FFMC License is reserved for those entities that deal with activities of forex trading. The RBI governs the money changing activities in the country and regulates FFMC License. As per section 10 of the Foreign Exchange Management Act, 1999, the money-changing activities are limited to the authorized entities governed by the regulation of RBI. Here in this article we will discuss types and procedure of FFMC license in detail;

FFMC License holders procure funds from Indian residents and non-residents and undertake forex trading activities. Such entities typically benefit foreign visitors and travelers seeking financial aid to support their activities. No entity is liable to undertake a money exchange business unless it avails license for the same from the RBI[1]. The unauthorized money exchanges are vulnerable to the hefty penalties as per the act.

Eligibility criteria to avail FFMC license in India

- Companies seeking FFMC License in India must be registered entities under the Companies Act 1956/ Companies Act 2013.

- A minimum net owned fund of Rs. 25 Lakh is mandatory for the individual seeking FFMC license for a single branch. Meanwhile, in the case of multiple branches, the minimum net owned fund escalates up to Rs. 50 lakh.

- Entities with a criminal record are not eligible to avail FFMC license in India.

- After the availment of the FFMC license, the entity must commence its business activity within six months, or else the license will lapse.

- The company must ensure that money exchange activity is mentioned in the object clause of Memorandum.

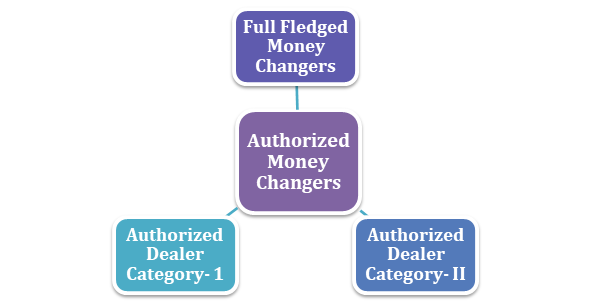

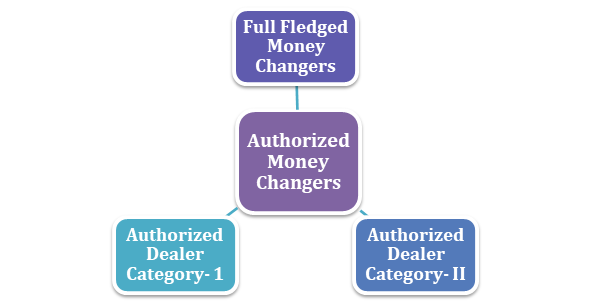

Authorized Money Changers category in India

Here is the list of AMCs that exist in India:-

- Full Fledged Money Changers (FFMCs)

- Authorized Dealer Category- 1 Banks (AD Category 1)

- Authorized Dealer Category- 2 Banks (ADs Category-2)

Types of FFMC Licence

- FFMC can pull off a franchise agreement with an authorized entity to perform money exchanging activities such as forex trading & coin conversion.

- FFMCs are permitted to trade Indian currency to foreign currency for the non-resident individuals against international cards.

- RBI has permitted FFMC to engage with forex trading, purchase traveler’s cheques or coins.

- An FFMC is authorized to sell foreign exchange for Forex prepaid cards, Business Visits, and Private visits.

Benefits offered by FFMC in India

- Full Fledged Money Changer has the capability to furnish sale facilities for foreign exchange.

- FFMC can furnish encasement certificates in case of purchase of traveler cheques, coins, and foreign currency notes from residents and non-residents.

- FFMC can perform foreign exchange activities for the overseas residents visiting India

- FFMC is able to address transactions regarding coins, foreign currency notes, & traveler cheques at the current exchange rate.

Read our article:How to Apply For FFMC License in India?

Procedure to avail FFMC License in India

Only those firms are eligible to avail FFMC license that ensures conformity with licensing prerequisites. The procedure of FFMC license is defined below as per the RBI’s guidelines:

- Fill up the FFMC license application by furnishing the required information.

- Next, submit the application along with the mandatory documents to the respective regional office of RBI’s Foreign Exchange Department.

- RBI would scrutinize the application under “Fit & Proper” criteria. As soon as the RBI completed the verification process and got satisfied, the license will be awarded to the applicant within the timespan of 2 to 4 months.

- The applicant will then need approval from the empowered committee of RBI.

Post-approval conditions for FFMC license holders

The applicants must cater to the given requirements as soon as they receive the FFMC license

- A copy Registration under Shops and Establishment Act, or rent receipt should be submitted to RBI’s regional office.

- After complying with the complete procedure of FFMC License, holders must initiate their business activity within six months from the day RBI furnishes the license.

- One copy of the FFMC license should be presented at every branch of business.

- FFMC must conduct comprehensive auditing for their transaction from time to time to ensure transparency.

- FFMCs must furnish audited Balance Sheet every year to RBI’s regional office.

Mandatory Documentation for FFMC License in India

The given list exhibits the range of documents that an applicant needs to submit to obtain an FFMC License

- A confidential report generated by the applicant’s bank in a sealed envelope.

- A duplicate copy of the COI of a company.

- Copy of AOA and MOM encompasses the provision for money changing activities.

- Copy of balance sheet, audited account, and Profit & Loss Account.

- Detail of the associated entities operating in an identical regime or dealing with similar affairs.

- Declaration ensuring that the company has no pending case against the Board of Revenue Intelligence (DRI)/ Board of Enforcement (DoE).

- A duplicate copy of the board resolution illustrating detail regarding the money exchange business.

Key Points to Remember

- The FFMCs are the RBI-driven entities that deal with foreign exchange and provide the services to the residents and tourists.

- Anyone who intends to enter such a business must be working under the canopy of corporate law and have a minimum-owned fund of Rs 25 lakhs.

- Every registered FFMC is under the obligation to maintain the balance books. Logbook that records activities and records of transactions and traveler’s cheque.

Conclusion

It is mandatory to obtain an FFMC license who wishes to carry the money exchange business in India. The FFMC entity registered with the Reserve Bank of India can deal with foreign exchange for a distinct purpose like the purchase of foreign exchange from the residents as well as non-residents visiting India. The business entity should ensure conformity with RBI’s provisions after the availment of the FFMC license to avoid legal conflict. Contact Corpbiz in case if you like to grab more information on the same.

Read our article:Guide: Compliances for a Full Fledged Money Changer in India