The NBFCs have considerably grown over years in terms of their complexity, technological sophistication, interconnectedness, operations, and size. Many of the NBFC’s have started to venture to new financial services sectors with the new products. Taking into consideration the noteworthy growth of NBFC, RBI has revised the regulatory framework for NBFCs in the recent years because it was much needed to ensure the transparency in its operations. In the blog, we will learn more about the RBI’s Revision on Regulatory Framework for NBFCs.

What is NBFC?

A Non Banking Financial Company (NBFC) is a non banking financial institutions registered under the Companies Act, 2013[1]. NBFC offers various banking services but does not have a banking license. It is engaged in the acquisition of shares, business of advances and loans, stock, hire-purchase insurance business, bonds or chit-fund business. But it does not include any institution whose principal business is that of industrial activity, agriculture, sale or purchase of any goods (except securities) or giving any services and purchase, sale, construction of any immovable property.

The functioning and operations of the NBFCs are regulated by the Reserve Bank of India (RBI) which is within the framework of Reserve Bank of India Act, 1934.

Read our article:NBFC Registration – Know the Entire Incorporation Procedure

What is the purpose of Revision of regulatory framework for NBFCs?

The main purpose behind revising the doctrines underlying the current regulatory framework was the need to examine and develop a scale based approach for regulating and recommending suitable measures supporting the healthy financial system. RBI introduced the regulatory frameworks for NBFC in order to keep updated with the changing realities and to re- examine the regulatory framework’s sustainability.

What is the regulatory framework for NBFCs?

