Limited Liability Partnership is considered a business that is formed with the combination of company and the partnership firm. LLP consists of all the benefits and characteristics of the private limited company, however it can be operated flexibly just like the normal partnership firm. Compliances are less in LLP as compared to a company, although the partners have limited liability as LLP has a separate legal entity from its partners. Some Documents for LLP Registration are required to incorporate an LLP.

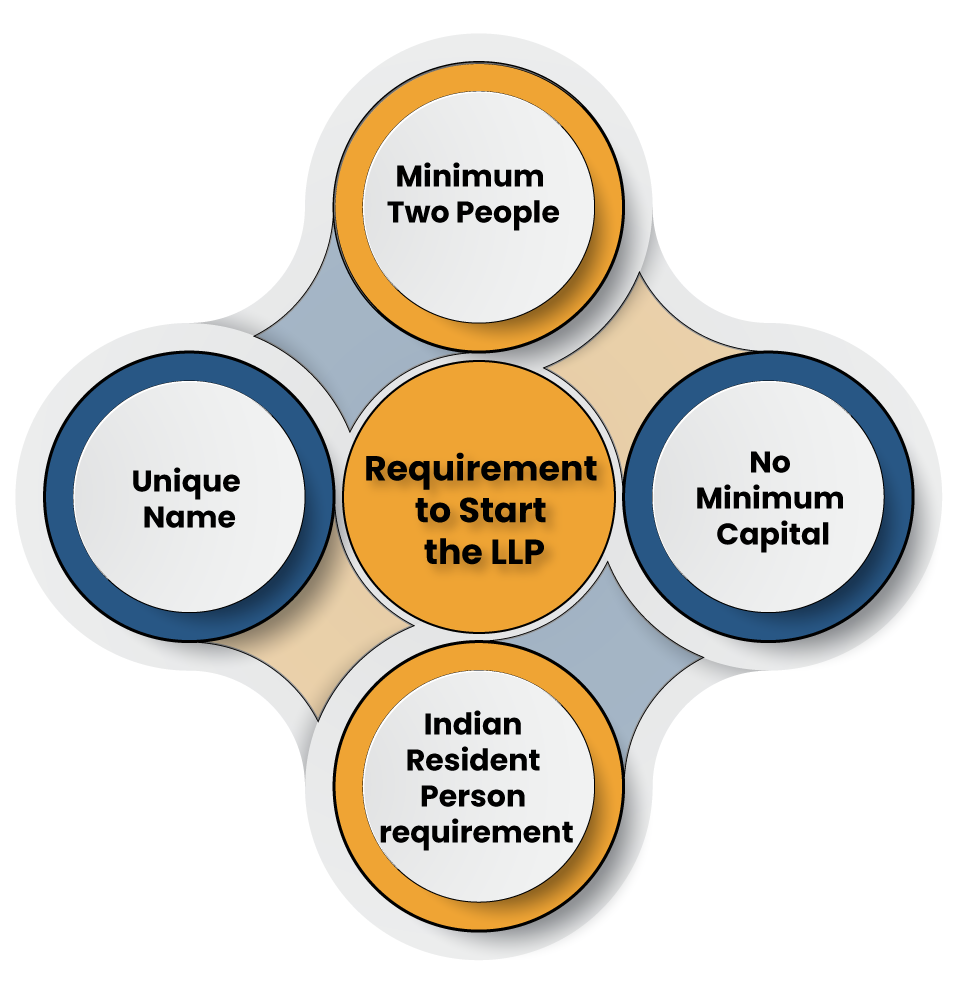

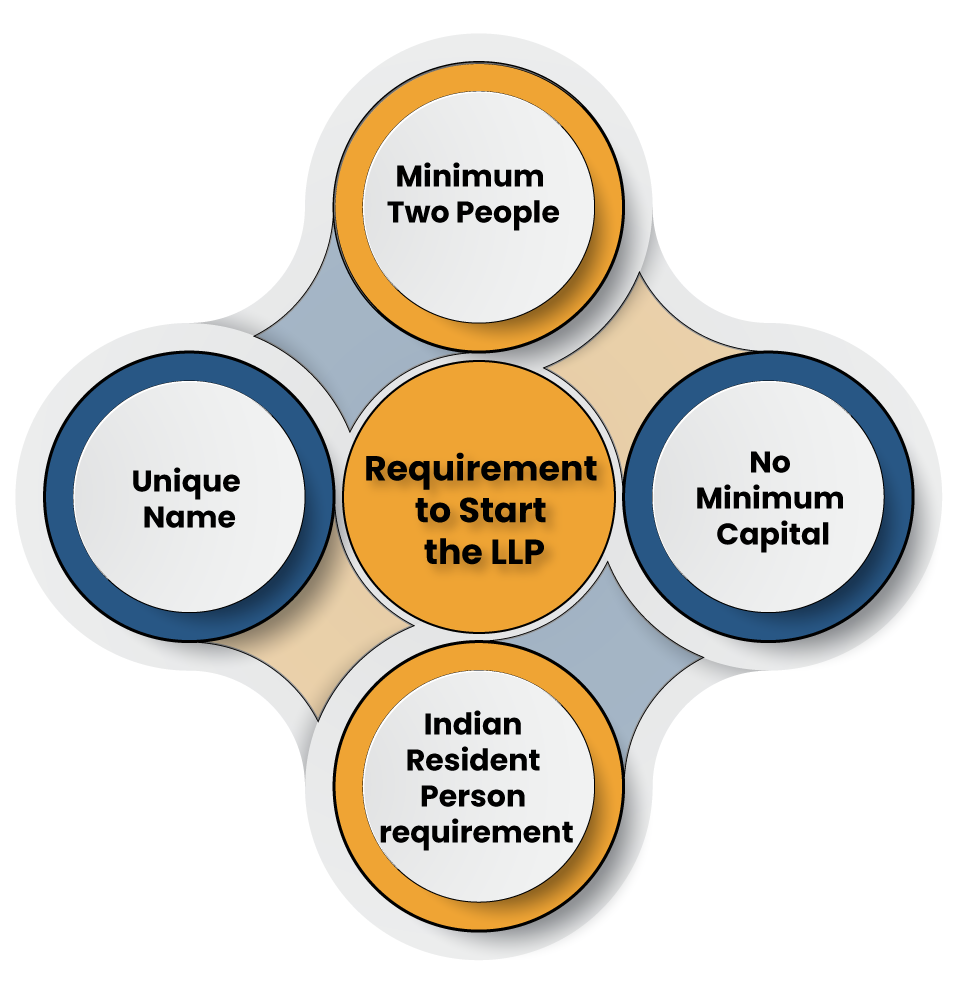

What are the Requirement to Start the LLP?

- Minimum Two People: Minimum two persons are required to register an LLP. However, there is no limit prescribed on maximum partners.

- No Minimum Capital: In case of LLP, the capital depends on a need of the business and contribution to partnership by partners. The Stamp Duty on a deed is based on the amount of capital invested.

- Indian Resident Person requirement It is necessary that one Designated partner of LLP must be from India.

- Unique Name: Name of the LLP has to be unique, and it must not be same or similar to any name of the existing company, LLP or trademarked entity which has been registered or applied for.

Read our article:A Complete Overview of LLP Registration for Foreign Directors

Required Documents for LLP Registration

- Latest passport size Photographs of all the partners

- PAN (Permanent Account Number[1]) of all Partners required minimum of 2 partners

- Identity Proof of each partner, (Aadhar Card, Voter ID Card, Driving License, or Passport)

- Address Proof of all partners (Bank passbook or statement, electricity bill, telephone bill, or any other utility bill)

- Copy of telephone bill, electricity bill or Bank Statement of all Partners having the present address

- Address Proof of Registered Office

- such as Electricity Bill along with NOC from the landlord or Rent Agreement and proof of ownership of a proposed registered office.

- Stamp paper for an LLP Agreement of a particular state where LLP has to be incorporated.

Documents needed on behalf of partners and LLP

Documents for LLP registration needed on behalf of partners that required to be submitted while registering the LLP are as follows:

Documents of Partners

- ID Proof of Partners: All partners are required to provide their PAN at a time of registering LLP. PAN card acts as the primary ID proof.

