Micro Finance Institutions are the main source of funding for the MSME and small entrepreneurs, in case where they can’t access banking or any other related services. Microfinance provides assistance to the poor section of society to overcome poverty and helps in economic development. MFI not only provides credit to MSME, but also includes other services like insurance, savings, and remittance. MSME sectors have been considered as an important pillar of economic growth of the country. Here, in this blog, we will discuss the Role of Micro Finance Institutions in financing MSME briefly.

What are the Micro Small and Medium Enterprises?

From the last 5 decades, MSME’s in India[1] has emerged as a highly dynamic and vibrant sector. MSME not only help in the strengthening of rural and backward areas but also provide employment opportunities. Micro, small and medium enterprise are complementary to large industries as additional units and provides its immense contribution towards the socio and economic growth of India.

According to Micro, Small and Medium Enterprise Development Act, 2006, “An enterprise where the investment in plant and machinery does not exceed twenty-five lakh rupees; A Small Enterprise, where the investment in plant and machinery is more than twenty-five lakh rupees but does not exceed five crore rupees; A Medium-Enterprise, where the investment in plant and machinery is more than five crore rupees but does not exceed ten crore rupees.”

|

Enterprise |

Investment in plant and Machinery/Equipment ( land and Building excuded) |

|

|

Manufacturing Enterprises |

Service Enterprise |

|

|

Micro |

Up to Rs.25 lakh |

Up to Rs.10 lakh |

|

Small |

Not less than Rs.25 lakh and up to Rs.5 crore |

More than Rs.10 lakh and up to Rs.2 crore |

|

Medium |

More than Rs.5 crore and up to Rs.10 crore |

More than Rs.2 crore and up to Rs.5 crore |

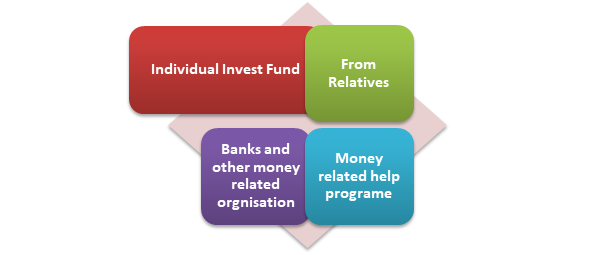

What is the source of finance for small businesses?

There are various types of source of finance for small businesses. Finance depends upon the size of business. Very first step is to figure out that how much money is required for the business. The source of finance for small business includes;

What are the Micro Finance Institutions?

Institutions those have micro financing as their main operations are known as Micro- Finance Institutions. Such Institutions mainly aims to offer microfinance services to different sectors. Micro Finance institutions are the financial companies which offer small loan services to the people who cannot avail banking services.

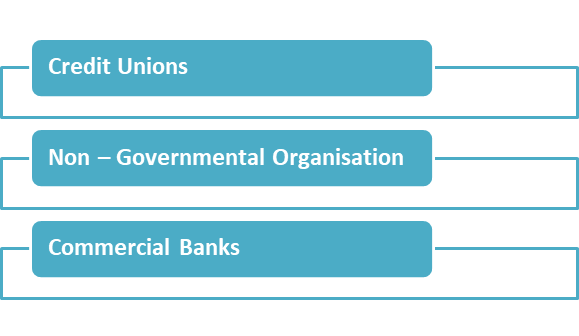

We have 3 types of institutions which offer micro finance services;

- Credit Unions

- Non – Governmental Organisation

- Commercial Banks

What is Micro Finance?

- It is also known as Microcredit, a way to provide finance facility to the small business owners;

- Mostly, Microfinance is providing loans, credit access, insurance policies etc;

- A micro-credit corresponds to a credit of low amount destined to people having little or no income.

