Privately held companies are being referred to as an independent legal entity. The director looks into the matter of these companies by managing all the imperative dimensions. In addition to that, the director is liable to keep the company in line with the existing compliances; the Board of Directors (BOD) represents the private limited company. There are many types of directors which plays different role in a private limited firm. The following section of this blog would explain the role of these directors in a subsequent manner.

Types of Directors that Serves the Private Limited Companies

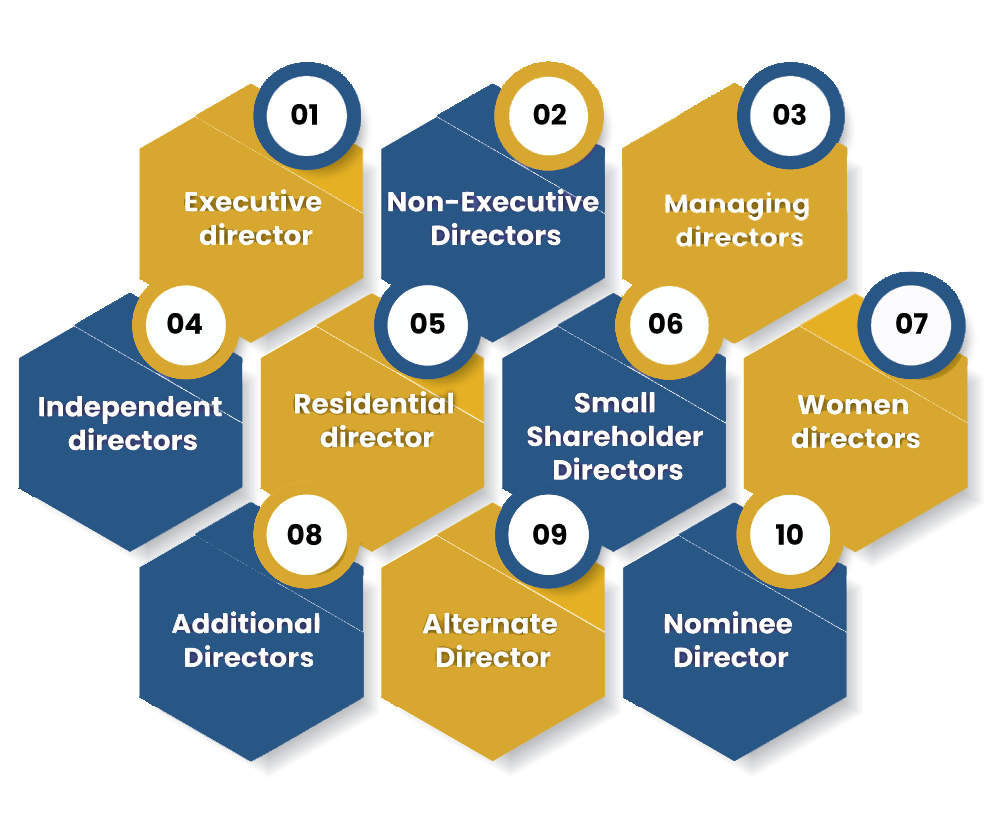

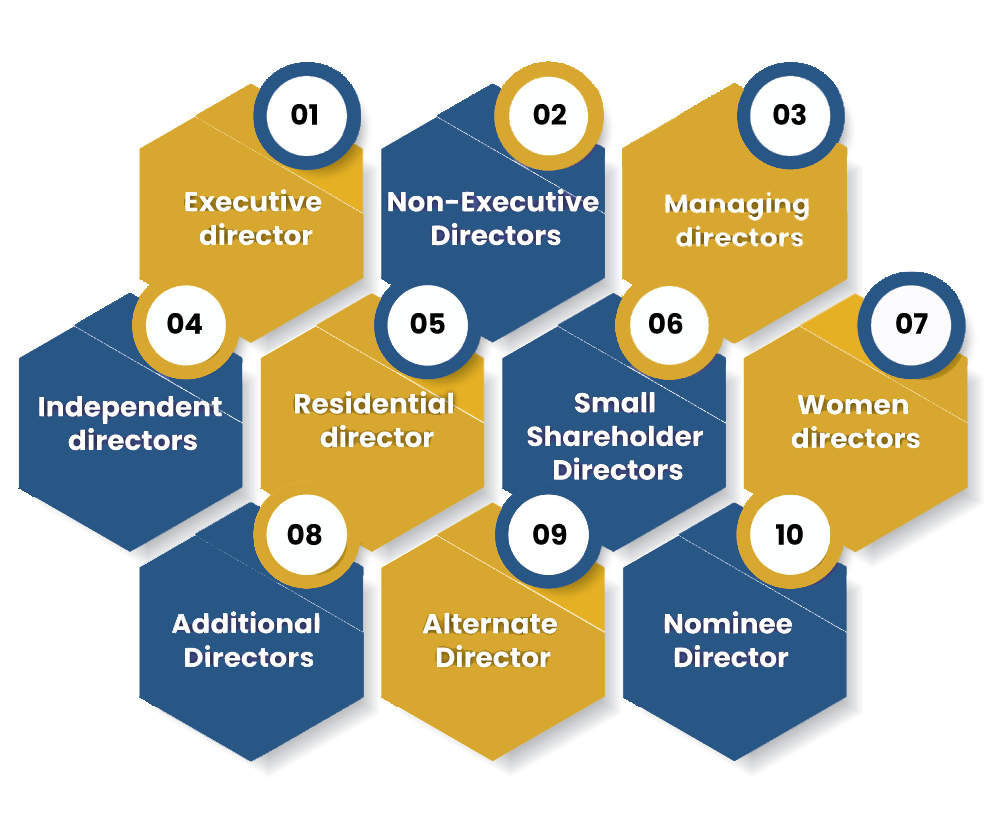

The following are the types of directors that serve the privately held entities:

