According to the Company Act 2013, Redeemable preference shares are those share that can be redeemed after a specific timeline (twenty years to be exact). Redeemable preference shares are a form of preference share. A company allots them to shareholders and later redeem them. This indicates that the firm can buy back the shares at a later date. Non-redeemable preference shares, as the name suggests, lack redeemable trait but still exist in corporate space.

What conditions should be met for redeeming preference shares?

Certain norms have to be met as per Section 48 of the Companies Act, 2013[1], for redeeming preference shares

- Such a share must be fully paid up.

- Terms outlined at the time issuance of such shares are fulfilled.

But, on shareholder’s approval & under the conditions cited under Section 48 of the Act, such terms can be altered. These include share’s redemption at the specific timeline or during a period or at the time the company have ratified.

The particular amount post share’s redemption can be kept as capital reserve & can be used for any bonus on the issuance of shares.

Such amount, in the Capital Redemption Reserve, is considered as Paid-up Capital by the company.

Read our article:Issue of shares on Preferential Basis: A Complete Procedure

Process about the Redemption of Preference Shares

Following are the instructions for redeeming the preference shares

- Arrange a meeting of the general body. Since prior intimation is necessary in this regard, make sure to issue the notice to directors and stakeholders about the meeting. It worth noting that intimation should be done seven days before the meeting.

- At the general body meeting, the passing of the resolution is mandatory for redeeming the preference share. Besides, the members must outline and agree to rules regarding the said shares. The areas like a type of preference shares and share number must be figured out in the meeting itself. Lastly, the member should pass a letter for redemption to serve the purpose above.

- Once the resolution is passed, the application, viz SH-7, must be filed with the Registrar within 30 days. The SH-7 must enclose the minutes of the meeting as well as the original copy of the resolution attested by the board members via signature.

What do you mean by Preference Shares?

- As the name suggests, the Preference shares are those share that allows its holder to receive the dividend on the priority basis. A company that allotted such a share is usually under an obligation to pay the dividend to those having the same share.

- Preference shares possess a wide range of benefits as compare to other shares.

- The preference share’s dividend is fixed at a specified rate even before the dividend on equity shares.

- During winding up, the company cannot hold such shares and repay accordingly to investors and shareholders.

- The issue of such a share is done as per the rules cited under Section 48 of the Companies Act, 2013.

