This article will brief you on everything about LLP Agreement & Stamp Duty Rates across India. Limited Liability Partnership (LLP) is a separate legal entity that operates under the provisions of the law. Due to legal status, LLP can sue or can be sued by others.

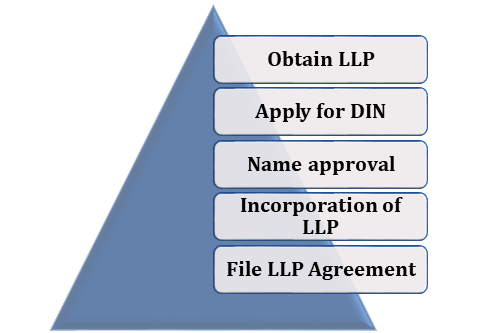

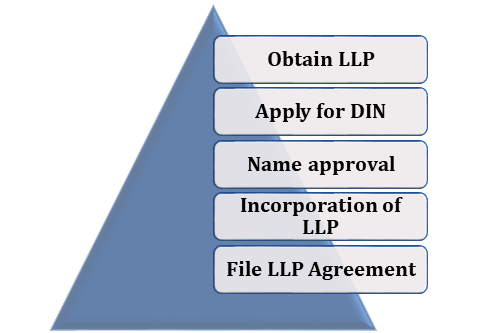

During the LLP registration process, the partners/applicant comes across the situation when they need to file an LLP agreement to MCA. It’s a mandatory prerequisite and the last step in the incorporation process. Keep in mind that any violation, in this case, could incur a substantial penalty.

What is an LLP Agreement?

The LLP agreement must encompass detail regarding rules and regulations for its partners. Every LLP agreement ought to be stamped to ensure authenticity. The applicant needs to take the printout of the agreement on the non-judicial stamp. Stamp duty varies from state to state and also depends on the contribution of Capital.

LLP agreement is identical to a legal deed that encompasses all the firm’s details, including incorporation to wound up. It also depicts information related to the role of partners, their mutual rights, the share of profit, and contribution. Additionally, the LLP agreement contains a broader description of LLP’s rule and regulation. For example, an LLP deed might consolidate the information that renders briefing on how a newbie can be appointed as a partner in LLP and how its tenure will be ended.

What is incorporated in LLP Agreement?

- Contribution of Partners

- Profits sharing ratio for calculating partners’ profit.

- Detail regarding the new partner’s admission process.

- Details illustrating provision related to a partner’s retirement and resignation.

- Requirements regarding the company’s response to the partner demise.

- Rules for termination of the partner in the firm.

- Duties and rights of partners.

- Removal and Power of Designated Partners.

- Appointment & Remuneration detail regarding the Designated Partners.

- LLP’s seal, and the detail on how the LLP would wind up.

LLP deed is a crucial part of the incorporation process, and it cannot be overlooked. As per section 23 of the Limited Liability Partnership Act, it’s mandatory to file an LLP partnership with the registrar in eForm three within thirty days of incorporation. The applicant must take the printout of the LLP deed on the Stamp paper.

Read our article: What are the Benefits of Limited Liability Partnership Registration?

Stamp Duty on LLP Agreement

Being a legal document, the LLP agreement must be printed on stamp paper. Remember that it is a mandatory requirement as per the provision of respective authority. The applicability of Stamp Duty on the LLP agreement is based on the state of incorporation and capital contribution from the partners.

| STATE | Upto Rs. 1 Lakh | Rs. 1 to Rs. 5 Lakh | Rs. 5 to Rs. 10 Lakh | Rs. 10 Lakh and above |

| Andhra Pradesh | 500 Rs | 500 Rs | 500 Rs | 500 Rs |

| Arunachal Pradesh | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Assam | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Bihar | 2500 Rs | 5000 Rs | 5000 Rs | 5000 Rs |

| Chhattisgarh | 2000 Rs | 2000 to 5000 Rs | 5000 Rs | 5000 Rs |

| Delhi | 1% of Capital | 1% of Capital Amount | 1% of Capital(Max : 5000) | 1% of Capital(Max : 5000) |

| Goa | 150 Rs | 150 Rs | 150 Rs | 150 Rs |

| Gujarat | 1000 Rs | 2000-5000 Rs | 6000-10000 Rs | 10000 Rs |

| Haryana | 1000 Rs | 1000 Rs | 1000 Rs | 1000 Rs |

| Himachal Pradesh | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Jammu and Kashmir | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Jharkhand | 2500 Rs | 5000 Rs | 5000 Rs | 5000 Rs |

| Karnataka | 1000 Rs | 1000 Rs | 1000 Rs | 1000 + (500 For Every 5 Lakh Increase) |

| Kerala | 5000 Rs | 5000 Rs | 5000 Rs | 5000 Rs |

| Madhya Pradesh | 2000 Rs | 2000 to 5000 Rs | 5000 Rs | 5000 Rs |

| Maharashtra | 1% of Capital(minimum of 500) | 1% of Capital | 1% of Capital | 1% of Capital(15000 Max) |

| Manipur | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Meghalaya | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Mizoram | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Nagaland | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Orissa | 200 Rs | 200 Rs | 200 Rs | 200 Rs |

| Punjab | 1000 Rs | 1000 Rs | 1000 Rs | 1000 Rs |

| Rajasthan | 4000 Rs(50,000 or below : 2000) | 4000 to 10000 (2000 on multiple of Rs. 50000) | 10000 Rs | 10000 Rs |

| Sikkim | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Tamil Nadu | 300 Rs | 300 Rs | 300 Rs | 300 Rs |

| Tripura | 100 Rs | 100 Rs | 100 Rs | 100 Rs |

| Uttar Pradesh | 750 Rs | 750 Rs | 750 Rs | 750 Rs |

| Uttarakhand | 750 Rs | 750 Rs | 750 Rs | 750 Rs |

| West Bengal | 150 Rs | 150 Rs | 150 Rs | 150 Rs |

Make sure that the agreement must be printed on non-judicial stamp paper. MCA seeks such a document to validate the incorporation of an LLP. The applicant must furnish the agreement to MCA[1] within thirty days of the Incorporation of LLP. Violation of such conditions attracts specific penalties that need to be paid out as per the provision of the relevant authority. So, we can conclude that this agreement is a vital part of the incorporation process that must be addressed by the applicant without any delay.

Conclusion

As it is obvious from the above fact, that LLP Agreement is an absolute necessity for the incorporation of LLP. The LLP deed must not be printed on the standard paper; otherwise, the authority cancels the request. Instead, the applicant must opt for non-judicial stamp paper to serve this purpose. After the completion of such prerequisites, don’t forget to get a non-judicial stamp on the agreement. Stamp duty varies from state to state, and it depends on the capital contribution of the partner. The table above would help get access to the stamp rate of different states. Kindly head over CorpBiz‘s experts, for technical advice on Stamp Duty on LLP Agreement.

Read our article:Modified LLP Settlement Scheme, 2020