Every nation strives to adhere to the four taxation canons that Adam Smith established. The canons of equity and economy stand out above the rest when it comes to computing PGBP. A person must only pay tax in proportion to his or her ability, and not more, according to the Equity Canon. According to the canon of economy, the government must work to take as little money as possible out of its citizens’ purses. These principles are upheld by the procedures for calculating PGBP since it is improper to tax enterprises exclusively on the basis of their income. Even while two firms may have the same turnover, their expense profiles may be very different. As a result, it’s crucial to account for and subtract all of the costs associated with running the firms in order to calculate taxes. The Presumptive Taxation Scheme is a straightforward plan that was put into the Income Tax Law to aid small assesses. An assesses who adopts these rules is immune from both keeping books of accounts and having the accounts audited. The provisions of the presumptive taxation scheme described under Section 44AE will be covered in this article. The purpose of Section 44AE is to provide relief plan to small taxpayers who are involved in the goods carriage industry. Specific provisions of Section 44AE Income Tax Act, 1961 have been discussed below.

Meaning of Section 44AE Income Tax Act, 1961

The Presumptive Taxation Scheme is a straightforward plan that was put into the Income Tax Law to aid small assesses. There are three programmes under this scheme, including Sections 44AD, 44ADA, and 44AE Income Tax Act, 1961. An assesses who adopts these rules is immune from both keeping books of accounts and having the accounts audited.

The Income Tax Department created a revenue strategy for small and medium-sized businesses called Section 44AE Income Tax Act, 1961. The objective is to streamline tax compliance procedures, relieve burdensome bookkeeping duties, and offer a uniform method for calculating income.

- Definition Of Goods Vehicles And Heavy Goods Vehicle

The following will serve as the presumptive scheme under Section 44AE Income Tax Act, 1961 for operating the business of operating, hiring, or leasing such goods carriages:

The definitions given to the terms “goods vehicle,” “goods carriage,” and “heavy goods vehicle” in Section 2 of the Motor Vehicles Act of 1988 must apply to each of these terms.

Additionally, Section 2 of the Motor Vehicles Act of 1988[1] defines goods carriage as any motor vehicle built or modified solely for transporting goods, as well as any motor vehicle not so built or modified when used for transporting goods.

Any goods carriage with a gross vehicle weight greater than 12,000 kilogrammes, as well as any tractor or road roller, are considered heavy goods vehicles.

What Are the Key Features of Section 44AE Income Tax Act

In some circumstances, an assesses who operates a company that involves operating, leasing, or hiring such goods carriages may choose to claim presumptive revenue under Section 44AE (1) Income Tax Act, 1961, in that case they can enjoy the following features:

- All Kinds Of Taxpayers May Benefit From Section 44AE:

Individuals, HUFs, firms, companies, etc., who operate goods carriages for hire or lease and who do not possess more than ten (10) such vehicles at any given moment during the year are eligible. Even if the person’s turnover surpasses the threshold of INR 1 Cr. or INR 2 Cr., they are not compelled to have their books of accounts audited if they choose Section 44AE Income Tax Act, 1961.

- Ownership, Not “Usage,” Is The Governing Principle Of Section 44AE:

Even if the truck is not used, income must still be provided in accordance with Section 44AE Income Tax Act, 1961. It will include an owner through a hire purchase arrangement or when the goods carriage has been put on a payment plan, regardless of whether the entire or a portion of the balance is due. The significance of the ownership term that the assessee had for the previous year of the goods vehicle. A portion of the month would be regarded as the entire month. Therefore, income shall be deemed earned even if a vehicle is idle, not in use, or being repaired. It is also essential to keep in mind that even if goods transporters are inactive due to a lockdown in the nation, they will still be subject to tax. Additionally, income will be taxed even if the transport authorities or police department have seized the goods vehicles.

In the M. Rajendran case [TS-298-ITAT-2014(CHNY)] ITAT rules that the presumptive rate under Section 44AE only applies when the assesses owns no more than ten (10) goods carriages at “any point during the previous year.” Since the law does not specify operation but instead considers ownership, Section 44AE benefits cannot be given when more than ten (10) goods carriages are owned, but only ten carriages were operated during the prior year.

- The Estimated Amount Of Revenue To Be Calculated Is:

There will be no further costs approved or approved, and the assumed revenue calculated above represents the whole income. Separate deductions for additional company costs, like wages, depreciation, etc., are not allowed. Any asset used in such a business that has had its value written down must be valued as though depreciation under Section 32 had been claimed and approved. However, taxpayers can claim deductions under Chapter VI-A, including those under Section 80C and Section 80D, etc. For taxpayers who choose Section 44AE, no disallowance may be issued under Section 40, Section 40A, Section 43B, etc.

- Allow For The Possibility Of Payment:

When the assesses is a partnership business, the partners’ compensation and interest on capital may also be deducted under the criteria and restrictions outlined in Section 40(b). There is no provision for a deduction for interest and partner compensation under the presumptive taxation method provided for in Sections 44AD and 44ADA. In Section 44AE, however, it is not the case.

