Getting started with a new business can be a rewarding experience. The Indian government promotes such entrepreneurial instincts by backing up small businesses. Lately, the global demand for pickles has reached new heights. Being an important part of Indian eating culture, pickle is now getting recognition from other parts of the world. Hence, entering into the Pickle Export business seems a win-win proposition for the business fraternity across India. The write-up will guide you through the legalities associated with setting up a Pickle Export Business.

Why Indian –based Pickles are always high on demand?

There is great admiration for Indian-based cuisines and spices in the global market. And pickle is no different here. The variety of pickles that our country produces is practically endless and customers from local and global markets love to have them even at steep pricing. Indian-based pickles have distinct smells and flavors, courtesy of the quality of spices used in them. Handmade spices, in particular, are gaining massive popularity among foodie customers globally. Generally, people from the lower strata of society are extensively engaged with pickle production.

Read our article:How to obtain IEC Code in India

An Overview on Indian Pickle Export Market

At present, Indian-made pickles are shipped to over 54 countries. The total valuation of the pickle industry in India is stood at $31.45 million. Moreover, the top 5 exports share is amounted to $21.46 million, reflecting how profitable it is to commence early & consolidate the market.

Additionally, the export valuation of these industry leaders constituted approx 69% of the overall export value. Hence, firms who intend to set up such a business must commence its preparation at the earliest.

Let us have a glance over the different aspects and documents required to set up a pickle export business in India[1].

Viable benefits of having an IEC at Disposal

- Open door to the global market

- Mitigates the legal hassles associated with the shipment of products

- Helps in clearing shipment from the custom.

- Speed up the shipping process by eliminating extraneous prerequisites.

- Align with the global standard of legal compliances

- Ensure access to government-backed schemes and benefits.

- Offers lifetime validity.

- Eliminates the requirement of return filing for registered traders.

Steps to Commence a Pickle Export Business in India

Step 1: Avail legal status for your company

You can do this by registering your company with the Ministry of Corporate Affairs. There is a slew of business forms registration available at MCA such as private limited company, public limited company, LLP, OPC, Proprietorship, etc. Apparently, each business structure seeks a different set of documents from the applicant. While opting for an apt business structure, make sure to take the following parameters into account

- Authorized share capital, if applicable

- Number of partners/shareholders/members

- Type of business

- Scope of operation

Step 2: Get your FSSAI Registration

FSSAI food license is a mandate for every food business operators in this country. One can visit FSSAI‘s online platform to apply for the same. Remember that FSAAI’s food license is available under a 3-tier system as given below

Get in touch with CorpBiz’s associates to avert complications of the registration process.

Step 3: Get your Import Export Code

India’s Foreign Trade Policy mandates the obtainment of the Import Export Code (aka IEC) from the DGFT for functioning as an exporter. IEC refers to a 10-digit number issued by the DGFT, i.e. Directorate General of Foreign Trade. Aspiring exporters and start-ups can visit DGFT’s online portal to apply for IEC in India. While filing a web-based IEC applicant, applicants will be prompted to upload some mandatory documents. The type of documents shall vary in accordance with the business structure and product category.

