Similar to tax deduction done at multiple income sources such as house rent, interest income, and salary, TDS can be done on life insurance and insurance commission payments. Section 194DA & Section 194D under the IT act, 1961 are the provisions applicable, respectively.

What is the Significance of Section 194D?

Section 194D encompasses payments by way of reward/remuneration in the form of commission or otherwise insurance business (including a business that deals with the continuance, revival of insurance policies). The deduction should be made at the time of transferring the money to the account of the payee or at the event of payment in the form of a cheque, cash, draft, or any other mode. Tax is applicable only if the amount paid or the total of the amounts of such income paid or payable during the financial years surpasses INR 15000.

Deduction of Taxes u/s 194D

Any individual who transfers a payment to an Indian national in the form of reward or remuneration as part of the insurance[1] business should deduct tax.

Tax Implications u/s 194D

Tax is applicable to the earlier of the given cases:-

- At the time of crediting commission to the account of the payee.

- When the actual payment is made in the draft, cash, cheque, or other modes.

- As per Section 194D, the tax is deducted at different rates based on the type of payee:-

- Individuals: 5%

- Domestic companies: 10%

If the payee does not mention the PAN, the tax will be levied @20%. It’s worth noting that Surcharge will be imposed on these rates.

Applicable Exceptions

The tax would not be applicable on the amount the payer transfer to the payee’s account in the given scenarios:-

- The commission credited is within INR 15,000.

- A self-declaration is available u/s 15G/15H.

What is the Significance of Section 194DA?

Any payment to be credited to Indian national upon the maturity of the insurance policy, including the bonus, other than the amount available under clause (10D) of Section 10, will be subjected to TDS.

Any individual who credits the payment to the Indian national after the maturity of the life insurance policy is liable to deduct applicable TDS as per Section 194 DA.

Tax Implications u/s 194DA

Tax is applicable @1% at the time of crediting the payment to the payee account. The union budget 2019 has proposed to amend the TDS on insurance policy proceeds to 5% on the income comprised in the proceeds paid or payable upon maturity.

Deduction of Taxes u/s 194DA

There is no need to levied taxes if the total payable amount is within INR 1 Lakh.

Applicability of the section 194D

Let’s say Mr. Prakash received a maturity amount of Rs 10 lakh from this life insurance policy. Mr. Prakash has paid the amount of Rs 3.5 lakh as a premium over the span of 10 years. In such a scenario, the maturity amount is about Rs 1 lakh.

Henceforth, the maturity proceeds will be credited after deducting TDS @ 1%. In this case, the tax deduction at source would be Rs 10,000 after Mr. Prakash receives Rs 9, 90,000.

Lower Tax Deduction u/s 194D

If you reap commission via an insurance business, you can send form 13 to the concerned official requesting a certificate that legalizes the payer to skip or carry on with tax deduction at a lower rate. This provision is available u/s 197. However, Section 206AA (4) states that the lower deduction rate or non-deduction is not applicable unless the taxpayer has quoted PAN.

The deductee/ recipient will receive a certificate regarding TDS reflecting the insurance commission payment & the TDS thereon.

