Most people become concerned when it comes to Income tax Return filing. We give several excuses that lack of financial knowledge is the thing which restricts us from filing the TDS return correctly. If you will get familiar with the rules and regulations, then filing TDR will become easy for you. We all know that income tax is deducted from the salary we are earning. But this is not only the TDS. Any deduction in the salary other than the income is filed using the Form 26Q. Any individual or company earning must file the TDS before crediting the payment amount. Here, we will have a look at the online procedure for the TDS return filing for the Non-Salary Deductions.

Basic Definition of the Payer and the Payee

In context to the TDS Return filing, a payer is a person who pays tax while payee is the person who receives the taxes after the deduction. Also, another term for payer and payee is Deductor and Deductee.

What is Form 26Q?

Form 26Q is applicable for TDS as per Section 200 sub-section (3) of Income Tax Act, 1961, which is a TDS statement for all non-salary payments submitted by the deductor along with his TAN number.

According to Section 200(3) of Income Tax Act, 1961, Form 26Q is applicable for Tax Deduction at Source on the payment other than the salary of an individual. The form is filed every quarter, and the payer has to submit the TAN (Tax Deduction Account Number) along with the amount paid during the quarter.

The non-government deductors must furnish the PAN. While for the government deductors “PANNOTREQD” is mentioned on the form.

What are the Sections covered in Form 26Q?

- 193 – Income from Interest on securities

- 194 – Income from Dividend

- 194A – Income from Interest other than Interest on Securities

- 194B – Income from (Winnings from lotteries and crossword puzzles)

- 194BB – Income from Winnings from horse race

- 194C – Income from Payment of contractor and subcontractor

- 194D – Income from Insurance commission

- 194EE – Income from Payment in respect of deposit under the national savings scheme

- 194F – Income from Payments on account of repurchase of units by Mutual Funds or UTI 94F

- 194G – Income from Commission, prize etc., on sale of lottery tickets

- 194H – Income from Commission or Brokerage

- 194I(a) – Income from Rent

- 194I(b) – Rent

- 194J – Income from Fees for Professional or Technical Services

- 194LA – Income from Payment of Compensation on acquisition of particular immovable property

- 194LBA – Income from specific units of a business trust

- 194DA – Income from the life insurance policy.

- 194LBB – Income from the units of investment fund

- 194IA – Income from the transfer of certain immovable property other than agricultural land 9IA

- 194LBC – Income from investment in securitisation trust.

What are the details mentioned in Form 26Q?

Form 26Q[2] contains one annexure in which the following details are mentioned:

- Challan Details (BSR code, payment date, total amount).

- Deductor details

- Deductee details

Also, you need to mention the reasons in case the deductor has not deducted the TDS or deducted the TDS at a lower rate.

Read our article:How Offences & Penalties Under GST Can Put In Trouble?

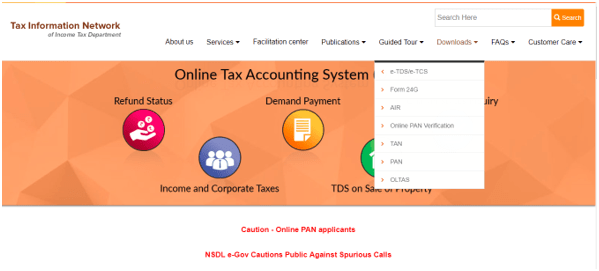

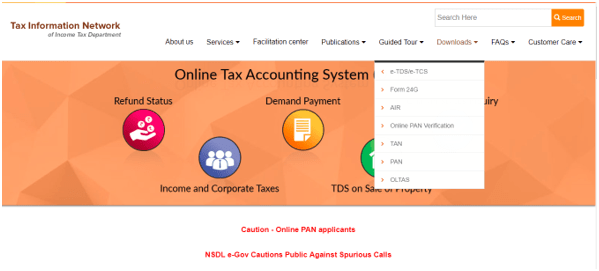

How to download the Form 26Q?

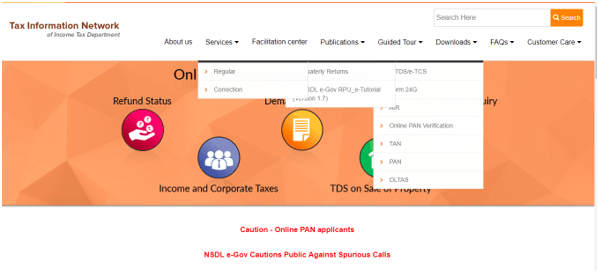

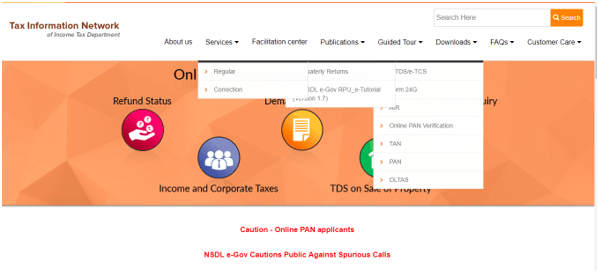

- Visit the NSDL (National Securities and Depository Limited) website:

- Select the option “e-TDS/e-TCS from the “Download” Section

- Now, select the option “Quarterly Returns” and then choose the “Regular”.

- After clicking on the option “Regular”, a new page will come, from there you can select the Form 26Q and download it.

What is the Due date of filing Form 26Q?

| Quarter | Due Date |

| April to June | 31st July |

| July to September | 31st October |

| October to December | 31st January |

| January to March | 31st May |

What is the rate of interest charged for the delay in TDS?

Here two cases arise:

- In case the TDS is not deducted – 1% per month from the due date of deduction to the actual date of deduction.

- In case the TDS is not deposited – 1.5% per month from the actual; date of deduction to the exact date of payment.

What is the penalty for late filing of Form 26Q?

The penalty for the late filing of Form 26Q is given below in the table:

| Section | Minimum Penalty | Maximum Penalty |

| Late filing of 26Q (Penalty under Section 234E) | INR 200 per day until the return is filed. | The maximum penalty is equal to the number of TDS deducted |

| Non-filing of 26Q (Penalty under Section 271H) | INR 10,000 | INR 1,00,000 |

However, there are some conditions under which no penalty will be charged under 271H:

- Tax Deduction at Source is deposited to the government.

- Late filing fees and interest.

- Return is filed before the expiry of the due date.

Revision of the form 26Q

In any case, if a discrepancy or mistake is noticed in the form after submitting the TDS returns, then at that case the deductor can file a correction statement. The deductor shall pay the charges or the fees for filing revised return. There is no limit in filing the correction form and the deductor can submit such multiple revised returns.

Conclusion

Well, to conclude, one can say that filing form 26Q is a mandatory procedure for all those who have other sources of income rather than their income. Tax saving and filing the income tax appropriately is the primary concern of every individual. You can either visit the NSDL portal for the filing procedure or contact our team of experts to fill the form on your behalf.

Read our article:Get Your New GST Registration in Just One Step