An annual return is a legal document that contains details of a Society’s shares, members of the Society, changes in memberships, all the governance resolutions etc. Usually, people assumed that the Income of small societies is not taxable; therefore, there is no requirement to file Income Tax return. Well, this assumption is no more correct, since amendment was made in Section 80AC of Income Tax Act 1961.

Though, Budget 2018 stretched the scope of section 80AC to deliver the benefit of deduction under the complete class of deduction. The extension was done under the heading “C- Deduction in respect of certain incomes” in ‘Chapter VIA,’ which shall not be permitted if a return of Income is not duly filed by the due approved date. In this blog, we will look at the information submitted by the co-operative Society in its annual return in detail.

What are the sections that stand in for 80AC of the Income-tax Act?

- According to the existing provisions of Section 80AC of the Income Tax Act, no deduction on charges would be permissible “under sections 80IA, section 80IAB, section 80IB, section 80IC, section 80ID, or section 80IE”, only if, no annual return of Income gets furnished.

- The Income received by the ‘assessee’ has to get furnished on or before the due date prescribed under Section 139(1). Any other taxpayers who are claiming such deductions do not come under the purview of Section 80AC of the Act.

- By the given Section, deduction under section 80P is allowed only if Income Tax returns have been duly filed on or before the due date as prescribed under section 139(1) of Income Tax Act of 1961. Deduction under section 80P 2(d) associated with Interest received from the Co-operative Society. Deduction u/s 80P 2(C) permits ‘Standard Deduction’ up to Rs 50,000/- only if Co-operative housing society taking Business Income such as- Income from Poster / Advertising Revenue.

What about the Banking Operations of Such Societies – effecting Deductions?

- Generally, every Society has Bank Account in Co-operative Bank or any State-owned or Nationalised Bank. Correspondingly, every Society has Fixed Deposit either in the Co-operative Bank or any of the Nationalised Bank.

- In terms of the above said, Saving Bank Interest or Fixed deposit Interest expected from Nationalised Bank is open to charges – taxable under the title of “Income from Other Sources.” It also signifies that it needs to file Income Tax return as per prescribed arrangements.

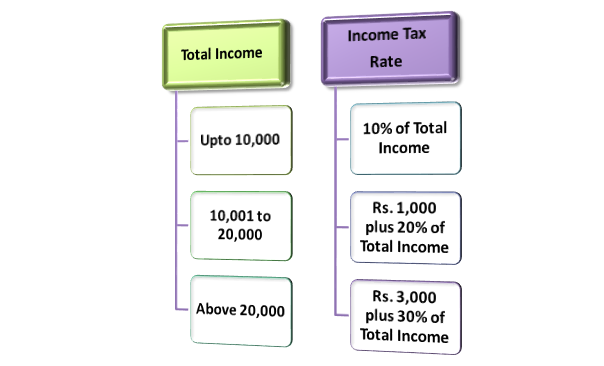

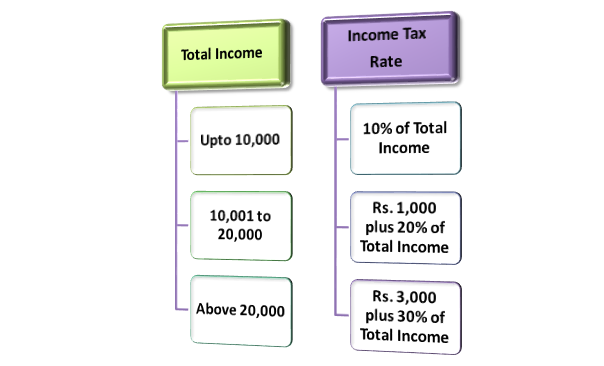

- Moreover, the ‘Saving Bank Interest’ or ‘Fixed deposit Interest’ recognized from Co-operative Bank can be deductible under section 80P 2(d) only if the return gets filed on or before 31st Oct for the Financial Year or Assessment Year as per adjustment during amendment made in section 80AC. The Saving Bank Interest or Fixed Deposit Interest received from Co-operative Bank is taxable at the following rate:-

What is the Performa of Annual Returns needs to be submitted by all Societies?