Executive Director

Executive Director is the full-time working director of the privately held organization. They possess plenty of responsibility to ensure the seamless functionality of the company. The company and its workforce expect them to be spot on with their decisions.

Non-Executive Directors

Non-Executive Directors are not subjected to look into the day to day matters of the company. However, they play a pivotal role when it comes to planning and policy-making. They can raise objections against the executive directors’ decisions and even suggest them proper solutions for the company’s collective goods.

Managing Directors

Managing directors are the key members that indulge in the decision-making process of the company. They have the rights conferred by the existing bylaws to direct another member of the company. A Public company that posse more than Rs 5 crore of share capital is liable to appoint a Managing Director.

Independent Directors

These types of directors don’t necessarily intervene in the company’s matter directly. In short, their primary job is to provide expertise to the managerial board of the company whenever the situation arises. Publicly held organizations with share-capital, outstanding loans, or turnover of Rs 100 cr, Rs 50 Cr, and Rs 100 cr respectively need two independent directors.

Read our article:A Detailed Outlook on the Roles of Directors and Shareholders in a Company

What is the Criterion of Qualification for an Independent Director?

The independent director in accordance with the existing bylaws:-

- Must have expertise and experience in the relevant field.

- Must not work as a promoter of the organization or its subsidiaries;

- Should possess no relationship with the promoters or directors of the organization.

- Should not work as the key managerial personnel for the company or its holdings.

- Should not possess voting power of more than 2% in such a company.

Residential Director

A Residential Director is referred to that category of directors who resides in the Indian Territory for at least 182 days. A company should appoint more than one residential director. Based on the board’s discretion, the Nominee Director can be provided with rights similar to other directors of the company.

Such directors are liable to undertake activities as per the provision underpinned by the Companies Act, 2013[1]. If a company tried to compromise the existing provision of the said Act, the company and its core personal may face the penal charges of Rs 50,000, which may further extend up to Rs 50, 00, 00.

Small Shareholder Directors

These types of Directors possess the right of appointing of director in a listed company. Such action is approved under the influence of 1000 shareholders or 1/10th of the shareholders, whichever is lesser, through a notification. A small shareholders director is not liable to take charge of more than two companies.

A small shareholder director can vacate his/her position in the company based on given scenarios.

- On incurring loss to the company through personal course of action.

- If their appointment is found to be done in a way other than provisions listed under the bylaws.

- He/she compromised the criteria of ‘independence’.

- If the position is compromised through a special resolution passed in a general meeting.

Women Directors

Women directors are the part of the companies whose securities are listed on the stock exchange or have a paid-up capital over Rs 100 crore and a turnover of Rs 300 crore.

Like other directors in the company, a women director undertakes activities independently. Such a director is liable to work towards the company’s betterment and improves its ability to stay in compliance with existing regulations. The tenure of the women director remains active till the subsequent AGM from the appointment date.

Women directors can vacate the position of the director by providing notice to the company. Such a director can be appointed during the event of company registration or after incorporation by the BODs and the shareholders.

Additional Directors

The appointment of the Additional Directors in the registered organization is made as per the provision listed under Section 161(1) of the Companies Act, 2013. Typically, these types of directors can be appointed through the circulation of a resolution. An individual can be an additional director by securing the position of the director until the subsequent AGM (Annual General Meeting).

Alternate Director

When the Director is not serving his/her tenure for more than three months, an alternative director can take the vacant position on a temporary basis. The alternate director cannot exercise the right, which is beyond the scope of the previous directors. BODs of the company usually appoint an alternate director, given the clause listed under the Article of Association or via AGM.

Nominee Director

A Nominee Director is generally nominated by an institution such as financial institutions and banks on the board of companies to serve the institutions’ interest. The interest can be reflected either in the form of loans or investment into shares.

Such strategic investment might affect the nominator’s profitability, and therefore, the appointment of such a director becomes imperative to facilitate tracking of the investee company’s operations & business. Nominee Director is generally appointed by the shareholder, central ministry, or the third parties. Nominee directors are appointed in the state of management crisis inside the company.

Conclusion

Directors possess different rights and positions in the organization—the division of power helps impart fairness and transparency to the system. Furthermore, the distribution of power intact the legality of the structure and also escalates efficiency. Handover your queries to the CorpBiz are professional in case if you seek some essential and in-depth insights on the above topic i.e., types of directors that serve the privately held entity.

Read our article:An Outlook on Director’s Liability in the Privately Held Organization