The Director in the Private Limited company primarily handles the internal and external matters that affect the entity in one way another. As per the legal framework, when an incorporation certificate is awarded to the company it transforms into a legal entity. It possesses a distinctive identity when compared to its owners, members, and shareholders.

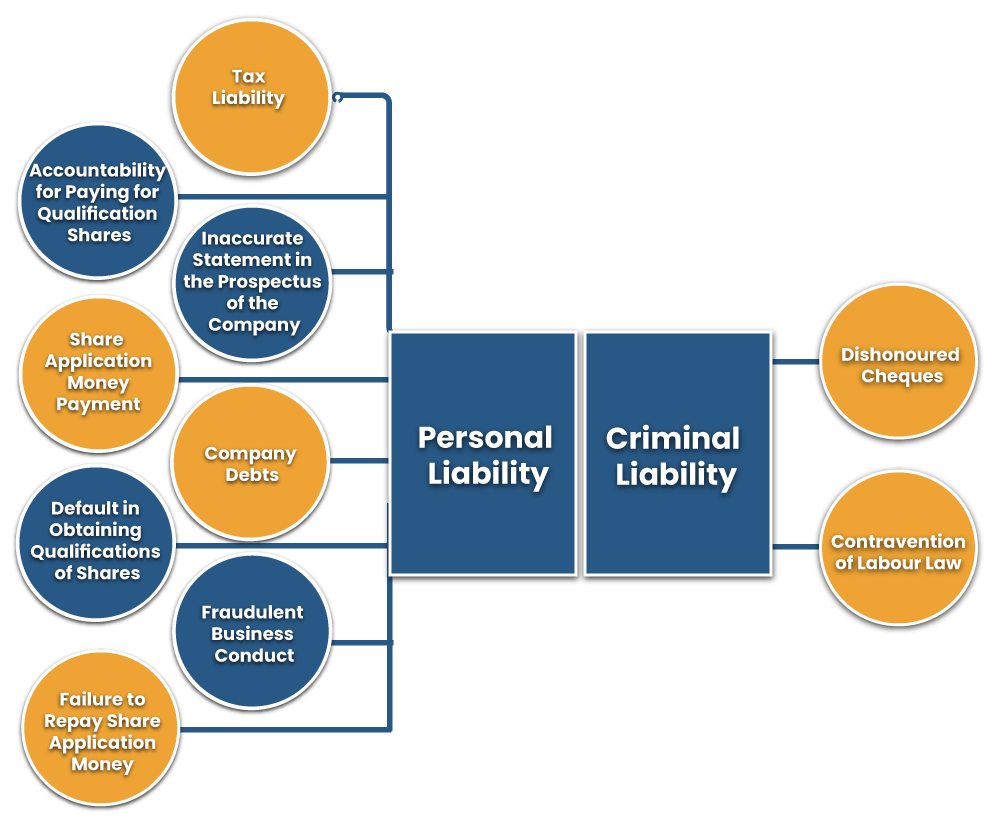

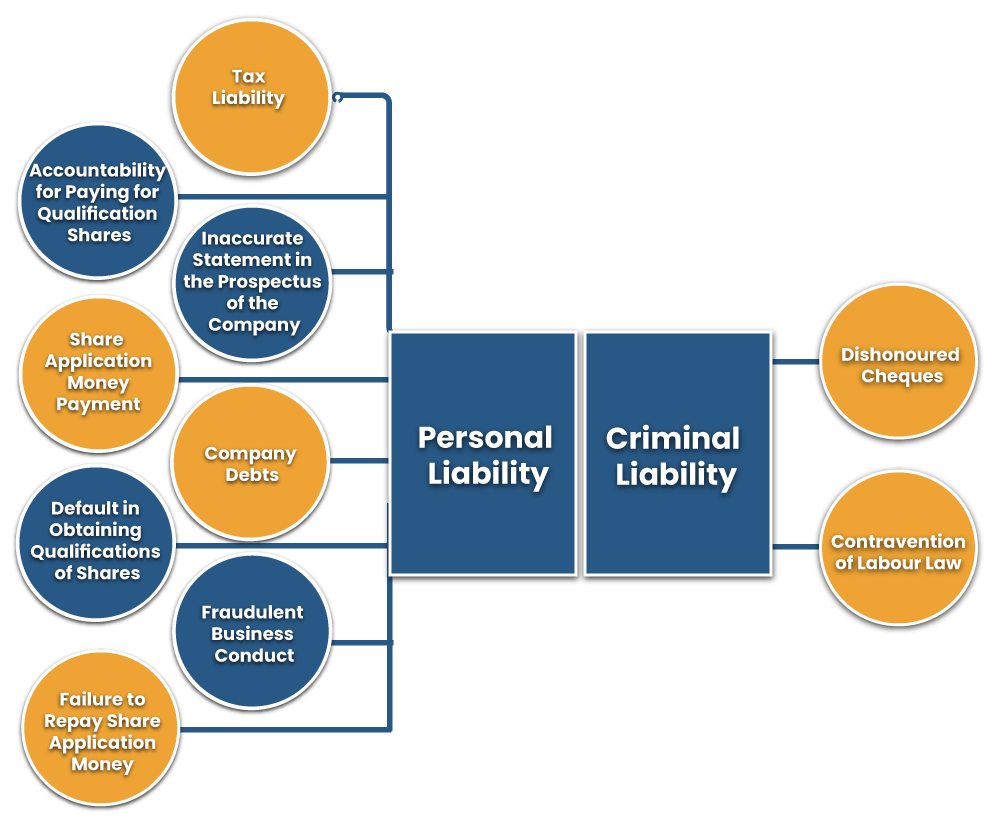

The same concept is applied to the Director of that company as well. The Director of the company possesses separate rights that he/she can exercise during the tenure of employment. This means that the Director is not liable to perform any action that is beyond the scope of the right conferred by the law. It implies that Director’s liability is confined around the predetermined rights cited in the existing bylaws. The following section explains the Director’s liability in privately-held entities:-

Personal Liability of a Director in Privately Held Organization

Personal liability of a Director in Privately Held Organization serves different aspects of its role and responsibilities, which are as follows:-

Tax Liability

Income Tax Act clearly states that in case of pending income tax of the preceding year, the director of the company will be held accountable for such a flaw. In another word, it is the Director’s liability to keep the track of all pending taxes and make sure the company is duly complying with the existing tax law.

Inaccurate Statement in the Prospectus of the Company

It’s the Director’s liability to ensure that the prospectus of the company doesn’t consolidates any invalid information that incurs any adverse effect in future. Any contravention to this condition can enforce the director to face the penal provisions. However, there is an exception to that- Director will not be liable to face legal proceeding in the following scenarios:

- If the Director took the prior approval for the issuance of the prospectus;

- If the Director was not intimated for such action before issuance, or he/she approved such action.

- If the Director didn’t approve such action and conveyed the same with the public through the notification.

- If the Director has a good reason to believe that the false statements might be legitimate.

- If the statement has any connection with the personal debt of the company.

Company Debts

A Director will not be held personally accountable for any debts avail by the company in the past unless the Director is found to be engaged with criminal undertaking related to it.

Fraudulent Business Conduct

Director will have to encounter the consequences raised by his/her action against the company’s interest. If the action of the Director is found to be illegal then he/she may be penalized as per the provisions mentioned under the law.

Failure to Repay Share Application Money

On the off chance, if the Director of the company cannot pay the share application money due to any reason, he will be accountable along with the company for such a discrepancy. As per the Company Act, 2013[1] , any violation in this regard would enforce the defaulter (Director(s)) to face the imprisonment for a year or so.

Default in Obtaining Qualifications of Shares

- Directors will be responsible for paying money related to the qualification of shares.

