This provision under Companies Acts section 190 states that there were a few numbers of resolutions that cannot approve without prior notice given to the company.

Legislative Background

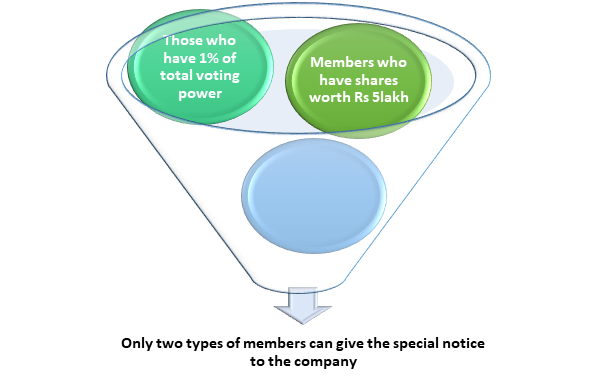

After getting a successful approval of company registration, there are few things needs to be considered, such as a special notice shall be provided by the board members that hold 1 percent of the total voting power or have holding shares of not less than 5 Lakh rupees.

A Resolution Requiring Special Notice

The Companies Act 2014, section 115, mainly gives the stress on resolutions requiring special notice. Special resolutions and resolutions requiring special notice are entirely a different thing altogether. The former deal with the approval of notice under section 114 of the Act is a procedure of approving the resolution by the member at the company’s annual general meeting.

It’s worth noting that the special notice doesn’t always signify that the specific resolution is an important one. Generally speaking, all matter that comes under the radar of particular notice is ordinary resolutions.

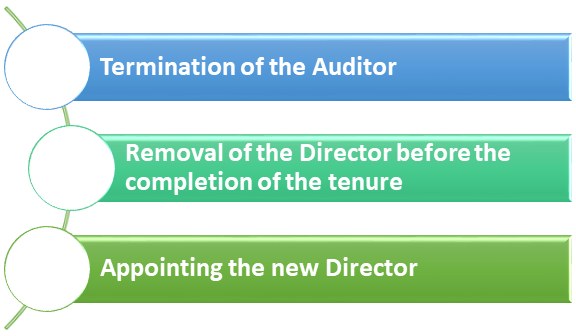

Here is the list of instances that demand special notice as per the provision of the Act.

- As per section 140, sub-section 4, the notice can be given when there is an urgency of hiring a candidate other than a retiring auditor or providing detail regarding its current service status.

- Section 169 (sub-section (2) and (5)) offers the provision of sending notifications when there is a need for removing the Director or to hire someone else.

Notice by the requisite number of members

The notice concerning specific resolutions needs to be sent by a member not earlier than three months and at least 14 days before the Annual general meeting. Such a time frame shall not include the day the notice is forwarded and the day of AGM.

Section 142 conferred on the company’s member the right to receive notice of any resolution, which was to form part of the plan to be dealt with at the annual meeting.

Time span for special notice

The obligation of the Company under Resolution Requiring special Notice

Once the notice is received at the disposal, the company must notify its members at least seven days before the AGM. Such notice must replicate the footprint of any general meeting as far as its flow is concerned.

Wherever it becomes difficult for the organization to conventionally notify its members, the newspaper that supports English and Vernacular language can use it as a publication medium. The newspaper must have wide circulation in the State where the company’s registered office is situated. The notice must notify the concerned official at least seven days before the Annual General Meeting.

Punishment and Compoundability under Resolution Requiring special Notice

Infringement of the section

This section does not procure any penal to address the infringement of the section. Hence, the enforcement of the section 450 Act becomes necessary. According to this very Act, the company and its officials on the defaulter list shall be subject to a penalty of Rs. 10,000. Moreover, if the violation continues, then the penalty of rupees 1,000 will be imposed on the defaulters.

Contravention of rules that supports Resolution Requiring special Notice

The Companies Act 2014[1] has a different approach toward the contravention of rules. Under section 30, the defaulters concerning the notice of the resolution shall be subjected to a fine of Rs 5,000. Meanwhile, the penalty of Rs 500 per day is imposed on the continual infringement of rules. The violation committed in this section is compoundable under section 441.

The Board of Directors is the crucial personals who run the management of the company. However, some of the management power is shared with shareholders that can be effectively used in the general meeting—resolution maybe ordinary and special resolution.

What are the resolutions?

A resolution is nothing but a strategic decision made Director or shareholder of the limited company. If the majority of the board member cast their vote in favor of the decision, a resolution is deemed to be passed. Two type resolutions typically pass in the General meeting are ordinary resolutions or special resolutions.

Shareholders and board members hold the necessary authority to pass any kind of resolutions at the general meeting. The collective decisions of directors are typically referred to as ‘resolution’. These decisions are bound to be passed at AGM.

Read our article:Demand for Poll under Companies Act 2013: An Overall Regime

What is the ordinary resolution?

Whenever a higher percentage of board members vote in favor of a resolution is known as Ordinary Resolution—the resolution approved by more than 50% of the members available at the Annual General Meeting.

The following modes should pass it.