It has been defined that in every year, within thirty days of holding of annual ‘general body’ meeting, the board need to file returns. It should address all the concerns relating to its constitution, technical and similar matters to the Registrar as prescribed. By chance, if the returns not filed, it will consider being an offense under the Act. Moreover, the persons accountable for such duties shall be penalized following the provisions prescribed.

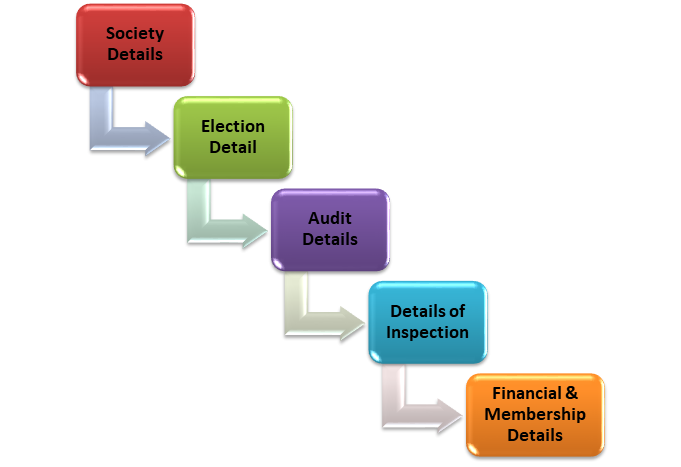

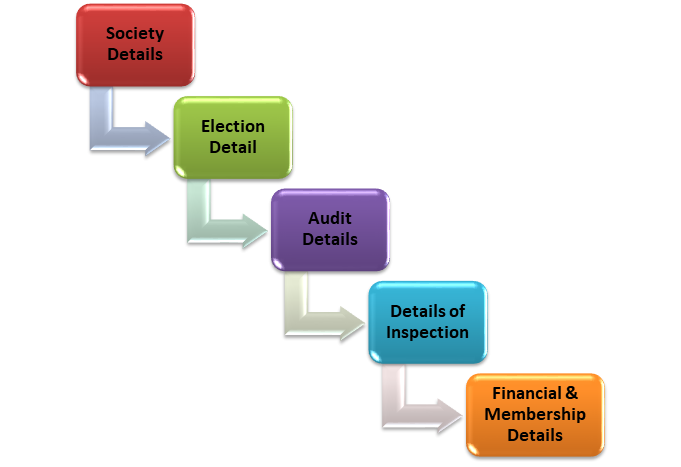

The Details required under prescribed Performa mentioned below:-

Complete Society Details: –

- Details of the Financial Year

- Credentials relating Registration No. of the Society

- Required Zone in which functioning

- Details

- Name of Society.

- Registered Address

- Complete Working Address – PIN

- Communicative Phone No /Email

- Declare Total No. of Members of the Society

- Disclose Share Capital

- Disclose Deposits (Rs. In Lakhs)

Complete Election Detail: –

- Date of Last Election

- Outstanding Date of next Election

- Particulars of Elected Members

- Date of last Annual General Meeting

- Time of previous Special General Body Meetings

- If Annual General Body Meeting held by 31st Oct of 20-(Yes or No)

- If no, whether delayed response given to the RCS in this regard, give details

Complete Audit Details: –

- Disclose year up to which Audit has been held,

(a) If Auditor appointed for the current Financial Year? Give all details

If Yes,

- Declare Name of Auditor

- Disclose Panel No of Auditor

- State the Date and Form No (issued by Registrar, Cooperative Societies office) through which appointed

- Disclose Auditor’s fees (in Rs.)

