NGO registration is a mandate for those who are intending to set up an NGO in India. NGO can exist in various forms; hence, if you want to engage yourself with a social cause by establishing an avenue, it is essential to get accustomed to it. This write-up will talk about the different Types of NGO followed by the benefits of the same.

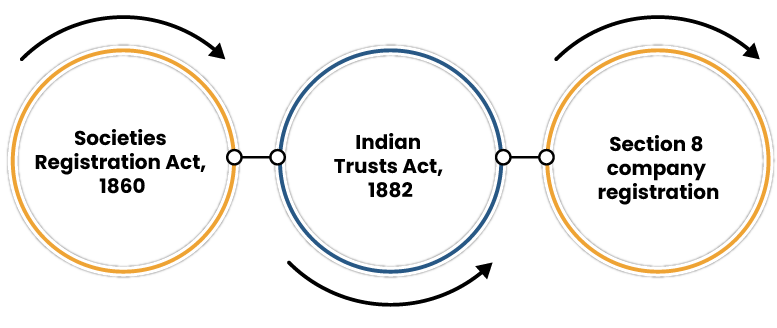

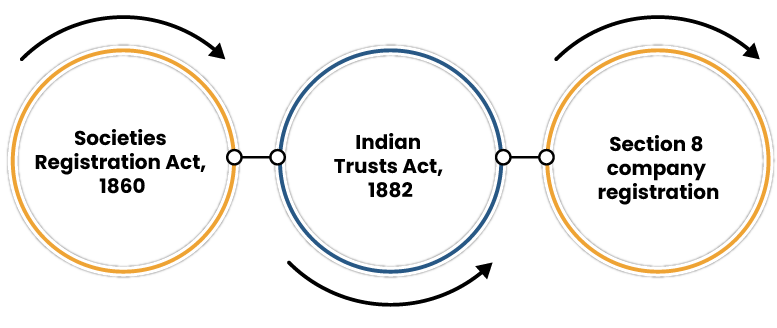

What are the different regulations that administer NGO registration in India?

Following are the laws that set out various provisions for NGO registration:

Types of NGO Registration

There are three options through which you can avail NGO registration in India:

What is the core objective behind legalizing a non-governmental entity?

If you wish to work for a good cause, then the best way to accomplish this goal is to obtain NGO registration in the first place. Various reasons for legalizing a society in India are:

These are the autonomous entity which aims to benefit the society in one way or another. They usually focussed on the upliftment of the poor and the needy ones.

Ideally, NGOs works for the betterment of the underprivileged people & facilitate those ample ways to thrives seamlessly.

Once you underpin the objective of your organization, you can proceed further to engage with the NGO registration process.

Different Types of NGO and their benefits

The following section will brief out the different Types of NGO that exist in our legal framework

Trust Registration:

The provisions regarding the trust registration are mentioned under Society Registration Act, 1882. These institutions are referred to as a public charitable trust & are generally established when the land or property is involved. The utilization of trust is for the relief of poverty, medical aid, poverty, etc.

Advantages offered by Trust Registration

- Trust doesn’t have to deal with the hassle of land acquisition as this facility is provided by the government.

- Trust legalized under the Trust Act utilizes Gov-Registered Name

- Trust functioning with norms of Trust registration is eligible for Tax-related benefits.

- 80G certificate benefits

- Benefit regarding service tax or income tax

Society Registration

Society registration is another legit way of legalizing NGOs in India. NGOs having this registration usually operate in the form of society. To function as a legit society, the individuals come together for advocating scientific, charitable, or any other purposes, as cited u/s 30 of the Society registration Act 1860.

Benefits under Society Registration

- A registered society rejoices an autonomous legal identity. Each member serving the society stands liable for their actions & not the other members.

- Limited liability – Since society NGO operates as an autonomous legal identity, the members rejoice limited liability.

- Access to several Rebates and concessions under the existing taxation framework

- Registered societies are less vulnerable to brand name violation.

Read our article:What are Section 8 Companies? Know its provisions and Incorporation Procedures

Registration for Section 8 Company

- Section 8 registration is another viable option for entities seeking to operate as an NGO in India. Entities under Section 8 company registration come under the ambit of Section 8 of the Indian Companies Act, 2013.

- These avenues aim to safeguard charity, religion, trade, etc. But, the income generated by such an establishment remained isolated from its shareholders. Such funds are generally allocated for promotional work and for a social cause.

- A society can be set up by a minimum of seven or more people. Apart from Indian national entities, foreigners & other registered societies are eligible to register for the MOA of the society.

- Just like a Partnership Company, society can function as a registered or unregistered entity. However, societies adhering to the underlying legalities can purchase properties and file cases in the event of a legal dispute.

- The state governments[1] administer society registration. Therefore, the applicant seeking such a registration required submitting a prescribed form before the respective state authority.

- The process of society registration begins with the name reservation. To serve this purpose, the establishing members are mandated to render their approval. After serving this obligation, the members are required to draft the Memorandum.

Benefits of Section 8 company registration

- As such is no legal prerequisite for maintaining a minimum capital requirement for setting up NGOs as per section 8 company.

- Just like trust, a Section 8 company also rejoices an autonomous legal entity.

- Section 8 companies have access to several tax benefits.

- Government has waived off stamp duty for registered NGOs, which otherwise come into play during the registration process.

- There is no compulsion for section 8 companies to add the suffix in their name, unlike private and public limited companies.

- Unlike trust and society, a section 8 company seems to foster better credibility.

- Section 8 encounters fewer legal complications when it comes to transferring the ownership. In the purview of Section 8 of the IT Act, 1961, people are eligible to transfer the ownership of both immobile & moveable assets without any legal hassles.

Conclusion

Setting up an NGO in India seeks legitimate paperwork and 100% adherence to underlying legalities. The Types of NGO mentioned above attract distinctive requirements and paper works when it comes to registration. , the new applicant may get confused with registration prerequisites thus;, it is advisable to avail professional advice when such a scenario sips in.

Read our article:How to apply for GST registration certificate online?