The Ministry of Finance, Nirmala Sitharaman has laid down the most awaited Budget for the year 2021-2022 on February 1, 2021. This time the Union Budget 2021-2022 was laid down considering various different situations but mainly the Covid-19 pandemic and the calamities which has critically affected the Indian economy.

Our Prime Minister announced the Pradhan Mantri Garib Kalyan Yojana, which had the value of 2.76 lakh crores under which there were provisions for free cooking gas for 80 million families for months, 800 million people to get free food grain, and cash directly to over 400 million farmers, women, elderly, the poor and the needy. Then in the month of May 2020, the government announced the AtmaNirbhar Bharat package (ANB 1.0). The government kept on watching the situation and with the need to recover more it laid down two more Atma Nirbhar Bharat[1] packages (ANB 2.0 and ANB 3.0). The measures taken by RBI for the total financial impact of all Atmanirbhar Bharat packages was anticipated to be more than 13 % of the GDP or 27.1 lakh crores.

Highlights of the Union Budget 2021-2022

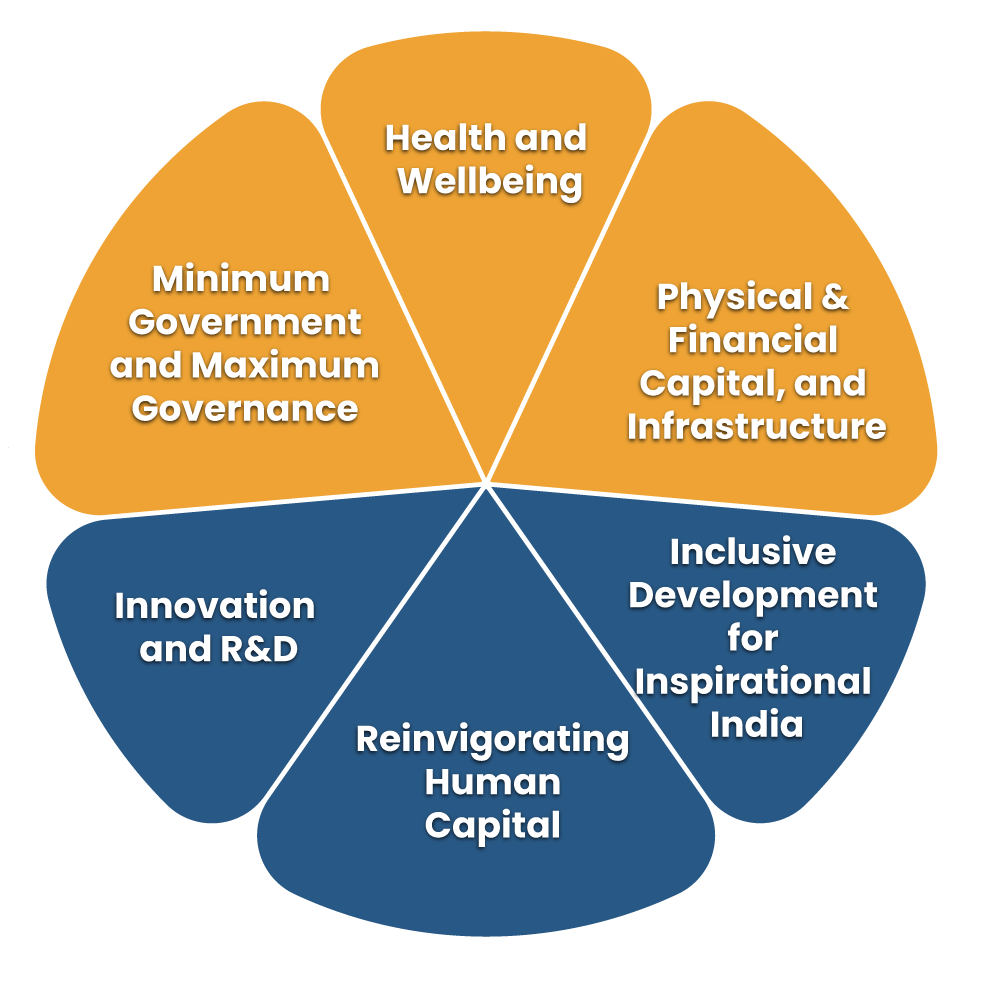

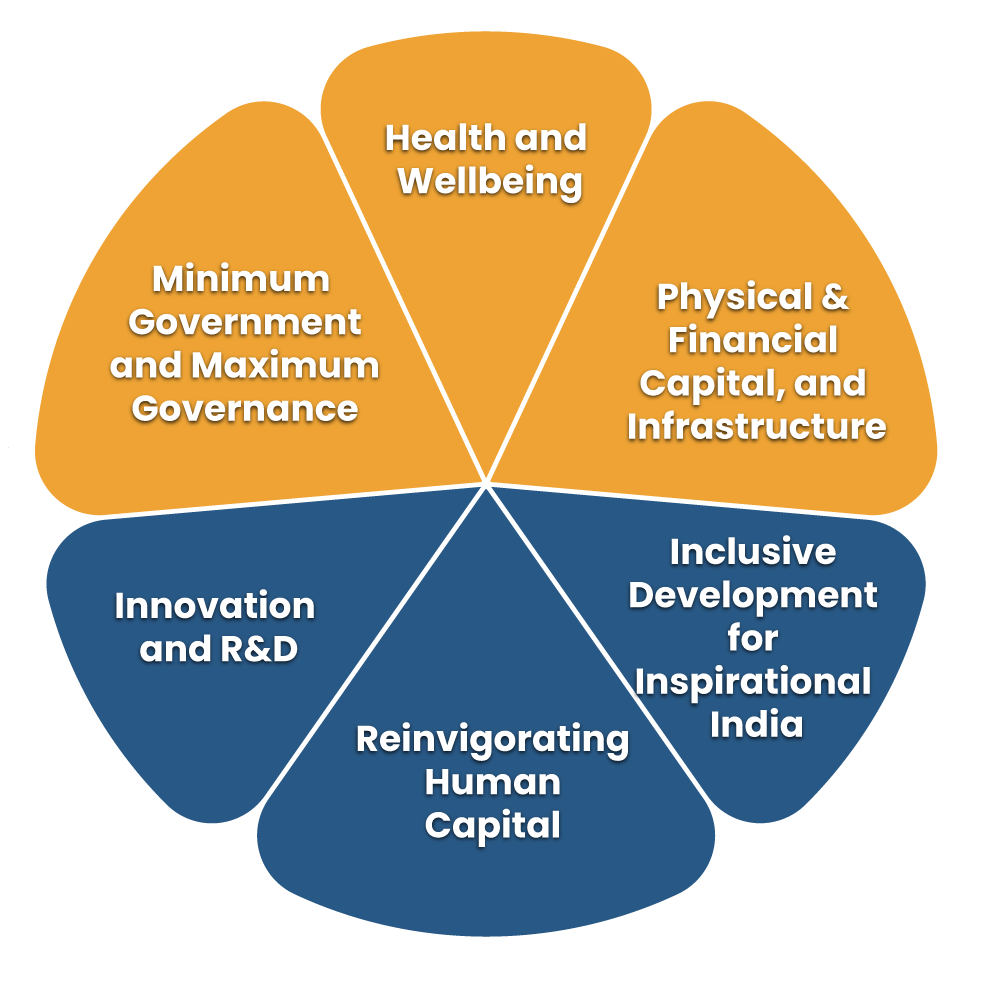

The six pillars on which the Budget 2021-2022 rests are:-

Health and Wellbeing

- Pradhan Mantri AtmaNirbhar Swasth Bharat Yojana– launched with an expenditure of Rs 64,180 crores for 6 years. Its main focus will be to expand capacities of primary, secondary, and tertiary care health systems, build up the existing national institutions, and construct new institutions to find the solution and to identify and find the cure of new and emerging diseases. These entire launches shall be made in the Budget 2021-2022 which is in addition to the National Health Mission.

