All companies in India are not operating for the profit purpose. Many companies primarily operate for the charitable and non-profit objectives. The company registered under the Section 8 of the Companies Act 2013, is known as Section 8 Company.

According to Section 8 of the companies Act, 2013 such companies are established for the promotion of commerce, art, science, sports, social welfare, charity, protection of any environment or any other such charitable objects. As per rule 8(7) of the companies Incorporation Rules, 2014 for the companies under Section 8 of the Act, all the section 8 companies are named and registered as an Association, Foundation, Society, Club, Organization etc. These companies are registered under Ministry Of Corporate Affairs, Government of India.

What are its provisions?

The Section 8 companies intend to apply its profits in promoting or helping out the needful and intend to prohibit the payment of any dividend to its members. Section 8 companies work towards the transformation of the society rather than just earning profit. These companies were earlier defined under Section 25 of Companies Act, 1956. The companies under Section 8 are easy to register as compared to Trusts and Societies. The Central government provides license to these companies stating all the guidelines. Companies failing to do so are ordered to wind up their companies.

Examples of Section 8 companies are the Federation of Indian Chambers of Commerce and Industry (FICCI[1]) and Confederation of Indian Industries (CII).

Advantages of Section 8 Company

Following is the list of advantages of the Section 8 Companies over trust and societies:

Tax Benefits

Section 8 companies are exempted from the provision of income tax. Also, these companies get other tax benefits and deductions.

Zero stamp Duty

Unlike other companies, Section 8 companies do not need to pay stamp duty on the AOA and MOA of the private or public limited companies.

Ease of transferring the ownership or title

According to the Income Tax Act, 1961, Section 8 Companies can transfer their ownership or title. Also, the interest and shares of other members of the company is also considered as movable property and are easy to transfer which in turn makes it easier for the members to leave and transfer its ownership to others.

Exempted from the title “Limited”

Section 8 companies are exempted from using the word “Limited” unlike other companies like private limited company and public limited company. However it is mandatory for the section 8 companies to use the suffix such as Foundations, associations etc.

Higher Credibility

Section 8 companies are more credible than other non-profit organizations like societies or trust. The licensing of these companies is done by the Central government. So, no changes can be made in the AOA and MOA of the Company.

Disadvantages of Section 8 Company

Now, let’s have an eye on the disadvantages of the Section 8 Companies which are listed below:

- The profit that the section 8 Companies make is used for the meeting the objectives like arts, commerce, science. It cannot be used by the director or shareholders by any means.

- The members of the Section8 Companies cannot be appointed as the officer.

- The members cannot make changes in the MOA and AOA of the company because the licensing is done by the Central government.

- The profit earned by the Section 8 companies cannot be distributed among its members.

Eligibility for forming Section 8 Companies

A company which intends to be registered under the Section 8 of the Companies Act, 2013 should keep these rules in mind before registering

- The company’s objective should be promoting fields like arts, science, commerce, education, religion etc.

- The company should use the profit from the organization in promoting the objectives of the company.

- The company should restrict the share of dividends to its members.

- Section 8 companies can only be registered as Private or Public Limited. It cannot be registered as one person Company (OPC).

- The company must confirm the proposed name, its objectives, registered office address, authorized capital, proposed Director and the members.

- The name of the company should reflect the charitable objective. Also the proposed name must be different from the category of undesirable names specified in Rule of Companies Act.

- The company’s name must include the words like Foundation, Forum, Association, Chambers, council etc.

- Requires license from the Central Government.

Requirements for Online Registration of Section 8 Company

- The company must be governed by the Companies Act, 2013.

- Minimum 2 Directors if the company is to be incorporated as a private limited company.

- Minimum 3 Directors if the company has to be incorporated as Public Limited Company.

- No minimum share capital is required. All the funds are brought through donations from the general public.

