The intent of introducing TDS was to collect tax from the very source of income. According to this mechanism, the person (deductor) liable to make a specific type of payment to another person (i.e. deductee) must deduct TDS. The person making such specified payments is responsible for deducting the TDS and making TDS payment online.

Importance of TAN for TDS Payment Online

TAN or Tax Deduction & Collection Account Number is a 10-digit number issued to individuals or organizations which are required to deduct or collect tax on payments made by them.

- According to Section 203A of Income Tax Act 1961, it is mandatory for all people or organizations to quote TAN details in all matters (liable to deduct TDS) and correspondences related to TDS (as TDS Payments, TDS Returns, Issuance of Form 16, etc.) with an Income Tax Department.

- In case of failure to do so, this will attract a penalty of ₹ 10,000.

- The banks do not accept TDS returns and payments unless a deductor or depositor has the valid TAN number.

Sometimes, people assume that PAN & TAN are similar documents but it is not the same thing. Therefore, TAN is obtained separately by people, organizations or institutions who are responsible to deduct tax. The only exception is provided in the case of a buyer of an immovable property. In this matter, a buyer or a deductor is not required to obtain TAN and can use PAN for remitting the TDS.

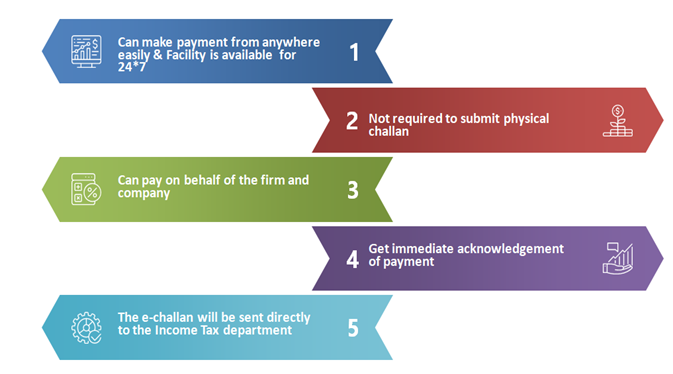

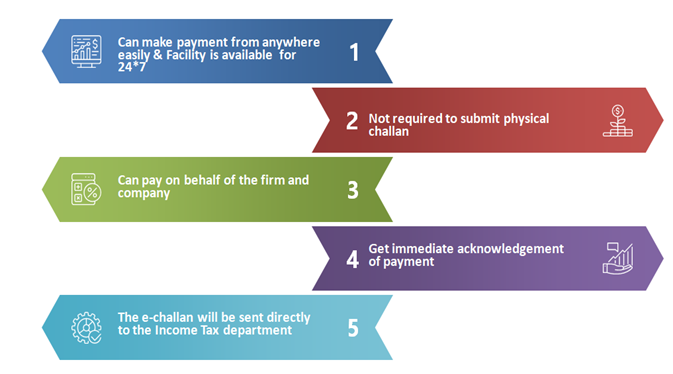

Advantages of TDS Payment Online

Read our article:TDS on Sale of Property: Procedure and Requirements

Procedure for doing TDS Payment Online

The payment of TDS can be made online through the NSDL’s official website. The process of e-payment is given below:

- Step 1: Visit to official website of NSDL (http://www.tin-nsdl.com) > Services > e-payment. On a main page click on to ‘pay tax online’

- Step 2: From a list of applicable challans, it appears on the home page of website, click on a ‘CHALLAN NO/ITNS 281 option.

- Step 3: It will be directed to the separate page where it will show to fill in all the required details.

- Step 4: The user will redirected to the new webpage where the details pertaining to the Tax Deduction Account Number (TAN), tax applicability, Assessment Year, the Pin Code and State, the payment mode, and also the type of payment has to be filled up. Once all the require fields have been filled up, the user has to fill in the Captcha code and click on to ‘Proceed’ button.

- Step 5: Once a form is submitted, the TAN will get verified. On a successful verification, taxpayer’s full name will prompt on the screen.

- Step 6: After a user confirms the data, they will be redirected to net banking website of the bank[1].

- Step 7: The user will be required to log in to their internet banking profile and make the payment of TDS.

- Step 8: After a successful payment, a counterfoil challan will be generated and that gets displayed on screen. The challan will have the (CIN) Corporate Identity Number and details pertaining to the payment and the name of the bank are shown. The challan can be saved for future reference.

How to Check a Status of Online TDS Payment?

One can check the status of TDS by following the steps:

- Visit to www.tdscpc.gov.in

- Type in a verification code and click on to ‘Proceed’

- Provide all the details mentioning the PAN and TAN number.

- Select a financial year followed by the quarter and type of returns.

- Click on to ‘Go’. One will be able to check the status of the TDS.

- Another way of checking the status of your TDS is:

- Visit www.incometaxindiaefiling.gov.in

- In case you are a new user then register first. If you have already registered, login to the portal by your login credentials.

- Go on to ‘My Account’, then click on ‘View Form 26AS’.

- Select a year & PDF format then download the file. The file is password protected so the date of birth will be the password.

- You can also use net banking facility to view the status of TDS payment. However, for that your PAN has to be linked to net banking portal in order to view a status of TDS payment.

What Happen in case Delay in Payment of TDS?

- In case of delay in TDS payment due to non-deduction of tax at source, then an interest of 1% per month is charged on a due amount. The interest is charged from a date from when the tax was deductible to a date when an actual deduction is made.

- In case of delayed in TDS payment after a deduction of (TDS) tax at source, an interest of 1.5% per month is charged on the due amount. The interest is charged for every month during which the payment is delayed. A rate of interest is charged from the date of deduction of the tax amount.

Conclusion

The TDS payment online system has been followed by a concept of “Any Time, Any Where”. It has also made the TDS administration a user friendly and transparent process and has helped minimize tax frauds. It is one common platform wherein the deductors, taxpayers and assessing officers have access to the same data.

Read our article:All about Documents Required for TDS Return filing