On Saturday, the Indian Government widened the ambit of the MSME credit scheme by incorporating credit for professionals like lawyers, doctors, and CAs. The twisted scheme also doubles the upper ceiling of loans outstanding, which previously existed at Rs 25 crores. The decisions seem to be a result of frequent demands made by the trade bodies and a new MSME definition. The revised scheme primarily benefits millions of professionals pan India seeking financial credit for their business.

Read our article:MSME Registration – Know the Entire Procedure

MSME credit scheme

Speaking in the context of the decision, the finance minister ensures that the MSME credit guarantee scheme would cover the scope of the individual credit providing financial aid to the professional for their business need from now onward. Furthermore, the inclusion of reconstituted outstanding limits for a loan would attract more businesses in the future, as it has been double under the MSME credit scheme. The professionals like CAs, lawyers, and doctors can now avail of credit under special credit guarantee schemes for MSMEs provided they have already received loans from financial institutions.

Emergency Credit Line Guarantee Scheme

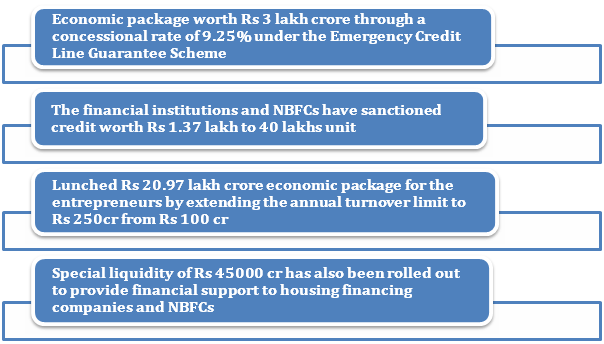

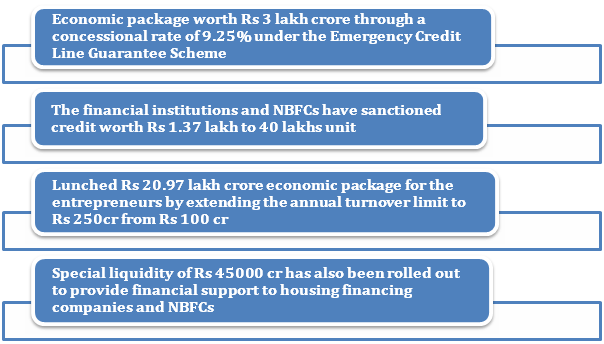

A few weeks ago, the union cabinet rolled out the economic package worth Rs 3 lakh crore through a concessional rate of 9.25% under the Emergency Credit Line Guarantee Scheme for the MSME sector. The scheme ensures 100% coverage via the National Credit Guarantee Trustee Company to the existing MSMEs. These projected benefits would be fueled by an economic package worth Rs 45,000 cr laid by the government for three years. It worth noting that, this scheme would remain active until October 31 of the current financial year.

Financial institutions and NBFCs credit sanctioned

The financial institutions and NBFCs have sanctioned credit worth Rs 1.37 lakh to 40 lakhs unit, out of which the disbursement of RsRs 87,227 has been done. Furthermore, the finance ministry[1] also broadens access to this newly launched Rs 20.97 lakh crore economic package for the entrepreneurs by extending the annual turnover limit to Rs 250cr from Rs 100 cr.

The Financial Services Secretary Debasish Panda cited that sanctioning individual loans would be a replication of the method used to furnish credits to corporates. He further added the special liquidity of Rs 45000 cr has also been rolled out to provide financial support to housing financing companies and NBFCs. However, he didn’t clarify the cabinet takes on the disbursement of credit to firms with low credit rating.

Conclusion

The NBFCs with a solid credit rating has already reaped more benefits from these government-driven relief packages. Apart from these crucial decisions, the ministry also relaxes funding limits under a guaranteed emergency credit line (GECL). Now the new limit has been set to Rs 10 cr against the earlier limit i.e.Rs 5cr. Feel free to visit CorpBiz’s site if you need technical advice on compliance affairs related to MSME registration.

Read our article:Can Startups Benefit From MSME Registration For Better Govt Support?