Fixing an inaccuracy in the tax return does not always demand a revised return. If you have received intimation from the Income Tax Department[1] under section 143(1) regarding an error, you are entitled to file a rectification. An ITR rectification (under section 154(1)) is provided by the Income Tax Department for the correction of the apparent error in your Income Tax Return. In this article, you will learn how to rectify ITR Online. So stay tuned and follow the given instructions carefully.

What types of errors are resolved under ITR rectification?

Filing ITR rectification can help users overcome the following errors.

- Factual error

- Calculation mistake

- An accounting error

- An error due to the absence of provisions of law.

The following examples will help you understand the nature of these errors.

- Severe arithmetic error in the tax credit

- Mismatch in the advance tax.

- Incorrect personal info such as gender or name.

- Additional details not submitted at the time of filing return

- Do not request for rectification regarding changing bank account or address details of the tax return.

What ITR rectification should be filed?

ITR rectification request only served the return that is already processed.

Any change in the income after the ITR rectification is not liable for any claim.

In this situation, users must file the Revised Income Tax Return instead of rectification. The filing of ITR rectification doesn’t entertain any deductions or exemptions.

Who is eligible to file the ITR rectification?

The filling of ITR rectification can be done by any individual or an Income Tax Authority.

In what case ITR rectification can be filed online?

If an individual has filed Income Tax Return via an online platform, then he/she is entitled to file the ITR rectification online.

Step by step guide on how to rectify ITR Online

Here is a step by step guide on how to rectify ITR online under section 154(1) –

Step 1 – Head over to the Income Tax Website

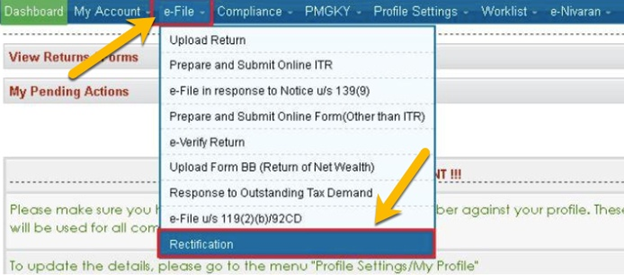

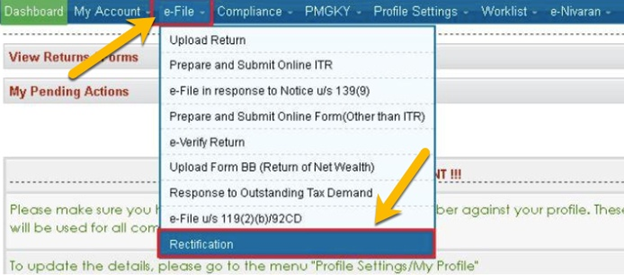

Step 2 – Explore the ‘e-File’ option and then select ‘Rectification’.

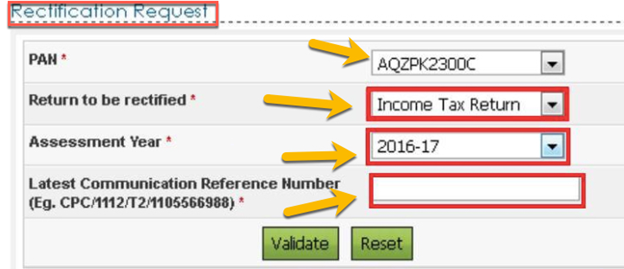

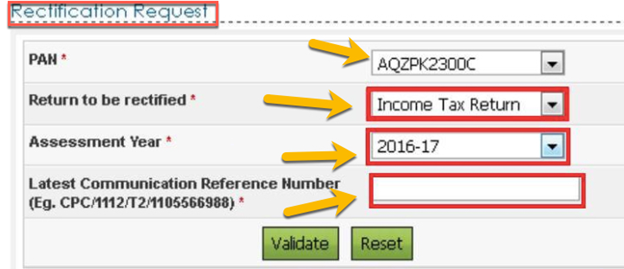

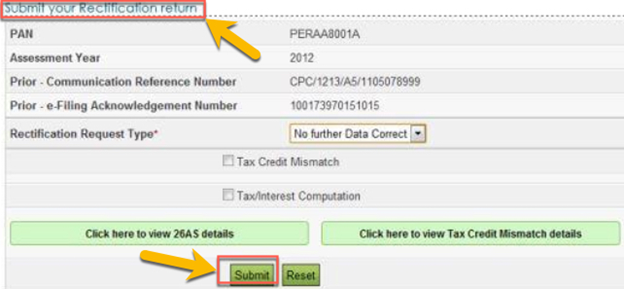

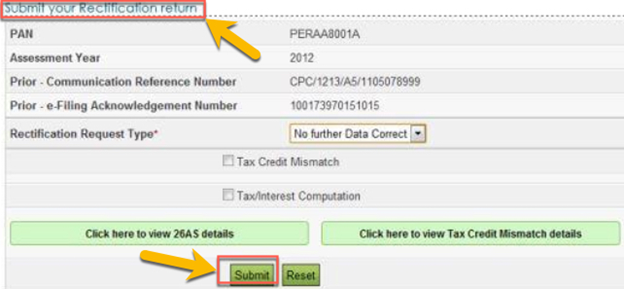

Step 3 – Now, you are supposed to choose the ‘Assessment Year’ followed by ‘Latest Communication Reference Number’ (as per the CPC Order). In case you possessed 2 orders, then go for the latest order number. Click on ‘Validate’.