Show of hands

The resolution inclined to vote must be decided by the show of hands unless the poll is demanded. In such an event, Chairman of the company may ask the board members to cast votes by raising their hands. When asked, the board members raise one hand each, and finally, the Chairman evaluates the total vote and decides who is against and with the resolution. This voting method is commonly used in almost all companies pan India.

Polling

Under the poll system, the voting is done according to the voting rights mentioned under the article of association. The member who holds a higher number of shares is more likely to become a part of this voting system.

The notice regarding the meeting shall be given to the relevant board members. In addition to this, the absentees’ members would not hold any value in this meeting, nor were they eligible to cast a vote. Radically, the ordinary resolution is passed at AGM (Annual General Meeting) in the presence of the board member.

- Selection of decisive accounts.

- Announcement of the dividend.

- Directors hiring or retirement.

- Auditors hiring or retirement and fixing their remuneration.

Certain items come under the category of an ordinary resolution.

Those are as follows:-

- Central Government is directing the company to change its name as per [Section 16 (1)].

- Some degree of change in the Share capital as per [Section 61 (1)].

- Announcement of the bonus shares [Section 63 (2)].

- Removal of a director under the command of Tribunal under Section 169 (1).

What is Special Resolution?

Special Resolution (SR) is a resolution that seeks the majority of votes from the board members to come into the action. Approval of the special Resolution can only be possible in the case when the votes cast in favor is three times greater than the vote cast against it. The special resolution only comes into action when it is approved at the AGM.

The notice regarding the general meeting must be given to the members, and the notice should clarify the Special Resolution’s scope and the intention.

The following purposes fall in the category of special resolutions.

- Any sort of alteration in the Objects Clause of Memorandum of Association to change the object clause. (Section 17)

- Voluntary winding up of the organization. (section 484)

- Removal of the company’s registered office. (section 146).

- Payment of interest out of share capital to defray the expenses of construction (section 208)

- Investigation of the company affairs by the inspector appointed by the Government (section 237).

- Payment of remuneration to the Director based on the percentage of the profit (section 309(4))

- Enabling any board member or Director of the company to hold the office of profit (section 314)

- To render unlimited liabilities of its Directors, Managers, or treasures by changing clause of the memorandum. (section 323)

- Handling mismanagement by terminating concerned officials (section 338)

- Appointment of managers to sell the company’s product outside India (section 358)

- Creation of reserve liabilities in a case when the company wound up its operation (Section 99).

- Disposing importance documentation as per the guidelines of the company (section 550).

- Permitting the managers to engage with the business which is identical and serve the same area of interest (Section 375).

- Rendering loan security to the person of the other company under the same management (section 370).

- Providing time extension for the repayment of the loan, which otherwise not possible under section 370 (Section 370 A).

- Change concerning Memorandum of Association.

- Feasible changes in the Articles of Association.

- Significant degradation of the share capital with the consent of the court or articles.

- Alternation in the contract mentioned in the prospectus.

- Re-alteration of the shareholders’ rights.

- Cranking up the number of directors.

- Termination of an auditor.

- Buy-back of shares.

Procedure for a Resolution Requiring special Notice

Signing of special notice

A special notice meant to serve the company must be signed either collectively or individually by the board member, holding one percent of the total voting power or holding share whose face value doesn’t exceed five lakh rupees.

Notice to the company

The members must send such notice to the company as soon as in a period of three months, but at least fourteen days before the annual general meeting.

Receipt of notice

The Company shall promptly give its members notice of the resolution as soon as the notice falls at their disposal. This action must be pursed at least seven days before the Annual General meeting.

Publication of notice

Where it is not possible to notify the member like a general meeting, English and vernacular newspaper can be used for the notification purpose. The publication must have a wide circulation in the State where the company’s office is situated.

If the company failed to serve the above purpose, such notice should also be shared on its website. It’s worth noting that the publication of the notice must be done at least seven days before the meeting. The criteria cannot be tempered as it is the essential provision of the resolution requiring special notice.

Point to be remembered in regards to the AGM

- The list of newly hired officers must be included in the minutes of meetings.

- If the top officials such as Directors or board members are attending the meeting, their details should be there in the minutes of the meeting. Also, those officials who aren’t in favor of the resolution are eligible to be a part of the minute.

- The Chairman is entitled to remove any matter out of the minute if it found to be faulty or giving a negative impression on the growth or identity of the organization. Also, the Chairman is fully authorized the exclude the Directors who aren’t in favour of the resolutions.

- The minutes of the meeting are deemed as valid evidence that proceedings were actually held and called off. All the hiring of liquidators and Directors made at the meeting shall be considered to be accurate.

- The minute book of the general meeting must be kept at the company’s registered office.

- Every board member has a right to inspect the minute book in the business hours at free of cost. However, a member should not violate the period of possession of the minute book, or else it will be considered as an offense against the Company Act.

- In the event, if the inspection is refused, every official in default is subjected to a penalty of Rs 5000 for each offense.

Conclusion

Most of you might find it challenging to understand the concept of a resolution requiring special notice through the rule book. We believe that you will find the above information helpful and productive at the same time. However, if some of you have some different thoughts in this regard, then don’t worry, we still got you covered. Our comment section is alive, and it works day in and day out just for your benefit. So don’t hesitate to provide your valuable feedback or queries in the comment section.

Read our article:Circulation of member resolution: Everything you need to know