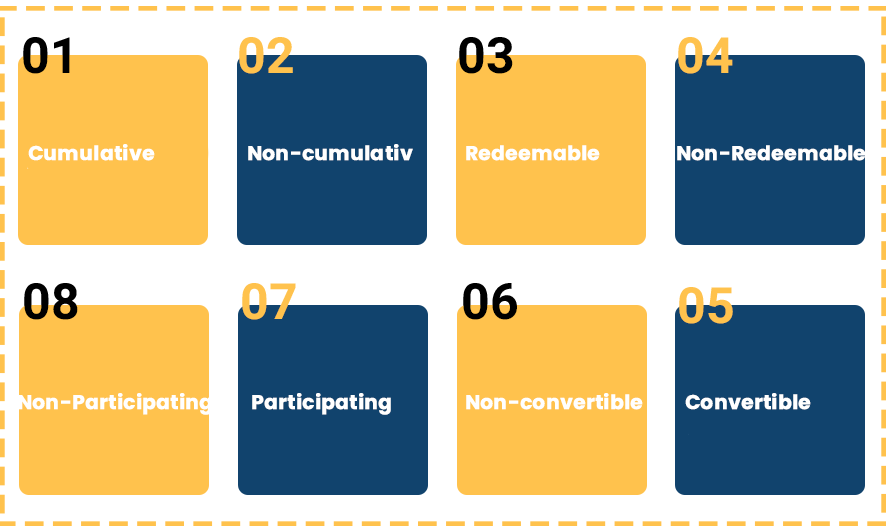

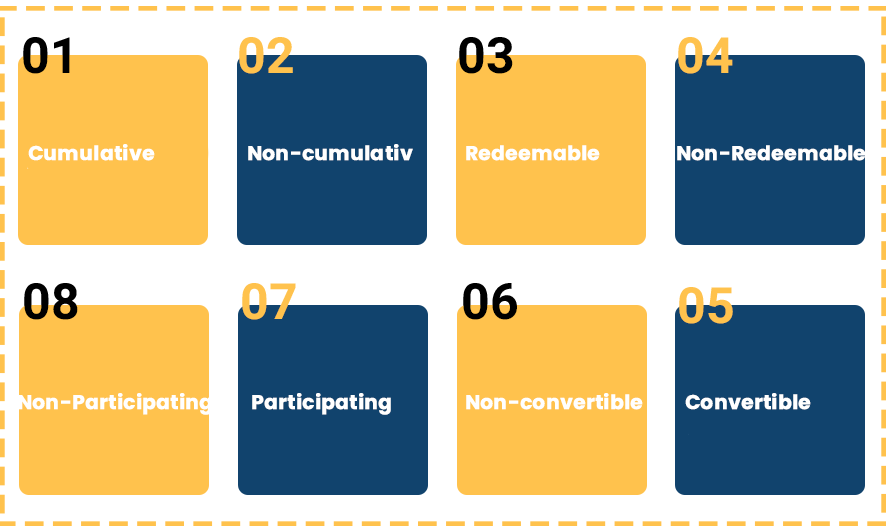

Types of Preference Shares

There are primarily eight types of shares that exist under preference shares. In case company’s dissolution, any of the eight types are payable before other types of equity. Let’s understand them one by one.

Cumulative

As the name suggests, the cumulative shares allow the shareholder to dividends that may have been overlooked in the past. Dividends act as a reward paid by the company to its shareholder. However, the company is not liable to do so. The company may pay less dividend or not at all for some time, and when it resumes, then shareholder must receive all the dividends in arrears.

Non-cumulative

Non-cumulative preference shares refer to those shares that allow a shareholder to reap fixed dividend each year from the organization’s net profit. However, if the company fails to pay out dividend on such share in any year, such dividends become inaccessible to shareholders in the future.

Redeemable

Redeemable preference shares are those shares that an organization has agreed it will, or may, redeem at some future date. The shareholder will still possess the right to sell or transfer the same subject to the company’s AOA or any shareholder’s agreement.

Non–Redeemable

Non-redeemable preference shares are those shares that cannot be redeemed during the company’s lifetime. But, the same is not true in the case of liquidation of an asset or winding up of a company.

Convertible

As the term suggests, the convertible share can be changed into equity shares after a specific timeline or as per the terms cited under the agreement.

Non-convertible

Non-Convertible preference share are those shares which are redeemable as per the provision of the Companies Act, 1956, & don’t include a share which is exchangeable with equity shares of the issuer at a later date,

Participating

The participating share allows its holder to participate in surplus profit during liquidation once the firm in question has paid it to other shareholders. Therefore, such shareholders receive a fixed dividend and possess a share in the firm’s extra earning. Most people invest in such shares of those firms where the likelihood of profit is seemingly high.

An agreement related to the preference share primarily encloses the given features.

- When a firm reaps profit, a particular share of the same along with the pre-fixed dividend shall be payable to the participating preference shareholders.

- In case of winding up of a firm, shareholders shall be allowed to get a particular share of the net sale generated.

- Such shareholders may possess voting rights over specific decision related to the sale of the business venture or vital assets.

- The shares may be cumulative, which implies that shareholders shall receive unpaid dividends on a priority basis than equity stockholders.

Non-Participating

As the name suggests, non-participating is a counterpart of an erstwhile share. Its holders won’t get a share in the firm’s extra earnings during the liquidation or winding up. The owner of such shares would only have access to pre-fixed dividends.

Conclusion

Hopefully, this blog has strengthened your understanding of the paradigm of Redeemable Preference Shares. You can reach out to our expert’s panel by commenting in the message box for further clarification.

Read our article:Issue of Preference Shares without Public Offer: A Complete Procedure