FFMCs are the RBI-approved entities that conduct money changing activities in India. Their job is to purchase foreign exchange from the individuals visiting the country and sell it for specific purposes, such as converting foreign currency into Indian rupees and vice versa. No person shall conduct forex trading activities without a valid FFMC license issued by Reserve Bank of India. Any individual who intentionally undertakes such business in the absence of a valid license is liable to confront certain penalties under the Act. In this article, you will come across conditions that trigger the Revocation of the FFMC License.

Revocation of FFMC License

Any license awarded under Section 10(1) of FEMA 1999[1] may be canceled by RBI if:

- It is in favor of public interest or

- If the licensee breaches the conditions that support the license’s integrity or has failed to meet the standards for which the authorization was granted.

Reserve Bank has the authority to cancel the license of any of the registered entities for the contravention of regulatory or statutory provisions. Additionally, RBI also holds the right to amend or cancel the existing conditions of the license.

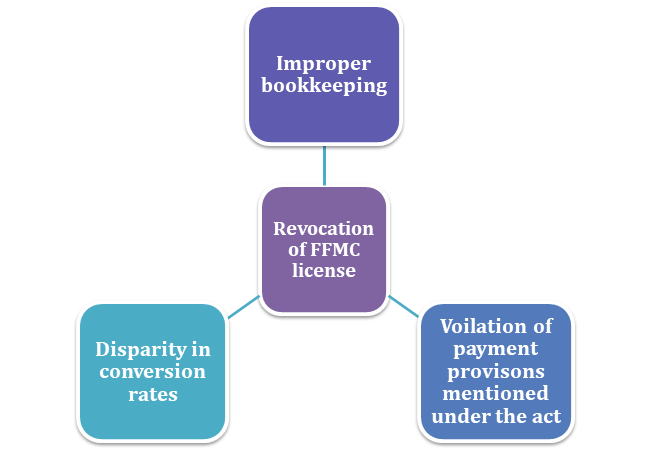

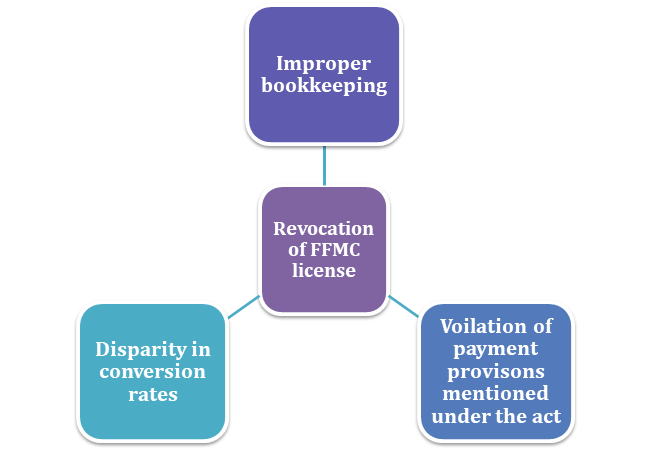

Prominent reasons for revocation of FFMC license

Improper Book-keeping

Bookkeeping is a core aspect of the FFMC working protocol. The licensee needs to maintain all the transactions in an immaculate manner in an account book. Such a book is exposed to periodic auditing that ensures transparency. Henceforth, any shortcoming in this aspect could trigger the chances of the cancellation. And the matter of the fact that RBI can scrutinize AMCs anytime; it’s a duty of the license holders to maintain the integrity of transactions throughout the years.

Mismatching in Conversion Rates

FFMC in India is liable to provide foreign exchange facilities to Indian nationals, overseas individuals visiting India and NRIs through a valid exchange rate applicable at the time of business. If the registered entity undertakes some unorthodox methods to alter the conversion rates for the sake of profit, it would be deemed a felony in the eye of law. The moment RBI picks this shortcoming; they might wound up the entity’s activities by canceling its license.

Violation of Provisions

FFMC working protocol is driven by specific provisions of law that cannot be overlooked in any conditions whatsoever. AMCs working with FFMC license are under the obligation to follow all the norms while conducting the business activities or in-house amendments. Any actions against these norms would be treated as an offense resulting in hefty fines and even revocation of license. Apart from these prominent shortcomings, there are few more factors as well that could trigger the cancellation of the FFMC license.

- System of Concurrent Audit is not implemented within the system.

- Foreign exchange rate chart not updated regularly.

- Entities fail to incorporate the list of core members on record.

- AMCs fail to comply with the payment provisions mentioned under the law.

Read our article:An Outlook on Benefits, Types and Procedure of FFMC License

Best Practices to Avoid Revocation of FFMC

Display Chart regarding Exchange Rate

All the FFMCs must display an exchange rate chart in the vicinity accessible to the general public. The chart must exhibit the exchange rate of foreign currency notes and travelers’ cheques for all prominent currencies. As the currency rates fluctuate frequently, the chart should be updated accordingly, latest by 10:30 a.m. Indian time.

Avoid Accumulation of Fake Currency Notes

If the AMCs mistakenly obtained fake foreign currency notes from the customers, it might write off the same after the top management’s approval. According to the Act, the limit of disposing of such currency is limited to the US $ 2000 per financial year. The moment AMCs crosses this threshold limit; they would require an RBI authorization to proceed further.

Implement Training Protocols for Employee

AMCs should implement an employee training program for the member working within the organization. The training modules should encompass policies and procedures pertaining to money changing activities to ensure transparency and integrity within the system.

Avoid Build-up Foreign Currency

As per law, AMCs are liable to maintain an optimum level of foreign currencies. Any build-up in this regard would hinder the company’s performance in the longer run. The majority of the transaction between AMCs and authorized dealers should discourage any payment in cash. The transaction related to foreign currency notes is confined to the limit mentioned in the provisions of RBI.

Conduct an Audit of Financial Affairs to Ensure Transparency

Any AMCs earning more than the threshold limit should conduct a comprehensive financial audit to ensure transparency. The entity must maintain the record of the same for cross-referencing with authority in case of scrutiny. It’s worth noting that section 12(1) of FEMA 1999, empowers RBI’s officers to audit the financial affairs of AMCs anytime. The officers have the authority to investigate the books and accounts of AMCs. The core members of the AMC should cooperate with the investigation officers in carrying out their activities. If AMCs member fails to comply with such conditions, then it would be deemed as a violation of the Act

Conclusion

There is no denying that FFMCs are a vital part of the Indian economy. They are accountable for handing forex trading activities within the framework of RBI’s norm. Anybody who aim to initiates such business needs to follow all the guideline of law without exception. Entities who try to bypass these provisions for the sake of profit would be liable to pay a hefty license. In some cases, the authority might opt for the revocation of the FFMC license.

Read our article:Guide: Compliances for a Full Fledged Money Changer in India