- Advance Tax Payment:

Taxpayers covered by Section 44AE Income Tax Act, 1961 will be required to pay advance tax, and there is no exception to this requirement. The benefit of paying the advance tax in one lump sum by March 15 is only accessible to taxpayers who fall within Sections 44AD and 44AD.

- Depreciation Not Allowed And Depreciation Not Absorbed:

Depreciation must not be permitted from the presumed income since Sec. 32 governs depreciation and the carryover of unabsorbed depreciation; nonetheless, a notional depreciation is supplied in the Block to determine the opening WDV of the next year.

- Benefit Of Set Off And Carry Forward:

The rules outlined in Section 70-80 of the Income Tax Act of 1961 for “set off and carry forward” of losses will apply to the deemed income. These rules will allow for the set off of brought forward losses of this business or any other business as well as current year losses from other businesses & other heads. J. The assessee’s GTI shall be deducted according to sections 80C to 80U, even if considered income is included in the GTI.

Eligibility under Section 44AE Income Tax Act, 1961

The following people are eligible under the provision of Section 44AE Income Tax Act, 1961:

- Any Individual

- Undivided Hindu Family

- Firm

- Company

An assesses who is in the business of operating, hiring, or leasing goods carriages and who did not possess more than ten goods vehicles at any point in the prior year may elect to use the presumptive taxation system under these rules. The limitation on owning more than 10 goods vehicles at any given moment during the preceding year is a vital requirement of this programme. Therefore, an assesses who owns more than 10 goods vehicles per year is not eligible to adopt this scheme. Other guidelines for the form include the following:

Calculations for partial months are made using complete months.

The revenue can be disclosed if it exceeds the default rates of INR 1000 (for heavy vehicles) and INR 7500 (for cars other than heavy vehicles).

Vehicles classified as heavy goods must weigh more than 12,000 kilogrammes.

Additionally, only the assesses who operate, hire, or lease goods carriages are eligible to use this scheme. Therefore, an assesses involved in the passenger transport industry cannot adopt these provisions.

- Illustration:

During the previous year, 2012–2013, Mr Kumar, who is in the business of operating, hiring, or leasing goods carriages, owned nine goods vehicles. Can he apply the presumptive scheme provisions of Section 44AE to this business?

An assesses who is in the business of operating, hiring, or leasing goods carriages and who did not possess more than ten goods vehicles at any point in the preceding year may adopt the requirements of Section 44AE. In this instance, Mr Kumar only possessed 9 vehicles throughout the course of the year; as a result, he met both requirements of the scheme and is now eligible to use the provisions of Section 44AE for his business of operating, leasing, or hiring goods carriages.

Treatment of Depreciation under Section 44AE

Depreciation on goods carriages is one of the costs that taxpayers cannot deduct when choosing the Presumptive Income Scheme under Section 44AE Income Tax Act, 1961. Because depreciation is already accounted for in the presumptive income rate under Section 44AE, taxpayers cannot claim any depreciation on the goods carriages they own.

As a result, taxpayers who choose the Presumptive Income Scheme under Section 44AE Income Tax Act, 1961 do not need to calculate and claim separate depreciation on their goods carriages. Depreciation is already accounted for in the presumptive income rate at a fixed rate based on the kind of car owned.

How Is Presumptive Income Computed Under Section 44AE?

The total of the earnings and gains from all of the goods carriages possessed by the assesses during the prior year will be the income under Section 44AE Income Tax Act, 1961. Two categories—heavy goods vehicles and other than heavy goods vehicles or light goods vehicles—are used to transport products. The following criteria will be used to determine each goods carriage’s earnings and gains:

Heavy goods vehicles

For each month or portion of a month that the assesses owned the heavy goods vehicle in the prior year, an amount equal to INR 1000 per tonne of gross vehicle weight or unladen weight was due.

OR

The amount that the assesses asserts to have received from such heavy goods vehicles during the fiscal year.

OR

For each month or portion of a month that the assesses owned the goods carriage in the prior year, an amount equivalent to INR 7500 was due.

OR

The amount that the assesses asserts to have received from such heavy goods vehicles during the fiscal year.

Last but not least, the assesses will be recognised as the owner of these automobiles even if they were leased or purchased in instalments. The presumptive taxation structure solely uses this treatment to compute profits and losses.

Calculation of Income under Section 44AE Income Tax Act, 1961

For qualifying assesses who choose the Presumptive Taxation Scheme pursuant to Section 44AE Income Tax Act, 1961, income will be determined on an approximated basis as follows:

The net total taxable revenue for such a business will be determined at the rate of INR 7,500 per vehicle per month, or a portion of that amount, for the month in which the assesses owned the goods carrier in the prior year.

Amounts more than those mentioned above may be declared by the assesses.

Whether it is a heavy goods vehicle (greater than 12MT gross weight) or a light goods vehicle (less than or equal to 12MT gross weight), the computation will still apply.

It should be emphasised that while determining income under Section 44AE Income Tax Act, 1961, a portion of the month will be treated as the complete month.

The income calculated above represents the assesses net income; no expenditure may ever be deducted from this amount.