- Display the date of submission of Audit Report to the Registrar, Cooperative Societies Office

- If objections have settled (YES/No)

- If accounts for this year approved by AGM (Yes/No)

- If Yes: – Date of AGM in which statements got adopted

- If No: -Give reasons

If No: –

- Give Reasons

(B) If accounts not audited for last Financial Year

Details of Inspection/Enquiries

- Is there any Query/inspection pendent (Yes/NO)

- Examination or Enquiries (Inspection under section 61 & Enquiry under section 62)

- Disclose the Name of Inspecting/Enquiry Officer,

- Give complete Address and Tel. No. of Enquiry Officer,

- Details related to Date of Appointment

- Details related Target date of submission of report

- Whether report submitted (if yes) date of submission:

- (If no) state Reason for delay

Give complete details of Group Housing & House Building Society: –

- If any waiting list (only for HB Society)

- Share the status date of waiting list members

- Disclose the total No. of waiting list members (only for HB Society)

- Updated details and date list of members submitted as per rule

- State the year up to which updated list of members sent to Registrar, Cooperative Societies Office

- State the list of date when sent

If all the resignations, exclusions, and enrolments up to that year

- Approved by Registrar, Cooperative Societies Office (Yes/No)

- List the No. of members cleared for draw,

- List the No. of members awaiting clearance

- List the Vacancy position

- Freeze Strength (Initial)

- List the Current Strength, if FAR increased by DDA

- Details on Land Allotments (Yes/No)

- Date of allotment of Land

- Time of obtaining the Architects Certificate

Finance Details of T/C Society

- Disclose Maximum Credit Limit

- Disclose Total Advance (in Rs.)

- Disclose Total Recovery (in Rs.)

- Disclose Outstanding Recovery

Read our article:An overview on Tax Residency Certificate & Double Taxation Avoidance Agreement: How To Get It?

What is the Income which is usually earned by a Co-operative Society by Contribution from Members?

- Contributions from Members are the most commonly attributed accounts in profit & loss account of any Co-Operative Society’. They got recognized under different heads, specifically, Maintenance cost Municipal Levies, Electricity Concerns, Lift Maintenances Cost, Water Cost etc.

- It may get highlighted that the Society acts as an agent who gathers these charges on behalf of members & spends the same to meet the numerous joint expenses of the Society. Whatever surplus generated due to such types of Income is not taxable as it is exempt grounded on the ‘Concept of Mutuality.’

- The elementary principle of Mutuality is a common association that rises when persons forming a group; associate cooperatively for an ordinary object. They contribute money for attaining that object and divide the surplus between them.

- The fundamental requirement in the case of mutual association is that “All the Fund providers to the common fund must be permitted to participate in the surplus.” Moreover, all the competitors to the surplus should be contributors to the mutual line of work. In short and crisp, there should be complete distinctiveness between the ‘contributors’ and the ‘participators.’

What are the Interest Charged on member Outstanding, Earned Investments, and Dividend?

- The Interest amount charged by the Society on unsettled dues of members forms a part of involvement from the members. It also qualifies the test for the ‘concept of mutuality.’ It is because the contributors & participators are identical persons. Accordingly,’ this is also getting exempt from the principle of Mutuality.

- Interest income received can be classified into Interest earned from ‘investments’ made in Co-operative Banks & from extra Investments. Moreover, Interest received from any investment made in Co-operative Banks is eligible for 100% deduction under section 80P (d) of the Act. Nevertheless, further interest income on investments is entirely chargeable.

- The dividend income gained from Indian Companies is completely exempt u/s 10 (34). Moreover, dividend received from Co-operative Banks succeeds to get exemption under 80P (d) is therefore 100% deductible.

What is the Rental Interest Charged from Advertisement Hoardings, Cable Towers, and the use of open spaces?

- The Advertisement Hoardings are fully taxable under the space of Business Income or Income arrived from other bases. Nevertheless, the expenses which can be openly attributable to receiving of this Income can get requested against this Income on a proportional basis.

- In the cases of Rental from mobile & Cable Towers, it is taxable under the space of ‘Income from House Property.’ Likewise, it is eligible for average deduction under section 24 (a) @ 30 % of the whole Rent. If in case, the Society has loaned out capital to construct said structure or Society in which the tower has instituted, then a proportional deduction can be demanded for Interest paid on borrowed assets.

