Taxes must be deducted at the rates specified in the relevant provisions of Income Act or First Schedule to the Finance Act. The concept of TDS was introduced with an aim to collect tax from the very source of income. TDS means tax deduction at source while the TCS means tax collected at source. One can make TDS payment due date through challan very easily. According to the Income-tax Act, if the person makes payment to the receiver, then TDS is required to be deducted at prescribed rate and then deposited to the government. However, for the TCS, a person receiving the payment has to collect tax from a person making payment and deposit thereafter to the government.

New TDS/TCS due Date Updates because of Covid19 by Finance Ministry

- The Government to infuse Rs 50,000 crores liquidity by reducing the rates of TDS, for non-salaried payments made to residents, and rates of Tax Collection at Source for receipts, by 25% of the existing rates.

- If delaying payments of advanced tax, self-assessment tax, regular tax, TCS, TDS, STT, CTT, equalization levy made at the time from 20th March 2020 to 30th June 2020, then the reduced interest rate at 9% instead of 12 %/18 % p.a. will be charged for this period. No late fee or penalty will be charged for delaying related to this period.

- According to the recent updates by the government on TDS and TCS certificates a department has been extended a validity of both lower or nil TCS, TDS certificate till 30th June 2020 with a view of currently going COVID-19 pandemic.

- The Notification No. 370142/23/2020 – TPL dated 24th June 2020 issued by the Government of India that TDS Deducted under section 194IA & 194IB on the transaction in a month of February and March, can be deposited up to 31st July 2020. The due date for filing of TDS and TCS return for Q1 and Q 2 of FY 2020-21 will be 31st March 2021.

- Quarterly TDS/TCS Certificate: After uploading the quarterly TDS return, one can generate the TDS/TCS certificate within 15 days of uploading the return.

