An optimal account receivable management can drastically improve the cash flow of the medical business. To make the Medical Account Receivable process seamless make sure to go through the following tactics mentioned below.

Is your healthcare company is dealing with an improper cash flow because of substandard Account Receivable management? This is a complex problem; the medical accounts receivable issue has disrupted the healthcare accounting that is adversely affecting the goal of the hospitals.

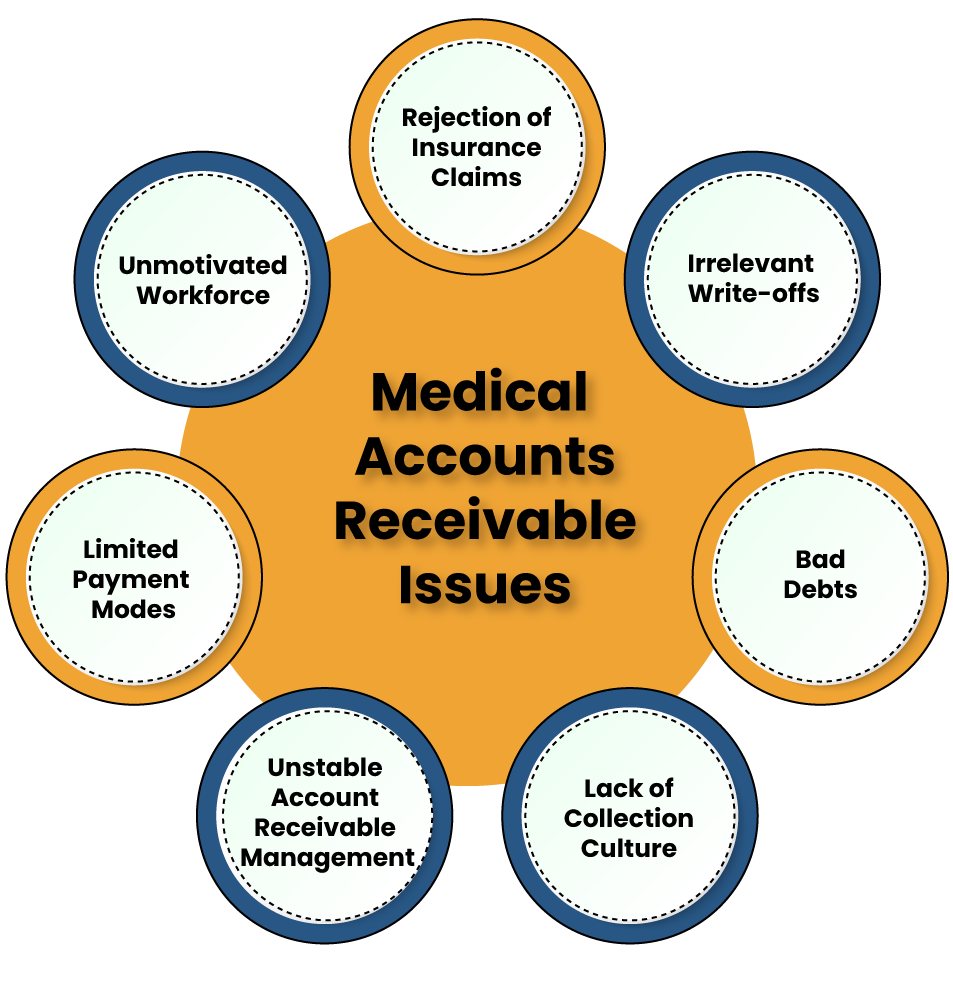

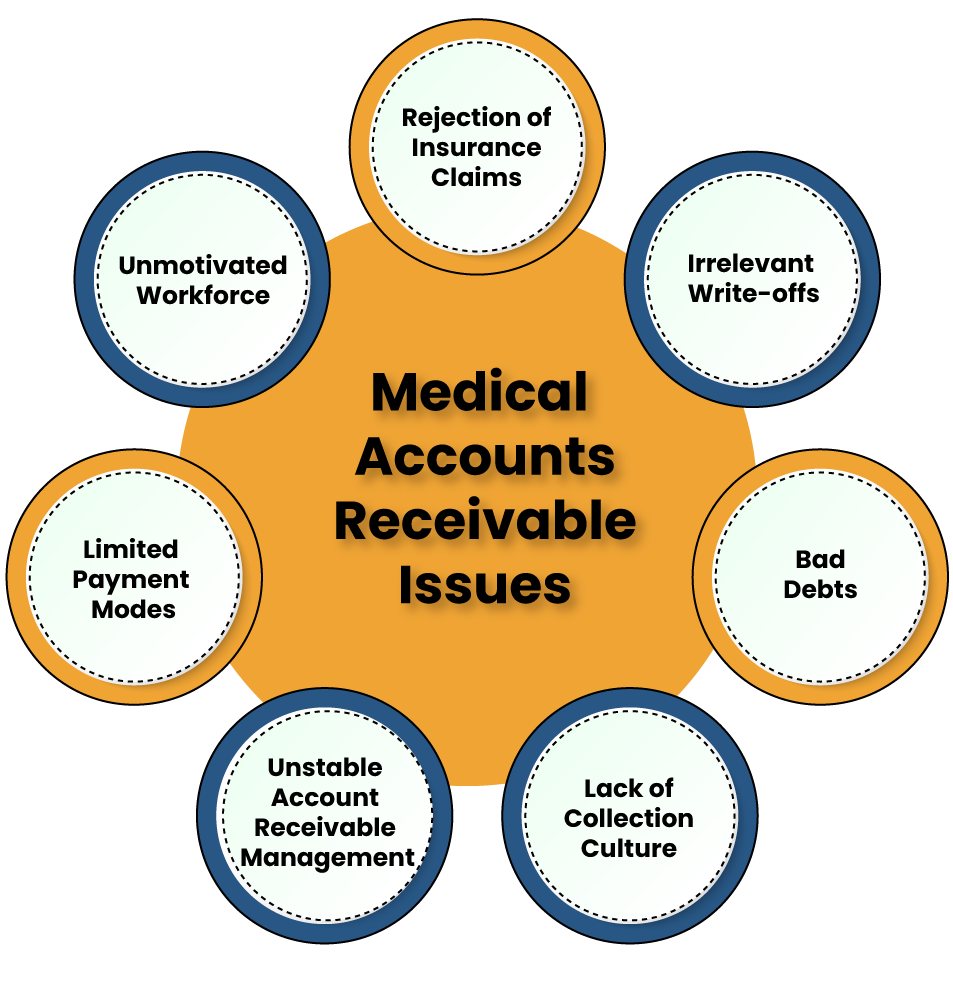

Typical Medical Accounts Receivable Problems and Viable Solution

Below we have individually explained the different medical accounts receivable problems along with their solution.

Bad Debts

Issue: – Surging bad debts are meticulous and are considered as the most obnoxious issue in medical accounts receivable management, whereas the patient’s responsibility is deemed as a major contributing factor to the revenue of the health industry. Earlier, patient’s responsibility was confined to the time of service, but now it is insufficient.

Solution – Your Company should accumulate all the essential billing and insurance details before rendering the service and estimate the expected cost as a part of expenses. So by checking the insurance bills, coverage, the patient already ascertains their responsibility.

Read our article:A Step by Step guide for Registration Process for Medical Devices in India

Irrelevant Write-offs

Issue -The team of medical Account Receivable (AR) management often overlooked those payments which are less in amount. This ultimately hampers the balance sheet of the hospitals. Not all patients are financially capable to deposit medical fees at once. Installment is the only legit option for them to address such expenses.

Solution – Before write-off, the AR team must investigate every aspect and try to pinpoint amounts that should be mentioned in the account book. By doing this, you can avert a potential element that might contribute to the loss of the company.

Rejection of Insurance Claims

Issue– One of the most common medical Account Receivable issues is rejected by insurance claims. A recent survey has shown that healthcare companies encounter a significant deficit of profit in the absence of a proper management system. Some reputed institution has suggested that the denial rate of insurance must lies between 4 to 5%.

Solution – Your team of AR management should investigate every claim form before submitting so that it can adhere to standards. Do not forget to enact better follow-up for denied claims. You must precisely probe the denied claims and look out for the particulars that need to be submitted.

Lack of Collection Culture

Issue -Payment collections are not a core job of health professionals, as their work is to render services to their patients. But getting paid for services is vital to consistently carry out a successful practice. Do you know why it is important to foster the culture of collecting payment?

Solution – A healthcare company needs to deploy an effective system of payment collection to avert issues like a bad debt. To achieve this, you may have to put some effective tools in place so that the payment collection can be done efficiently. It is needless to mention that the team member must have access to these tools.

Limited Mode of Payment