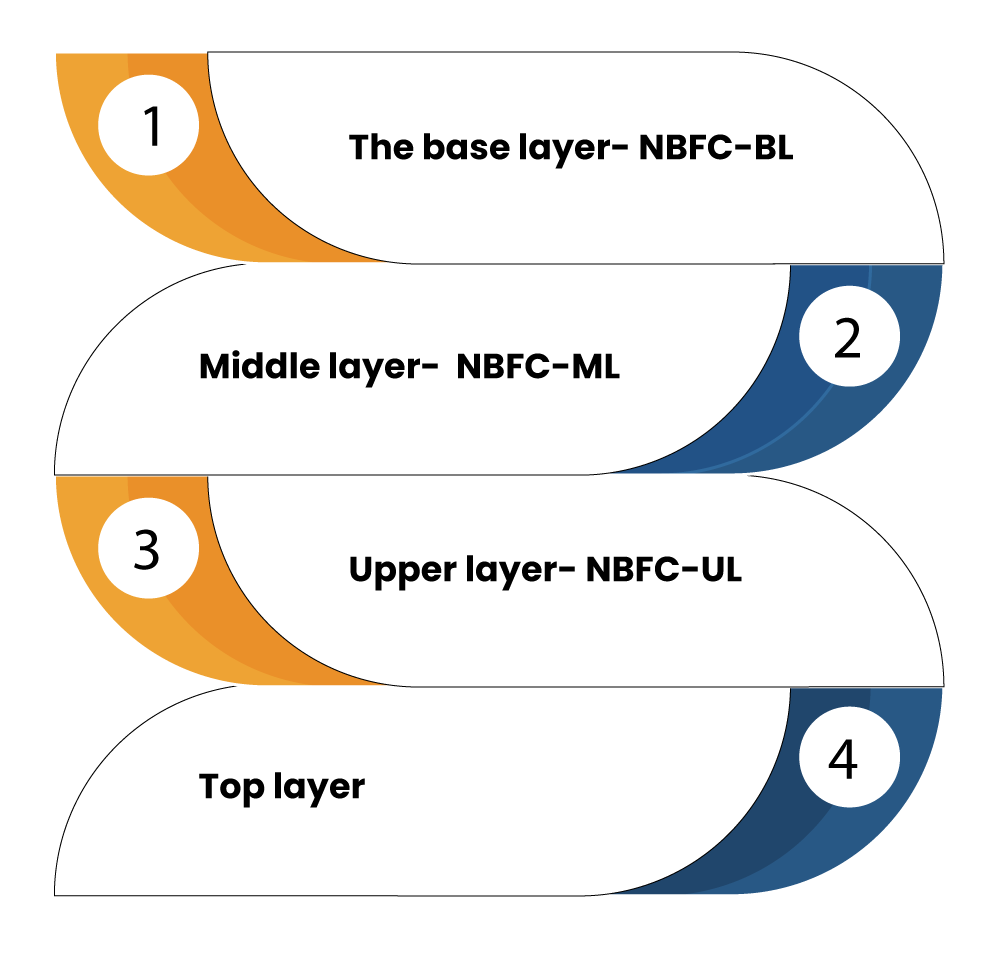

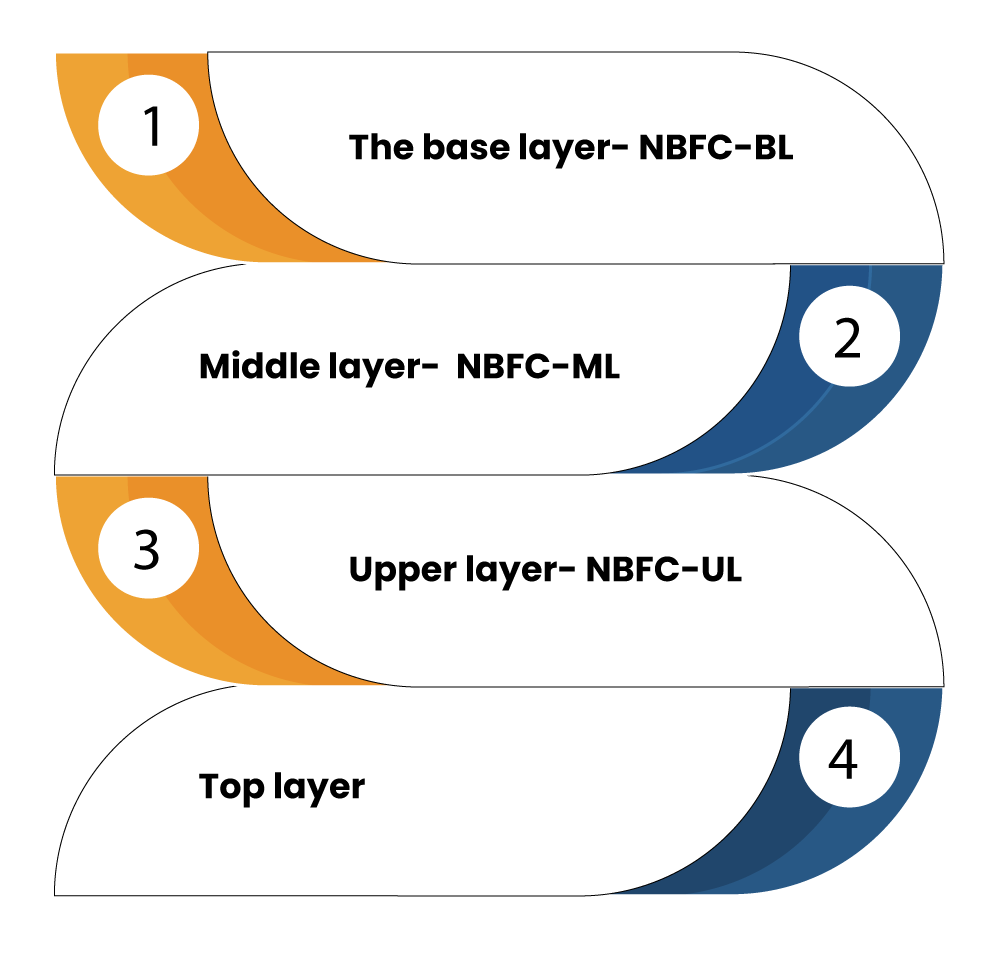

The supervisory and regulatory framework for NBFCs is based on the four-layered structure as said by RBI i.e. –

- NBFC Base Layer – The NBFC at the base layer is classified as the non-systemically NBFC i.e. as a NBFC-Non Deposit Taking, Non-operative Financial Holding, NBFC Non-Aggregator License and Peer to Peer Lending and NBFC for asset size of Rs. 1000 Crores.

At base layer, the norms for NBFC –BL has been revised by the Central Bank from Rs 2 Crore to 20 Crores and the balancing of the NPA is covered from 180 days to 90 days.

- NBCF Middle Layer – It includes NBFC which is presently classified as Non Deposit Taking Systemically Important, NBFC-ND-SI, Standalone Primary Dealers, Deposit taking NBFC, Infrastructure Debt Funds, Housing Finance and Core Investment Companies. The linkages to the exposure limits are changed from the Owned Funds to the Tier Capital. For the financing of IPO, the limit has been fixed to Rs 1 Crore

- NBFC Upper Layer – In the Upper layer at least 25 to 30 NBFCs are enclosed. The NBFC included under this layer shall work like a bank. It is recognized as CET and for enhancing the regulatory capital for NBFC-UL, Common Equity Tier (CET) I Capital might be introduced. CET has been accessible at the rate of 9 % at Tier I capital.

- NBFC Top Layer – The NBFC at the top layer is kept empty in the structure. Basically, the top layer of the pyramid structure shall remain empty unless the supervisors view some particular NBFCs. According to the supervisory judgments, if some NBFC in the upper layer are undergoing some extreme risks then in such case they will be added to considerably higher regulatory or supervisory requirements.

What is the guideline for the revised regulatory framework for NBFCs?

The guideline for the revised regulatory framework for NBFCs is as given below:

- A Layered Approach- Under this framework, it has been revised into the four-layered structure as has been explained above. The structure includes-

- A Pyramid Structure – This structure is formed in a pyramid shape and has the minimum regulatory intervention. It has been further classified as non systematically important NBFC – NBFCP2P , NBFC-ND, and the leading Platforms like – NOFHC, NBFCAA, and Type I NBFCs and the third layer which includes the systematically significant NBFC like Deposit-taking NBFC (NBFC-D), NBFC-ND-SI, IDFs, HFC’s, SPDs, CICs and IFCs.

- Adverse Regulatory Arbitrage- The banks shall be addressed for covering NBFCs under this layer for the purpose to reduce the systematic risk in case of any spill over. The regulatory arbitrage has been divided into two parts:

(a). Structural arbitrage and b) Prudential arbitrage.

The banks in the structural arbitrage case, maintains the SLR and CRR against the time demand liabilities.

In the Prudential arbitrage case, the NBFC benefits from the flexibility in provisos of the asset classification, capital adequacy, and provisioning norms.

- Extant Regulatory Framework- The framework will apply to NBFC-NDs that are still existing regulatory frameworks. It shall be applicable to the base layer of the NBFCs. NDSI will be applicable to the middle layer of NBFCs.

- Revision for upper layer- The alteration in the lower layer NBFCs shall equally apply to the upper layer of NBFCs unless there is any conflict stated.

- The threshold of the systematic importance- presently it is 500 Crores but it has been revised to Rs 1000 crores.

- NPA Classification Days – The NPA days is reduced down from 180 days to now it is 90 days.

Conclusion

Therefore, it can be concluded that with the revision of the regulatory framework for NBFCs, the RBI has upgraded the hierarchy of the structural pyramid. The objective behind this is to ease the procedure of NBFC Registration and promote flexibility by granting the much required backup within the financial system.

Read our article:NBFC Registration: Step by Step Procedure