Documents Required for Section 8 Company Registration

- Aadhar Card or Pan Card of all Directors

- Passport Size Photographs

- Voter ID/Aadhar Card of all Directors

- Self attested copy of address proof like Bank statement, Mobile bills, electricity bills(not older than 2 months)

- Registered Office Documents

- Rent/lease agreement

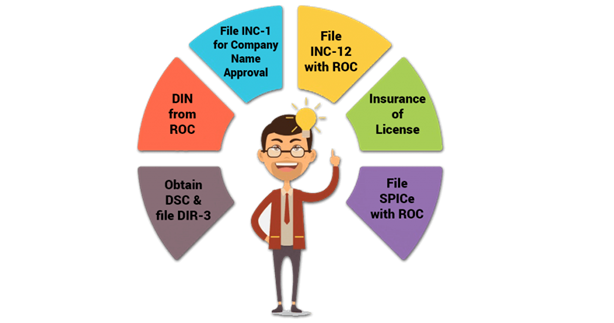

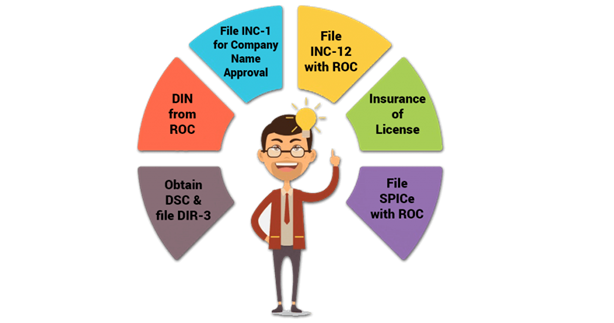

What are the Procedures For Registration of Section 8 Company?

Apply for Digital Signature Certificate (DSC)

Digital Signature is the online signature used for filing and is issued by Ministry of Corporate affairs (MCA). A digital signature is a secure digital key issued for the purpose of validating and certifying the identity of the person. Some of the certified authorities which issue the digital signature certificate are E- mudra, national Informatics Centre, Code Solutions and Indian Institute of development research in banking technology. The documents required while applying for DSC are:

- Photo ID – Voter ID or PAN or Driving License

- Address Proof- Voter ID, Utility Bill, Bank Statement (Utility bills and Bank Statement must not be older than 2 months)

- Photo of the applicant

For Name Availability

- Shall give the proposed name and it is mandatory to use the words Foundation, Association etc. for Sec8 company.

- Main object of the company.

For SPICE+ form– Application for Incorporation Certificate

- Memorandum of Association

- Articles of Association

- All the subscribers PAN number to the Memorandum (1st Directors of the company)

- Address Proof, ID and other contact details of the subscribers to the Memorandum.

- Notarized Rent Agreement from the Registered Office.

- Non Objection Certificate from the owner to use the premises

- The premises utility bill not older than last 2 months

- Declaration from all the directors under form INC 15

- Declaration by the Chartered Accountant under Form INC 14

- Anticipated Income and Expenditure for next 3 years in the approved Format.

For AgilePro

- Name of the Bank where company is preparing to open Bank Account.

- Specimen Signature for EPFO

- Non Objection Certificate to open a bank account

- For GSTN – declaration of Authorized signatory

Step 2:

1. To check the name availability with the RUN utility,

2. To Login with the MCA website

3. To fill in the online form and attach the object clause and Submit

Important: As the validity of the approved name for the company is for 20 days, so SPICE+ is required to be filled within 20 days after the name is approved.

Step 3:

Filling of Web Form Spice +

Once the name is approved, the Spice forms shall be filled for further process.

Procedure to fill the Web Form:

- Login to the MCA website

- MCA services> open Spice +

- Select the Existing Application

- Fill in the complete form and attach all the documents in the attachments section.

- Along with Spice+, the INC9 and Agile Form shall be filled.

- After Submission, download the forms for verifying and affix DSC.

- Submit with the required fees all the three Forms as LINKED Forms at MCA website.

- After the SPICE and AGILE is approved – Incorporation Certificate and License No. is granted and shall have Company Identification No. (CIN), Incorporation Date, PAN and TAN of the company.

Penalty under Section 8 Companies

If any company under Section 8 Companies Act, 2013 fails to comply with the terms and regulations of Section 8, then according to the provisions of Sub-section (11), the Company shall be held punishable and have to pay:

- A minimum fine of INR 10 Lakhs which can extend to INR 1 Crore.

- The Concerned Director is punishable and will face the imprisonment for a term of three years with a fine of minimum INR 25000. The fine can also extend to INR 25 Lakh.

Conclusion

Section 8 Companies primarily operate for charitable and non-profit objectives which are for the well-being of our society. Also, it has got several exemptions in terms of tax and others.

Read our article:What are the Relaxations given to Section 8 Companies under Company Law?