- Directors will be liable to pay for the qualification of shares if failure to do so within the given time and company goes into liquidation.

Share Application Money Payment

The company and the Director share the equal responsibility for repaying the share application money received if it is yet to be repaid within the prescribed timeline.

Accountability for Paying For Qualification Shares

In case the Director is yet to avail the qualification shares within the prescribed timeline, and such a company is already facing issues like asset liquidation. The official liquidator can raise the value payable against the shares from the Director.

Criminal Liability of a Director in Privately Held Organization

Criminal liability of a Director in Privately Held Organization serves different aspects of its role and responsibilities, which are as follows:-

Dishonoured Cheques

Stamping approval to the dishonored cheque is a criminal offense. If the Director is found to be engaged with such an act, he will be held accountable for the same along with the company.

Contravention of Labour Law

In the case of the contravention of the labor laws, the Director along with the company will be liable for such mishaps and criminal liability can be imposed on both of them for such an act. Directors who are not managing the overall operation but handling a certain aspect of the company would stand unaccountable for such an action.

A Brief Note on the Piercing of Corporate Veil

Directors have limited liability on the personal ground since the company act as a legal person. However, the paradigm of lifting the corporate veil transfers the liability. This typically is witnessed in the event when the directors with a criminal intention endeavor to set off their unlawful acts under the company name.

If the company is found to be guilty of defrauding the creditors then the Director associated with this mishap will be stands liable and the notion of lifting the corporate veil comes to the reality. Evidence of any illegal conduct with the Director’s knowledge will be sufficient to shift the liability. This is primarily done in the public interest so that the Director of the company cannot use the Salomon principle* to avert the liability.

What is the Salomon Principal?

According to the Salomon principle, the incorporated entity will be treated as a separate legal entity and have a distinctive identity from its directors, shareholders, employees, and agents. In the cue of this, the company can face the legal proceedings in its name and assets independently from its shareholders. Therefore, Salomon principle renders the positive impact on the Director’s liability as far as their accountability within an organization is concerned.

Conclusion

From the liability viewpoint, the line that separates the directors or core member from the company is pretty gloomy. This inherently prepares the ground for the defaulters seeking to indulge in fraudulent activities and shift the liability towards the company. Of course, there is a defense mechanism in place to counter such a disparity.

The Company Act, 2013 has drawn a line of distinction between the company and its directors on the liability part in the different events. Talk to CorpBiz’s expert if you intent to explore more dimension of Director’s liability in the private limited company.

Read our article: What are the Requirements Before Choosing Company Name in India?