Ministry of Finance has extended the date for filing annual GST return for the financial year 2020 to March 31, 2021. Previously, the due date for filing GST return was Dec 31.

There are primarily two forms of annual GST return that exist under the GST regime – GSTR9 and GSTR 9C. GSTR-9 has been mandated by the government for the taxpayers regardless of their turnover. Meanwhile, GSTR 9C refers to a reconciliation statement that is supposed to the filed by those taxpayers whose turnover surpasses Rs 2 crore.

It’s worth noting that the filing (FORM GSTR-9/ GSTR-9A) for the Financial year 2018-19 is subjected to those taxpayers who had turnover well below Rs 2 crore. The reconciliation filing in Form 9C for FY 2018-19 is optional for the individuals whose yearly revenue up to Rs 5crore.

What will be the Penalty for Late Filing?

Failing to file the Annual GST Return in form GSTR9 within the prescribed time limit shall lead to a penalty of Rs 100/day as per the existing GST Act. That means in case of delay filing, the taxpayer shall be subjected to pay ₹100 under CGST & ₹100 under SGST separately which bring the total amount to Rs 200/day.

This is subject to a max of 0.25% of the turnover of the taxpayer in the relevant state or union territory. Currently, there is no provision for a late fee under IGST yet. GSTR 9 is an annual GST return to be filed yearly by taxpayers registered. There are important points you should keep in mind, which are as follows:-

- It encloses information related to the outward & inward supplies made/obtained during the given financial year subject to different tax heads such as CGST, SGST & IGST & HSN codes.

- GSTR technically encompasses all the monthly/quarterly returns filed in that year. Despite the complex filing procedure, this return comes in handy in the extensive reconciliation of data for transparent disclosures.

Read our article:CBIC: Extension of deadline for GST Return Filing FY 2019-20

What are the Details Required to be filled in the GSTR-9?

Given the existing act, GSTR-9 is bifurcated into 6 parts & 19 sections. Each part seeks information that accessible from the previously filed returns & books of account. This form largely seeks for disclosure of yearly sales, dividing it between the cases that are exposed to tax and not expose to tax.

From the purchase viewpoint, ITC availed concerning the annual value of inward supplies is required to be disclosed by the taxpayer in the GSTR-9 form. These purchase needs to be bifurcated accordingly in term of inputs, input services, & capital goods. Detail of ITC seeking to reverse owing to ineligibility is to be entered.

What are the Contents of Form GSTR-9C?

GSTR-9C entails two major parts, which are as follows:-

- Part-A: Reconciliation Statement

- Part-B: Certification

Part-A: Reconciliation Statement

The figures in the financial statements[1] (audited ones) are at the PAN level. Henceforth, the Tax levied, turnover, & ITC availed on the specific GSTIN must be taken from the audited account of the company as a whole.

In the view of Notification No: 56/2019 rolled on the 14th Nov 2019 for FY 2017-18 & 2018-19

- Turnover adjustment detail to be made in tables 5B to 5N has been pronounced optional and adjustments, if any, which are subjected to reporting in Table 5O by the taxpayers.

- A taxpayer has the access to the option for non-filing of ITC reconciliation in tables 12B, 12C & 14.