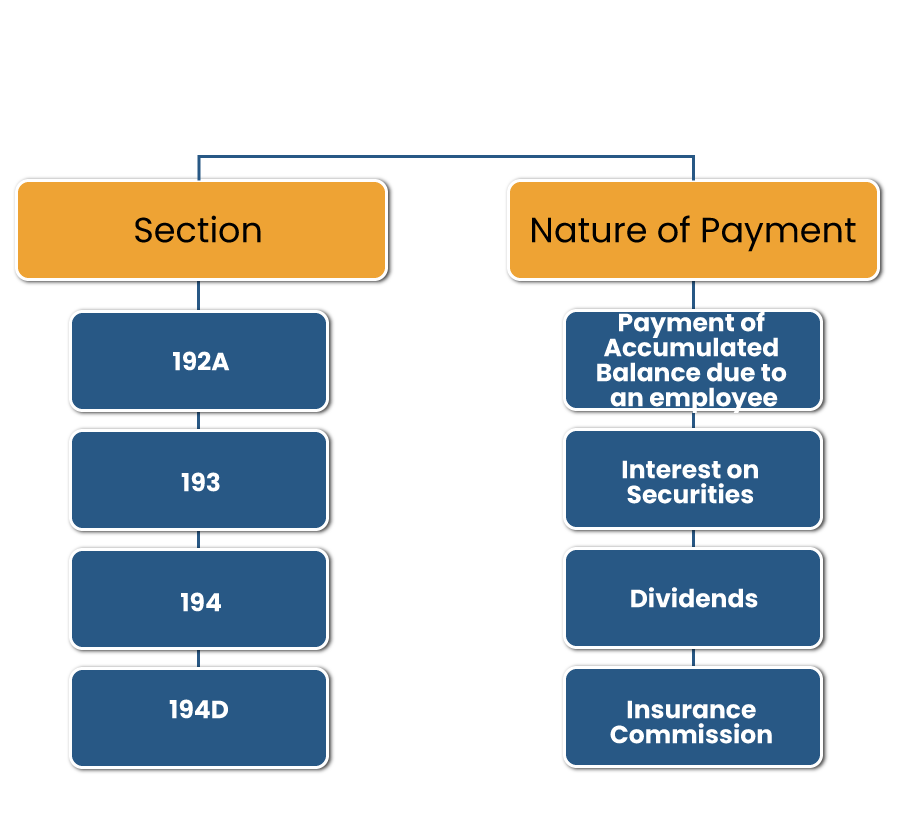

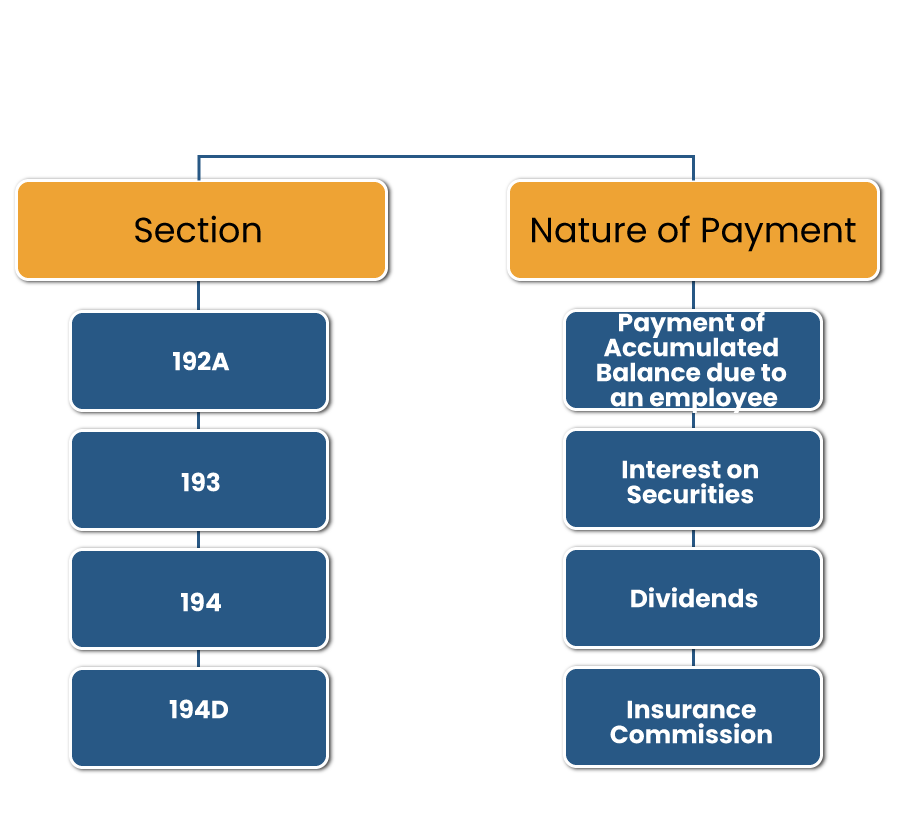

Tabular Representation of TDS Rate Chart

| Section | Nature | Cut off (INR) | Individual/ HUF/ Other |

| 194D | Insurance commission | 15000 | 5% |

| 194DA | Life Insurance | 100000 | 1% |

Latest Update as per the Union Budget 2021

- No changes in the IT slab rate (including old and new)

- No ITR filing requirement for Senior citizen (aged 75 years and above) having only pension & interest income.

- No change in HEC rates, Surcharge, and standard deduction.

- No change in the income tax rate as per the section 24(b), 80C & other sections as per chapter VI-A.

- Benefit under section extended to an additional one year, i.e., up to 31 March 2022.

- Section 80EEA:- timeline for loan approval is extended till 31 March 2022.

Read our article:Search Cases under Section 153D of the IT Act, 1961: Lawfulness of Prior approval for assessment

Important Points to be Remembered by the Taxpayers

- The percentage of TDS on the commission has been capped at 5%

- TDS will be imposed if the assessee’s total income surpasses the total amount, which is not chargeable.

- Commission income is taxable under the GST regime.

- Section 195 talks about the TDS applicability on the non-resident. There are multiple taxes for TDS u/s 195. These are set under the 10% to 30% bracket.

- The threshold limit related to TDS on the commission has been set at Rs 15000.

Conclusion

To sum up, section 194D talks about the tax implication on the commission earned by the insurance agent after selling the policy. If the assured sum of the commission earned by the agent surpasses the max- threshold limit, i.e. Rs 15000 annually, then 5% of tax will be imposed on such income.

Meanwhile, section 194DA deals with the LIC withdrawals, and it states that LIC withdrawal that is taxable under the IT Act will be subjected to 1% TDS if the amount for such withdrawal exceeds Rs 1,00,000. Drop your queries in the comment section in case you have any regarding this topic.

Read our article:Mistakes While Filing Income Tax Return: Procedure of Rectification