- Jal Jeevan Mission (Urban) – Budget 2021-2022 will launch this mission with an aim of water supply in Urban Local Bodies with 2.86 crores household tap connections and liquid waste management in 500 AMRUT cities.

- Strengthening the Nutritional Content– The Government will merge the Supplementary Nutrition Programme and the Poshan Abhiyan and launch the Mission Poshan 2.0.

- The Urban Swachh Bharat Mission 2.0 –will be implemented with a total financial allocation of 1.41 lakh crores.

- Voluntary Vehicle Scrapping Policy– Budget 2021-2022 has proposed this policy to remove old and unfit vehicles causing vehicular pollution.

- Clean Air Policy for the current serious air pollution with 2,217 crores in 42 urban centres.

- The Pneumococcal Vaccine-Covid 19 vaccine which is a Made in India product will be manufactured and made available to the whole country with Rs.35000 crore budgets.

Physical, Financial Capital and Infrastructure

- AtmaNirbhar Bharat-Production Linked Incentive Scheme (PLI): The Budget 2021-2022 mentions that the manufacturing companies will be an important part of global supply chains and for this PLI schemes will create manufacturing global champions for an AtmaNirbhar Bharat for 13 sectors with 1.97 lakh crores. This will generate youth employment.

- Textile Industry – scheme of Mega Investment Textiles Parks (MITRA) will be launched in addition to the PLI scheme to increase competition in textile industry globally.

- Infrastructure Development– The National Infrastructure Pipeline (NIP) launched for creating the institutional structures by big thrust on monetizing assets, and by increasing the share of capital expenditure in central and state budgets both.

- Infrastructure Financing – Development Financial Institution (DFI) is essential to act as a source, enabler and medium with a sum of 20,000 crores for infrastructure financing.

- Monetisation of Asset- New infrastructure construction needs a Monetized public infrastructure asset for which a “National Monetization Pipeline” will be launched.

- Sharp Increase in Capital Budget– An increase in capital expenditure of 5.54 lakh crores which is 34.5% more than the previous one.

- Roads and Highways Infrastructure – The Budget 2021-2022 will invest total 5.35 lakh crores in Bharatmala Pariyojana project out of which 3.3 lakh crores of 3,800 kms have been constructed.

- Railway Infrastructure – National Rail Plan: 2030 for India was prepared by Indian Railways which has the mission to make a ‘future ready’ Railway system by the year 2030.

- Urban Infrastructure – Expansion of metro rail network and extension of city bus service is one of the major responsibility of Government under the Budget 2021-2022. A new scheme of 18,000 crores with the use of innovative PPP models to enable private sector players to finance buses. Two new technologies naming ‘MetroNeo’ and ‘MetroLite’ will be build to provide metro rail systems at low cost.

- Power Infrastructure – National Hydrogen Energy Mission launched for generating hydrogen from green power sources.

- Ports, Shipping, Waterways- 7 projects worth more than 2,000 crores will be offered by the Major Ports on Public Private Partnership mode.

- Petroleum & Natural Gas – Ujjwala Scheme to benefit 8 crores households will now further cover 1 crore more beneficiaries.

- Financial Capital – The provisions of SEBI Act, 1992, Depositories Act, 1996, Securities Contracts (Regulation) Act, 1956 and Government Securities Act, 2007 were consolidated into a rationalized single Securities Markets Code. An additional capital infusion of 1,000 crores to Solar Energy Corporation of India and proposal of 1,500 crores to Indian Renewable Energy Development Agency is made.

