There are various provision under Income Tax Act that provide liberty for paying tax after the due date , however the condition is to pay interest on late payment delay. Such provision interest on delay in filing TDS return of income mentioned under section 234A, interest on default in payment of advance tax mentioned under section 234B, interest on deferment of payment of individual instalment or instalments of advance tax mentioned under section 234C, and interest for an excess refund granted to a taxpayer under section 234D. Therefore, provisions pertaining to TDS interest fall under section 234B, 234A, 234C and 234D.

Failure to Collect tax at source/delay in Payment of tax

The interest levied for failure to collect tax at source/delay in payment of tax collected at source mentioned under section 206C (7) and interest levied for failure to deduct TDS and delay in payment of TCS mentioned under section 201(1A).

There is provision related to interest on failure to deduct tax at source and delay in payment of tax deducted at source mentioned under section 201(1A) and interest on failure to collect tax at source and delay in payment of tax collected at source mentioned under section 206C (7).

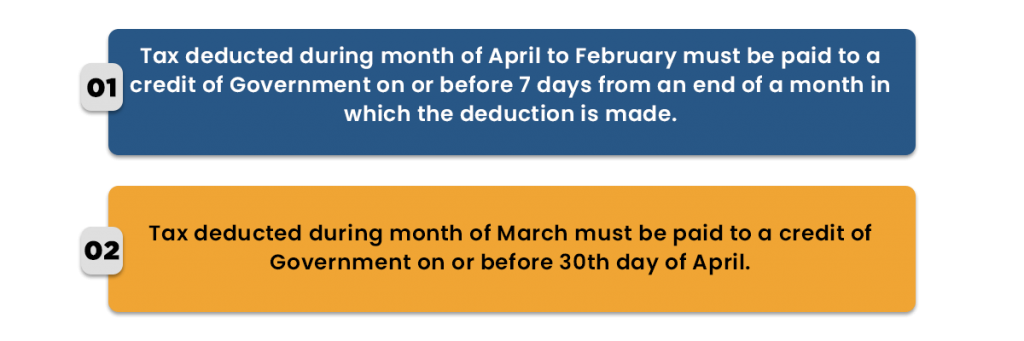

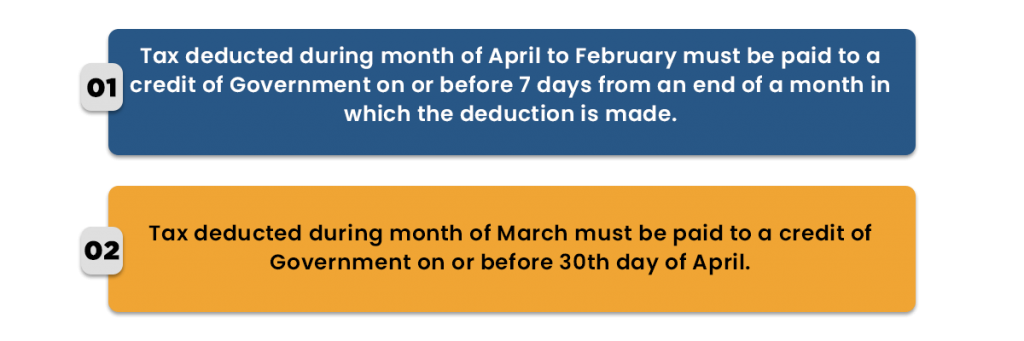

The provisions related to due date of payment of TDS to credit of Government

Before knowing the provisions related to levy of interest for failure to deduct tax at source/delay in payment of the TDS, it is necessary to know the provisions related to a due date for payment of TDS to a credit of Government account. Under Income tax Act from Section 192 to 195 is for payments on which tax is to be deducted by a taxpayer. The tax deducted by a taxpayer (i.e., a non-Government payer) must be paid to a credit of Government as follows:-

An Interest for failure to deduct TDS and Delay in payment of TDS

According to section 201, if any person fails to deduct the tax wholly or partially who was liable for such deduction has to pay simple interest in the form as mentioned below:

- Interest must be levied at 1% for every month or part on an amount of such tax from a date on which such tax was deductible to a date on which such tax was deducted.

- Interest must be levied at 1.5% for every month or part on an amount of such tax from a date on which such tax was deducted to a date on which such tax was actually remitted to a credit of Government.

In other words, interest shall be levied at 1% for every month or part of a month for delay in the deduction and at 1.5% for every month or part for delay in the remittance after deduction.

TDS Interest in Case deductee Pays a Tax

According to section 201, a taxpayer who fails to deduct whole or part of TDS must be treated as an assessee-in-default. However, a taxpayer who fails to deduct whole or part of the tax made to a payee will NOT be deemed to be an assessee-in-default in respect of tax not deducted by him, after satisfying the following conditions:

- A recipient has furnished his return of income under section 139.

- A recipient has taken into account the above income in its return of income.

- A recipient has paid the taxes due on an income declared in such return of income.

- A recipient furnishes the certificate to the effect by an accountant in Form No. 26A.

In other words, in case of a partial deduction of TDS or any short deduction of tax a taxpayer will not be treated as an assessee-in-default. However, in such case, even if a taxpayer is not treated as an assessee-in-default, he will still be liable to pay interest under section 201(1A). In this case, interest must be payable from a date on which such tax was deductible to a date of furnishing of return of income by such payee. An interest in such a case will be levied at 1% for every month or part of month.

The Provisions related to due date of Payment of TCS to a Credit of Government

Under Section 206C there are various provisions on which tax has to be collected at source. The tax so collected must be paid to the Government within a period of 7 days from last day of a month in which the tax is collected at source. When it is collected by an office of Government then it must be paid to the Central Government on the same day.

An Interest for failure to collect tax at source and delay in payment of TCS

According to section 206C(7), if a person is responsible for collecting tax does not collect tax or after collecting tax fails to pay to the Government within due date specified, then he must be liable to pay simple interest at a rate of 1% per monthor part on an amount of such tax. An interest will be levied for a period from a date on which such tax was collectible to a date on which tax was actually paid.

An Interest in case if a buyer or Licensee or Lessee has Paid the Tax

According to section 206C (6A), a taxpayer who fails to pay tax whole or part of the TDS must be treated as an assessee-in-default. However the collector who fails to collect whole or part of TDS (other than TCS referred under sub-section 1F, 1G and 1H) must NOT be deemed to be an assessee-in-default in respect of tax not collected by him, in case a buyer or licensee or lessee from whom tax is collected satisfies the mentioned conditions:

- In case he has furnished his return of income under section 139.

- In case he has taken into account that amount for computing income in such return of income.

- In case he has paid tax due on an income declared by him in such return of income.

- In case he has furnished a certificate to effect from an accountant in Form No 27BA.

In other words, in case of the non collection of TDS or short collection of tax, if conditions are satisfied, then a person responsible to collect TDS will not be treated as an assessee-in-default in respect of tax not collected or short collected by him. The interest will be payable from a date on which such tax was collectible to a date of furnishing of return of income by such buyer or licensee or lessee. Interest will be levied at 1% for every month or part of a month.

Conclusion

According to the Income-tax Act[1], the TDS is required to be deducted at a prescribed rate and then deposited with the government. While the TCS, the person receives the payment must collect tax from the person making payment and deposit thereafter with the government. Both must be timely paid otherwise liable for interest on late payment.

Read our article: Form 16B – TDS Certificate Regarding Sale of Property