Recession and severe dip in growth is not new to the automobile sector. Even before the pandemic outbreak, this sector was struggling to get back on track. As the year 2021 unfolds, the automobile industry is optimistic to recoup from the losses caused by the COVID-19 pandemic.

The schemes like Manufacture and Other Operations in Warehouse Regulations’ (MOOWR), Manufacture and Other Operations in Warehouse Regulations’ (MOOWR), and ‘Remission of Duties and Taxes on Exported Products’ (RoDTEP) has already been launched and shows a positive sign of improvement.

Under the PLI scheme, the government of India has proposed a budget of INR 57,042 crores targeted to the auto sector & a supplementary package of Rs 18,100 crores for Advanced Chemistry Cells used in an electric vehicle. The scheme aims to reduce the import demand and incentivize production for suitable entities.

The PLI scheme contributes nearly 40% of India’s manufacturing GDP, it is expected that it will channelize the focus towards manufacturing to propel growth and create ample job opportunities.

Read our article:GST Collection for December 2020 Hits all-time High Record

What is the Expectation of the Auto industry from the Latest Budget?

With Union Budget is around the corner, the entire country will be on its toes has been expecting something extravagance from the Finance ministry. The Honorable minister Nirmala Sitharaman has promised that the Union Budget of this year would be groundbreaking as the government tries to stabilize the distressed economy and drive growth.