Goals of Microfinance Institutions

Main object of MFI are as following;

- MFI works as financial institution that helps in the development of sustainable community;

- Further, MFI offers support to the lower section of the society;

- Figure out the options available to help abolish poverty at a faster rate;

- Work upon generating self-employment opportunities for the underprivileged;

- Empowering rural people by training them in simple skills so that they are capable of setting up income generation businesses.

In India microfinance operates through two ways which are;

- SHG – Bank Linkage Program

SHG is the acronym to self –help group. Self help groups are usually group of 10 to 20 local men or women. It is bank – led microfinance channel initiated by NABARD as an Action Research Project in 1989. Once the group is created, members make small saving contribution in group periodically, until enough capital in the group is saved for starting lending procedure. Further, these groups get linked to banks for opening saving account and for future credit requirement. Such group receives credit from banks after assessing of their credit worthiness.

- Micro Finance Institutions (MFIs)

Micro Finance Institutions (MFIs) plays an important role in helping financial incorporation and thus helping the poor with finance. It ranges from small non-profit organizations to larger banks.

What are the main features of MFIs?

- Small scale borrowers:

A micro finance provider generally provide loan to low income customers, along with the person who is underemployed, or those who have unofficial family business such as small traders.

- Credit risk investigation:

Records related to loan are generally kept loan officers from his stops at debtor’s home and business. Debtor usually lack official financial statement, thus loan officer help in keeping records using awaited cash flows, payback schedule and credit amount.

- Utilization of security:

Such lenders usually do not have proper security conventions requested by bank; mainly they need to take care of financial organization. Such institutes are valued by lender.

- Credit approval and checking:

Micro –lending institutions have the tendency of great degree of circulated process, loan authorization by loan committee. They strongly rely upon the skill and reliability of loan officer along with this from executive they require precise and timely information.

- Controlling debts;

Mainly, loan officer perform the supervising, as information related to customer is essential for valuable collection.

Read our article:MSME Form 1: Know The Procedure to File, Due Dates and Penalties

What is the role of microfinance in funding small and medium enterprises?

India is a developing country, where rural economy is the backbone. In developing countries like India Microfinance institute plays the significant role towards alleviation of poverty, and further bettering the economic condition. Micro small and medium enterprises have been the main source of employment and livelihood of a big section of society in devolving countries. However, the financial need of MSME are been fulfilled by Microfinance Institutions. MFIs become solely instrumental in capitalizing much small business for their growth.

Through following ways microfinance institutions help in funding MSMEs;

- Credit Facilities are easily approachable –

For MSME microfinance institutions serve as the primary credit and lending platform. MFIs not only provide lending facility to low income individual but also to the medium enterprise. Accessing to loan in MFIs is much easy from other organized financial sector.

Moreover, most of the institutions provide loans with affordable rate of interest along with simple procedure and less documentation.

- Inclusive Policies

Small enterprises generally provide employment to unskilled and semi skilled laborers, who are from the weaker section of the society. The MFIs lender focuses towards these section and work on developing them economically by developing simple business models and policies.

- Help in business expansion

Micro financers’ offers blueprint for business expansion and also provide assistance for carrying their operations. With the help of aid MFIs providing to MSME, they can increase the number of their outlets and can become contenders in market.

Through this way, Micro financer can easily recover their loan, and can lend to the next lender. Therefore, by allowing MSMEs to use their funds, can increase their productivity and also increase profits in the process.

Conclusion

In order to support small enterprises, MFIs are working to make their services better, by the way of understanding unique needs of MSME. They are tailoring their services and working toward making the process much easier so that, MSME can easily avail their services. With the help of management MFIs can create client concentric approach, with hiring knowledgeable and dedicated staff.

In devolving nations like India and other nations, the concept of micro finance loans and micro finance institutions has been embraced. Now, Micro finance lending has become the lifeline for the MSME. Such Institutes help many deprived sections of the society, so that they can become able to integrate with the main stream.

Read our article:RBI Extends Deadline for One – Time Restructuring of MSME Loans