Issue -Fewer payment modes can be a hassle for your collecting needs and may hinder the authenticity of the balance sheet, particularly in the longer terms.

Solution – Your firm should deploy multiple payment options other than wire transfer or cash payment. The inclusion of payment options like debit or credit cards can help maintain seamless cash flow.

Lack of Awareness among the Patients Regarding Payment Policies

Issue– Remember the prolonged debt can turn into the default in no time. So be cautious while rendering the services to your patient. If possible, holistically coordinate with your patient and make them understand your financial policies and responsibility.

Solution – You can take advantage of the following modes to educate your patients.

- Insurance Verification

- Claim Processing

- Appointment Scheduling

- Appeal Letter

- Provider Web Site

Make sure that your patients should become well aware of policies regarding payment, payment methods, and outstanding balances.

Unstable Account Receivable Management

If a medical account receivable management lacks transparency or inability to resolve the complex issue on time then sooner or later it will lead your firm to heavy losses that also include bad debts and shoddy feedbacks from patients. Furthermore, you can keep track of escalating bad debts in your account book.

Solution – You must conduct in-depth verification of your bank statements to determine whether all the transactions are legit or not. This will give you an extra edge to counteract the fraudulent activities or errors so that you can render the best of services to your patients.

Unavailability of Relevant Processes

Issue– Every healthcare institution is distinctive thus; their payment collection method differs from each other. Two healthcare companies might look identical from the outside, but they would have different management, account dispositions, patient demographics, and information system to automatically detect the best mode for collection based on the preferences.

Solution – You must get well aware of your organization’s needs and find out which mode of payment collection wills effectivelymeet your requirement.

Unmotivated Workforce

Issue -If your staff is not contributing to the company’s goal then there is no point in availing of their services. From doctors to administrative staff, everyone should be well aware of their respective responsibilities. Any confusion or conflict in this aspect could lead to poor efficacy, which in turn can hamper the company’s objective and profit.

Solution – Managing medical accounts receivable requires years of expertise and adequate staff training. A healthcare[1] firm that is dealing with management or workforce issues may struggle to pay attention to this valuable area. Thus; such firms left with no other option than outsourcing the service. Outsourcing may cost you in the initial stage but it can offer you benefit in terms of accuracy, efficacy, and productivity. Additionally, it can let you get access to reliable services and advanced technology.

Conclusion

The healthcare industry is invariably complex when contrasted with other sectors. It is more vulnerable to payment and account receivable issues. Better account receival policies in place can help you overcome the issues with medical accounts receivable.

Read our article:Accounts Receivable: Definition and Tips to Manage