We have seen this new trend emerging between the entrepreneurs, who have started using the term-limited liability partnership (LLP). Mostly the Lawyers and Chartered Accountants use “LLP” for their firm, for example (AB &CD, LLP). It’s a kind of business format which combines the flexibility of partners and the benefits of limited liability of a company at a very minimal cost of compliance. Here in the blog, we’ll have a look on, what is LLP, and benefits of limited liability partnership Registration.

What is a Limited Liability Partnership Registration?

Limited Liability Partnership was introduced in 2000 by Partnerships Act 2000. It’s a new kind of corporate structure that combines the flexibility of partnership and benefits of limited liability of the company. By this, we mean that LLP is an alternative corporate business vehicle, which will provide the benefits of Limited Liability of company, further also allows its member the flexibility of organizing their internal management.

In such an organization, some or all the partners have limited liability. Further, in an LLP, one partner is not liable or responsible for any misconduct or negligence. LLP registration provides easy set up of the firm, besides this firm needs to follow less hassle-free day to day operations.

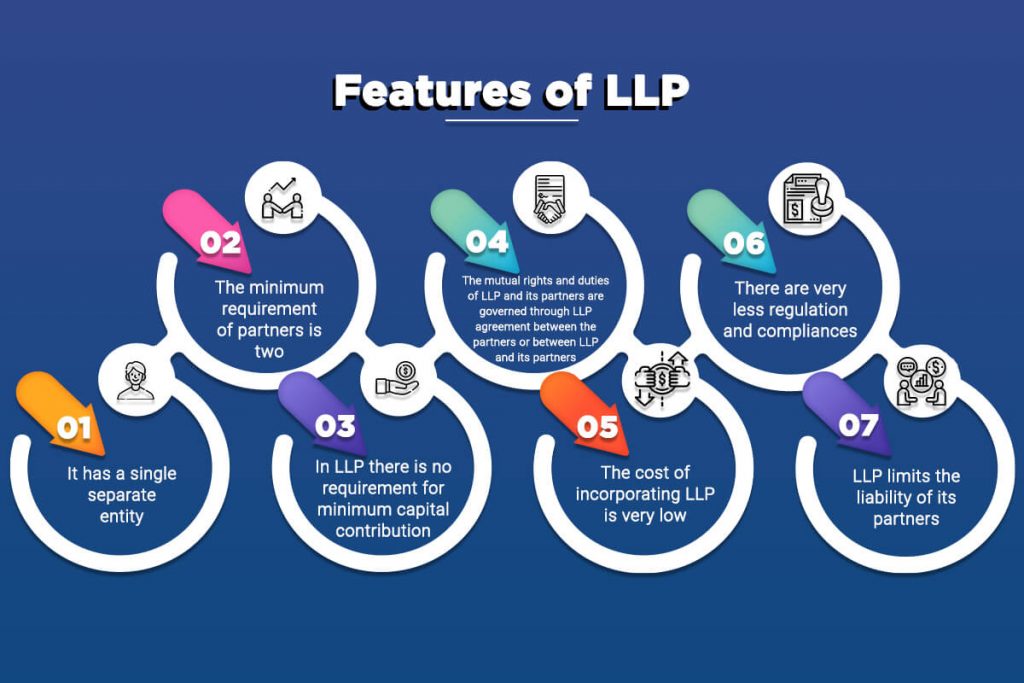

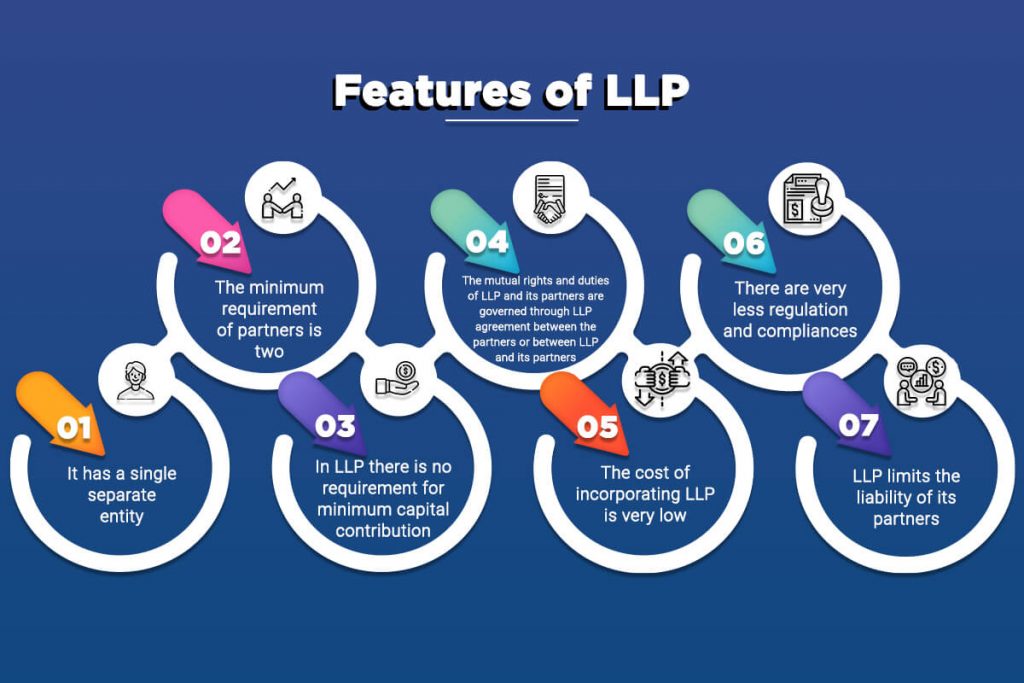

Features of limited liability partnership

Process of limited liability partnership Registration

Obtaining Digital Signature Certificate (DSC);

