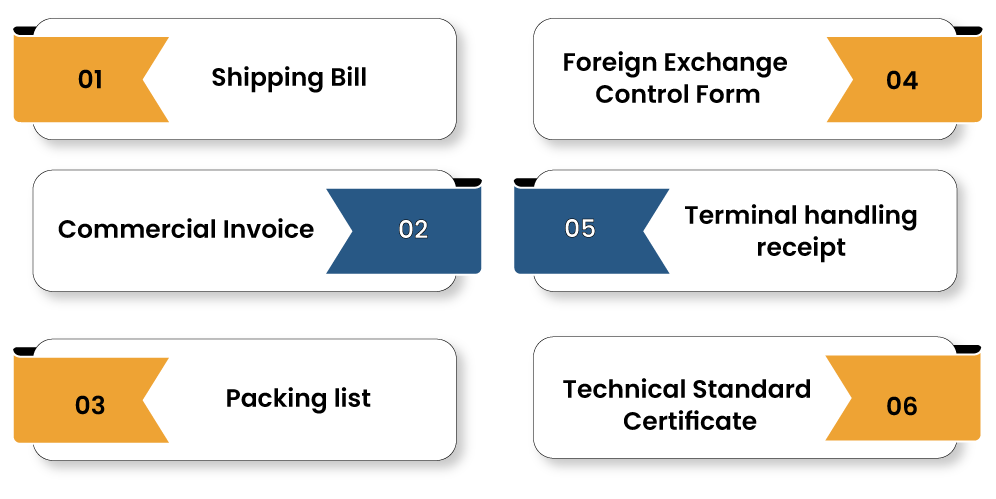

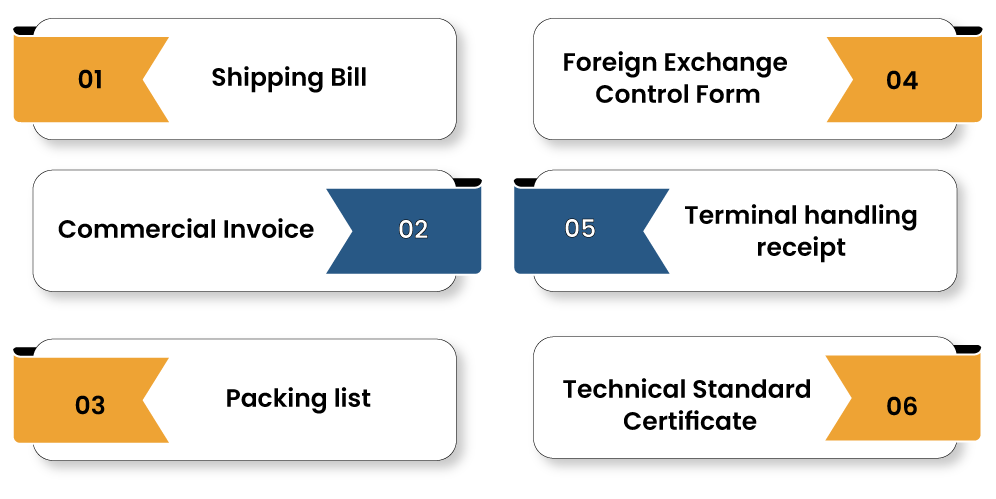

Present Mandatory documents to the Bank

The mandatory shipping documents to be provided by the exporter include:

The Realization of Export Proceeds

The Indian exporter needs to deal with banking protocols after facilitating the bill of exchange.

So these are the legal implications that one has to address to start export business from India. Before we wrapped up this write-up, let have a glance over some important tips:

- Do not forget to insured your shipment from certified marine insurer.

- After securing the purchase order, visit ECGC to avail credit risk insurance. This will help you mitigate the possibility of payment default.

- Rely on predetermined exchange rate (agreed by both the parties) to avoid future dispute.

Conclusion

Catering to the aforementioned legal implications is mandatory to start export business in India. Export business is promising and adheres to tons of potential. But to explore that potential to the fullest, one has to comply with the aforementioned requisites without any compromise. If you seek some further clarification on the licensing part, then prompt us without thinking twice.

Read our article:Exporting food items to the USA? Secure IEC, EIC, & FDA Registration