- Increasing FDI in Insurance Sector – The Budget 2021-2022 propose the amendment in the Insurance Act, 1938 to increase the limit of FDI to 74% in Insurance Companies and allow foreign ownership and control with safeguards

- New Structure for Stressed Asset Resolution – An Asset Reconstruction Company Limited and Asset Management Company would be set up to merge and take over the existing stressed debt under the Budget 2021-2022.

- Deposit Insurance – To improve credit discipline and protect the interest of small borrowers for NBFCs with minimum asset size of 100 crores, the minimum loan size for debt recovery is reduced to 20 lakhs under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.

- Company Matters – After decriminalizing the procedural and technical compoundable offences under the Companies Act, now the Government is decriminalizing the Limited Liability Partnership (LLP) Act, 2008. Revision of the definition for Small Companies under the Companies Act, 2013 to increase their threshold and proposal to incentivize the incorporation of One Person Companies (OPCs).

- Disinvestment and Strategic Sale –The Budget 2021-2022 plans to privatize two Public Sector Banks and one General Insurance company. The AtmaNirbhar Package has introduced the policy of strategic disinvestment of public sector enterprises.

- Government Financial Reforms – Extension of the Treasury Single Account (TSA) for universal application where self-governing bodies can straightforwardly draw funds from the Government’s account during the time of actual expenditure which saves their cost of interest. And a separate Administrative Structure is setup to make the ‘Ease of Doing Business’ more efficient for Cooperatives.

Inclusive Development for Aspirational India

In this section, the Budget 2021-2022 focuses on the Agriculture and Allied sectors, farmer’s welfare and rural India, migrant workers and labour, and financial inclusion are covered.

- Agriculture – The MSP regime has changed to guarantee price 1.5 times the cost of production across all commodities. Under the SWAMITVA Scheme rights will be given to village property owners. ‘Operation Green Scheme’ is launched to boost value addition in agriculture and allied products exports.

- Migrant Workers and Labourers – One Nation One Ration Card scheme is launched where beneficiaries can claim their right anywhere in India.

- Financial Inclusion– Credit flow under the scheme of Stand Up India for SCs, STs, and women. The margin money requirement is reduced from 25% to 15% and loans for agriculture are included.

Reinvigorating Human Capital

- School Education – The Budget 2021-2022 plans that the National Education Policy will be enforced in the school. And Higher Education Commission of India will be set up for the higher education in India.

- Skilling-Post-education apprenticeship under National Apprenticeship Training Scheme (NATS) will be provided to the youth, training of graduates and diploma holders in Engineering will be provided under this scheme.

Innovation and R&D

The Budget 2021-2022 proposes that by investing 50,000 crores in National Research Foundation for over 5 years it will strengthen the overall research ecosystem. National Language Translation Mission (NTLM) will be launched which will enable the wealth of governance and policy related knowledge on the Internet being made available in major Indian languages.

The New Space India Limited (NSIL) will carry out the PSLV-CS51 launch. For Gaganyaan mission, four Indian astronauts are being trained on Generic Space Flight aspects in Russia. Deep Ocean Mission launched for survey, exploration and projects for the conservation of deep sea bio-diversity.

Minimum Government, Maximum Governance

The Budget 2021-2022 aims for a major reform in Tribunals is introduced for the purpose of speedy delivery of justice. National Commission for Allied Healthcare Professionals Bill is introduced in the Parliament to ensure health of the professions.

The National Nursing and Midwifery Commission Bill is introduced to bring about transparency and efficiency in the nursing profession. A Conciliation Mechanism for quick resolution of contractual disputes is being setup to give relief to major contractors and private investors.

Conclusion

Considering the situation of India battling pandemic and its serious affect on national economy, the Government has provided with major reliefs to deal with the same. The Union Budget 2021-2022 has come up with pro- farmer’s policy to settle down the dispute of facing the current farmer’s protest.

After a series of mini-budgets, this major budget is directed towards handling the major difficulties for the economy and many government finances have been created to counter COVID invasion. The Union Budget 2021-2022 will surely prove to help the national economy to cope up with the loss and rise with the power again.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty