Micro, Small and Medium Enterprises, broadly known as MSMEs, considered as the key pillar of the Indian Economy. Their contribution towards nation’s GDP is quite remarkable. MSMEs allow Indian citizen to venture into any business and aid society via job creation and facilitation of cheaper goods and services. They have also gradually and constantly revive the artisan class in untapped Indian regions by rendering job, & access to credits & other services to the class. Moreover, they continually support cutting-edge technology, infrastructure development, & stimulate the modernization of the nation as well as society as a whole. This write-up will cover all relevant MSME benefits that steer small business towards the path of growth.

On account of numbers, presently MSMEs’ contribution accounted for whooping 30% to the India’s GDP, and nearly 45 percent of the manufacturing output, & almost 48 per cent of the nation’s exports. These figures indicate the prowess of this sector and show how important it is to the nation’s development. MSME has gone through tough phase during the Covid-19 phase. But, thanks to the government subsidies that have helped this sector revive swiftly without much of a hassle.

Read our article:MSME Registration: Essentials and Upcoming Benefits for Business

What are the key MSME benefits that boost growth of small businesses?

In order to assist this sector, the GOI launched the MSME (Amendment) Bill in 2018 & re-emphasized on the MSME Act, 2006. MSME (Amendment) Bill proposed that there is no requirement for frequent verification to determine the required investments required to be routed toward plant and equipments needed. Additionally, the MSME operation would continue to execute in a non-prejudice, non-discriminatory, & objective manner.

Some of the common MSME benefits proposed by the government under the aforesaid Bill include:

1. Access to Collateral Free Bank loans

One of the most productive MSME benefits offered by the government for MSME sector is the availability of collateral-free bank loan. This initiative aims to facilitate assured funds to small entities under MSME sectors. Under the scheme, both new as well as old enterprises can availed the benefits. A trust, viz; Credit Guarantee Trust Fund Scheme was launched by Indian government, SIDBI (Small Industries Development Bank of India) & MSME ministry to ensure the seamless implementation of Credit Guarantee Scheme) for entities operating under MSME sector

2. Low processing charges for patent registration

Under the prevailing bylaws, MSME registered entities have the access to fees relaxation on their patent registration. This advocates small entities to keep innovating on new technologies and projects. The businesses can access such a subsidy after furnishing application to the relevant ministries.

3. Relaxation on Overdraft* Interest Rate

Enterprises & Businesses operating as MSME registered unit can avail a benefit of 1% on the Overdraft in a scheme that varies bank-wise. This aids to make small entities secure during financial crunches.

What is overdraft*?

Overdraft refers to a credit extension given to the entities encountering nil-balance in their salary or saving account.

4. Seamless Access to Industrial Promotion Subsidies

Entities that have been operating as a MSME registered unit can have access to government driven subsidies for Industrial Promotion

5. Access to Government-based tenders

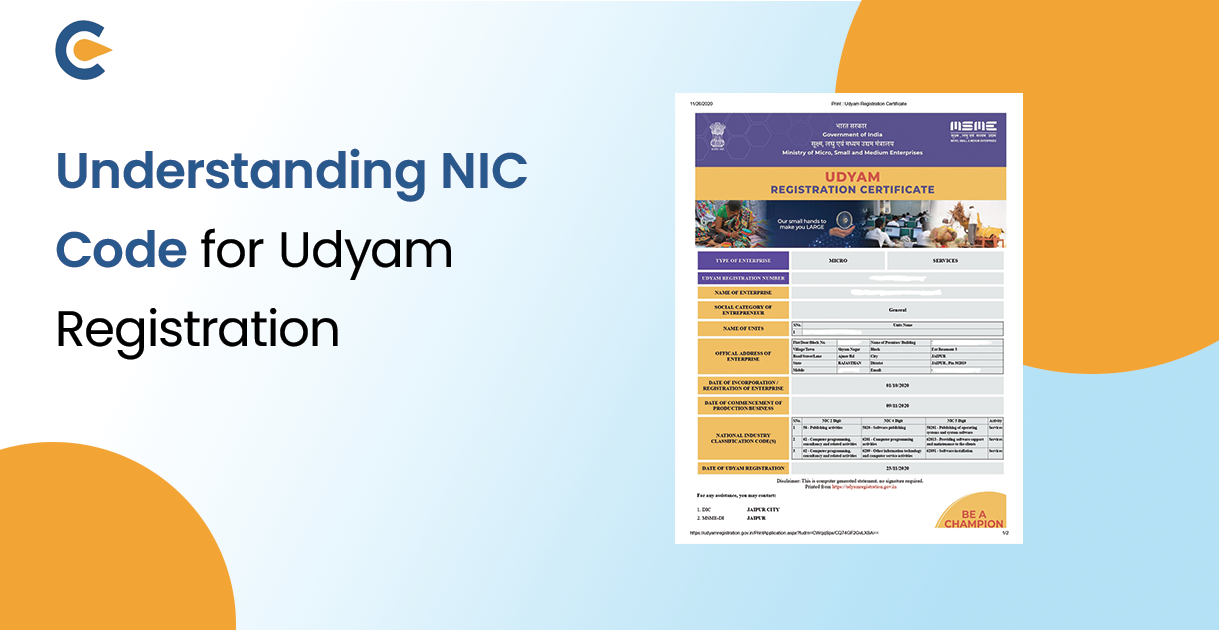

Entities with MSME registration now have to access the exclusive government tenders. The facilitation of such services is done via e-portal called Udyam Registration Portal which is in sync with Government e-marketplace.

6. Security against the late payments

MSMEs continually encounter the risk of late payment which eventually leads them towards financial crisis. To safeguard registered entities, the apex court of India has mandated that buyer of MSME’s goods and services to clear the payment on or agreed date or within 15 days from the purchase date. If the buyer fails to make timely payment or deferred the payment for more than 45 days then the interest would be imposed in accordance with the RBI’s direction. The government has also proposed a One Time Settlement Fee regarding non-paid amount of MSME in this context.

7. Relaxation on Electricity Bills

All MSME-registered entities are entitled to avail concessions on their electricity bills. This allows entities to boost the production rate & secure more orders without worrying about capital expenses related to electricity and maintenance. To avail such a benefit, the MSME has to make a formal request to department of electricity via submission of prescribed application firm and certificate of registration.

8. ISO Certification Charges Reimbursement

Any registered MSMEs in India have the right to claim reimbursement of the expenses related to ISO certification. In general, cost of securing ISO certification is relatively higher than any other registrations due to the presence of countless compliances-related guidelines. Most of the expenses occur in the form of tedious paperwork. Government initiative to cut down the expenses for ISO registration would provide a great deal of relief for MSME entities willing to make mark in international market.

9. Access to Market Assistance Scheme

The MSME ministry runs a Marketing Assistance Scheme that facilitates fiscal aid to MSMEs to boost their marketing efforts. The scheme offer MSME business the required funding so that they can involved into the given marketing activities for their business:

Conclusion

MSME sector is the pivotal sector of the Indian Economy that steer the nation toward the path of sustainable growth. Since it is considered as a major GDP contributor, government[1] is making every possible effort to improve their standing by facilitating relevant schemes and benefits. The MSME benefits mentioned above seem quite significant considering the way they boost the small businesses. These growth-driven benefits aim to foster better working environment for small entities in India.

Read our article:Can Startups Benefit From MSME Registration For Better Govt Support?