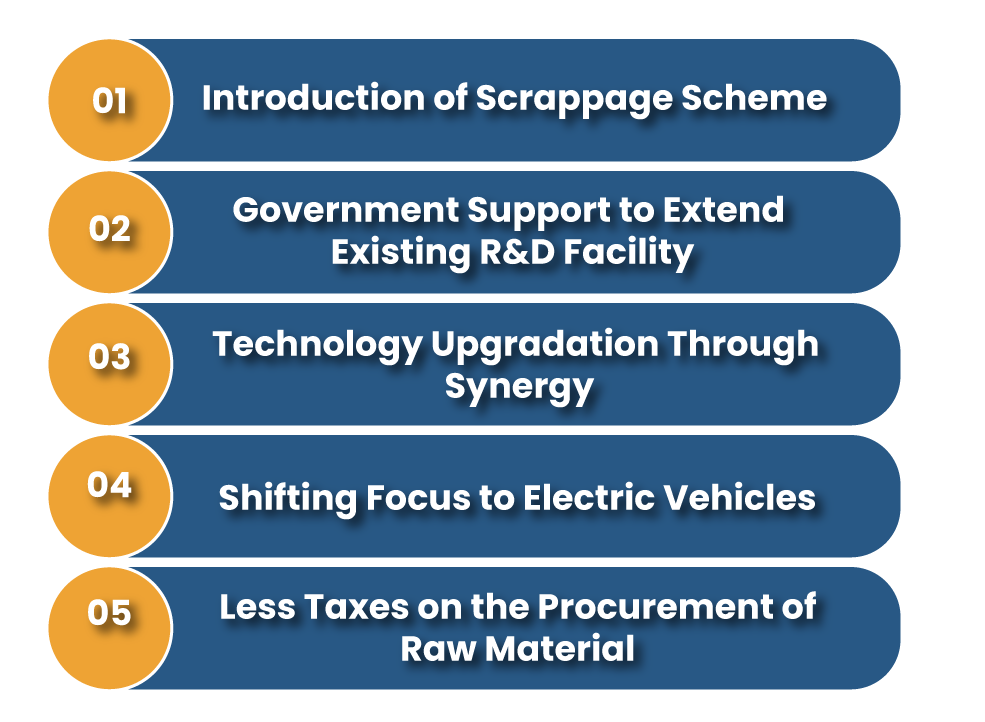

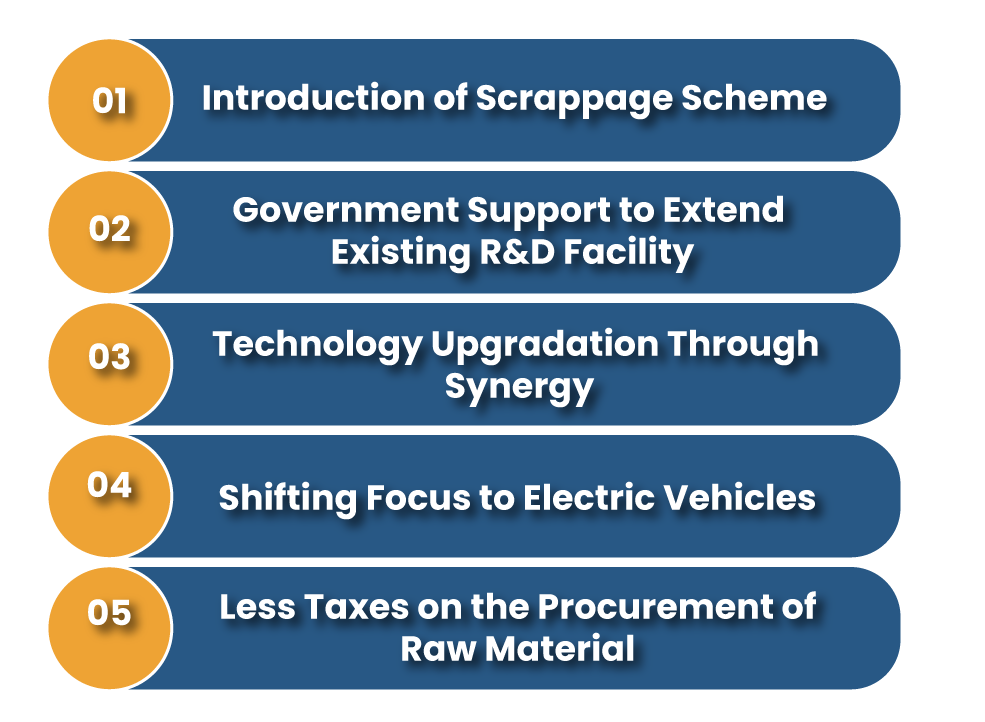

In such a situation, the automobile sector expecting to confront major reliefs from the Latest budget in several areas that also includes direct and indirect taxation, in addition to the multiple policy-level initiatives. From the policy-level standpoint, the automobile sector will experience the PLI scheme to be more focused on import substitution & factor the development period related to establishing an effective value chain in the country.

A major car manufacturer in the nation seeks reductions in road taxes & the cost of registration. Furthermore, the conducive financial schemes & plans will further escalate sales. The government got to launch growth-centric schemes to support electronics & semi-conductor manufacturing & assembly to lure overseas investment in the nation.

Key Factors that Incurs Growth for Automobile Sector in Future

High Expectation from Scrappage Scheme

To scale up the market demand, the government might introduce the much-awaited scrappage scheme targeted to the automobile sector. Scrappage scheme serves dual purposes; first, it removes the old and efficient vehicle from roads and second, it stimulates growth for the automobile sector by increasing the demand.

According to experts, a suitable Scrappage scheme is promising enough to create an autonomous industry with a business opportunity worth 6 billion dollars/year. Apart from this, the scheme can also render an opportunity to create a new form of business that deals with the recycling of plastic and rubber of scrapped vehicles.

Impact of COVID 19 on the Automobile sector

The pandemic has disrupted the auto sector like never before. Crippled commercial and economic activities have deepened the woes of automobile dealers. In the peak phase, the sector has encountered a loss of Rs 2300 crore/day. In addition to that, the employment scenario in this sector has been affected as the estimated job loss stood at 3.45 lakh.

As per SIAM (Society of Indian Automobile Manufacturers), in April 2020, the automobile sector registered a revenue loss of about Rs 69,000 crores. In the same year, the overall sales of auto units encountered a decline of 30% as compared with 2019. While the passenger cars might encounter some recovery in 2021, the luxury & super segment will continue to struggle.

It is also speculated that the government may come up with a COVID cess/ surcharge on high-income earners, which might hamper the personal disposable income of the end-users. This would cause a severe dip in the vehicle demand, thereby enforcing the auto sector to face the financial crunch.

How Reduced GST Rates can help the Automobile Sector to Thrive?

The reduced GST rate is vital to stimulate the growth of the auto sector. In the personal vehicle segment, the sector has manifested an escalating preference for personal mobility due to the social distancing norms. To expand the same, the government of India[1] and the GST council might cap the GST at 18% from 28% to make the two-wheelers and entry-level cars cheaper for the end-users. In view of this, the government may also reduce the compensation cess rates to support everyone’s interest.

Moreover, limiting the restrictions to avail ITC of GST paid on a vehicle for businesses would make the automobile cheaper when utilized for business purposes, besides addressing the requisite of GST to mitigate cascading of taxes. In addition to that, the increased rate of depreciation of automobiles under Income Tax would boost the demand.

Other incentives such as deduction in registration charges/road taxes will minimize the cost burden on consumer automobiles. With car loans being disbursed at a low rate of interest by banks and other private lenders, the finance ministry may consider augmenting the availability of tax deduction of interest applicable on the loan for electronic vehicles to other vehicles as well.

Conclusion

In view of unprecedented times, the need to incorporate these requisites is much more than ever in this union budget and there is nothing wrong in claiming that this is a suitable phase for implementing measures to trigger economic growth & drive the agenda of the government to bring the economy back on track.

Read our article:Let’s Understand the Important Dates for GST Return Filing in Detail!