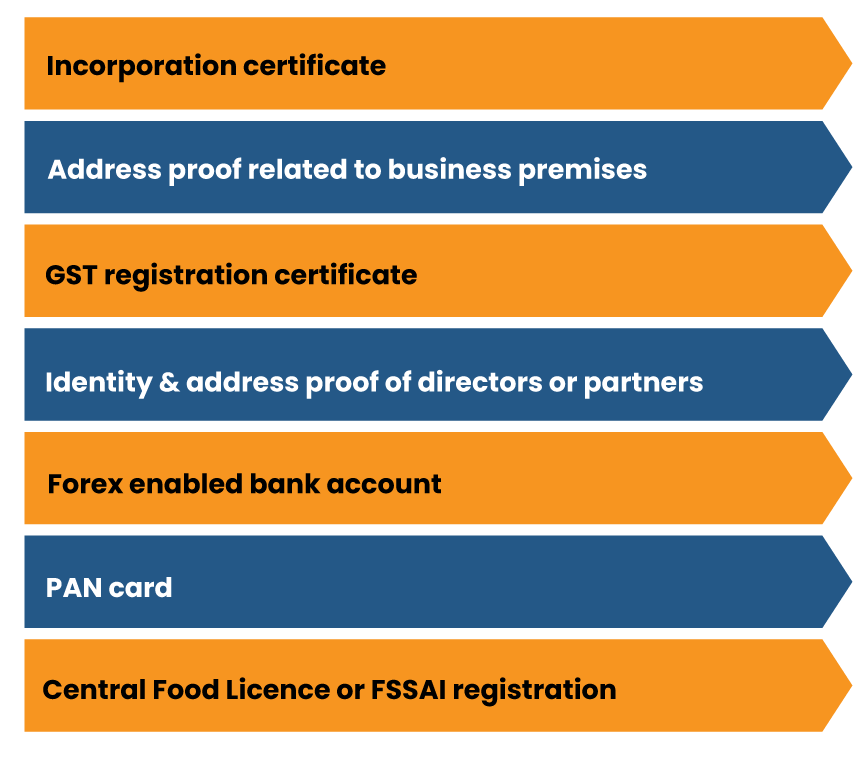

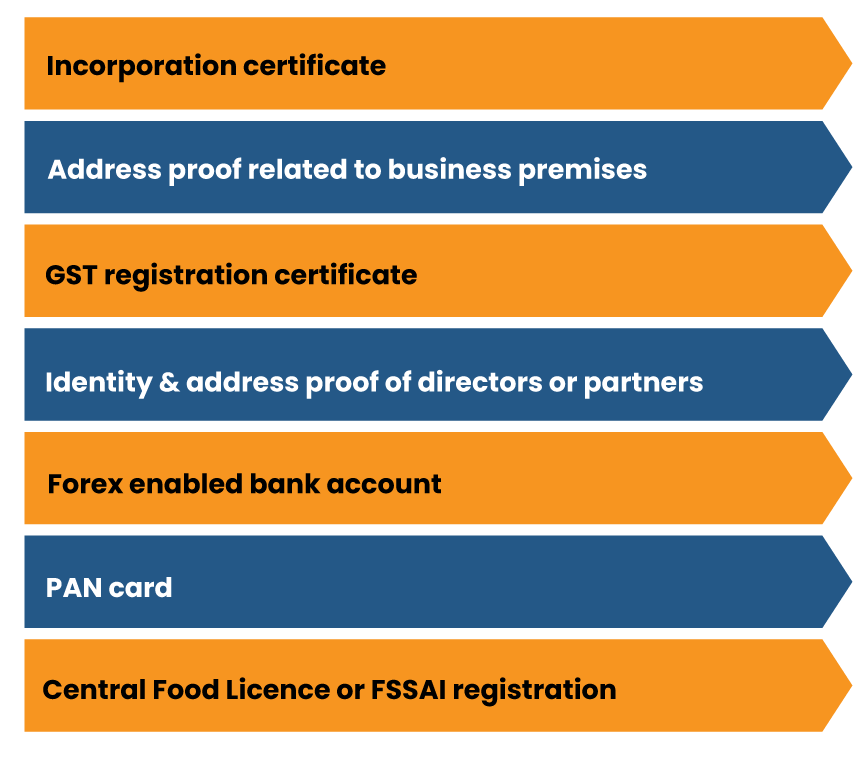

Here is the list of some basic documents for obtaining IEC from DGFT

Step 4: Get the APEDA license

Agricultural & Processed Food Products Export Development Authority, aka APEDA, is an apex institution founded in 1985. The product enlisted under APEDA Act is known as schedule products and exporters of such products have to avail of APEDA registration.

To get this registration, the applicant must furnish the application form within one month of commencing business activities. There is a provision for time extension in case the applicant fails to serve such a requirement. As soon as the applicant submits the form along with the required fees, the authority will grant the Registration -Cum- Membership- Certificate (RCMC). Connect with CorpBiz for more detail on that.

Step 4: Identify the Key Markets to Export your produce

Identifying the target market in a global landscape is a complex task that seeks a certain degree of professionalism and knowledge. Pinpointing the key market doesn’t mean referring to the past sale data or export figures. In fact, it goes beyond these generalized practices. Therefore, it is advisable to get in touch with an expert marketing firm.

Step 5: Look out for trustable vendor/buyers

Next, you need to pay attention to identifying the real and legitimate rivals or buyers for your product. There are many web-based portals and third-party vendors out there that can connect you with interested parties residing overseas. The portal entails the listicle of potential buyers to enable you to verify their legitimacy.

Step 6: Collab with reputed shipping firms

Catering to customer’s demands with authenticity is a key trait of a successful exporting business. Any delay in the shipment will accrue mistrust and keep your prospects beyond your reach. To avert such complicacies, make sure to collab with trusted shipment firms that can ensure end-to-end support for shipment management.

Mandatory Documents for Pickles Export Business

- Bill of lading/ Postal Receipt/ Airway Bill/ Railway Receipt/ Lorry Receipt

- Commercial Invoice/ Packing List

- Shipping Bill/ Postal Bill of Export/Bill of Export

- Import Export Code

Conclusion

The worldwide demand for pickles in the recent past has been astounding and it will likely escalate over time. It is a business model that adheres to a low-risk profile and immense growth potential. It is advisable to keep your investment profile low in the initial phase and increase it accordingly in accordance with the demand.

Staying in compliance with DGFT’s guidelines will keep the legal hassles aside and let you focus on things that matter the most. Do not forget to prompt us if you need professional backing for resolving legal hassles while setting up your business.

Read our article:A Complete Guide on Documents Required For IEC Registration