- Address Proof of Partners: Partner have to submit anyone document out of Voter’s ID, Passport, Driver’s license or Aadhar Card. Name and other details such as address proof and PAN card should be exactly same. If spelling is incorrect of its own name or father’s name, or date of birth is different in address proof & PAN card, it must be corrected before submitting to RoC.

- Residence Proof of Partners: The latest bank statement, telephone bill, electricity bill, mobile bill, or gas bill has to be submitted as a residence proof. Such bill or statement must not be more than 2 months old and must contain a name of partner as mentioned in the PAN card.

- Photograph: Partners must also provide their passport size photograph, preferably on white background.

- Passport (in case of Foreign Nationals/NRIs): For becoming the partner in Indian LLP, foreign nationals and NRIs have to submit the passport compulsorily. Passport must be notarised or apostilled by the relevant authorities in a country of such foreign nationals and NRI, else Indian Embassy situated in that country can sign all documents.

- Foreign Nationals or NRIs have to submit the address proof also which can be a driving license, residence card, bank statement, or any government issued identity proof containing the address.

- If documents are in other language, then notarised translation copies must be attached.

Documents of LLP

1. Proof of the Registered Office Address

- Proof of the registered office has to be submitted during LLP registration, within 30 days of its incorporation.

- If a registered office is taken on rent, then rent agreement and a no objection certificate is obtained from the landlord. No objection certificate has to be the consent of the landlord to allow the LLP to use the place as ‘registered office’.

- Besides, anyone document out of utility bills such as gas, electricity, or telephone bill must be submitted. The bill must contain complete address of the premise and owner’s name and the document must not be older than 2 months.

2. Digital Signature Certificate

One of a designated partners requires to have a digital signature certificate. It is important as all documents and applications will be digitally signed by the authorised signatory only.

Conclusion

In an LLP an Audit has been exempted up to certain level of turnover in case of LLP. The minimum of two partners are required to form an LLP. However, there is no maximum limit on the number of its partners. Hence it becomes a preferred choice for small businesses as its also limits the liability of partners unlike the general partnership. The Corpbiz proven to best company in providing LLP registration, as we have experts who can advise you in best possible way.

Read our article:How to Apply for LLP Registration in India