Allowances and Disallowances under Section 44AE

Any deduction under Sections 30 to Section 38 will not be available to an assesses who chooses the presumptive taxation plan under Section 44AE Income Tax Act, 1961. Income will be estimated at a presumptive rate, and the provisions of deductions won’t apply.

The terms of deductions will not apply in the case of a person choosing the presumptive taxation system of Section 44AE Income Tax Act, 1961, and income will be computed at a presumptive rate.

Additionally, a partnership firm may deduct from the deemed income in accordance with Section 44AE under two circumstances. As follows:

- The compensation account and

- Partners receiving interest.

On the account of depreciation, no separate deduction is permitted. But any asset used in such a business must be claimed and has already been given written-down value (WDV).

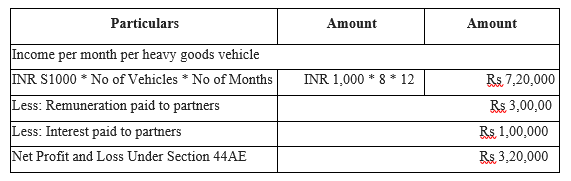

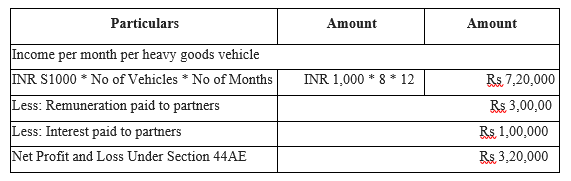

- Let’s use an illustration to better understand:

The business of operating, employing, and leasing freight carriages is operated by the partnership company Arun and Associates. The partnership firm conducts the following transactions during the fiscal year:

- 8 light freight trucks will be leased from April 1 to March 31.

- Partners received compensation totalling Rs. 3 lakhs.

- One lakh rupee worth of interest was paid to partners.

The following formula will be used to determine profit and loss under Section 44AE:

Turnover Limit under Section 44AE Income Tax Act, 1961

Although gross receipts may even exceed audit limits because the tax audit limit only applies to the number of vehicles, if you choose 44AE Income Tax Act, 1961, there is no need for an audit.

For instance: For the fiscal year 2020–21, a transport contractor with 6 trucks generated gross receipts of INR 105 Lac. Does he have to pay the tax audit?

There are no requirements under Section 44AB for tax audits of assesses involved in goods transportation operations when the gross revenue exceeds INR 100 lacs. The accounts must be audited under Section 44AB only where the assesses offer income below the presumed limit outlined under Sections 44AD or 44AE. The focus of Section 44AE is the number of vehicles, not the total amount of revenues, for determining income for assesses operating a business of hiring, leasing, or plying goods carriages. The accounts do not need to be audited under Section 44AB if there is no provision like the proviso to Section 44AD (1), even if the assesses have annual receipts totalling more than INR 100 lacs, as long as they meet the presumptive threshold set forth in Section 44AE Income Tax Act,1961. The accounts must be audited under Section 44AB only when the assesses offer income below the presumed limit stated in Section 44AE, regardless of the amount of receipts.

Books of Account under Section 44AE Income Tax Act, 1961

The plan significantly eases the burden of maintaining accounting records on the assesses. An assesses who implements the provision as mentioned earlier is exempt from the section 44AA (applied solely to businesses covered by this section) requirement to maintain books of accounts. Additionally, the provisions of section 44AB (which deal with audits) do not apply to such businesses. As a result, the programme exempts the assesses from keeping regular books of accounts. The programme exempts the assesses from both the audit of accounts as well as the upkeep of books of accounts.

- Illustration:

Mr Kaushal operates a firm that hires, rents or leases cargo carriages. During the previous fiscal year, 2020–2021, he owned eight (8) goods vehicles and reported income in accordance with the requirements under Section 44AE Income Tax Act, 1961. Will he be responsible for keeping the books of accounts for the aforementioned business in this situation?

According to the provisions of Section 44AE Income Tax Act, 1961, an assesses who adopts the aforementioned provision is exempt from keeping books of accounts in accordance with section 44AA (applicable exclusively to businesses covered by this section). It should be emphasised that the relief is only applicable to businesses covered by the Section 44AE’s requirements and not to any other types of businesses. Therefore, if Mr. Kaushal owns another business, the provisions of section 44AA regarding the keeping of books of accounts will apply to that business.

Conclusion

The Income Tax Department created a revenue plan under Section 44AE Income Tax Act, 1961 for small and medium-sized businesses. The objective is to streamline tax compliance procedures, relieve burdensome bookkeeping duties, and offer a uniform method for calculating income. The assesses who choose this presumed taxation plan are not required to keep their books of accounts up to date or have them audited.

For any assesses the tax plan under Section 44AE is not required. Any taxpayer is free to choose not to participate in this programme; it is an option. A few advantages were offered under the system of Section 44AE Income Tax Act, 1961, including streamlined taxation, maintenance assistance, and audits of the books of accounts. All deductions from Section 30 to Section 38 are also disallowed. As a result, you must choose after careful tax preparation.

Read Our Article: Income Tax Return E-Filing: Things You Must Know