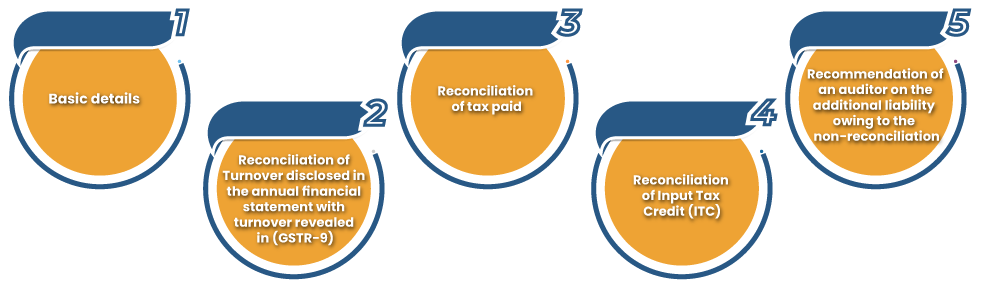

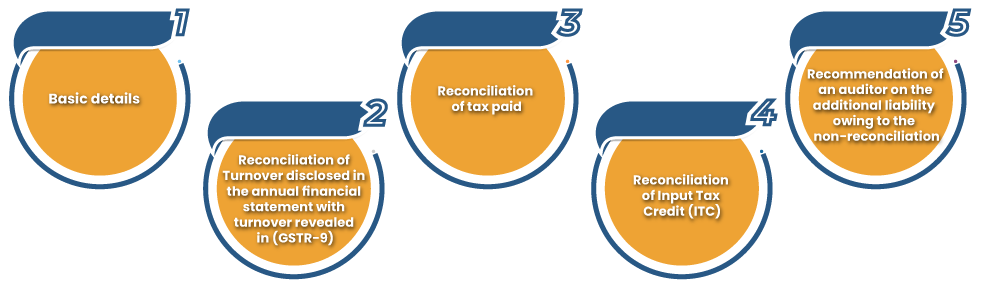

The Reconciliation Statement is bifurcated into five parts, which are as follows:-

Part-I: Basic details

This part consolidates legal name, GSTIN, & trade name. The taxpayers should also enclose if he/she is liable to address audit related compliances under any other law.

Part-II: Reconciliation of Turnover disclosed in the annual financial statement with turnover revealed in Annual GST return (GSTR-9)

This consolidates reporting taxable, as well as gross turnover, disclosed in the Annual return along with the audited financial statements. It’s worth noting that the Audited Financial statements are subjected to the PAN level. This may require the bifurcation of the audited financial statements at the GSTIN level for the reporting purpose in GSTR-9C

Part-III: Reconciliation of Tax Paid

This section encloses reporting of GST rate-wise tax liability following the accounts and paid as disclosed in GSTR-9 correspondingly with the difference thereof. Moreover, it needs the taxpayers to mention the additional liability owing to unreconciled differences noticed upon reconciliation.

Part-IV: Reconciliation of Input Tax Credit (ITC)

This part comprises detail related to the reconciliation of input tax credit availed & used by the taxpayer as disclosed in GSTR-9 & mentioned in the audited financial statement. Further, it seeks a reporting of expenditures booked following the audited account, with the break-up of eligible & ineligible income tax return & reconciliation of eligible ITC claimed as per GSTR-9. This declaration will come into existence after taking the reconciliation into account if any.

Part-V: Recommendation of an auditor on the additional liability owing to the non-reconciliation

Here, the auditor must disclose the tax liability detected via reconciliation exercise & GST audit, pending payment by the taxpayer. This can be deemed as to be non-reconciliation of turnover or ITC on basis of:-

- Amount paid against the purchase of supply not disclosed in the Annual returns (GSTR-9)

- Invalid refund to be paid back.

- Outstanding amount to be addressed.

Further, an additional option shall be given to the taxpayers to reconcile taxes as preferred by the auditor at the bottom of the reconciliation statement.

Part-B: Certification

The GSTR-9C can be approved by the same individual who undertook the GST audit or it can be certified by the other person who did not undertake the GST audit for that specific GSTIN. The difference between the both is that the former one has to draw the opinion on the books of accounts audited by another CA in the statement of reconciliation. The format related to the Part-B for certification report will differ based on the type of the certifier.

Conclusion

The introduction of the GSTR-9 and GSTR-9C has simplified the filing of the annual return for the taxpayers. Depending on the criteria mention above, the taxpayer is required to fill the relevant form with valid information. Drop your query to connect with Corpbiz associates and avail professional-grade advice on the matter related to annual GST return.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty