Each financial year individuals with a yearly income of more than INR 2.50 lakh are mandated to file a tax return with the IT department of India. A person or the assessee has to complete the return filing by 31st July of the assessment year.

Given the trend of the past years, Government often extends this date once or twice. However, it’s worth noting that any delay in such matters attracts a penalty; therefore, it must be avoided. In this write-up, we will talk about Income Tax return e-filing in detail.

Documents Required for Income Tax Return e-filing

As you brace yourself to estimate the tax liability & file a tax return, the first step is to collect & arrange the given documents ready for reference. Note that there is no need to upload any documents with your IT returns filing. The documents are needed for the precise estimation of your income & to provide the legit information in the calculator.

- PAN number

- Last year’s Income tax return.

- Bank statements related to your bank accounts as well as of minors whose income is to be integrated with yours

- Form 16 (aka Tax Deduction Certificate) granted by your employer. In case you join new company during the year, keep the said form issued by all your employers.

- Yearly statements of all your share trading accounts & mutual fund.

- Certificate related to Home loan tax deduction granted by the bank for the principal repaid & interest paid.

- Receipts of PPF, NSC, medi-claim, ELSS, and LIC used as tax-saving investments

- Details pertaining to tax-free income reaped during the financial year such as long term capital gains on equity, tax-free bonds, and agricultural income.

Read our article:Income Tax Returns: Which is the Correct ITR Form for you?

Income Tax Return E-filing: A Step by Step Process

Income tax e-filing is a simple and straightforward process- all you need to head over the incometaxindiaefiling.gov.in and follow the given steps.

- Create an account via PAN number (Permanent Account Number) & password. The username can be your PAN number.

- After setting up an account, log in to the Income tax e-filing portal via PAN, password, Captcha.

- Now, tap on the ‘e-file’ menu & then explore the ‘Income Tax Return’ link.

- You will be routed to the return page. Here, you will see the auto-populated PAN number[1]. You were required to opt for the correct option from the drop-down menu placed against the following options.

- Assessment Year

- ITR Form Number

- Filing Type

- Submission Mode

- Tap on the ‘Continue’ button, and then go through the on-screen guidelines carefully for correct filing of relevant fields mentioned in the online ITR form.

- Now, select the suitable verification option among the following under the ‘Taxes Paid and Verification’ tab to validate the IT return;

- I would like to e-verify.

- I would like to e-verify later, within 120 days from the date of filing.

- I would not like to e-verify, instead send the ITR-V through normal or speed post to “CPC, Income Tax Department, Bengaluru, 560500, within 120 days from date of filing.

- Next, tap on the ‘Preview and Submit’ button.

- Validate the data provided in the ITR, & then ‘Submit’ the ITR.

- Next, opt for the e-Verification by selecting ‘I would like to e-Verify’ option & then choosing one of the options given below after providing the EVC/OTP when asked.

- Aadhaar OTP

- EVC generated either through bank ATM or through option in My Account.

- Prevalidated Demat Account

- Prevalidated Bank Account

- Make sure to enter the EVC/OTP within sixty seconds, or else the return would be automatically submitted, & you would have to validate later.

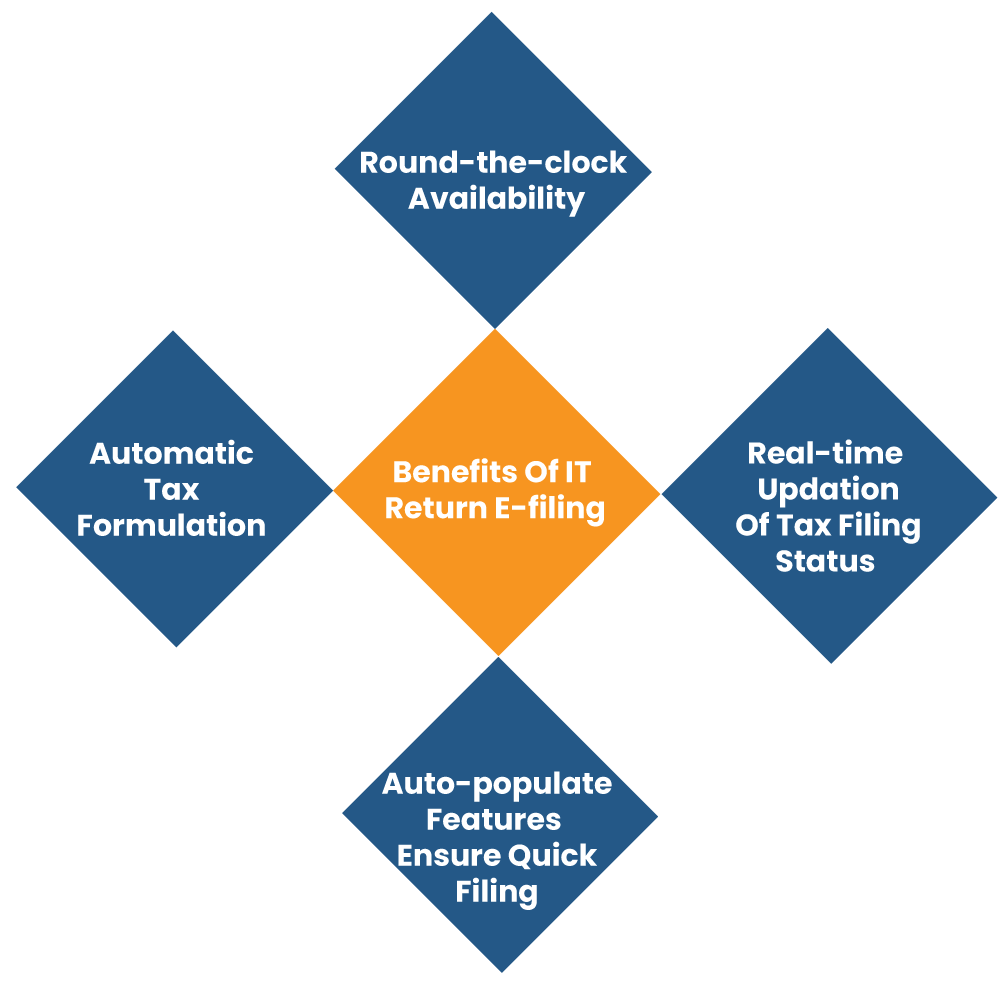

Potential Benefits Related to the Income Tax Return E-filing

- The Income tax return e-filing offers an obvious advantage over manual tax filing because of automatic tax formulation and electronic submission.

- Another unprecedented benefit that e-filing offers is the round-the-clock availability, i.e., it is accessible 24×7 throughout a year. It mitigates the hassle of non-filing on public holidays.

- The real-time updation of tax filing status makes the e-filing option a prominent choice for the taxpayers of this country.

- Income Tax Return E-filing is time-efficient for both taxpayers and the income tax authority.

- E-filing mitigates any requirement of manual paper handling. Technically, it is paperless and only seeks the uploading of few documents in a soft version. Also, it eliminates the need for taxpayers to gather supporting documents, again and again, owing to the availability of a stable database.

- Since E-filing supports email as a primary corresponding mode, it ensures faster processing of refunds for taxpayers. Unlike pre-electronic days, where taxpayers have had no clue regarding their refund status, e-filing is more agile and robust in this context.

- E-filing ensures seamless and swift return filing due to auto-populate features that overcome the need for entering the same details repeatedly.

- E-filing boasts tons of productive features for taxpayers, including a tax calculator and computable worksheet that mitigates any chances of error that is quite prominent with manual filing.

Conclusion

Income Tax Return E-filing offers unprecedented convenience to taxpayers who are more concerned about correct filing. It is seamless, robust, agile, and, most importantly, precise when it comes to tax calculation. Connect with CorpBiz’s professionals if you need any assistance regarding the e-filing of the tax return.

Read our article:What is the Claiming Process of Income Tax Refund?