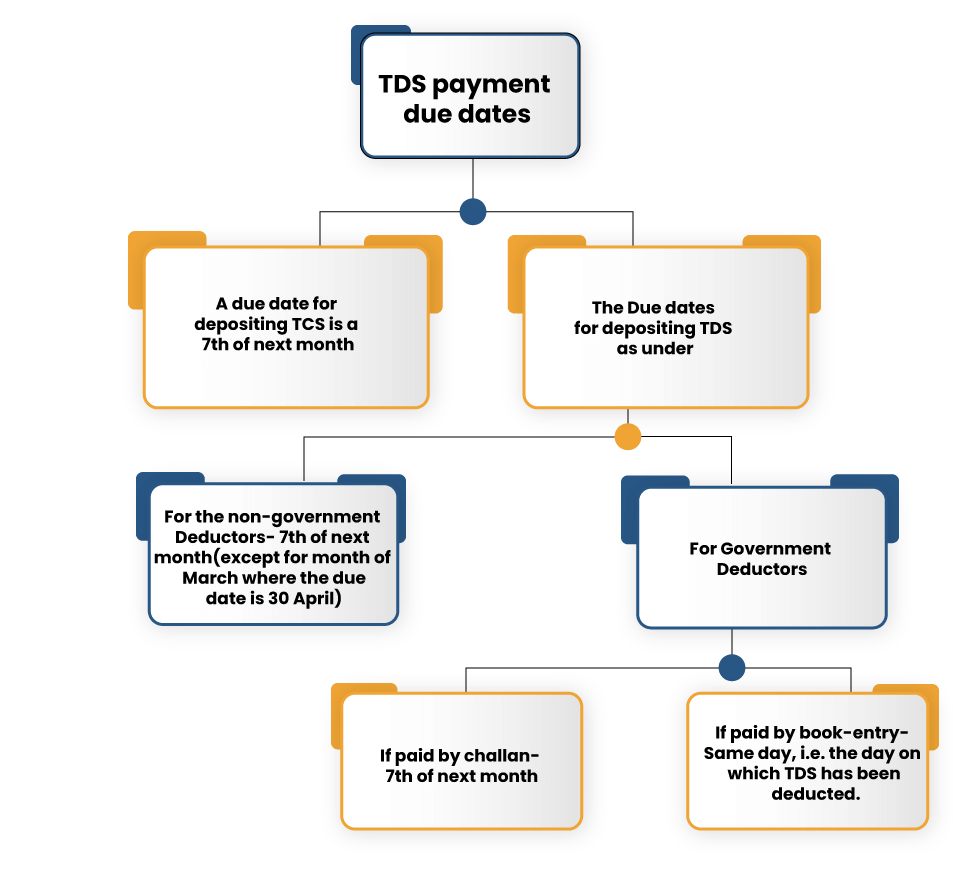

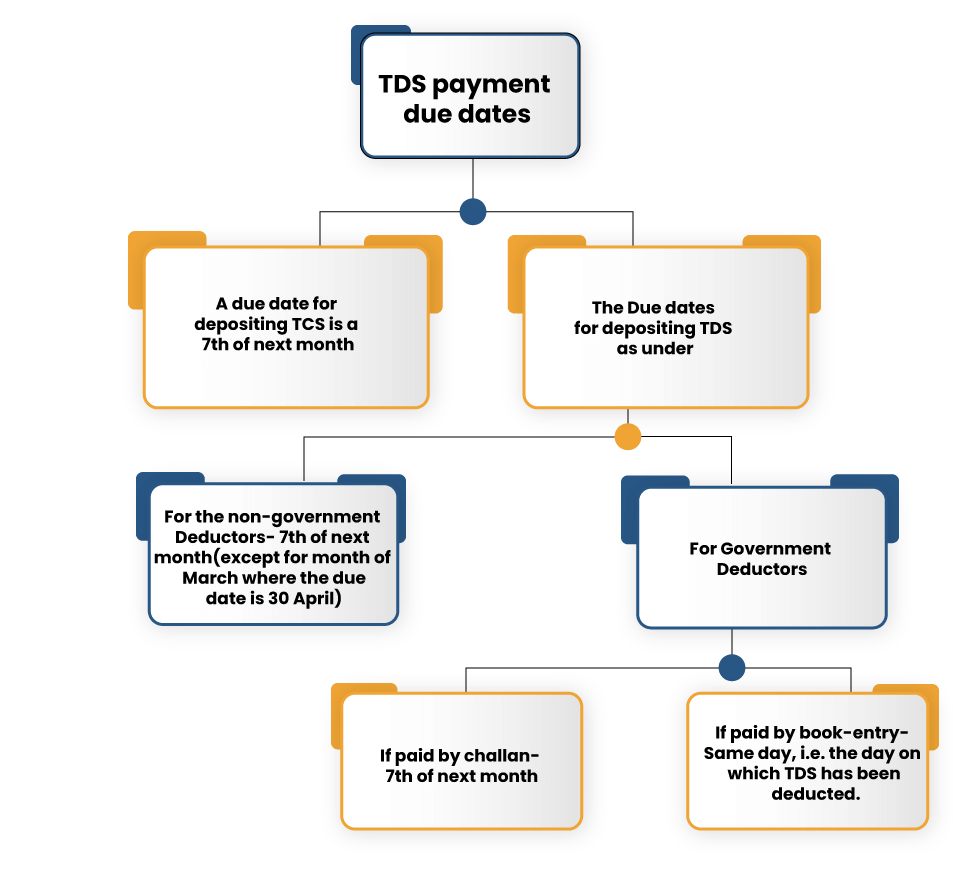

TCS and TDS Due Dates for Payment Deposit

TDS Payment due Date for Sunday or any Public Holiday

Tax-deductible at source is done at a time of the payment to a receiver and tax deducted is directly deposited by a taxpayer to the government directly. TDS filing is mandatory for all who have been into a payment transaction, and therefore there are various compliance by the government. As per rules, in case the upcoming TDS return due date is falling on Sunday or any other public holiday, then they can also pay the TDS on the next working day.

Penalties on Return Filing After the TCS/TDS Payment Due Date

- TDS ensures on-time payment of tax on behalf of the income generator but not on behalf of one who deducts the tax. For instance: if an employer deducted tax on behalf of the employee, implies that an employee has paid the tax that doesn’t mean the employer has also paid the same. So, now here comes the role of penalties and late payment charges.

- The penalty or delayed payment fees will be charged by the Income Tax Department (ITD) to an individual who does not follow the compliance with the Income tax law or could not meet the tax duties in a well- manner. Hence when the individuals fail to pay the taxes on time, the penalties are levied along with an interest.

- In the same way, if the deductor or employers who deduct the TDS (Tax Deducted at Source) from an income of their employees, fails to pay TDS to government or fails to submit relevant tax documents to the Income-tax department on time, becomes liable for the penalties for the late or non-payment of the TDS.

- Section 234E of the Income Tax Act[1], was introduced on 1st July 2012, deals with late payment fees or the penalty applicable for late submission of quarterly TDS and TCS returns by a Deductor to the Income Tax Department.

Late Filing Fee on missing TDS/TCS Return Due Date

As per Section 234E, the late fine of Rs 200 per day has to be paid to Income Tax Department in case of late filing TDS return and TCS return. The fine shall be levied for every single day of delay until a late payment charges become equal to an amount of TDS and not more.

Conclusion

TDS means Tax Deducted at Source, is a type of tax which is levied on payments to individuals or companies if the paid amount crosses certain threshold limits. For instance, if the company is paying a salary to an individual, and if this paid amount is eligible for TDS, then at the time of payment the company has to deduct the applicable tax from the original amount and deposit the same with the Income Tax Department. In this way, the recipient gets their salary with tax already deducted at source.

Read our article:Let’s Understand the ways to Make TDS Payment Online