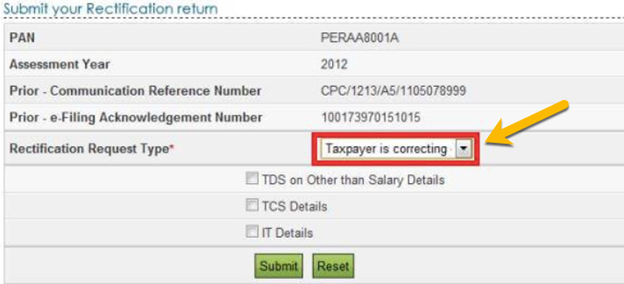

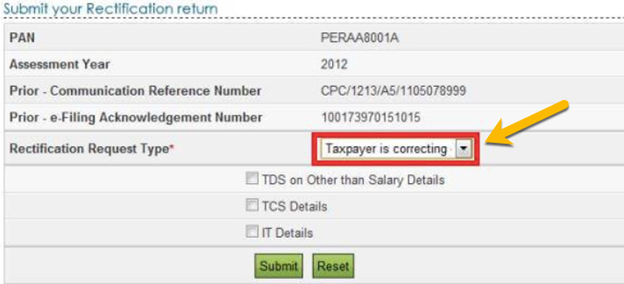

Step 4 – Select ‘Validate’>’Rectification Request Type’.

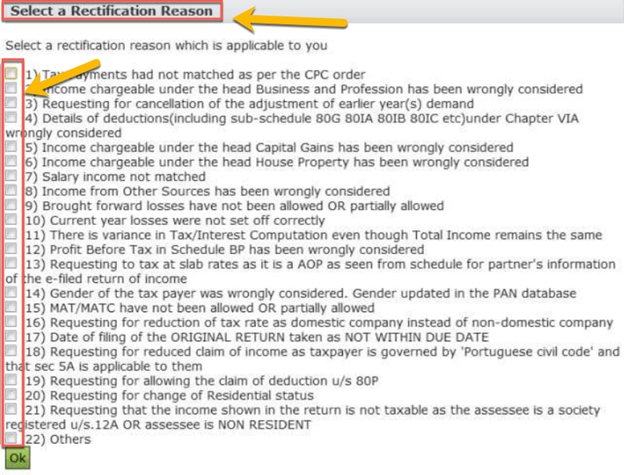

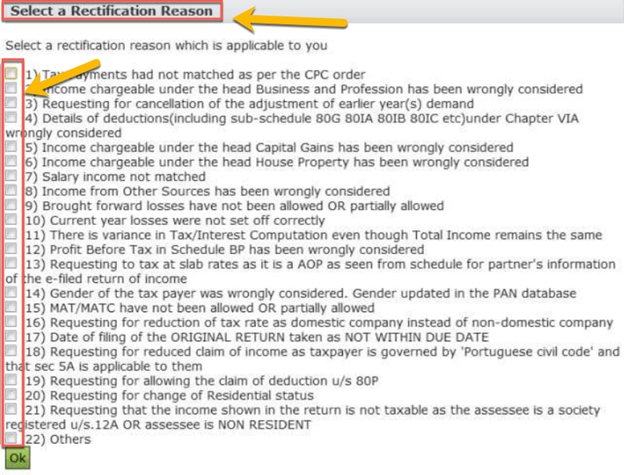

Here is what needs to be done as soon as you select a reason under Rectification Request Type’.

- Taxpayer Correcting Data for Tax Credit mismatch only

As soon as you opt for this alternative, three checkboxes will prompt on your screen. Now, you are fully entitled to use one of the checkboxes that suit your case for the correction purpose. Keep in mind that a maximum of 10 entries can be appended for respective selections.

- Taxpayer is correcting the Data in Rectification.

Choose the purpose of inquiring rectification and the Schedules in return being changed. Next, you must upload the XML file. A maximum of 4 reasons can be selected for this purpose.

- No further Data Correction required. Reprocess the case − This option serves the Tax Credit mismatch or Tax/ Interest mismatch. You can opt for the checkbox for which you seek reprocessing. Here you no need to upload the Income Tax Return.

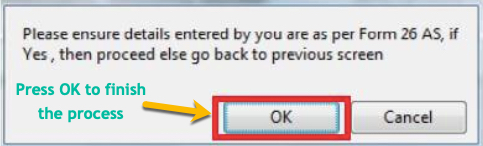

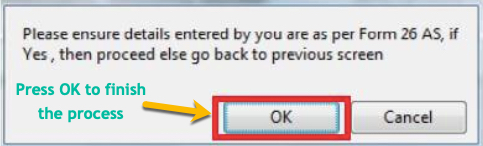

Step 5 – Finally, hit the ‘Submit’ button. A confirmation window will pop up on your screen. Click on OK to wrap up the process.

After processing the request for rectification, the order (as per Section 154) will be issued.

Read our article:Types of ITR (Income Tax Returns)

Let’s have a quick overview of provision available in rectification under section 154(1)

- Every taxpayer in the country is entitled to file the rectification. Apart from that, an Income Tax Authority can also do the same if they point out the apparent error which primarily made from their side.

- Rectification is not subjected to any change in the income, once the error is rectified. In those sorts of circumstances, the user must opt for the Revised Income Tax Return.

- The rectification request does not serve tax exemptions or deductions.

- The rectification request does not serve the unprocessed return.

- Online rectification is only possible in the case of online submission of the income tax return.

- The rectification request cannot be used to alter the bank account number or address listed on the tax return.

Conclusion

Hopefully, now you have learned how to rectify ITR Online. We are quite certain that you will not encounter any sort of hassle while filling up the ITR rectification for the tax return. However, if you still have some second thoughts regarding this info then kindly let us know, we will be obliged to help you out.

Read our article:Income Tax Return Filing without Form 16