- Point to be noted; if the Rentals received for the use of open space or terrace, it should gain from Members or Non-members of the Society. If it gets acknowledged from Members, then it can be justifiable not to be taxable on the principle of “Mutuality.” If it gets accepted from Non-members or outcasts, then it shall be utterly taxable under the parameters of Income from House Property. It will qualify for deductions, as stated earlier.

What is the Non-Occupancy parking, and Charge needs to be fulfilled by Co-operative Societies?

- The non – occupancy charges are being composed from members in their Regular Bills, though the income tax departments interpretation says that this amount gets acknowledged from the members. These members should be who has not been staying in the locations of the Co-operative Societies. Consequently, though he is a contributor to the total amount, he is not relishing the amenities of the Co-operative Society. Therefore it also can be said that it is not a participator. Bearing in mind about the same, the ‘mutuality concept’ is not fulfilled & this Income is taxable as per provision.

- Again, in this case of parking charges, the point to be seen is whether the receiving’s are from members or Non – members of the Society. In the instance of collections from members, they get protected by the general concept of ‘Mutuality.’ Nevertheless, in the case of Societies surrounded by shopping complexes, the parking charges demanded from outsiders would be chargeable.

What are recent Rulings reflected upon deduction eligible to Co-operative Societies?

- In the case of “Kuthuparamba Range Kallu chethu Vyavasaya Thozhilali Sahakarana Sangham Ltd Vs. CIT (Kerala High Court)” it says that Toddy Tapping- Collection of juice is eligible for deduction U/s. 80P. The trees belonging to the members of the Society will be agricultural products developed by them. The selling of such produce grown by its members would be the marketing of an agrarian food under a regulatory command.

- In the case of “ITO Vs Shree Keshorai Patan Sahakari Sugar Mill (ITAT Jaipur),” it says that the deduction U/s. 80P(2)(d) is eligible to the Co-operative Society on Interest from co-operative banks. It can get accomplished despite being not providing credit services to the members of the co-operative Society.

- In the case of “ITO Vs. M/s. Perinthalmanna Service Co-operative Bank Limited (ITAT Cochin)”, Sec 80P Deduction is available to Co-Bank for Interest on Investments with Sub-Treasuries during its Business of primary agricultural credit society.

- In the case of “M/s. Sri SaiDatta Mutual Aided Co-operative Credit Society Vs. Asst. (ITAT Hyderabad)” it says that consent of Mutuality cannot be denied simply for the reason that there are two classes of members as per bye-laws of Society

- In the case of “ITO Vs. Nannambra Service Cooperative Bank Ltd. (ITAT Cochin)” says that the Primary Agricultural Credit Society (PACS) was not permitted to obtain Banking License; therefore, it is not authorized for deduction under section 80P(2).

- In the case of “Income-tax Officer Vs. The Somavamsha Sahasrajuna Kshatriya Credit Co-operative Society (ITAT Bangalore)”, it says that Credit co-operative society providing credit facilities to members of Society can demand deduction u/s 80P(2)(a)(i)

- In the case of “ Income Tax Officer Vs. Shri Bapooji Pattin Southard Sahakari Niyamit (ITAT Bangalore),” it says that Society allowing Loan to non-members cannot demand for the claim deduction U/s. 80P

- In the case of “Jaipur Sahakari Kraya Vikraya Samiti Ltd. Vs. ITO (ITAT Jaipur)”, it says that, the Auditor’s opinion on Section 80P Interpretation, cannot be an Information for Reopening U/s 147

Conclusion

By agreeing to the broad-spectrum, the insight says that the Income of Co-operative Societies is not actionable to taxes. For that reason, many societies do not bother to take PAN No. and file Income Tax returns. It is a complete wrong observation since though certain types of Income of Co-operative Societies are exempt; there are other revenues which are chargeable to Tax. With this, Corpbiz has practiced professionals to help you with the process of filing Annual Returns of your Society, ensuring the successful and appropriate completion of your work.

Read our article:ITR Rectification – A Complete Guide on How To Rectify ITR Online