Much before initiating the LLP registration process, firstly DSC needs to be obtained for the purposed designated partners of LLP. LLP needs to file its documents online; hence, therefore, all the documents need to be signed digitally. It’s mandatory for the designated partner to obtain the DSC from government recognized certifying agency.

Obtaining Director Identification Number (DIN);

DIN is required to be obtained by every designated member of proposed LLP. The application shall be made in Form DIR-3 to obtain DIN. Along with the application documents required to be attached are like – Adhaar Card and PAN card. DIR-3 form needs to be signed by the qualified full-time CS of the company, or by the Managing director/Director existing company in which the applicant is nominated to be appointed as a director.

Reservation of Name;

LLP-RUN (Limited Liability Partnership – Reserve Unique Name)is required to be filed for the reservation of name of purposed LLP. Central Registration Center shall undertake the process under Non –STP. Before purposing the name, the applicant shall visit MCA Portal, providing a free name search facility. This service will provide closely resembling names of an existing company.

The registrar will approve the name which undesirable by the central govt. Or is not being used by any existing LLP. An applicant can recommend two names for the LLP at a single time.

Incorporation of Limited Liability Partnership

- Incorporation form FiLLiP (Form for Incorporation of Limited Liability Partnership) shall be filed to the registrar of jurisdiction, where the registered office of LLP is situated;

- Fees shall be paid as per Annexure ‘A’;

- Incorporation form can also be used for allotting DPIN if an individual does not have DPIN or DIN.

- Through FiLLiP form, the application for the reservation may be made;

- If the purposed name is approved, then this approved and reserved name shall be filled as the proposed name of the LLP.

File Limited Liability Partnership Agreement

Mutual rights and duties between the partners and also between the LLP and its partners are governed through LLP agreement.

- From 3 needs to be filed with the attached LLP agreement on MCA portal;

- And, needs to file within the 30 days of the date of Incorporation.

- The LLP Agreement shall be printed on Stamp Paper. The value of Stamp Paper varies from state to state.

Read our article:Advantages of LLP (Limited Liability Partnership) over Private Limited Company

Documents Required for Limited Liability Partnership Registration

For Partners

- PAN card/ID proof

- Address proof

- Residential Proof

- Photograph

- Passport (In case of NRI’s)

For LLP

- Proof of Registered office address

- Digital Signature Certificate

Benefits of limited liability partnership Registration

1. No limit on Owner of Business

Only two partners are required for limited liability partnership. Unlike a private limited company, wherein member’s number is restricted to the limit of 200, there is no such limit of partners in LLP.

2. No minimum contribution required

No minimum capital required while forming an LLP. An LLP can be formed even with the least possible capital. Furthermore, the contribution of a partner may consist of tangible, movable or immovable or intangible property or other benefits to the limited liability partnership.

3. Minimal cost for Incorporation

The cost of limited liability partnership Registration is low as compared to the cost of incorporating a private limited or a public limited company.

4. Lower compliance burden

In an LLP, only annual returns are required to be filed along with the statement of Accounts and solvency.

5. No requirement of compulsory audit

Whether it’s a private or public company, irrespective of their share capital, are required to get their accounts audited. Whereas in LLP, accounts to be audited annually except for LLPs having a turnover less than Rs. Forty lacs or Rs. 25 lacs contribution in any financial year.

According to Section 40 (b), “Interest to partners, any payment of salary, bonus or commission or remuneration allowed as deductions in the hands of Limited Liability Partnership.’’

Need of LLP

It has been observed from a long time, the business formats are required to provide such a format of business which can combine the flexibility of partners and the advantages of limited liability of company, and that too at a very low cost of compliance.

The format of limited liability partnership is useful for the small and medium size of enterprises. LLP has mostly used vehicle for the professional or in the service industry. LLP is itself responsible for its losses and debt occurring in business, rather than that of its partner/member. Therefore, LLP is recommended as a profit-making business.

Individuals or the operating businesses can be members of LLP and shall have at least two members. The rights and responsibilities of all members shall be laid down in “Deed of Partnership”. A “Designated Member” would be held responsible for the operations in relations to making communication with the companies house, preparations of accounts etc., and will act as a responsible person in case LLP gets dissolves.

Conclusion

LLP’s are considered to be flexible legal and tax, allowing its partners to get benefited through the less liability format, on which LLP works. The liabilities of partners incurred only in the normal course of business, which does not extend to the personal assets of the partners. Bill concerning LLP was passed back in 2008, and it was supposed that this bill would surely bring a remarkable difference to the existing companies laws in India.

Read our article:How to Register Your Limited Liability Partnership Firm in India?