As per the provisions under section 10 of the Foreign Exchange Management Act, 1999, any firms that want to engage in money changers activity must obtain a Full Fledged Money Changer License in India.

FFMC license comes with additional obligations that need to be catered as per the given provision. If any FFMC struggles to ensure conformity with compliances, then this could lead to hefty penalties. Before we delve deeper into the concept of Compliances for a Full Fledged Money Changer in India, let’s go through some basics first.

About Full Fledged Money Changer

Full Fledged Money Changer or FFMC is a legal entity that engaged in the trading of foreign exchange that benefits NRIs and the residents of the native country.

As per provisions under section 10 of the FEMA Act, 1999, no business can involve in the forex exchange services until and unless it is authorized from the relevant authority. Furthermore, RBI approval is mandatory for the entities that are willing to participate in the FFMC business. This condition is non-negotiable, and its violation could lead to massive penalties as per the FEMA Act.

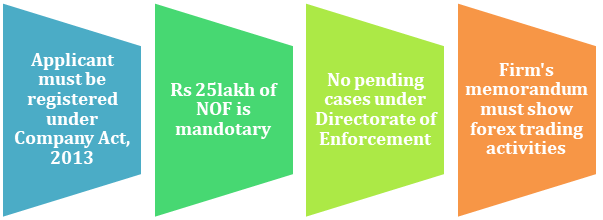

Pre-requisites for obtaining FFMC License

Anybody who willing to obtain an FFMC license in India needs to cater to the requirement mentioned below.

- Companies Act, 2013[1] registration is a mandatory requirement for obtaining this license.

- The willing company’s minimum net-owned funds must be well above Rs. 25 lakhs and 50 lakhs for single and multiple branches FFMC, respectively.

- The company should not be accused of violating provisions under the Directorate of Enforcement and Directorate of Revenue Intelligence.

- The Memorandum or object clause must reflect the core operation of the firm i.e., money changing activity.

Post-approval requirements for Full Fledged Money Changer in India

On the receipt of RBI’s approval, FFMCs need to ensure conformity with the following requirements:

- Provide a registration copy under Shop Act or other documentation like a copy of lease agreement, rent receipt, etc., to the RBI’s regional office before business initiation.

- The newly-established FFMCs need to conduct its operation as per the RBI’s instructions.

- A copy of the RBI license supporting FFMC should ensure its presence in every working branch.

- The Full Fledged Money Changer ensures the periodic audit of their activities on a concurrent basis.

- Every FMMC pan India is entitled to provide its audited balance sheet to the RBI’s regional office.

Read our article:How to Apply For FFMC License in India?

Annual Compliances for Full Fledged Money Changer in India

- On the receipt of the FFMC license and post-commencement of the company’s operation, you must ensure conformity with the following compliances.

- Ensure the proper maintenance of purchase register w.r.t foreign currency, logbooks, and travelers’ cheque.

- Ensure monthly submission of statements w.r.t trading of foreign currency to RBI.

- Ensure monthly submission of receipt statements accompanied by the purchase of US $10,000 or above transaction to the RBI’s regional office and Foreign Exchange Department.

- Ensure the submission of the quarterly statement w.r.t foreign currency account maintained in India.

- FFMCs must submit an annual audited balance sheet along with the certificate issued by statutory auditor’s w.r.t NOFs (Net-Owned Funds). Submission should be done within the due date.

- FFMC must implement a robust, auditing framework to ensure transparency.

- The annual statement must found their way to the relevant authority such as the Regional Office of the FED (Foreign Exchange Department), RBI without any delay.

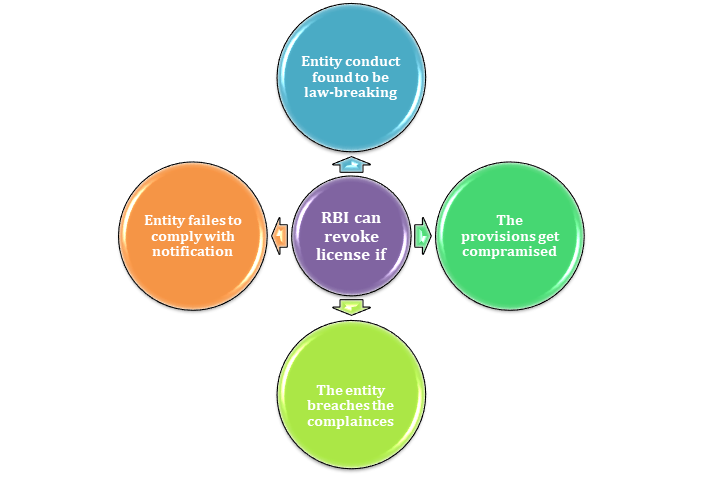

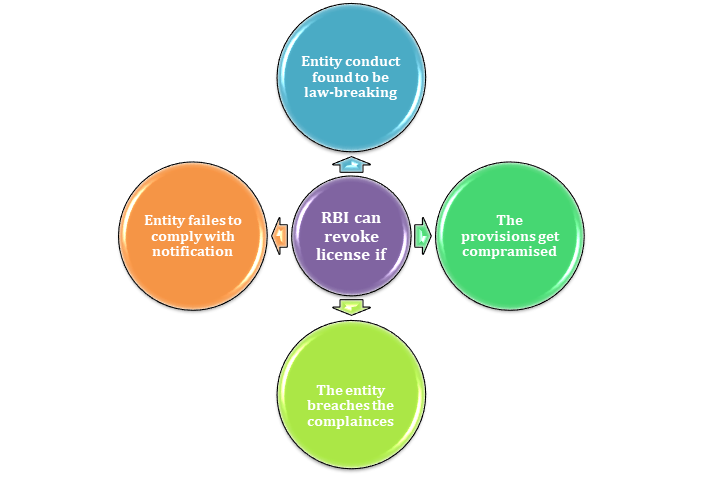

Conditions that support cancellation of FFMC license

The RBI may cancel an authorization conferred under Section 10(1) of FEMA 1999 at any time if:-

- The money changing activities found to be unreasonable.

- The authorized person is not complying with the given provision, regulation, notification.

Reserve Bank has the full authority to cancel the authorization of any of the branches in case of provision violations and infringement of statutory compliance. The RBI has a right to amend the existing provisions whenever they want without informing the licensee.

FFMC License: Key points to remember

- Entities other than the bank can apply for the Full Fledged Money Changer license.

- FFMC license needs to be renewed every year. Thus, an application, along with mandatory documents, must be provided to RBI.

- A net owned fund for an applicant to obtain FFMC is Rs. 25Lakh for a single branch and 50 lakh for multiple offices.

- FFMCs needs to maintain all the documents w.r.t to forex trading for future due diligence.

- A periodic audit of FFMC is mandatory as per RBI’s guideline. Thus its violation could lead to cancellation of license.

Conclusion

FFMC license helps to comply with the legality of the business. It also helps in availing certificate of encashment during the purchase of coins, foreign currency notes, and Travellers’ cheques. FFMC is a must-have requirement for anyone looking to grow its footprint in the foreign exchange business. Frankly, the compliances concerning FFMC are not as stringent as it seems, and it would not act as a barrier unless one decided to deviate from the norm. If the concept w.r.t Compliances for a Full Fledged Money Changer in India isn’t clear to you, feel free to get in touch with us.

Read our article:Guidelines For The FFMC License; A complete Overview